The Layer 2 War: Arbitrum vs Optimism

Every crypto market cycle is fuelled by a new coordination structure, business model or alleviant to a constraint of a previous cycle. We see Layer 2 solutions as the next area of innovation and investor attention.

In this article, we will explore Layer 2 solutions and attempt to describe their role in the broader crypto economy. We will then provide a quick health check on the Arbitrum and Optimism ecosystem, both of which are defined as Optimistic roll ups. Lastly, we will explore our closing big-picture thoughts on Layer 2’s and explain how we plan to navigate this theme.

What are Layer 2 Solutions, and Why Should You Care?

Blockchains are global accounting systems; we view blockchains such as Ethereum as real time gross settlement systems. Every transaction, regardless of size or complexity, is validated by the entire network.

This introduces the need for additional scale because as we increase the number of transactions on a blockchain we begin to hit resource limitations. The nodes that validate the network need more processing power and storage capacity; if we increase the minimum resource requirements for nodes, we risk centralisation over time as fewer participants can afford to run such infrastructure.

The proposed solution to this problem has been debated throughout the blockchain revolution. But the core solution is rather simple: If we want to maintain the decentralisation of the underlying blockchain, we need to increase the economic density of its individual transactions.

Increasing economic density can be described as squeezing as much $ value (number of transactions* $ value per transaction) into each and every block. This is where layer 2 solutions come into play. You can think of layer 2 solutions as net settlement systems that batch multiple transactions into “one line item” on the underlying blockchain. This is very similar to how our current financial rails are structured today.

Central bank ledgers are like the underlying blockchain, and commercial bank ledgers, payment systems, and fintech apps are like layer 2 solutions.

Please be aware that we have grossly oversimplified these roll ups for the sake of getting the main point across; if you are interested in a deeper dive on both of these roll ups you can find our Abritum article here and our Optimism article here.

Business Models and Token Structure of ARB and OP

The business models of ARB and OP are almost identical. They run their own ledger and charge a fee for transactions, which needs to be greater than what they pay Ethereum validators for settlement.

Currently, both of them operate with the same margin of 20%, for every $100 of fees they charge, $80 is paid to Ethereum validators and $20 is earned by the layer 2.

The tokens are structurally the same, both utilising staking and conferring governance, while ETH remains the asset that gas fees are paid in. This is in stark contrast to the design of many L1 tokens that serve monetary functions (they pay the taxes = gas fees) and usually have a value flow in form of a dividend or token burn.

Roll ups are essentially in the business of purchasing Ethereum blockspace and then selling that blockspace to their community for a profit.

Health Check

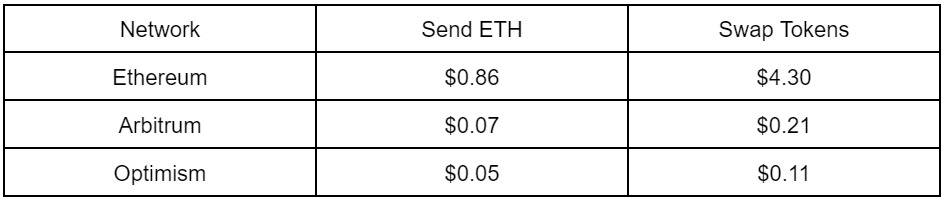

The most obvious first question we need to ask about Layer 2’s is whether they have actually delivered on their most fundamental promise: Lowering fees for users.

Safe to say that they have delivered on this; however, these fees can probably still be reduced further, and improvement proposals such as EIP-4844 Proto danksharding seek to do just that.

Price

Since the Arbitrum token launch (23 March 2023), the ARB token has outperformed the OP token. Both, however, have trended lower over the last four months. But the race that these two are in has only just begun, and there are plenty of other technological approaches to building roll ups that are about to come to market.

Value

Value is a tricky dimension in crypto, but it is, regardless, a good yardstick for understanding how the market is pricing these opportunities. Remember, these are long-duration assets in their very early stages of development, so the multiples are expected to be inflated and overzealous. Multiples like this are seen in all new frontier technologies building the fourth industrial revolution.

Clearly, the market is eating up the excitement of Layer 2 solutions as both these leading projects command extraordinary multiples in Fees and Earnings. Perhaps these traditional valuation multiples aren’t practical or useful when assessing Layer 1 or Layer 2 tokens, as these networks are more similar to nation-states than they are businesses.

Both ARB and OP have significantly low circulating supplies relative to their fully diluted supplies, the market will need to be able to absorb the new supply of these coins before it can move higher. But the flip side of this supply expansion is that new token issuance is used to incentivize new users and developers to join these networks.

Quality

The quality assessment reveals just how neck and neck these two projects are.

Arbitrum seems to have attracted more users and financial capital, but it's important to build into account token incentive schemes that may be giving the illusion of relative outperformance. Once the early-stage token incentive programs come to an end, we will get a much better understanding of who is best able to capture users and financial capital.

Arbitrum does stand out when we consider the number of protocols or projects built on top of it, almost three times the amount that exists on Optimism. Following the developers and where they are choosing to build their businesses and applications is always something to monitor in the world of public blockchains.

Remember, the whole point of these roll ups at a high level is to increase the economic density ($ value* transaction count) of ethereum blocks. So it's no surprise that both Arbitrum and OP are doing similar amounts of transactions to their underlying blockchain Ethereum.

Our expectation is that transaction count on Arbitrum, and Optimism will outpace Ethereum as users seek cheaper fees and application developers continue to migrate to roll ups.

Growth

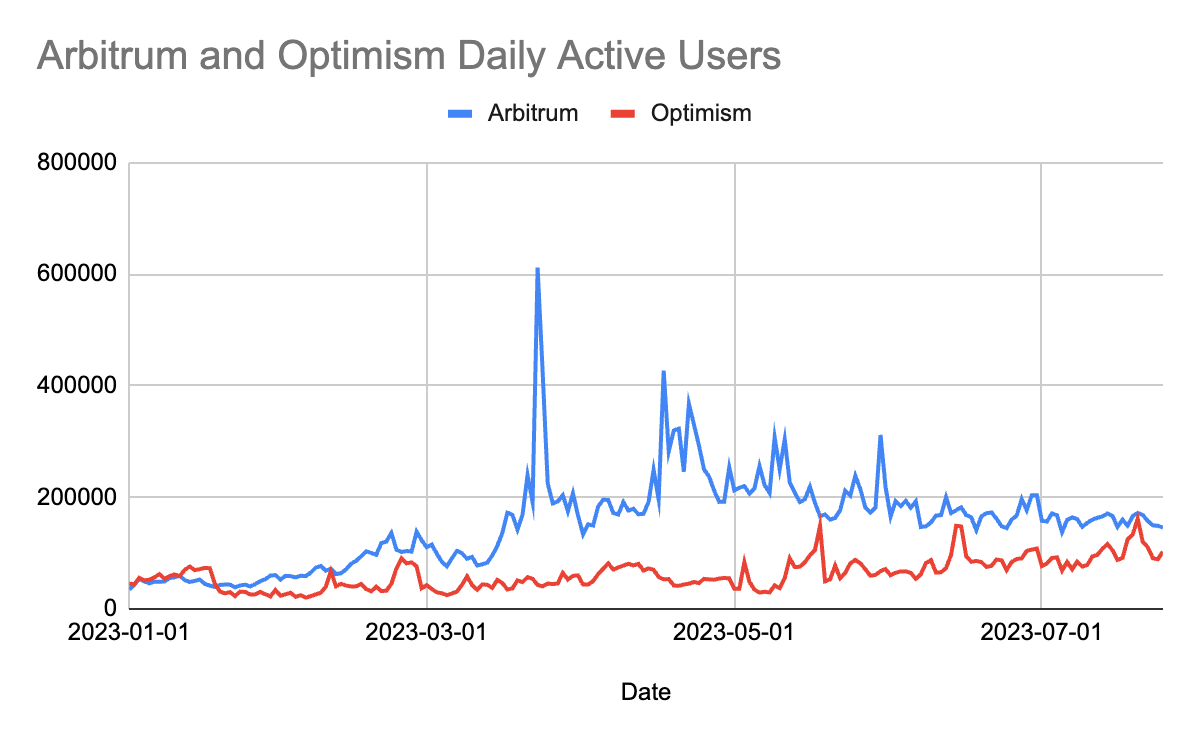

Assessing the growth of these networks further suggests that Arbitrums incentive scheme has begun to lose its traction while Optimism shows signs of stronger organic growth across TVL, daily active users and fees generated.

The strongest divergence between these two ecosystems is the change in daily active users; Arbitrum saw an initial explosion in users in anticipation of the ARB airdrop but has since experienced a slow bleed in users. OP performed an airdrop in May 2022 and has seen the opposite with a slow grind-up in users over the last 90 days.

Closing Thoughts

Roll ups or layer 2 solutions are similar to Avalanches subnets, Cosmos’s appchains, Polkadots parachains and Polygons supernets. It's safe to say that multiple ecosystems share this methodology of scaling through layers. However, public blockchains such as Solana are taking a vastly different route. We wrote in-depth on this in our article, The Unbundling of Blockchain Infrastructure.

There's a case to be made that the future is one which revolves around a few Layer 1 platforms, such as Ethereum and a plethora of specialized Layer 2 solutions. We envision a future where even enterprise blockchains that seek permissioned access and privacy eventually become layer 2 solutions that leverage the security and consensus offered by public networks.

We can also envision a future where these attempts fail; we have seen this many times in the past with solutions such as state channels or side chains which, all at their genesis, presented truly promising methodologies to scale. Only time and experimentation will sculpt the winners in crypto, and we need both to understand whether these solutions achieve their end goals without unacceptable tradeoffs.

Optimism is very interesting to us mainly due to the OP technology stack, which you can learn more about here. The OP stack means anyone can launch their own version of Optimism; recently, we have seen crypto titan Coinbase choose the Optimism technology stack to build out Base. We believe this is the beginning of a much bigger trend and expect to see Web 2 companies, crypto companies, brands and even financial institutions building applications on the OP stack and plugging into the Ethereum Internet of Value.

Arbitrum shares this vision but has taken a different approach. Unlike the OP stack, which allows competitors to build their own versions of Optimism without permission, Arbitrum offers developers the ability to permissionlessly build Layer 3’s that pay the Arbitrum sequencers to process and execute their transactions. Perhaps the ARB token is better positioned to capture the value generated by builders who use their technology when compared with what Optimism is doing. You can read more about the difference in approach here.

A concern for us when investing in layer 2 tokens is the saturated and hugely competitive peer group of similar solutions. This article has focused on Optimistic roll ups and hasn’t even touched on ZK roll ups which offers equally if not more interesting opportunities and potential design spaces.

What's evident in the health check of these two projects is the effect that airdrop programs and incentive schemes have on network usage. As other layer 2 tokens come online, we expect to see a vampire-like effect where users migrate to networks where clear rewards are present and away from networks that are tapering off their incentive schemes.

Our approach to layer 2 tokens is the same as we treat every other theme,

1. Understand the theme, the players in the game, the measures of success and the key incremental changes required to scale.

2. Maintain a portfolio of tokens in that theme that maximize measures of success.

3. Diversify across technological approaches to avoid concentration in any particular approach.

Our Predictions for Layer 2’s

Broadly when we think about what has value in the crypto ecosystem, we consistently come back to the core resource of crypto, Blockspace. Layer 2’s, in this context, sell on refined blockspace to their users; they essentially add value to the existing supply of secure blockspace, making it cheaper and more expressive for the users of their solutions.

Mastering, monetizing and adding value to blockspace is, in our view, a valuable exercise, and we believe this view is shared by builders and users alike. Our predictions are:

1. Layer 2 solutions will become the main gas guzzlers of Ethereum gas fees within the next 18 months; you can track this on Ultrasound money on the burn leaderboard.

2. We will see an explosion in the amount of Layer 2 solutions; you can track the number and variety of Layer 2 solutions at L2Beat.

3. The majority of applications will migrate or be built first and foremost on a Layer 2.

4. We will see both general purpose Layer 2’s and application-specific layer 2’s.

5. As Layer 2’s proliferate, their networks specialise, and over the long run, this specialisation extends the capabilities of the crypto economy.

6. Composability and interoperability between Layer 2’s will be solved and refined, leaving users with a seamless internet of value experience.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems that require due diligence to comprehend and operate in. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long-term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.