The Unbundling of Blockchain Infrastructure

TL;DR

· The prevailing bias in the crypto asset market is the idea that the bulk of investment value of the industry will be captured by the Infrastructure layer.

· The prevailing bias is in stark contrast to previous technological revolutions.

· The adoption cycle will change the expectations of the technology and therefore more attention needs to be paid to the needs of the next billion users.

· Key advancements in scaling are at the heart of the coming innovation cycle.

· We believe that blockchain infrastructure will be greatly unbundled over the coming 3-5 years.

· There are many potential playing fields for this transition to occur.

· How we see the trade and assessing your infrastructure to application ratio.

Introduction

Opportunity in any market exists in anything that causes the perception of the investor to take on a new shape. For many years, the Fat Protocol Thesis popularised by Placeholder VC has dominated the perception of the digital asset market. But as the market and, more importantly, those who have come to use this new technology platform change, so too does the perception of where value will be captured.

This essay seeks to add context to the current state of the digital asset market and bring to light a change in the tide that can be monetised through thoughtful positioning. We cover the prevailing bias of the crypto market, how the adoption cycle changes the requirements of what needs to be built, how the innovation cycle has changed the set of design choices, where we expect this to play out and what we expect to see as a result.

Given terminology is loosely thrown around in this industry, our broad definition of infrastructure and applications is as follows:

Infrastructure – Anything that aids in the provision of data, execution, consensus and settlement for transactions of value.

Applications – Anything that leverages this infrastructure to provide a particular service. This includes primitives, which are usually smart contracts that live on the underlying infrastructure.

The Prevailing Market Bias and Previous Technological Revolutions

Every technological revolution is comprised of new and essential infrastructure that inspires new industries or redefines old ones. In the bulk of these examples, the value from an investment perspective was to be captured by the new products, markets and services created by new infrastructure sets and not necessarily the infrastructure itself.

Infrastructure can be easily commoditised, but the businesses it enables can differentiate, own the customer experience and port their products to specialised infrastructure providers as required.

All of the previous technological revolutions illustrated that value capture occurs in the applications of a new technological paradigm. The internet is a brilliant example and something we often use in describing the rise of the internet of value. The protocols and rule sets that make it possible for the information to get from my desk to yours didn't capture close to the amount of investment value when compared to the applications it came to create, such as Google, Facebook and Amazon.

In the early speculative phase of the internet, we saw a similar trend to what we are witnessing today in digital assets. A new general-purpose technology was born, and many decided the best way to express an expectation of future success was to bet on the infrastructure providers such as AOL. They would have been far better off investing in real businesses leveraging the underlying technology.

Ironically the applications of the internet age that captured the bulk of users have pivoted into building their own infrastructure. After all, who is best positioned to know what their clients really need, those who own the customer relationship or the infrastructure providers?

As it stands, the blockchain industry has been perceived and structured as if the bulk of investment value is to be obtained by the infrastructure of this new technological movement. The brilliant minds of Placeholder VC played a significant role in shaping this perception when they wrote The Fat Protocols Thesis.

The TL;DR of Fat Protocols is that monolithic blockchain structures would accrue value as a function of the applications they facilitate and secure. But innovation and technological constraints have pressured this vision, and a new thesis has emerged.

The Adoption Cycle

Before we get into the innovations that have changed the landscape, we would like to set the scene where we find ourselves as an industry. The adoption cycle dramatically affects the tides of this changing environment and underlying market structure. We are now 14 years into the blockchain revolution, and plenty of attention has been placed on the infrastructure to enable this new world, but we don't have many truly useful applications. This is a massive problem and the greatest opportunity of the next 3-5 years for anyone building or investing in blockchain technologies.

As of writing, according to research from Crypto.com, roughly 435 million people have interacted with digital assets, and even fewer have interacted with sectors such as decentralised finance and the variety of web3 applications. DeFi, for example, has only had 6 million unique wallet interactions, according to Dune Analytics. There is a reason for this, though.

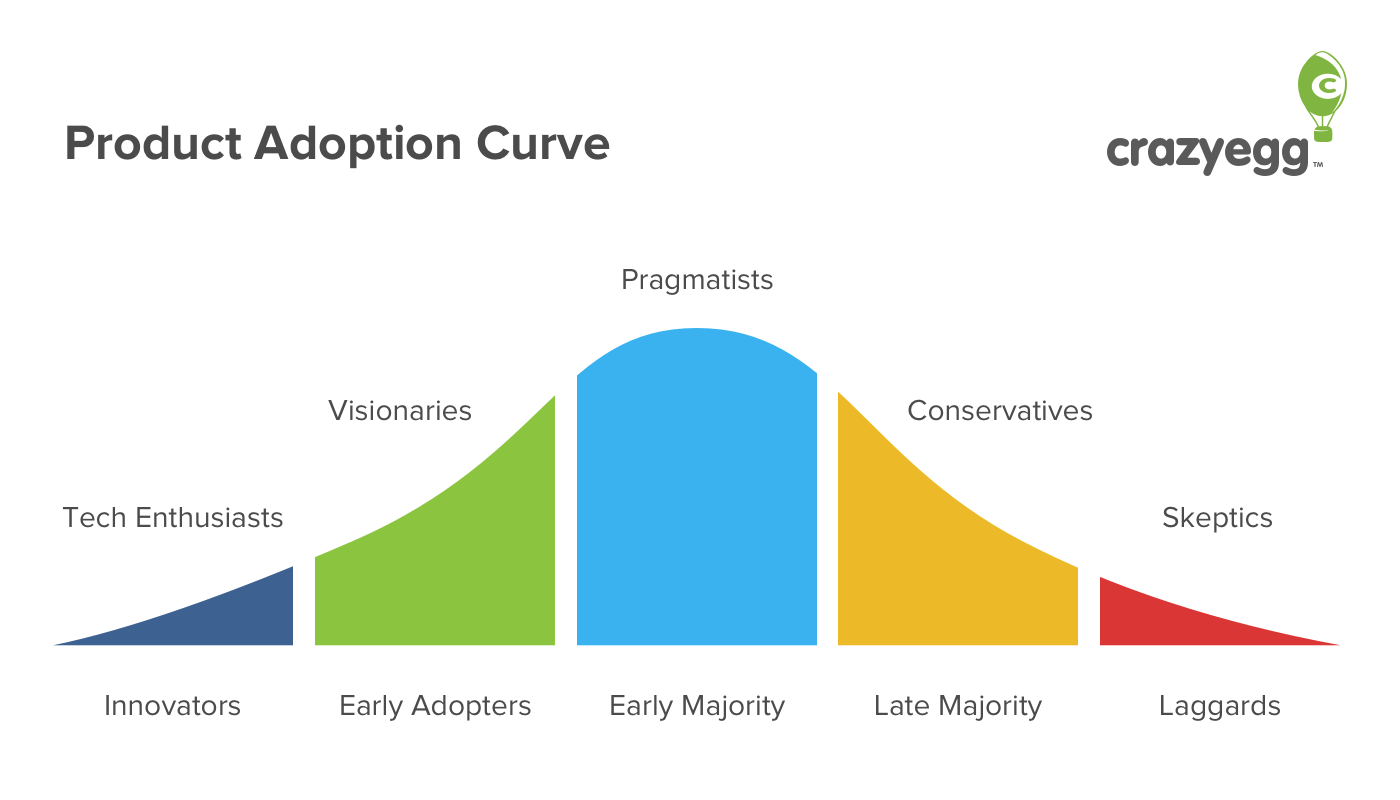

The innovators and early adopters of any technological revolution are the "true believers". These individuals can look past the inefficiencies, terrible user experience and high risk associated with something new and scary. They are less focused on where the ball is and place greater emphasis on where it is going, and therefore, they are naturally more tolerant of the growing pains of a new technology platform.

However, this group is not the future user base of this technology. The prospective users will expect nothing less than a 10x better service than their analogue alternative. They will expect efficiency and seamless user experience.

What the future requires of all things blockchain is plain and simple. Useful applications…

The Innovation Cycle

In our minds, the meaningful innovations presented by the blockchain revolution are:

- A trust-minimised, globally distributed settlement system which has dramatically reduced costs associated with rule enforcement.

- A digital bearer instrument with zero counterparty risk.

- Smart contracts that enable the creation of trust-minimised financial and non-financial services.

- A standard for fungible assets

- A standard for non-fungible assets

Each one of these breakthroughs has created enormous asymmetric investment opportunities. They have all individually sucked in human and financial capital at a rate we haven't seen before compared to previous technological revolutions. The introduction of bitcoin brought with it multiple copycats and alternative implementations. The rise of Ethereum and smart contract functionality gave birth to the second-largest sector in the space. Creating the fungible token standard enabled the ICO boom, trust-minimised financial services onboarded large swaths of new users, and the non-fungible token standard has extended blockchain's reach to creatives and brands.

Every innovation cycle is characterised by one of these zero-to-one developments. In 2023 we have yet another breakthrough that will alleviate previous constraints and create the conditions necessary to onboard the next 1 billion blockchain users.

The majority of useful applications today are built on monolithic blockchain structures. These blockchains provide a sort of cloud computing service that maintains an always available state of who owns what and how much of it they own. The core constraint for both user onboarding and the creation of useful consumer applications is a general lack of scalability and customisability.

These core roles have historically been performed by a single set of nodes where all of them perform the same computation and are required to agree on the N+1 state of affairs. However, recently we have begun to see a maturing class of blockchains that modularise these component pieces. This allows the granularization of core components and further specialisation. We believe that blockchain infrastructure will be greatly unbundled over the next 3-5 years.

Firstly, this unbundling puts significant strain on the Fat Protocols Thesis as the components of what makes blockchain special are separated and further commoditised. Secondly, it refines the infrastructure required to create trust-minimised applications for various use cases. We believe that this will cause a shift from "fat protocols and thin applications" to "tall applications and thin protocols". This market structure more closely resembles the end state of the previous technological revolutions.

As with everything in life, this isn't a solution to all our problems but rather an expansion of what is possible and the introduction of a new set of trade-offs. Dmitriy Berenzon, in a brilliant essay that you can find here, outlines the advantages and disadvantages of this new modularised infrastructure.

Our previous article expanded on incentives for applications to build on modularised infrastructure. So this month, we will elaborate on the benefits of performance and customisability.

Performance of applications which are more often than not a collection of smart contracts operating on a general-purpose platform such as Ethereum, are constrained to the performance limitations of the underlying platform. They can only work according to the rules of the underlying ledger and are susceptible to the issues that arise when the network becomes congested.

For example, when Yuga labs released their Otherdeed NFTs, gas fees spiked due to the enormous demand for Blockspace. This demand and resulting gas fee spike affected every other application built on the same network. This is an unacceptable consequence of monolithic blockchain structures and something you would expect every application to attempt to eliminate.

On customisability, the sky is the limit. In the same way that performance is constrained by the general-purpose rules of a monolithic blockchain, so is the expanse of potential design possibilities. Applications, for example, cannot customise transaction ordering in a way that is beneficial to their particular use case, and they can only innovate on the edges of the network. The modular era introduces the opportunity for application developers to break free from the constraints of general-purpose platforms and innovate at a rate impossible to replicate on slower-moving general-purpose platforms.

Our expectation is that the coming years will afford a plethora of new opportunities for application developers. For investors, this is fantastic as we will see true differentiation between various applications. At Etherbridge, we will look for applications and use cases best positioned to take advantage of the modular infrastructure stack.

The Playing Fields

Ethereum

Ethereum has, over the years, become the central hub of all things blockchain. The move to a roll-up-centric roadmap has positioned it well to benefit from this transition. There are many different roll-ups built on top of Ethereum that we expect application developers to use to bring their ideas to life. You can keep track of all things Ethereum L2 at L2Beat.

Cosmos

The Cosmos ecosystem was essentially built as if this transition was given from the very beginning. The ecosystem has a variety of projects building application-specific chains to handle different use cases, which you track here. Further planned upgrades, such as shared security, could solve even more of the growing pains of AppChains. Together with Inter blockchain communication (IBC), Cosmos envisions an interconnected web of interoperable app chains.

Polygon

Polygon has been called the swiss army knife of blockchain scaling technologies and has implementations across every possible scaling methodology (PoS checkpoints, Validium, zkRoll-ups, optimistic roll-ups). Polygon's combination of various scaling methodologies and brilliant business development places it in good stead for onboarding many partnerships with brands such as Adidas, The Walt Disney Company, Meta, Stripe and Reddit, already partners of Polygon.

The Darkhorse, Bitcoin

For many years bitcoin has been in an innovation slump relative to the speed and direction of other ecosystems. However, the advent of inscriptions brought to the mainstream by Ordinals could mark a turning point for innovation on bitcoin. You can read more about Ordinals here. On the back of this, we have seen attempts to create bitcoin roll-ups, their design and realities still require further exploration, but the trajectory is exciting.

Assuming the bitcoin developer community can utilise bitcoin's far superior decentralisation and security whilst overlaying a faster, more expressive execution environment, we could be in the early stages of a boom in bitcoin scaling technologies.

Other notable ecosystems are Avalanche with their Subnets and Polkadot with their Parachains.

The Early Days of Tall Applications

At Etherbridge, we have long held the view that we will know that blockchain is winning when the majority of people who come to use it are unaware of the fact that they are using a blockchain. The awareness is one thing, but the true goal is for the complexities of blockchain to be abstracted to a point where you don't have to care about its underlying plumbing as a user.

Think about fintech; users aren't concerned or even slightly interested in the underlying mechanics of the business. They want a great user experience and seamless service offering.

The applications that will come to define the blockchain revolution will give users just that, a full suite of services abstracted to the point that your 80-year grandmother can use. We win when people use blockchain-enabled applications not because decentralisation is maximised or trust is minimised but because the products are superior and easy to use.

As the infrastructure modularises, this reality gets much closer. This modularisation will allow applications to vertically integrate their service offerings and branch into new markets or sectors. We are seeing the early stages of this with Uniswap. They recently moved into NFT marketplaces with the acquisition of Genie and are also piloting their wallet.

As things continue to progress, we expect to see more of this vertical integration, more application-specific wallets, more core service offerings and even customer support services.

The future is tall, vertically integrated applications built on thin specialised protocols.

The Trade

The trade, in this regard, is simple, but the time horizon is unclear. The digital asset market is overcrowded in terms of available infrastructure. The majority of high-value projects are infrastructure related. It's essential to remain aware that there is no single winner, but there certainly are stand-out market leaders such as Ethereum.

According to data from Messari, Infrastructure and Bitcoin account for 95% of the total value of the digital asset landscape. The remaining 5% is shared between all Defi and Web3 projects.

If the future of blockchain is for truly useful applications, then this ratio is entirely out of whack. Investors can prepare for the changing environment by firstly remaining aware of their infrastructure-to-application ratio and secondly by positioning themselves tactically in applications with strong roadmaps to take advantage of the performance, customisability and value accrual benefits of a modularising infrastructure layer.

We believe that a rerating is imminent in the coming cycle and that the leaders of the following cycle will be found in the application layer and not in the infrastructure layer. This is core to how the Etherbridge fund is positioned. As of writing, the fund is 70% infrastructure and 30% applications, with the goal of adding quality applications to the portfolio throughout the coming cycle.

With all trade ideas, there are always caveats, the biggest one being that the industry still needs to settle on what constitutes minimum viable infrastructure. Therefore infrastructure market leaders are still susceptible to losing market share. If the infrastructure remains uncrystallised, it will continue incentivising developers into building "new and improved" infrastructure instead of useful applications. For this trade to work, we need the marginal benefit of competing as yet another piece of infrastructure to be squeezed to such a point that innovation is pushed up the stack. Our view is that this moment in time is fast approaching.

Only time will tell, but this is undoubtedly a transition to keep top of mind as the blockchain revolution continues to play out.

Notable Articles and News Stories This Week:

New York AG Alleges ETH is a Security in KuCoin Lawsuit

New York Attorney General Letitia James became the first regulator in the US to claim in court that ethereum is a security in a lawsuit against exchange KuCoin.

Seychelles-based KuCoin has been operating in New York without registering as a securities and commodities broker-dealer, James alleged in the suit.

KuCoin facilitates trading of ETH, James added, “a speculative asset that relies on the efforts of third-party developers in order to provide profit to the holders of ETH.” The exchange should have registered before offering ETH, LUNA and TerraUSD — all of which fall under the securities classification, according to James.

However, the NYAG may not have the final say on the issue. Rostin Behnam of the CFTC told the Senate Agriculture Committee as recently as Wednesday that ETH is in fact a commodity, not a security.

“We would not have allowed the Ether futures product to be listed on a CFTC exchange if we did not feel strongly that it was a commodity asset,” he explained.

Read more comments here

Cosmos Governance Gives Greenlight to Interchain Security

In a nearly unanimous vote which concluded on Tuesday, Cosmos’ community members staking the ATOM token approved a proposal to launch the next major upgrade to the Cosmos Hub.

The v9-Lambda upgrade will establish the first version of interchain security (ICS) — also known as replicated security — a service the Cosmos Hub will provide to a new generation of consumer chains in the Cosmos ecosystem.

Those consumer chains, in turn, will bring value to the Cosmos Hub, according to proponents — such as Zaki Manian, co-founder of Iqlusion.

“The right way to think about ICS is it’s in the family of staking primitives, like Eigenlayer: What Eigenlayer is to Ethereum, ICS is to Cosmos,” Manian told Blockworks.

The network upgrade — expected to go live March 15 — was approved by over 99% of voters comprising about 58% of ATOM staked, which is seen as a vote of confidence in the network, according to Avril Dutheil, general manager of Neutron, known online as Spaydh.

Read more about the upgrade here

MakerDAO Eyes More US Treasury and Bond Investments

Decentralized protocol MakerDAO is looking to increase its investments in US Treasury and bonds to $1.25 billion in a proposal by community member and CEO of Monetalis, Allan Pedersen.

In an earlier Maker Improvement Proposal (MIP), the community governance of MakerDAO voted in favour of deploying an estimated $500 million in short-term US treasury bond exchange-traded funds (ETFs), making headlines at the time.

This latest proposal will increase the debt ceiling of the US treasury bonds by $750 million to take advantage of the current yield environment and increase revenue on Maker’s existing assets.

“After review of various highly liquid money market options, we found that the simple solution of laddering US Treasuries over a 6-month period with bi-weekly maturities presents a strong, flexible and effective solution for Maker,” Pedersen wrote.

Read more about the move here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.