Arbitrum

Market Recap

FTX Going Under Brings The Crypto Market With

Arbitrum

This week we continue our exploration of the different projects trying to scale Ethereum and unlock its full potential. We have already covered two separate projects, Polygon and Optimism, and the approaches they have taken to solve the scaling issue.

This week we will dive into Arbitrum, a project similar to Optimism in that it uses optimistic rollups; however, there are some differences in the way they implement them.

However, before we do this, we are going to share an Ethereum update as Vitalik Buterin recently released an updated roadmap where they detail the project's next steps and how rollups are core to their final vision.

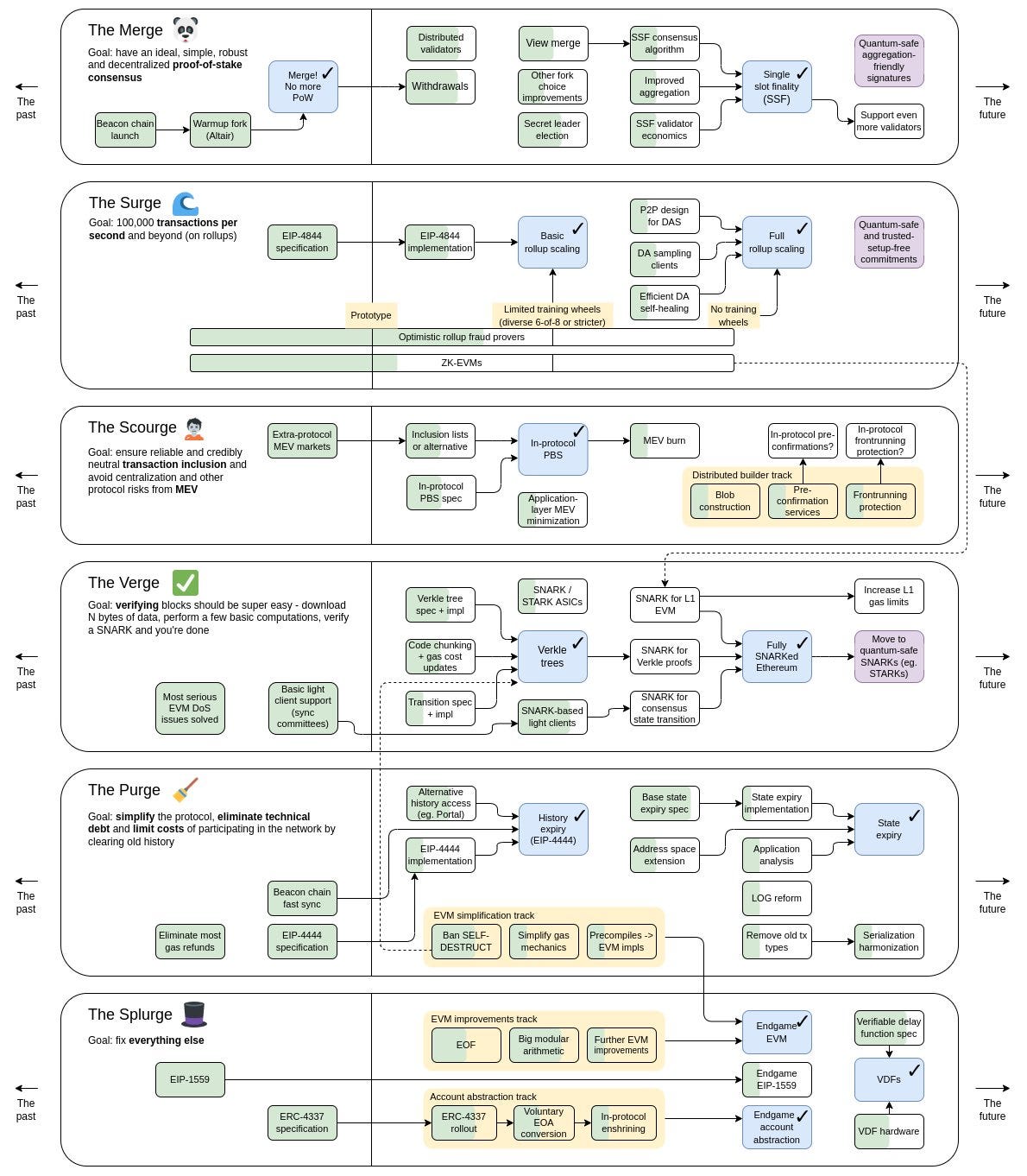

Ethereum Roadmap Update

On the 5th of November, Vitalik released an updated Ethereum roadmap containing some new details on the project's future. One of the most notable changes was the way in which they visioned scaling Ethereum in the short to medium term.

As per the old roadmap, they were going to use sharding as a scaling solution in the Surge. However, now they will be relying on rollups, including optimistic and zero-knowledge. They plan on implementing EIP-4844 or otherwise called proto-danksharding, which introduces a new transaction type called a blob-carrying transaction. It is similar to a typical Ethereum transaction but includes an extra piece of data called a blob. This blob can contain a large amount of data that will be used by rollups. This new transaction type will scale data availability on Ethereum and allow rollups to grow their capacity significantly until full sharding is potentially implemented over the longer term.

This shift in the Ethereum roadmap shows us how, when there are breakthroughs in technology, projects can leverage this open-source innovation to improve their own network.

It also paints a bright picture for rollup projects and their hand in Ethereum's future success. One of these is Arbitrum.

What is Arbitrum?

Arbitrum is an optimistic rollup scaling solution for Ethereum. Arbitrum was started in 2018 by Offchain Labs, a development company founded by Ed Felten and Steven Goldfeder.

In 2019 they raised $3.7m in a seed round led by Pantera Capital. They also concluded another capital raise in April 2021, where they managed to raise $20m.

The following month, the Arbitrum Beta Mainnet was launched and found traction as a viable scaling solution for Ethereum. They followed this with another capital raise in August, where they received a further $100m from various parties. This also coincided with the launch of the Arbitrum mainnet. Since then, the network now boasts over 1.7m unique addresses settling over half a million transactions daily, with over $2b in value locked on the network.

How Does Arbitrum Work?

Arbitrum uses optimistic rollups to help a blockchain scale. Optimistic rollups inherit their security from their parent chain, which in this case is Ethereum. The whole point of using a rollup is to offload as much computational work and data storage from the Ethereum blockchain as possible.

As a recap from last week, several rollups exist; however, the two main types are Optimistic and Zero-Knowledge rollups. From a high-level, zkRollups uses complex cryptography called a Zero-Knowledge proof to determine whether a transaction is valid. Optimistic rollups are different in that they "optimistically" assume all transactions contained within the rollup are true. This makes optimistic rollups extremely quick as the network doesn't expend resources confirming these transactions. However, to keep the network honest, there is a challenge period (usually about a week) in which anyone can contest what they believe to be fraudulent transactions. Therefore, one of the significant drawbacks of using this scaling approach is that withdrawing funds from the network can take a long time as you have to wait for this challenge period to end.

Arbitrum and Optimism are close competitors, they have a very similar approach to scaling, but they have some differences regarding their network architecture and how they implement the optimistic rollups. So let's dive in and see how Arbitrum works.

Arbitrum Architecture

Currently, the Arbitrum project runs two different chains in parallel. The first is an Arbitrum rollup chain called Arbitrum One, and the second is an AnyTrust chain called Nova. These two chains have been launched so that developers can pick the one that best suits their needs which is generally a tradeoff between security and transaction costs.

Arbitrum One

Arbitrum One is the first chain that the project launched. All data created on the rollup is posted to Ethereum, where it is stored. This means that because the data is kept on Ethereum, it inherits the security of the chain itself. It also means that any party that wants to participate in validating the chain can do so by analysing the data kept on Ethereum. The tradeoff here is that transaction fees are higher because you are required to pay the Ethereum gas fees. This process and where the data is stored are very similar to how Optimism works; however, the transaction lifecycle, when compared to Optimism, has subtle differences.

The Transaction Lifecycle

Arbitrum One and Nova have a similar transaction lifecycle; the core difference is where the rollup data is kept, which we will describe in the next section. This transaction lifecycle is how the developers see Arbitrum One in its final form. As it currently stands, several parts are being done solely by the Arbitrum team, such as running the sequencer (again, similar to Optimism).

1) Sequencer Receives a Transaction

A transaction will generally start its lifecycle with the sequencer. The sequencer is the primary party responsible for transaction ordering once a transaction has been received from a user. Arbitrum One's sequencer allows a transaction to be received in one of two ways:

The first is direct, which is when you are transacting within the layer 2 environment itself. As an example, this would be using Uniswap or Aave on Arbitrum One. The second is from the layer 1 itself via the "Delayed Inbox". This would be when a user is looking to deposit ETH or bridge other tokens to Arbitrum One from Ethereum.

2) Sequencer Orders Transactions

Once a transaction has been received, the sequencer is responsible for correctly ordering the transactions. This process starts when it receives a transaction and places it in its off-chain Inbox, this is done in the order in which it is received. It is then locally executed by the Arbitrum Virtual Machine (VM), where it is given "instant" confirmation as it is "optimistically" assumed to be correct.

In the Arbitrum network, this is called a "soft confirmation", as it relies on a user trusting that the sequencer is fulfilling its role reliably and honestly. It should be noted that the sequencer itself cannot propose invalid states or forge a user's transaction; the worst it can do is reorder or delay specific transactions.

3) Sequencer Posts Transactions In a Batch

The sequencer will post batches of layer 2 transactions every few minutes onto the Ethereum mainchain.

If the sequencer isn't including your transactions in these batches, it is also possible to post them directly to Ethereum yourself through the Delayed Inbox, where they will be included. This may come at an extra cost, but it ensures that the network has some form of censorship resistance.

Once this process has happened and the batch has been posted, you can consider your layer 2 transactions finalised with the same guarantees that you would expect from an ordinary Ethereum transaction.

4) Validator Asserts Rollup Block That Includes Transaction

Once a batch containing transactions has been posted to the Ethereum chain, a validator staking tokens will run the Arbitrum VM over the transactions in the Inbox (this is the same as what the sequencer did earlier; however, it is now being done to the transactions on Ethereum). They are required to make an assertion as to the chain's state every 30-60 minutes.

Two different things can happen here, either a transaction in a rollup block goes unchallenged, and after a week, it is considered final, or it is challenged, and two validators enter a dispute period where one must prove that the other is incorrect through a multi-round fraud proof. This is where fraud proofs (fault proof in the Optimism system) are used to determine who is telling the truth. It only takes one honest validator operating to ensure the chain remains true, as they can prove which transactions are legitimate through mathematics.

Another thing to note here is that even during a dispute about a specific transaction, the Arbitrum nodes continue to operate, and validators continue to make assertions on the valid transactions that occurred in the same block, so the finality that was provided at stage three is still guaranteed for legitimate transactions

5) Rollup Block Is Confirmed On Ethereum

Once the dispute has been resolved or a week has passed, that block is now considered final on Ethereum. This is the point at which you can now withdraw your assets if you intended to do so. If all the transactions you wanted to be processed happened on layer 2, then step five has no effect on you as the user.

Arbitrum One has been the network's flagship product and is how most transactions occur. Nova, as previously stated, is slightly different in where the rollup blocks are posted and kept.

Nova

Arbitrum One inherits its security from Ethereum. Nova is different in that it introduces a trust assumption in exchange for significantly lower fees. This assumption lies in trusting a Data Availability Committee (DAC) to manage and maintain all transaction information. In the Arbitrum One transaction lifecycle, all the data the rollups need are available on the Ethereum chain itself; it contains a complete record of everything that has happened previously. Yet, this comes at an expense, as you are required to pay Ethereum validator nodes to maintain these records.

Nova is different because it doesn't keep its data on Ethereum but rather with this DAC. This introduces another point of centralisation as it is easier for them to collude when compared with all the Ethereum validators.

This is one of the primary design constraints that rollups have. They themselves are constrained by their ability to access data quickly and cheaply on their parent chain. This is an issue that EIP-4844 intends to address, as the blob-carrying transaction will make more data available for these rollups to leverage.

The two chains together provide developers with flexibility around their applications. At the end of the day, they need to decide whether the tradeoff between security or cost is more important depending on what they are trying to achieve.

Optimism vs Arbitrum

As you can see, Optimism and Arbitrum are very similar projects; however, there are differences.

Arbitrum has two chains, the most distinct being Nova which has the DAC.

Another technical difference is that Optimism uses single-round fraud proofs (they call them fault proofs), and Arbitrum uses multiple rounds. Optimism is also EVM compatible and has a Solidity compiler, and while Arbitrum is as well, it has its own Arbitrum VM and supports all EVM programming languages.

The final difference is that Optimism has the OP token, while Arbitrum doesn't have one yet. Nevertheless, they plan on launching one at some point in the future.

Conclusion

Arbitrum is a leading project in the scalability sector and currently accounts for just over 50% of the market regarding total value locked on the chain.

They have received significant funding and have proven that they can deliver on their development promises.

Optimistic rollups used by projects like Arbitrum and Optimism have dominated the scalability industry. However, they may be challenged as we see new rollup technology emerge, such as Zero-Knowledge proofs. While the technology isn't 100% there, it does prove a significant contender to these networks, and we will see how they pivot as the technology reaches parity. One thing is for certain though: rollups will form a crucial part of the Ethereum ecosystem going forward.

Notable Articles and News Stories This Week:

SBF Warns FTX Investors of Bankruptcy Without More Cash

FTX investors have been warned that the crypto exchange may be forced to file for bankruptcy protection if it doesn't get a cash infusion, Bloomberg reported Wednesday.

The news follows reports that Binance balked at an earlier promise to buy the troubled trading empire after looking at its books. Bloomberg reported the FTX exchange faces an $8 billion shortfall.

FTX has been on a tailspin for a week following CoinDesk's reports of the blurred lines in the books of Sam Bankman-Fried's once-mighty empire.

Read more about FTX here

U.S. Consumer Prices Rose Just 0.4% in October, With Annual Pace Slowing to 7.7%

The Consumer Price Index rose 0.4% in October, far slower than expectations for 0.6%. The annual pace slowed to just 7.7% versus estimates for 8%, and down from 8.2% in September. Core CPI – which strips out food and energy – rose 0.3% in October, slower than expectations for 0.5% and falling from September's 0.6%. On an annualized basis, core CPI was up 6.3% in October slower than expectations for a 6.5% rise and falling from 6.6% in September.

Read more here

David Chaum Rolls Out Privacy-Protecting CBDC Technology

Will central bank digital currencies (CBDCs) replace cash and bank transfers in the future? And will they be an ultimate tool for financial surveillance and control, or is another, more benign future possible?

David Chaum, creator of the Bitcoin predecessor eCash and, more recently, the Elixxir cryptocurrency, believes the democratic world can have a version of CBDCs that protects privacy. He is working with the Swiss National Bank (SNB) on Project Tourbillon, designed for privacy-focused central bank money.

The project will be developed under the auspices of the Bank of International Settlements' (BIS) Innovation Hub, the organization announced on Thursday. The project will add to the range of CBDC pilots already in the works by the BIS Innovation Hub.

Read more about the private CBDC here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.