More than Digital Gold

As Bitcoin continues to dominate market attention and capital flows, the broader cryptoasset landscape shows signs of maturing and achieving potential synergy with the existing system (stablecoins and tokenisation). This memo delves into the current state of the market, highlighting Bitcoin's dominance and the capitulation in altcoins. We will explore key onchain metrics, network activity trends, and historical patterns, which lead us to believe the altcoin market is in a buy zone.

Altcoins are extremely sensitive to economic expectations and risk sentiment. To gauge expectations and sentiment, we look to a z-scored copper to gold ratio. Currently, it is below the zero bound and falling, suggesting an economic slowdown, recession fears, or risk-off sentiment. Altcoins do best in rising risk sentiment, which we have yet to see this cycle.

This explains relative altcoin underperformance versus BTCUSD and why altcoins have failed to break all-time highs. BTCUSD has also been significantly buoyed by Microstrategy's aggressive buying and a successful ETF launch.

Bitcoin continues to suck the air out of the room, as we outlined in "The More Things Change, The More They Stay The Same", a rise to highs in Bitcoin dominance has preceded every altcoin season. It's an ingredient that forces altcoin capitulation and offers great entry points for building altcoin positions. There's a good chance bitcoin dominance is finally topping here.

Investors have capitulated on altcoins en masse. The average crypto sector is down more than 30% year to date.

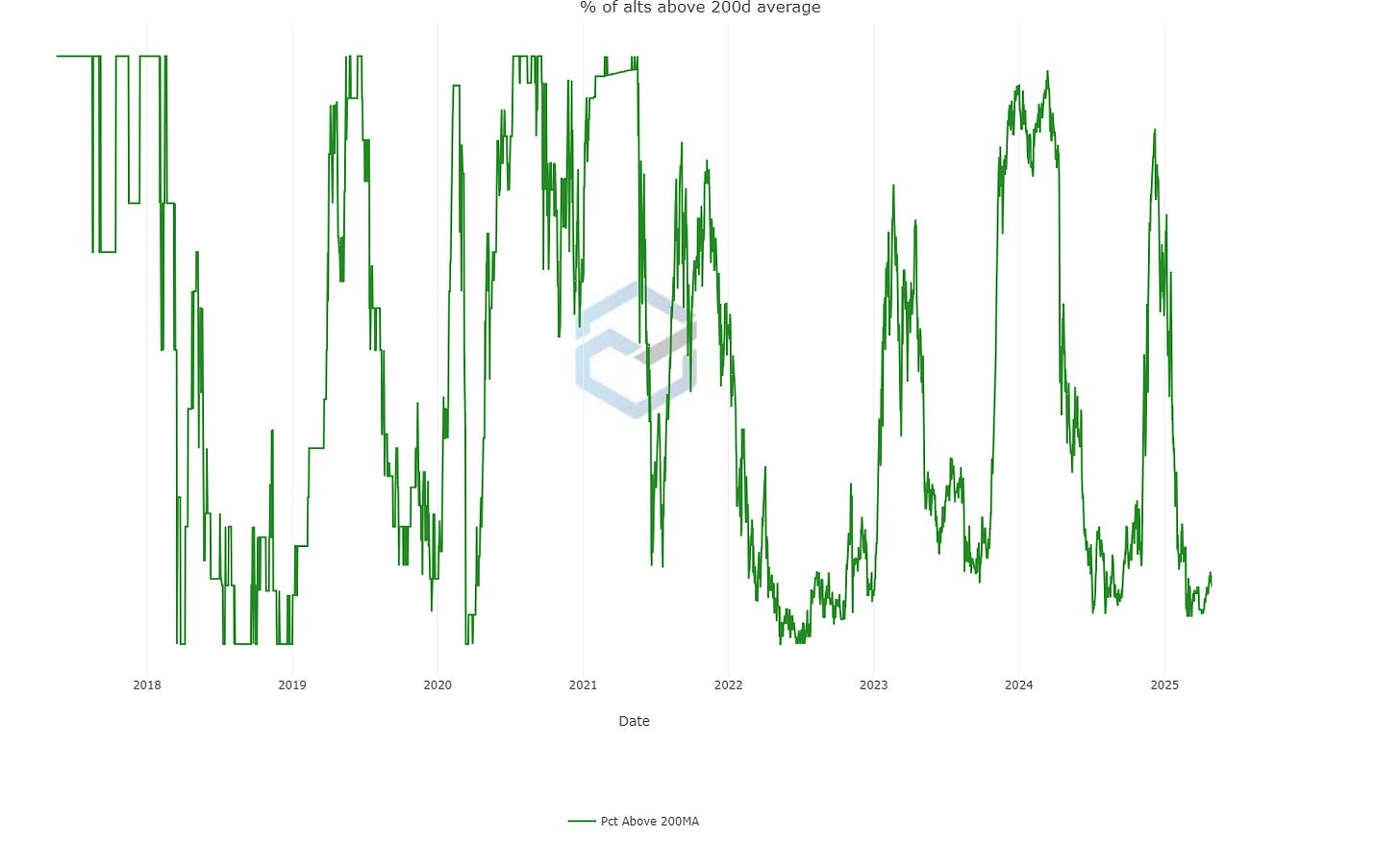

Less than 10% of altcoins trade above their BTC-denominated 200-day moving average, which has historically marked the buy zone for altcoins.

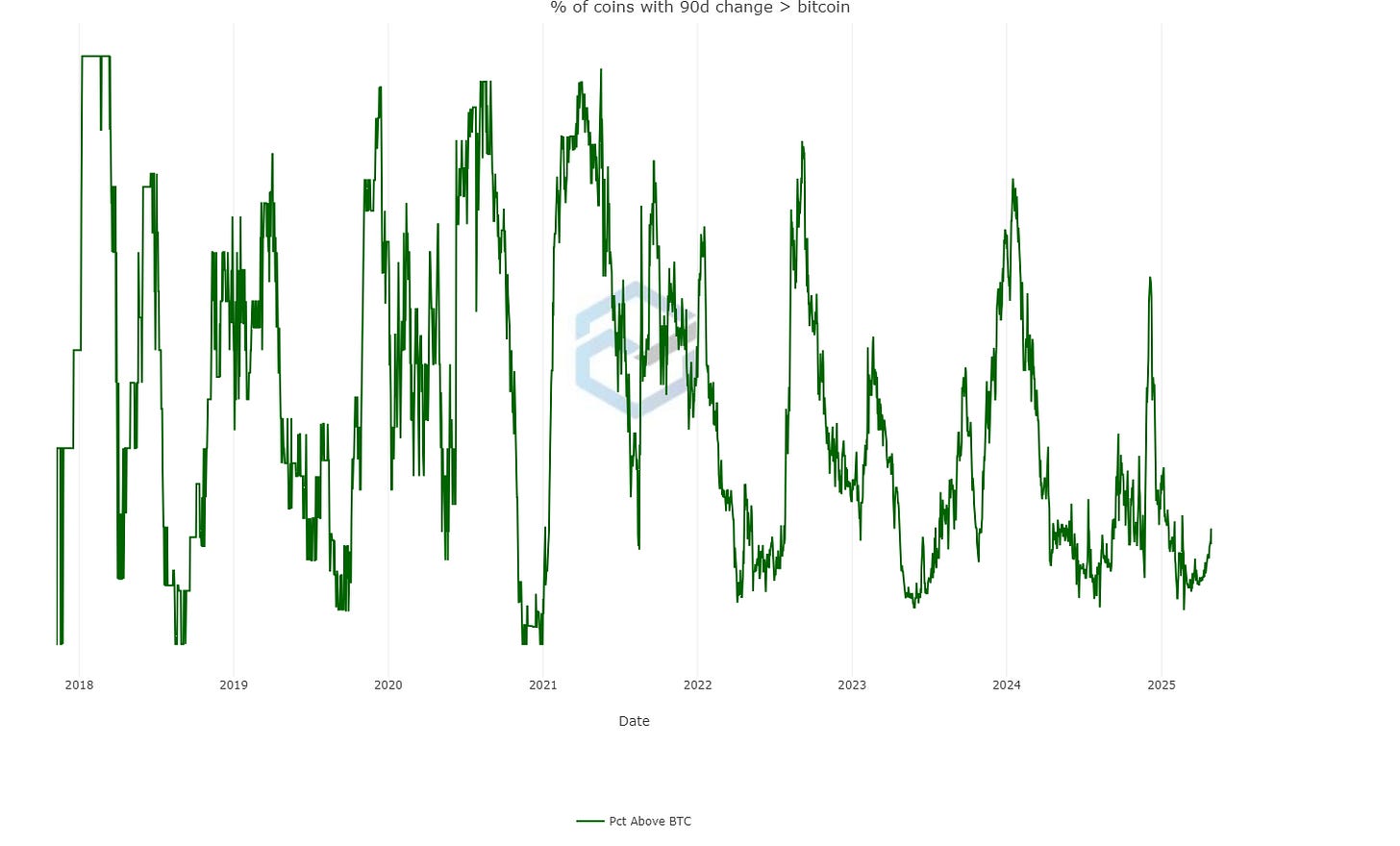

Only 11% of the investable universe has beaten BTCUSD over the last 90 days, another sign that we are in the altcoin buy zone.

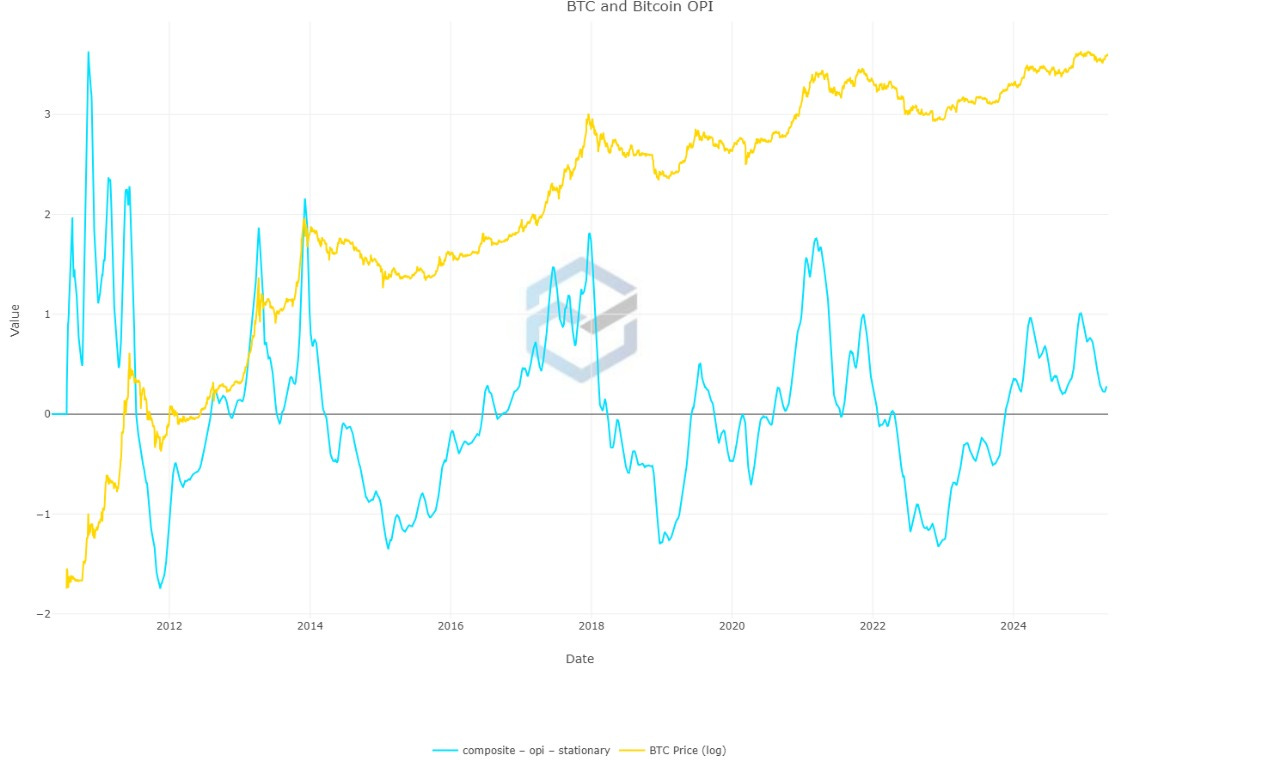

The Bitcoin Onchain Pulse index (OPI), which looks at bitcoin's market value relative to production cost, holder cost basis, and holder net unrealised profits and losses, suggests that BTCUSD is elevated but not overbought.

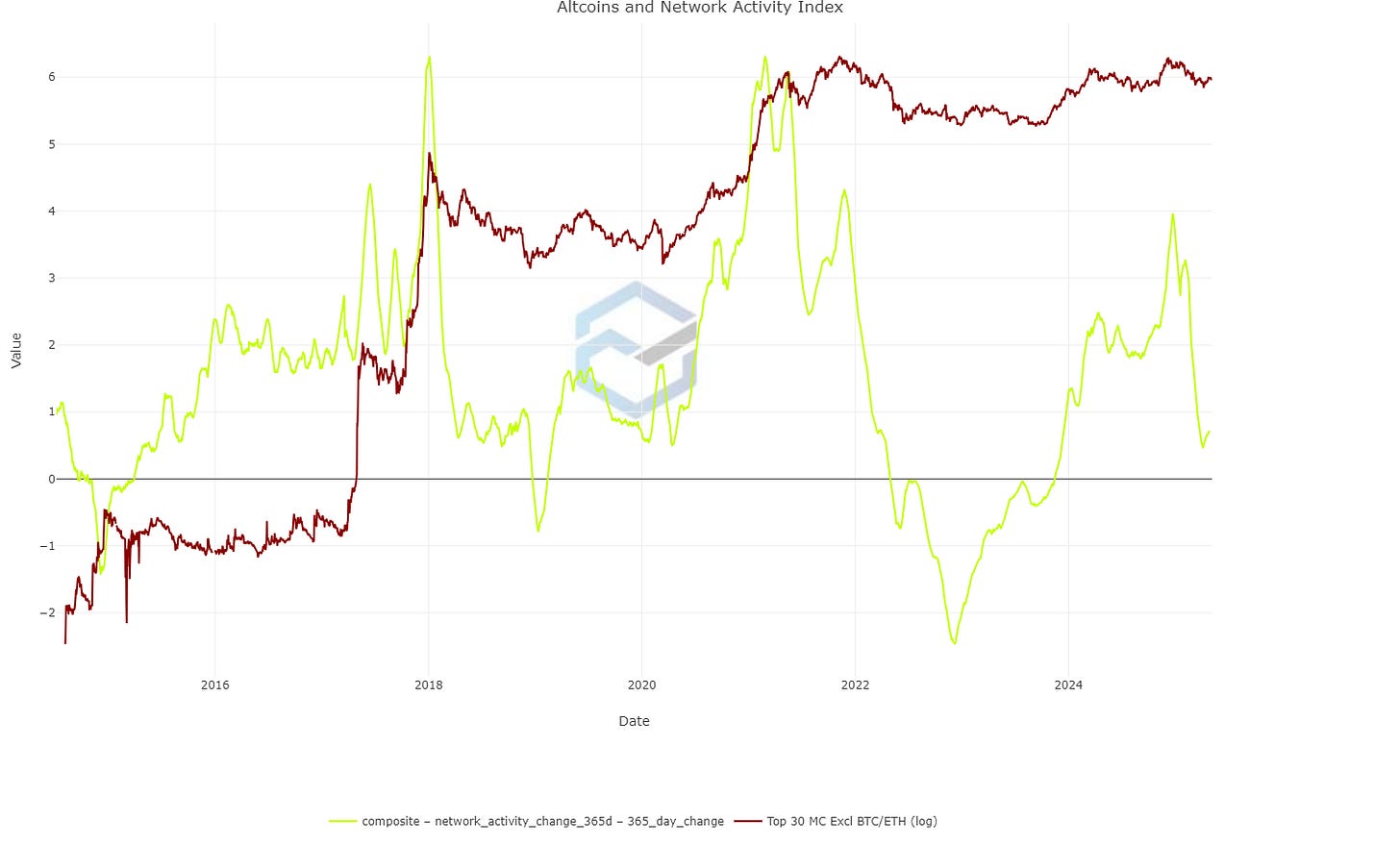

The Token Onchain Pulse Index, similar to Bitcoin OPI but covering the broader crypto universe (Top 30 excluding BTC and ETH), suggests that altcoins are cheaper here relative to BTCUSD and approaching oversold territory.

The network activity index has fallen off a cliff since Trump's inauguration, but a bounce in altcoin prices could easily bring meaningful activity back to these networks.

If the recovery we saw in April carries through to positive returns in May, we would expect network activity to bottom out and rise with rising prices. This is a powerful feedback loop, where price rises are matched with increasing network activity, supporting further capital inflows.

As I outlined in "The More Things Change, The More They Stay the Same", leading altcoins are the heartbeat of real usage in crypto. Between just 10 cryptoassets, we can capture 80% of all network activity in the industry (see overall compounders below).

Further to this point, we have been ringing the bell on "The End of the Dot-Crypto era" and "The Great Divergence". Our thesis is that blockchain technology is going mainstream, and institutions are building blockchain-enabled products on smart contract platforms (again, not Bitcoin). Quality assets will flow onchain and decentralised finance will finally make sense as it comes to service real productive assets (stablecoins, treasuries, stocks, etc).

Bitcoin is elegant and simpler to digest. It's apolitical, non-discretionary money. That's an incredible use case with an enormous total addressable market. It's likely that over the next 5 to 10 years, Bitcoin, as digital gold, will reach market cap parity with gold itself, that's a good 10x from current prices.

But crypto is so much more than digital gold…

Are stablecoins going to run on Bitcoin?

Are tokenised real-world assets going to find a home on Bitcoin?

If Bitcoin is the only trade in town, how do we explain that Bitcoin holds less than a 2% market share of crypto network activity?

Crypto is a computing revolution, blockchains like Ethereum are shared global computers that anyone can use or build on. Like a computer, Ethereum can run programs (smart contracts) which offer alternatives to every financial service we have today. Unlike the current financial system, these shared computers have no gatekeepers and don't require permission to build on; this creates a hyper-competitive environment for developers to build useful applications and contribute to extending the capabilities of the shared computer.

Over the long run, we believe this hyper-competitive environment will lead to hyper-efficiencies for end users. Blockchains solve the fragmentation problem of the Internet; the thousands of isolated servers of intermediaries can be consolidated onto a single shared computer like Ethereum.

Digital gold is an enormous opportunity, for sure. But upgrading the entire financial system and internet architecture, extending its expressivity, transparency, global reach, and inclusivity, is an even bigger, yet understandably more difficult idea to grasp.

What assets are we interested in right now?

As always, we are looking for crypto compounders, these are liquid, measurable and quality cryptoassets with evidence of above peer group growth in key performance indicators.

After 10 years of uninterrupted uptime since day one and 16 flawless upgrades, Ethereum is emerging as the institutional chain. Given its large distributed validator set, network liquidity, and battle-tested token standards, we expect its dominance in real-world asset issuance to persist.

The Pectra upgrade, Ethereum's latest major network enhancement, strengthens its position as the leading institutional blockchain. Implemented in April 2025, Pectra delivered improved scalability, lower transaction costs, and enhanced smart wallet capabilities, all while preserving Ethereum's renowned security and decentralisation.

Wouldn't it be poetic if the bottom of ETHBTC was marked by the Pectra upgrade, given that its top in 2022 occurred around its last major upgrade, the Merge?

Solana is emerging as a consumer chain. While we are open to institutions building on Solana, network outages and a small validator set remain hurdles in our view to bringing real-world assets onto Solana. Yet Solana may succeed in use cases where security and decentralisation are subordinate to speed and throughput, i.e., consumer and retail applications.

Sui is a compelling competitor to Ethereum and Solana. It was built by ex-META employees who were behind the Libra project. The tooling, learnings, and failures of the Libra project have been key to the development of Sui. Sui continues to grow its market share of network activity and, in our view, could continue to capture market share as the industry becomes more mainstream and institutionalised.

Crypto is going mainstream in a big way, just look at this highlight reel of the last month:

1) Stripe launched stablecoins in 100+ countries

2) Ramp launched stablecoin cards

3) Superstate launched onchain equities

4) Robinhood is building its own crypto platform

5) Biggest deal in crypto history (Coinbase/Deribit)

6) Meta is back in the stablecoin game

7) Ethereum shipped a massive upgrade

8) Bitcoin back above $100k

As we have alluded to in our three most recent memos, we are entering the parabolic phase of the adoption cycle, this is what we having been waiting for since our entry into the industry in 2017. Strap in, it's going to be an exciting couple of months.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.