End of The "dot-crypto" Era

Our short term view for 2025 was boring or scary. February threw boring out of the window, in less than two months we have seen trade war scares, politicians launching and rug-pulling memecoins, politicians tweeting about crypto strategic reserves, a massive exchange exploit and downside economic surprises.

Price action through these events has been scary, at the beginning of February we saw a massive liquidation across cryptoassets, with some remarkable recoveries. Ethereum for example experienced a 25% intraday drop only to close the day positive. The month ended with a violent push to the downside, with many assets retesting early month lows and some falling even lower.

Macro uncertainty, memecoin madness and a reminder of security challenges have soured retail sentiment to a level last seen during the implosion of Luna Terra in June of 2022.

The crypto pendulum has swung again, in May of 2024 we wrote about this dynamic:

“It's difficult to identify another asset class or industry that possesses such a violent sway in public opinion and investor sentiment as that of crypto. For the entirety of this technology's existence, it has swung viciously back and forth between “a revolutionary technology” and “a nothing burger”.“

The crypto pendulum swings from romanticising about the future to being confronted by the present state of the industry. The memecoin shenanigans of 2024/25, the involvement of high profile politicians and uncovering of the rampant fraud and manipulation have left many questioning the current crypto state of affairs.

At present we know that three categories in crypto are working well:

1) Asset Issuance

The primary function of multi asset ledgers such as Ethereum and Solana is to process, execute, settle and secure a variety of assets. During crypto’s installation phase we have seen countless assets issued on these networks (ICO boom, DeFi Summer, NFT boom, Memecoins) we are in the early days of seeing real world assets issued onchain such as tokenised treasuries. The range of assets issued on blockchains will continue to grow, and this growth will include high-quality assets, not just crypto-native tokens.

2) Stablecoins

Stablecoins tie back to blockchains' key function of issuing and managing assets. Bringing the global, direct, peer to peer nature of blockchain technology to fiat currencies. Additionally USD backed stablecoins are becoming a large buyer of US debt at a time when foreign nation states have slowed their purchases of US debt. The US admin will look at this dynamic and see a win-win situation, where they can extend the network effect of US dollars and find a new buyer of US debt.

3) Asset Exchange

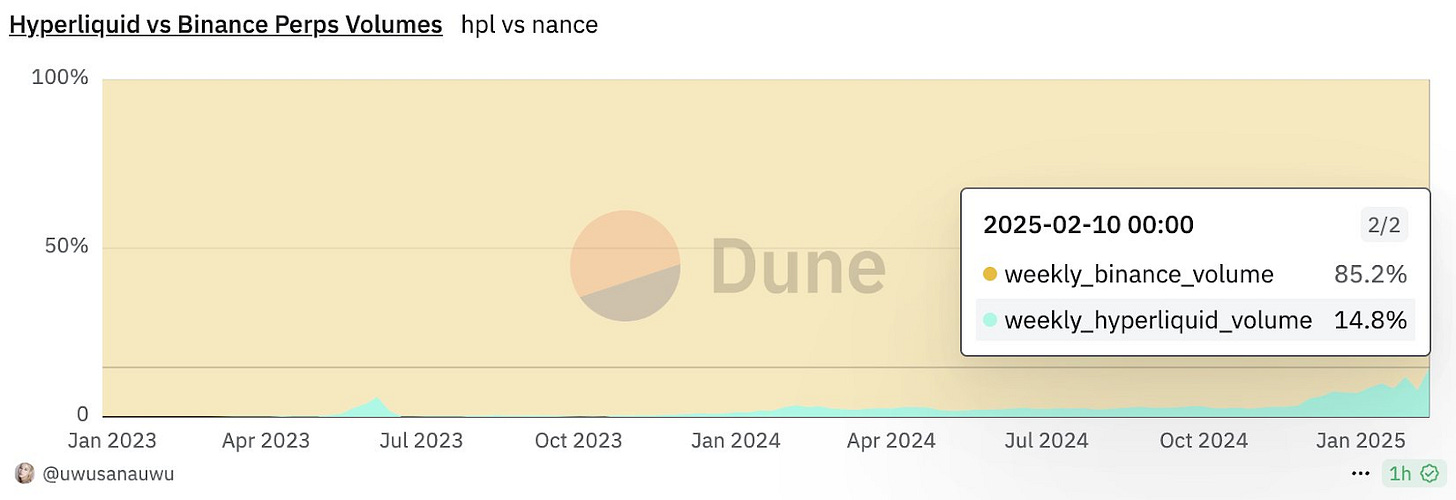

Crypto has also proved its ability to conduct frictionless exchange of assets. Decentralised exchanges are slowly gaining on their centralised counterparts. I expect them to continue taking market share as the quality of assets onchain improves.

These working elements of crypto are limited to a few projects in a sea of undifferentiated tokens. There is a clear oversupply of investable opportunities in crypto, fragmenting investor attention and creating casino-like, player vs player conditions where traders are constantly chasing the new shiny thing.

The fact that crypto tokens trade mark to market daily is both one of the biggest strengths and weaknesses. I firmly believe that looking through the noise, focusing on projects with solid and improving fundamentals is the only long-term strategy worth following in such a noisy industry.

Readers are probably sick of hearing me say this but in the depths of yet another ~20%+ pullback in crypto prices, I can’t help but feel more positive than ever about the future of the crypto economy.

A framework I always come back to and have spoken about at length in previous posts is Caralota Perez’s framework for technological revolutions and the S curve.

For the last 15 years we have been stuck in the installation phase, a period of creative destruction, a period where the new paradigm collides with the old, a financial frenzy with plenty of speculative bubbles.

Today, I firmly believe we are entering the chasm, where we transition from installation to deployment of this technology. What is in front of us is creative construction, a time where production capital begins to lead financial capital and a time of widespread application of this new paradigm.

A prerequisite for crossing the chasm is regulation and the industry has seen enormous wins on the regulatory front this year.

Regulation is moving in a crypto progressive direction, enticing institutional participation. Interest in crypto seems to be isolated primarily to stablecoins and bitcoin as a store of value asset for now but my read is that once rules of the road are established we will see a new wave of institutional experimentation. This will change everything we know about crypto.

Jeff Dorman from Arca articulates well.

This will mark a clear departure from speculative financial capital to disciplined production capital. A transformation from fringe crypto native projects “dot-crypto” to new technologies integrating with existing systems. The catch however is that while regulation is imminent it is uncertain.

Real businesses are going to use blockchain whether it be for asset issuance (RWA), back office administrative tasks, asset exchange or payments. These businesses will bring their clients onchain but many of these clients may never be exposed to the tail end of crypto native projects.

The way to read this is that regulation is great and sorely needed but the existence of regulation may not be good for a wide range of cryptoassets, especially the tailend of undifferentiated nonsense, lovingly referred to as “Shitcoins”.

But I believe it will be enormously positive for “Compounders”, networks and applications that have clear and demonstrable network effects and strong evidence of compounding on their advantages. BTCUSD, ETHUSD, SOLUSD, JTOUSD, LDOUSD, UNIUSD, AAVEUSD, ENAUSD, MKRUSD are examples of such compounders.

Compounders in my view have a higher likelihood of:

1) Becoming a venue or tool for production capital to issue, manage and exchange assets.

2) Competing with the wave of institutional competition on the horizon.

I have no interest in chasing the new shiny crypto native thing, I have seen too many come and go. Only a very small percentage of crypto projects have compounded their early success. I expect this trend to continue and view regulation as a knife cutting through the perpetual casino of undifferentiated shiny things.

As for current market conditions this is business as usual, since Jan 2023 we have had six 20%+ drawdowns and going further back since Jan 2017 we have had seventeen 20%+ drawdowns. Volatility is the price you pay for potential outsized returns. There is always the possibility that this current slowdown transitions into a full blown contraction. If we continue to get negative surprises in economic data then it's likely that crypto network activity will continue to slow and a 2018 or 2022 style bear market may ensue. If equities continue their downtrend its likely crypto will too.

However, much of the negative economic surprises we are experiencing today are already at work easing financial conditions, the dollar index is 5.8% down from recent highs of 110.14 to 103.6, US 10 year yields is 11.6% down from 4.8% to 4.2%, estimates for Fed Fund rate cuts have adjusted upwards from two to three cuts this year and real time inflation measures such as Truflation have fallen off a cliff.

Interestingly, the DXY’s move this week was exceptionally large, marking only the fourth time in the past twelve years that we’ve seen such a steep one week decline. Historically, each event was followed by a major Bitcoin rally—an 87x run after August 2015, a 10x climb after March 2020, and a 5x gain since November 2022. These episodes highlight two key insights: first, that financial conditions tend to lead risk assets by a couple of months, and second, that current conditions are loosening and doing so quickly.

In the same way that tight conditions of the past two years have sowed the seeds of present negative economic surprises, I see the current loosening of these conditions sowing the seeds of future positive economic surprises. My base case is that the economy is slowing but won’t go into a recession and that we bottom in March or April and continue the upward trend into the backend of the year.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.