The More Things Change, The More They Stay The Same

2025 is off to a tough start. Our call on boring or scary price action seems to be holding up. Bitcoin remains boring and is range-bound between $106k and $91k. Altcoins have been scary, with the average sector down 25%+.

Our concentrated and conservative positioning has worked well so far with the fund narrowly up for January (+4.8%). Consensus seems to be building around the idea that crypto cycles are dead and everything has changed. I have had chats with multiple industry participants who feel this way.

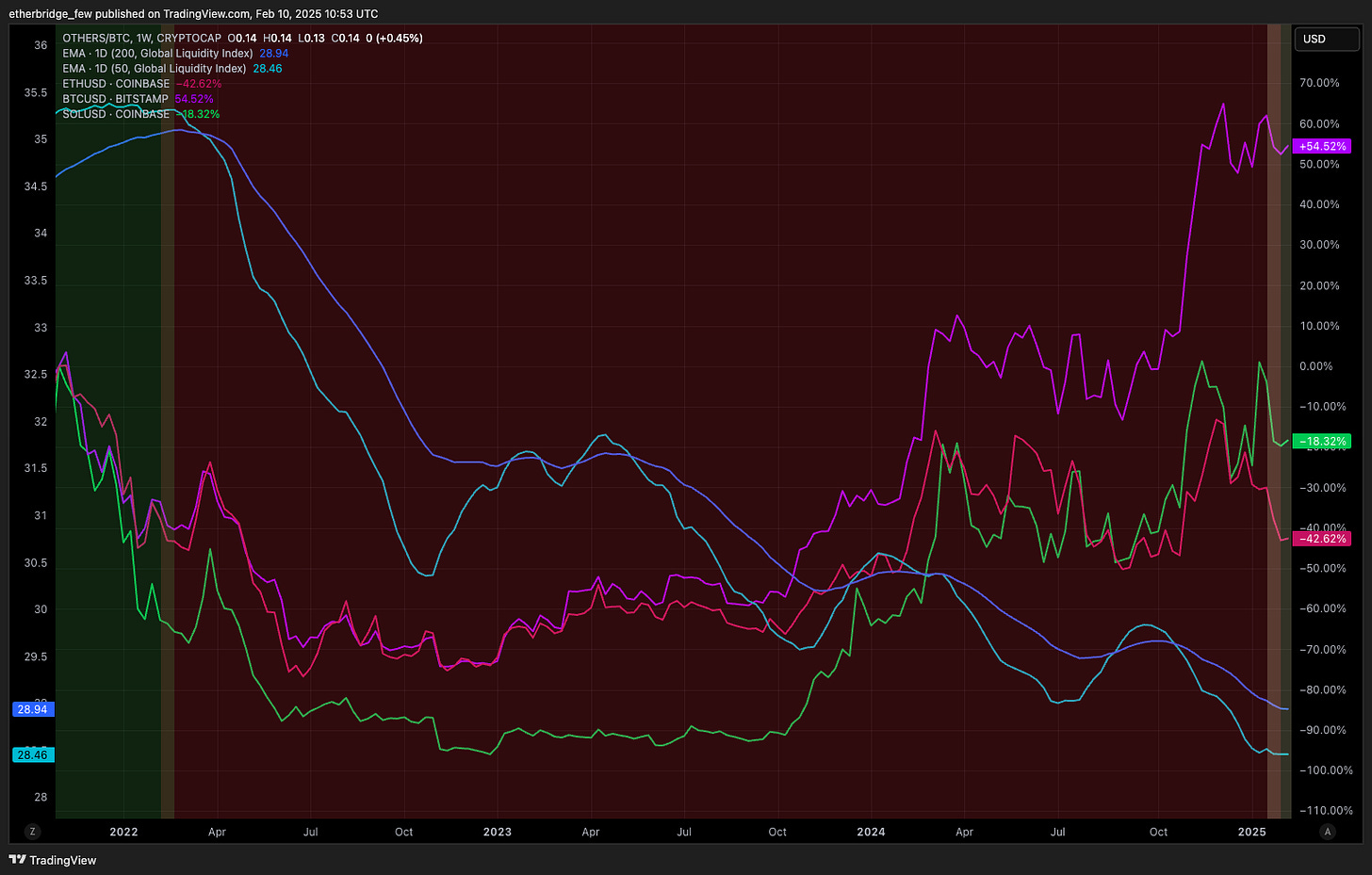

There is some evidence to suggest that this view is appropriate, just look at excess returns measured as OTHERS/BTC compared to previous cycles. Altcoins have materially underperformed BTC and their previous cycle performance.

To compound this problem the industry has a clear oversupply of tokens, predominantly due to the relentless issuance of memecoins. Memecoins are not bad in my view but rather a necessary evil to accelerate the development of blockchain technology. Pornography for example still accounts for ~4% to 35% (depending on methodology) of internet traffic and is responsible for many improvements in content delivery systems and streaming services. Memecoins are just pornography of the internet of value, the launch of the $TRUMP meme served as an incredible stress test of the Solana blockchain, we now have real evidence that Solana can handle Nasdaq-like trading volumes without falling over. As I said, a necessary evil…

Since December 2024 we have seen memecoin issuance consistently above 40k tokens a day!

The structure of flows in crypto has also changed, the BTC ETF has been the main recipient of new flows to the industry. Unlike previous cycles this speculative capital sits behind the walled garden of traditional finance, you can’t just swap your BTC ETF into a basket of altcoins on Binance.

BTC has also become differentiated as a “macro asset”, it is being spoken about as a treasury asset for corporations, states and even the federal government. There is a non-zero possibility that we see a Bitcoin strategic reserve in the United States, how crazy is that?

Together BTC and memecoin madness has sucked the air out of the room, with educated capital skipping altcoins and just buying BTC ETFs and degenerate gamblers going straight to memecoins in the hope of hitting the jackpot. This can be seen clearly in bitcoin dominance which has been on a two-year up-only trajectory, from 39% in 2022 to 61% today.

The irony of this within the context of calls for “this time is different” is that massive run-ups in Bitcoin dominance have preceded every major altcoin bull market. The more things change the more they stay the same, prices affect investors way more than they like to acknowledge and many are now capitulating on their bullish views on altcoins. They are bearish not because something has changed but because they have been wrong on timing and can no longer handle the relative underperformance relative to BTC. This is exactly what happened in late 2016 and 2019. I see the setup very differently.

Here Is How I See it:

1. Predicting the next few months of price is a fool's errand, we have risk measures in place that will force us out of the market if necessary but those alarm bells are not going off just yet.

2. The market is peak fearful and bitcoin is trading at $97k only 6.4% off all-time highs. The retail sentiment is terrible, most likely because they have been losing in memecoins but the institutional sentiment is great and very positive about crypto’s future.

3. Altcoins are already down 30-50% off 2024 highs.

4. Crypto industry-wide KPIs continue to compound at exponential rates, the bulk >80% of this activity isn’t happening on Bitcoin, it's happening in altcoin land. (SOL, ETH, NEAR, BNB, TRON, ARB, SUI, APT, RAY, UNI, HYPE, AAVE, BASE)

5. We have a pro-crypto majority in the United States and immense legislative support for crypto. Guess what we are actually going to get regulatory clarity on what we can and can’t do.

6. Both President Trump and his treasury secretary Scott Bessent are calling for lower interest rates and more accommodative policy.

Seems like being bearish altcoins was a call for a couple of months ago, but with these forward-looking tailwinds, I find it difficult to construct a bearish view.

Why I Think The Cycle Is Intact:

Let’s start with excess returns (OTHERS/BTC) compared to the global liquidity index** (two blue-shaded lines smoothed) and the Purchasing Manager Index (PMI) (a proxy for the business cycle). The green shaded periods are times of expanding global liquidity, the red shaded periods are times of contracting global liquidity. We can also point out that the bottom panel PMI shows that the best times for OTHERS/BTC are when the business cycle is expanding (ie: above 50).

Below is a very similar chart but this time using Bitcoin Dominance, ie: Bitcoins % share of total crypto market capitalisation. As expected dominance rallies in contracting liquidity and corrects into expanding liquidity.

This next chart shows the performance of BTCUSD (purple), ETHUSD (red) and SOLUSD (green) from the highs on November 1st, 2021. BTCUSD was the only major to break all-time highs during this liquidity contraction, supported by rumours of a strategic bitcoin reserve, Republican victory and a successful ETF launch.

The next chart I want to highlight is the US dollar. It's interesting to note that bottoms in OTHERS/BTC correlate closely with bull traps in the DXY, and tops in OTHERS/BTC coincide when the DXY is bottoming out. This has been true for most of crypto’s mega rallies, I don’t see any reason as to why this should change.

My expectation is that conditions are going to be more accommodative from here. Truflation, an independent measure of inflation in the US, has softened considerably. If Truflation is to be believed then I am confident bond yields have topped here and will come down over the course of the year, most likely at an accelerated pace compared to current projection of just two cuts this year. This will support a reversal in the dollar as well as improving global liquidity conditions.

Basically, nothing has changed, my read is simple, crypto is risky. Risk assets need easy money, they are incredibly sensitive to changes in monetary policy and global liquidity conditions, until these conditions improve we should expect the market to continue underperforming the most well-known and increasingly accepted cryptoasset, Bitcoin. Not because the game has changed but because the game remains the same.

Altcoins are dead, long live Altcoins!

** Global Liquidity Index = Federal Reserve System (FED) – Treasury General Account (TGA) – Reverse Repurchase Agreements (RRP) + European Central Bank (ECB) + People’s Bank of China (PBC) + Bank of Japan (BOJ) + Bank of England (BOE) + Bank of Canada (BOC) + Reserve Bank of Australia (RBA) + Reserve Bank of India (RBI) + Swiss National Bank (SNB) + Central Bank of the Russian Federation (CBR) + Central Bank of Brazil (BCB) + Bank of Korea (BOK) + Reserve Bank of New Zealand (RBNZ) + Sweden’s Central Bank (Riksbank) + Central Bank of Malaysia (BNM).

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.