Time For ETH

This month, I intend to build on the ideas laid out in "More than digital gold" and "The End of the dot crypto era", as well as clearly describe the differences between BTC and ETH as investments. My core idea is that Ethereum's time has finally come.

More Evidence Of The End of Dot-Crypto

Crypto has been in the headlines a lot this last month, and for good reason. Each of these stories paints a nuanced picture of blockchain technology's maturation. Crypto is ready.

Social Proofing Crypto as an Investment

In the 1980s, Ric Edelman founded what is now known as Edelman Financial Engines, a registered investment adviser with $287 billion in assets under management as of the end of Q1. He's now recommending a 10% allocation to crypto for conservative investors.

Edelman's endorsement of crypto is another significant piece of social proof from traditional finance.

Edelman's recommendation is a forward-looking assessment of the ideal allocation to cryptoassets and is closer to what we view as the optimal allocation (5%-10%) for diversified portfolios.

Stablecoins Go Mainstream

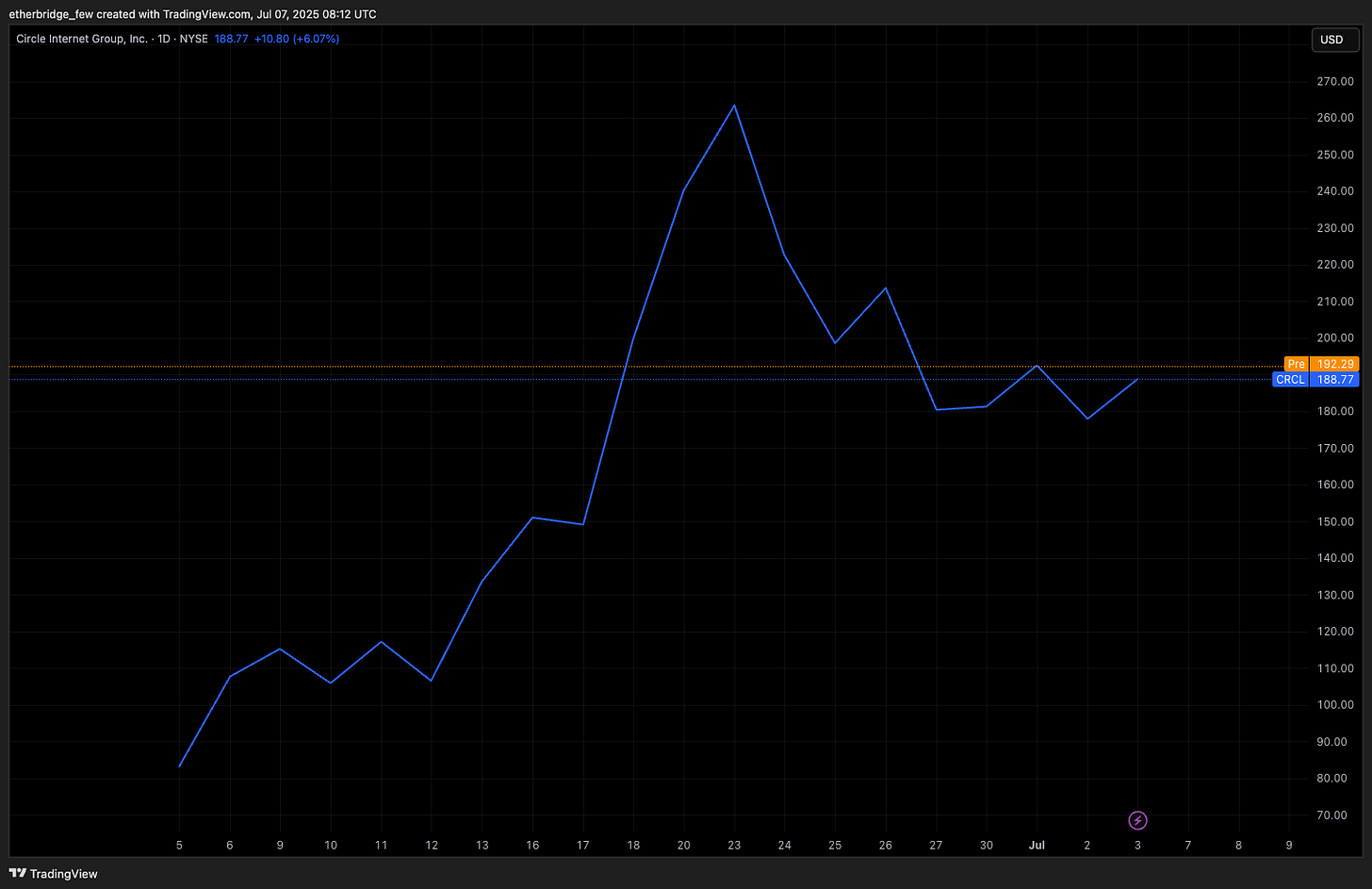

Wall Street's demand for stablecoin opportunities has been on full display with the recent listing of Circle, the issuer of the USDC stablecoin. The stock IPO'd at $31 per share on June 4th, reached a high of $299 by June 23rd, and now trades at $188.

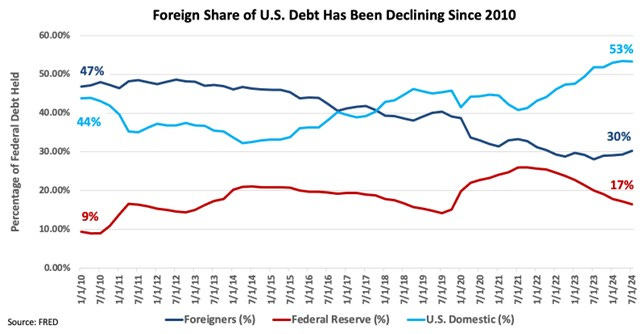

US Treasury Secretary Scott Bessent is very positive about Stablecoins. Stablecoin issuers are required to collateralise every stablecoin issued with US treasuries. Bessent views stablecoin issuers as a new buyer of US debt at a time when foreigners are increasingly turning away from it.

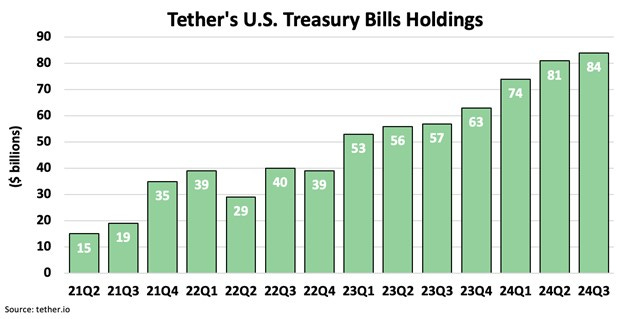

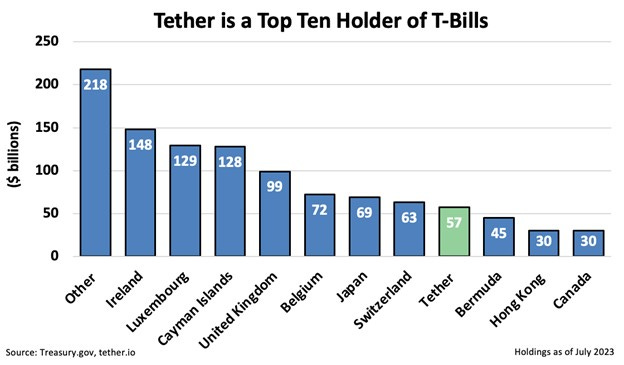

Just look at Tethers (issuer of USDT) US treasury holdings.

This places Tether in the top ten holders of US debt globally.

Bessent sees stablecoins as a reinforcing mechanism for the US dollar reserve status. In a Senate hearing last month he said:

"In the history of the US dollar as a reserve currency, there have been numerous passages along the way where many people assumed that the US dollar would lose reserve currency status." and added that "there has always been a new mechanism that has cemented its role as a reserve currency."

A notable example is the 1970s when then-President Nixon severed the Dollar's link to Gold, and the exchange rate plummeted. The Dollar swiftly regained its global footing, however, when Saudi Arabia agreed to price crude in dollars and recycle the proceeds into US Treasury securities, thereby birthing the petrodollar system.

He went on to tell lawmakers last month at a Senate Appropriations subcommittee hearing that:

"Stablecoin legislation backed by US Treasuries or T-bills will create a market that will expand US dollar usage via these stablecoins all around the world. I think that 2 trillion is a very, very reasonable number, and I could see it greatly exceeding that."

JP Morgan Deposit Coin

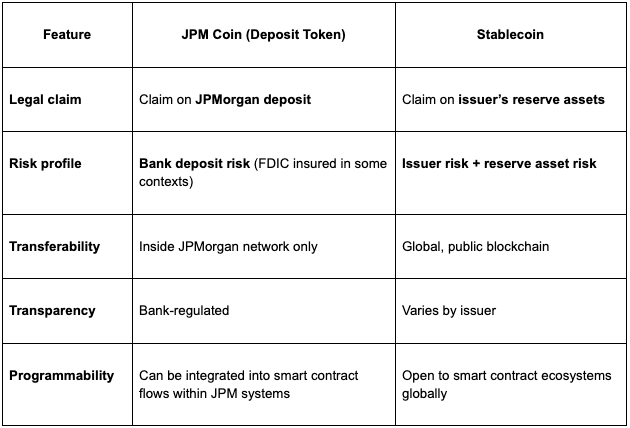

While much of the conversation has centred on stablecoins, J.P. Morgan stepped in with a new US dollar stable token in the form of deposit coins. A new and unique US dollar-pegged design.

Deposit coins are digital representations of commercial bank deposits (e.g., dollars held in a JPMorgan account) designed to move on blockchain rails. They are effectively tokenised deposits.

Deposit coins serve as a reminder of the beauty of programmability offered by networks like Ethereum. We will see a lot of experimentation with different designs and conventions.

Robinhood and Tokenisation

"We think tokenisation is perhaps the biggest innovation to come into capital markets in the past decade," - CEO of Robinhood Vladimir Tenev.

Tenev is pursuing a blockchain strategy and outlined his intentions:

"Last year, in a nutshell, I was really like, 'How do we rebuild Robinhood, in [many] countries, completely onchain?' I think that's kind of what we are delivering right now. It's really exciting to see that in one app… and we are able to offer stock, ETF, perpetual, spot crypto. "

Robinhood moving onchain is just another display of blockchain maturing landscape and increasing synergy with existing capital markets. Robinhood eventually aims to support 24/7 trading, self-custody, and bridging.

Robinhood is a significant first step in bringing equities on-chain. Over the long run, however, our view is that businesses themselves will create tokenised share offerings, allowing clients to purchase the underlying assets directly.

Time for Ethereum?

In 2020 and 2021, we got the first real glimpse of Ethereum's future; this period is affectionately known as DeFi summer. Those two years were filled with experimentation in internet finance applications; by the end of DeFi summer, we could exchange, lend, borrow, trade and manage our assets without any central coordinating entity, all made possible by Ethereum.

Since then, the narrative around Ethereum has been weak. ETHBTC, the price of ETH in BTC terms, is down 70%.

ETHBTC now trades near its 2018 lows; at these levels, we believe ETH is the most mispriced and misunderstood cryptoasset in the entire market.

Ethereum is now positioned as the institutional platform for Internet finance, and regulatory tailwinds are finally supportive of its adoption, which we forecast to be pervasive in the world of finance.

Ethereum hosts 60% of all issued stablecoins and 82% of all tokenised real-world assets, securing over $760B in value across its ecosystem. The majority of public blockchain financial activity is happening on Ethereum.

It's time for ETH.

Understanding The Difference Between BTC and ETH

I have always been fascinated by this incessant need for market participants to categorise cryptoassets into familiar yet often inappropriate buckets. People need to generalise, and they do this by taking something new and unique and placing it into a familiar construct.

This is often referred to as Skeuomorphism, the design principle that uses visual cues to make digital elements resemble their real-world counterparts, often to make interfaces more intuitive and familiar. A good example of this can be found in the early days of smartphones.

If you had ever purchased an iPhone in the early years, you would have seen that the background of the iPhone was a bookshelf. This was familiar and understandable. My phone, like my bookshelf, is where I can keep my address book, calculator, photo album, and maps, but unlike my bookshelf, I can take my phone anywhere.

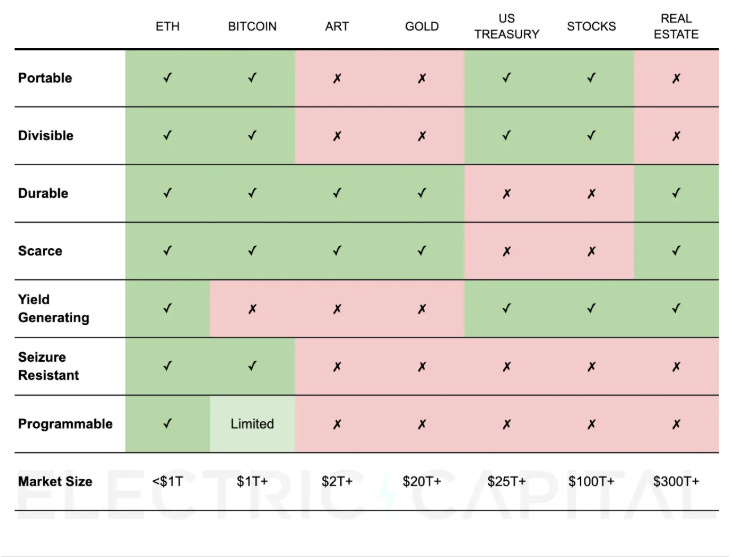

Crypto is repeating this with examples like BTC is digital Gold and ETH is digital oil. While these skeuomorphic terms are great generalisations, they completely underappreciate and discount the new and previously impossible features of these assets.

We prefer to think of BTC and ETH as non-sovereign stores of value. Both assets are unique in their own right, but they also share many similarities. The core differences boil down to yield generation and programmability.

We define BTC as an apolitical, non-discretionary form of money.

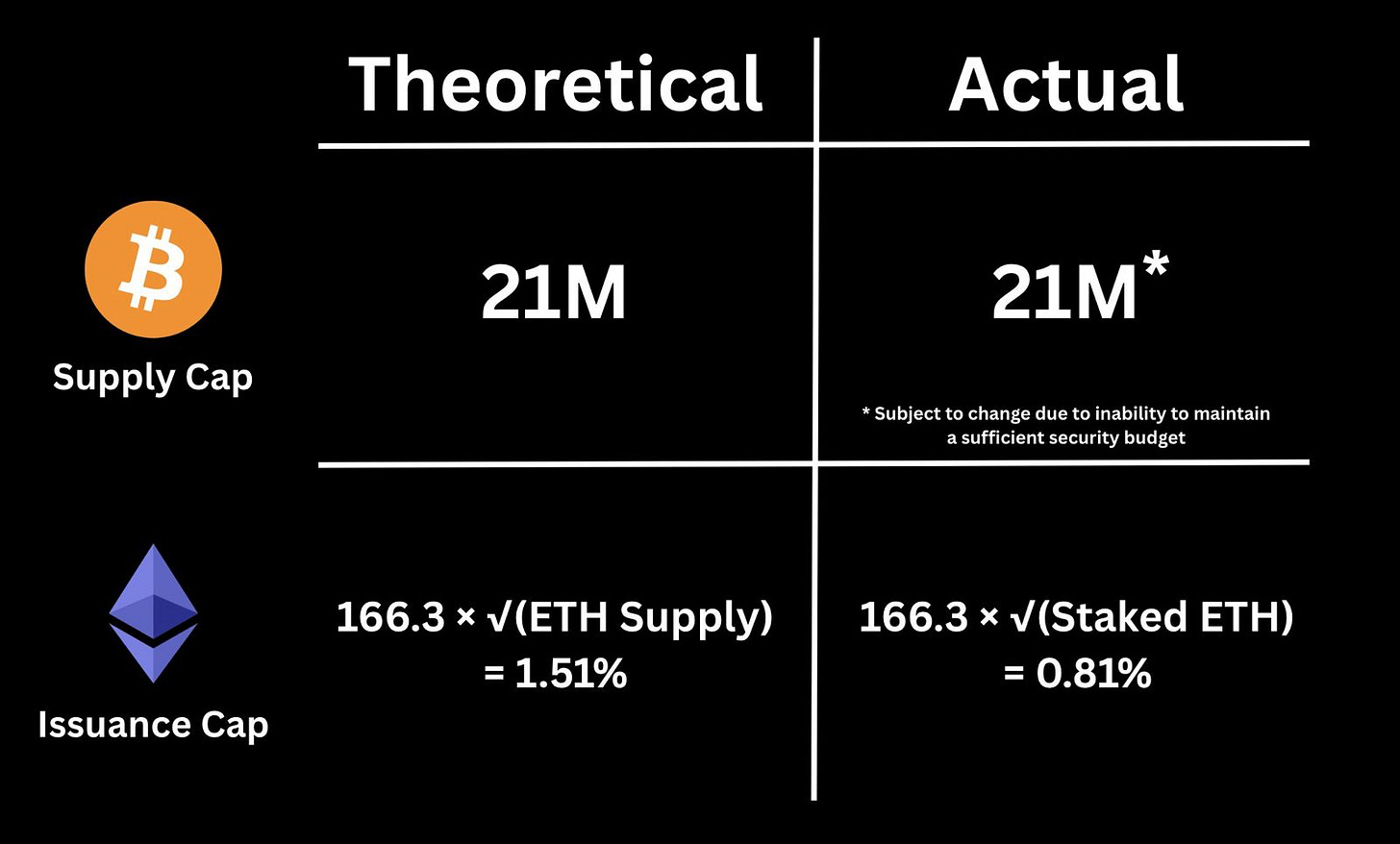

What makes BTC special is, firstly, its theoretical fixed supply of 21 million, and secondly, its predefined issuance schedule, enforced by the difficulty adjustment. I can't think of a single asset where the holders know the exact supply 100 years plus into the future, and that's really what makes BTC special.

We define ETH as a productive, yield-generating fuel for the Internet of finance. ETH secures the Internet of finance, captures value from its growth and has built-in scarcity and sustainable supply dynamics.

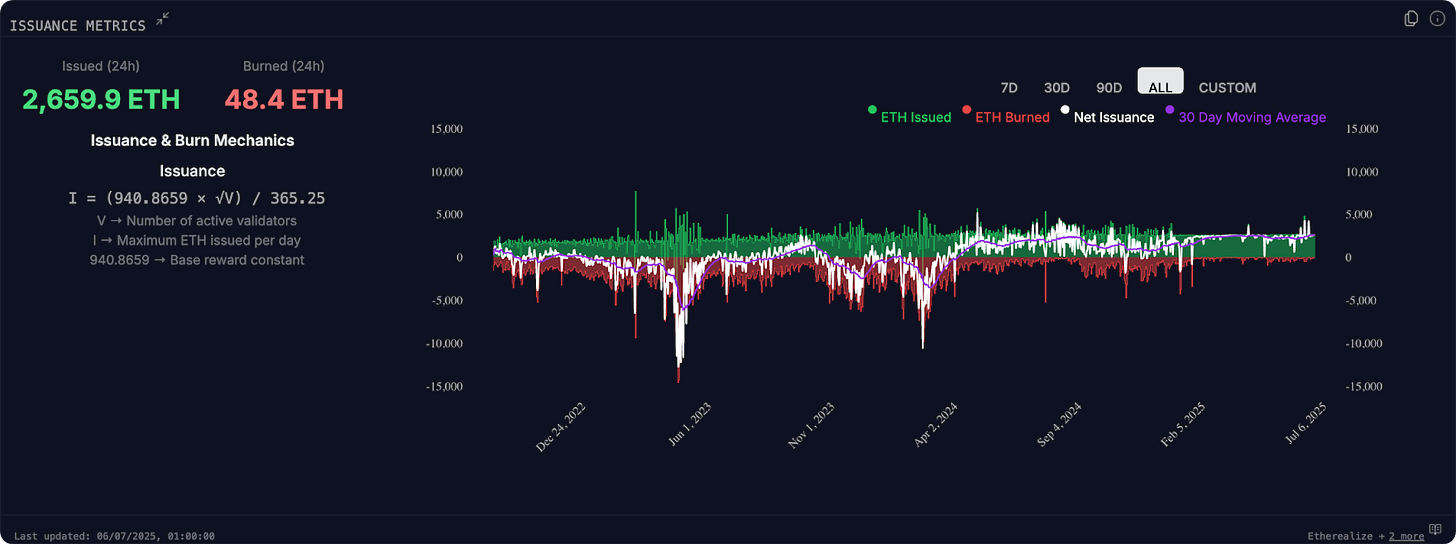

ETH doesn't have a fixed supply. Instead, ETH targets a minimum viable issuance with a fixed upper bound of 1.5% per year in an extreme scenario. For context as of writing, BTC is currently inflating at 0.85%, ETH at 0.68%.

However, unlike BTC, the issuance of ETH is offset by the usage of the Ethereum network. ETH, in this sense, is essentially fuel that is consumed every time a stablecoin is transferred, every time a tokenised real-world asset is issued, every time a transaction is executed and every time a new application is deployed.

If we are right, and capital markets migrate to the Ethereum network, then usage will continue its exponential journey upward and tilt ETH issuance from marginally inflationary to outright deflationary. In the past, we have observed issuance becoming deflationary during periods of high usage, and we anticipate many similar episodes in the future.

This highlights the core difference between these two assets: BTC as an unproductive store of value and ETH as a productive fuel for internet finance. We are bullish on both of these assets but for different reasons.

BTC is arguably the greatest economic story ever told, and many have come to see it and, more importantly, express it as a hedge against a backdrop of unsustainable debt levels and fiscal deficits. In a world where all roads lead to monetary debasement and inflation, BTC has emerged as the ultimate safety boat of choice.

ETH is the fuel, security, and collateral of the emerging Internet of Finance, which can be thought of as an emerging economy in cyberspace. If you are bullish on the applications and use cases of blockchain technology, then ETH is the best way, in our view, to express that.

Interestingly, the ETHBTC ratio is tightly correlated to our global risk sentiment proxy, the copper-to-gold ratio. The copper-to-gold ratio is a useful tool for understanding the business cycle and maps nicely onto other data points, such as the Purchasing Managers' Index.

Copper is an industrial metal that benefits from productivity, while gold is a safe haven metal that benefits in times of uncertainty.

Interestingly, the relationship between BTC and ETH is very similar, although the data is limited.

The copper-to-gold ratio is bottoming out here, and ETHBTC has also made a meaningful uptick from the lows. ETH has fundamental tailwinds at this point in time, primarily due to regulatory support in the form of the GENUIS and CLARITY acts, as well as the adoption of tokenisation and stablecoins. These forces will drive interest and capital flows into ETH over the coming months.

We view stablecoins as a killer application that will serve as the next significant adoption catalyst. Our general thesis is that stablecoin issuance leads to more stablecoins being deployed in DeFi applications, which supports the further usage of network tokens, such as ETH, as collateral, thereby bolstering network token prices and incentivising more institutions to build useful applications on public blockchains.

Every crypto bull market is driven by mass token generation events, and stablecoin issuance combined with increasing tokenisation projects will be no different. However, the scale and utility of this higher-quality issuance will be more marketable and meaningful than mass token generation events of the past and, therefore, potentially more potent an ingredient for a rerating of ETH, compelling ETH alternatives, and Internet Finance applications.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.