Polygon

Market Recap

A Good Week For Crypto, Commodities and Equities

Polygon

Layer two scaling solutions will form a crucial part of the blockchain stack. They are a technology that operates on top of a blockchain, increasing its speed/throughput and efficiency.

We have previously explored layer two solutions and why they are necessary and reviewed a few of the different approaches used. An increasing number of projects are coming to the market, and many have made significant breakthroughs when it comes to their approaches.

Over the next few weeks, we will explore these projects and the ways they are increasing the capabilities of blockchain.

Why Do We Need A Layer Two In The First Place?

Blockchains, by their nature, are constrained by certain design choices. They are required to make inevitable tradeoffs to provide a specific service. It is a well-known problem within the blockchain developer community and has even been dubbed the Blockchain Trilemma by Ethereum's founder Vitalik Buterin.

The above triangle can help you clearly visualise this problem. As they currently stand, blockchains can only be designed to emphasise two of the three sides. You can be secure and decentralised, scalable and secure or decentralised and scalable. While they frequently possess an element of the third, it is often less than ideal when trying to design the perfect blockchain. Most often, it is decentralisation that is sacrificed for scalability.

Ethereum is probably the best example of a blockchain that this trilemma has affected, resulting in extremely high gas prices over extended periods as people compete to have their transactions accepted and processed by validators. With the recent move to Proof of Stake (PoS) and the future implementation of sharding, they hope to relieve some of these problems. Nevertheless, even Vitalik has seen the need for additional help from layer two's if Ethereum and blockchain are to achieve their true potential while being as secure, scalable and decentralised as possible.

Polygon was one of the first projects to tackle the Ethereum scalability problem and found significant traction along the way.

What Is Polygon?

The Polygon project was founded in October 2017; however, it was known as Matic back then. Co-founded by Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun, the project intended to address the issue of scalability on Ethereum.

In 2017 the foremost approach to blockchain scaling was using Plasma. A Plasma chain is a separate blockchain that is anchored to the mainchain and executes transactions off-chain using its own block validation mechanism. This proved harder to implement than initially thought, so the team focused on using the technology in addition to a PoS sidechain.

In 2018 market conditions were tough, and the team continued to build and explore different scaling solutions beyond Plasma while also contributing significantly to the Ethereum ecosystem. It was in April 2019 that they conducted an Initial Exchange Offering (IEO) on the Binance Launchpad, where they raised over $5m.

It wasn't until June 2020 that the mainnet was launched. This achievement marked two and a half years of active research and development. The team also realised that the scope of what they wanted to achieve could be bigger, and in February of 2021, they rebranded from Matic to Polygon to reflect their intention of being the "swiss-army-knife" for Ethereum scaling and infrastructure development. In addition to the Matic PoS chain and Plasma chains, they planned on expanding their scaling solutions to incorporate several others.

Since its launch, the project has continued to grow. Currently, it has over 1600 established decentralised applications (dApps) using its network, including some well-known projects such as AAVE, Uniswap, Curve Balancer and Sushi. For an extensive list, you can go here.

How Does Polygon Work?

Polygon intends to provide a different number of scaling solutions. Each will have unique drawbacks and benefits, including their native compatibility with dApps on other scaling solutions. This optionality will allow developers to choose which is best suited for their application.

When Polygon launched, its primary means of scaling was the PoS chain.

Polygon PoS Chain

This PoS chain is the primary chain of Polygon. It is an Ethereum Virtual Machine (EVM) compatible sidechain secured by a number of PoS validators who submit transactions to the Ethereum mainnet. The Polygon Network is broken into three core layers: the Ethereum Layer, Heimdall Layer and the Bor Layer.

Ethereum Layer

On the Ethereum mainnet, several smart contracts exist that help coordinate the activities that occur on the Polygon chain above. The smart contracts implement the following features:

User can stake their MATIC tokens on the staking contracts on the Ethereum mainnet and act as a validator in the system.

As a validator, you can earn staking rewards for validating the state transitions on the Polygon Network.

Save checkpoints on the Ethereum mainnet (these will be covered in the Heimdall layer).

Heimdall Layer (Verification Layer)

The Heimdall layer is primarily responsible for aggregating the blocks produced on Bor into a Merkle tree and then publishing that Merkle root at specified periods to the root chain on Ethereum. These Merkle roots are a snapshot of what has happened over a specific period on the Bor layer and are called checkpoints.

As blocks are produced on Bor, validators on the Heimdall layer are responsible for the following:

1) Validating all blocks since the last checkpoint

2) Creating a Merkle tree of the block hashes

3) Publishing that Merkle root hash to the Ethereum mainnet

These Merkle root hashes, or checkpoints, are important for two reasons:

1) They provide finality on the root chain. The network can be rolled back to the last valid checkpoint if anything goes wrong on the Polygon sidechain.

2) Providing a proof of burn when a user wants to withdraw their assets. This makes sense as the assets cannot be concurrently available on both the mainnet and the sidechain.

This layer plays an important part in ensuring the data that moves between the Ethereum mainnet and the Polygon sidechain is legitimate and secure.

Bor (Block Production Layer)

Bor is the layer responsible for organising the transactions that occur on the Polygon sidechain into blocks.

Bor block producers are chosen from a validator set shuffled by the Heimdall validators. These blocks are then verified by the validators on the Heimdall layer and converted into the Merkle root hash.

As it stands, this is the core architecture of the Polygon Network. However, the architecture will change as they continue fulfilling their dream of being the Swiss army knife of scaling solutions and acting as a scaling solution aggregator. In the next section will dive into the new scaling approaches and services Polygon plans to launch.

Polygon Scaling Solutions

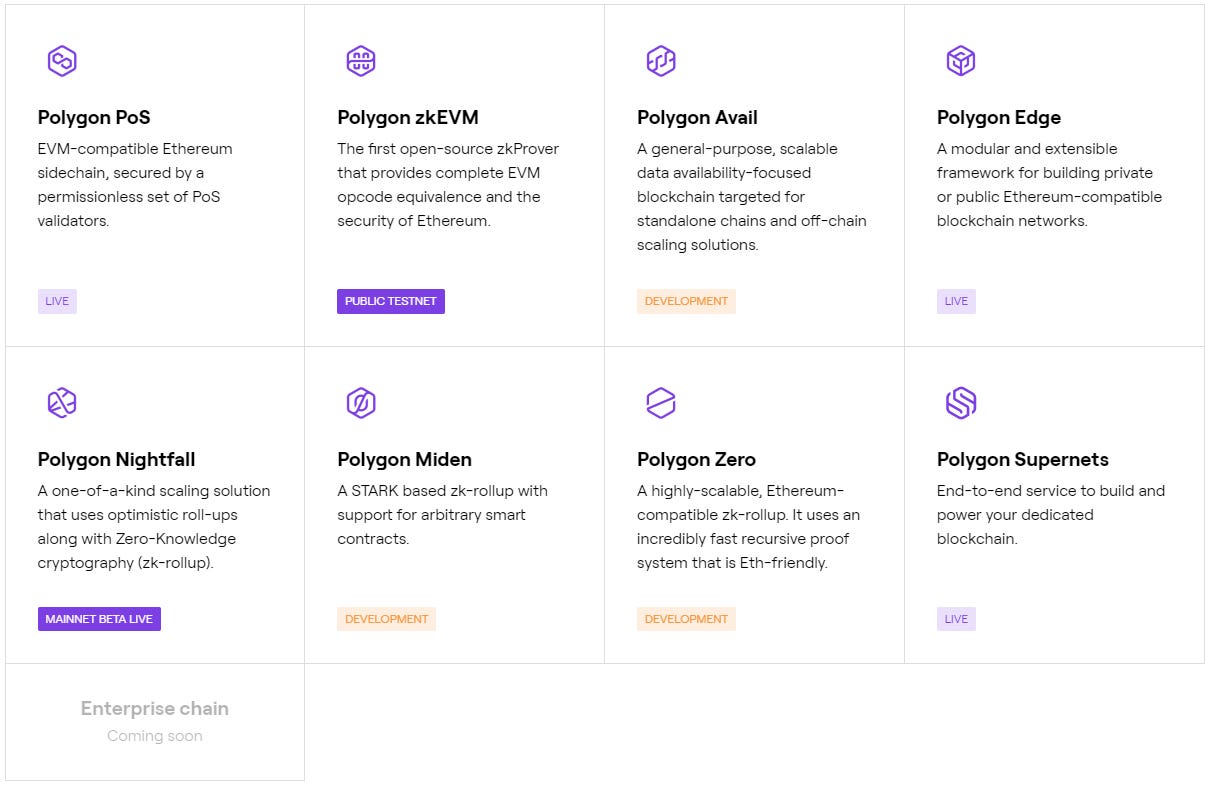

The Polygon Network is expanding rapidly, introducing several alternative solutions that developers can use to scale their dApps depending on what suits them best. They all have different scaling approaches, including optimistic and zk rollups.

Polygon zkEVM

Polygon zkEVM is a scaling solution that is specifically focusing on payments and token transfers on Ethereum. It was originally a standalone project called Hermez that was acquired by the Polygon team in 2021 for their zk rollup technology. It was one of the first public network mergers to occur in the industry.

zkEVM is a scalability solution that utilises cryptographic zero-knowledge technology to provide validation and quick finality of off-chain transaction computations.

Zero-knowledge proofs are an exciting technology through which one party can prove to another party that a given piece of information is true without having to reveal the information itself. It involves complicated cryptography pioneered by several in the industry; nevertheless, the concept dates back to 1985 and so is an approach that has been worked on for some time.

The zkEVM is responsible for batching transactions (rolling up) from layer two and then producing a validity proof that attests to the correctness of the rolled transfers that happened off-chain. This validity proof is then stored on the Ethereum mainnet; it is similar to the checkpoint that is created in the PoS chain, however, the data stored is very different. The benefit that this approach provides is that by only storing the proof and the compressed data that is created in the batch transfers, you can increase the speed and efficiency of the network.

The above diagram provides a good overview of the flow of data and shows where data is batched. You can visit the following page for an in-depth article on the zkEVM architecture.

Polygon Miden

Polygon Miden uses similar technology to the zkEVM. Yet, it allows more flexibility and expressibility in what you can do. Whereas zkEVM focuses on transactions, Polygon Miden focuses on smart contracts.

Miden uses zk-STARK (Zero-Knowledge Scalable Transparent Arguments of Knowledge) technology to power its solution. Using zk-STARKs, Miden can roll thousands of layer two transactions into a single Ethereum transaction.

The Miden solution has its own STARK-based virtual machine called Miden VM. It is similar to Ethereum in that it is Turing complete; however, it also supports certain features that aren't currently possible with Ethereum. Through this VM, users will be able to create arbitrary smart contracts that are written in Solidity and other programming languages.

Miden can bundle 5000 transactions into a single block and create a STARK proof that attests to the execution.

Polygon Nightfall

Polygon Nightfall is a privacy-focused scaling solution. It uses Optimistic Rollups to lower the cost of privately transferring ERC20, ERC721 and ERC1155 tokens while using zk proofs to preserve privacy. Optimistic rollups are different to the Zero-Knowledge rollups we have previously described; the most crucial difference is the verification process. This is beyond the scope of the article, but for an in-depth comparison, you can go here.

Nightfall uses Optimistic rollup contracts that are deployed on the Ethereum mainnet. These work by having a proposer roll up transactions into individual blocks and submitting these blocks to the Optimistic contracts on the Ethereum mainnet. Once this has been completed, there is a period in which these transactions can be challenged.

The introduction of zk technology and its privacy-preserving abilities provides some specific use cases, such as supply chain management, private NFT marketplaces or private DAO voting.

Polygon Edge

For many people developing and maintaining their own blockchain can be a complicated and expensive process. Polygon through Edge has attempted to alleviate some of the complexity by providing blockchain modules or pieces that can be used to create customisable private or public Ethereum-compatible blockchains. Polygon Edge is not a scaling solution but rather a framework and tool for building custom blockchains.

It is an excellent tool for bootstrapping a new blockchain network while having the ability to be fully compatible with Ethereum smart contracts and transactions (or any EVM-compatible blockchain, for that matter).

Polygon Supernets are an extension of this service offering and leverage the Edge frameworks and modules to create customisable blockchains. They also offer other services, such as professional validator sets and other tools that make it easy to bootstrap your network.

Polygon Avail

Polygon Avail is an interesting project that is trying to solve the data availability issue. Data availability is one of the core concerns when creating scalability solutions. You have two options, the data the solution needs is stored on the mainnet of the layer one blockchain; alternatively, it is stored somewhere else. The tradeoff is that it is most reliable when stored on the chain itself; however, it can significantly slow down the scalability solution.

Creating an offchain trustless data availability solution is complex. That is what Avail is trying to achieve.

Polygon has launched several initiatives that may put it at the forefront of blockchain scalability; nonetheless, at its core is the MATIC token, through which many of these services will be coordinated and secured.

MATIC Token

While the project rebranded from Matic to Polygon, they continued to refer to the native token as MATIC.

The MATIC token plays three core roles in the Polygon ecosystem:

1) Gas

When you use the network and want to process transactions or use any dApps, you are required to pay a fee to use the chain. This is how projects like Ethereum and Bitcoin also work.

2) Network Security

Polygon uses a PoS consensus mechanism. This means users can stake MATIC, secure the network and earn a reward for doing so. The chance of losing your MATIC stake if you are caught being dishonest is what disincentives an attack.

3) Governance

MATIC holders can participate in network voting and influence decisions via the Polygon Improvement Proposal system.

Conclusion

Polygon has positioned itself well to absorb a portion of the layer two scaling market. It hasn't focused on one specific approach and instead has positioned itself as a scalability aggregator. This may be very attractive to developers as they can choose which method best suits their needs.

They have also provided people with the tools to build their own blockchains, including those who wish to create private enterprise chains or application-specific chains while leveraging the advantages of public chains.

These two approaches may prove highly successful as blockchains are used more and more across the globe. It is an exciting project that is worth watching, and we look forward to seeing it continue growing in the future.

Notable Articles and News Stories This Week:

UK Regulation of Crypto as Financial Product Edges Closer

UK lawmakers have voted in favour of a crypto-related amendment to the Financial Services and Markets Bill, but it could take a while until the proposed rules are enacted. The House of Commons, the UK Parliament’s lower house, met on Tuesday for a reading of the bill, which tailors financial services regulation to UK markets post-Brexit.

The bill is intended to remodel the country’s regulatory framework, including setting out a range of measures that place the country in a more competitive financial position in the future. The wide-ranging financial bill earlier sought to regulate stablecoins as a form of payment. It now includes regulations around both stablecoins and cryptoassets, among a list of other proposed amendments by several lawmakers.

Read more about the bill here

74% of Institutions Plan To Buy Crypto: Fidelity Survey

Financial services giant Fidelity has found more institutions are invested in crypto than a year ago, despite the market downturn. Fidelity found 58% of surveyed investors reported owning digital assets in the first half of 2022, representing an increase of 6% year over year, according to Fidelity Digital Assets’ fourth annual Institutional Investor Digital Assets Study published Thursday.

“While the markets have faced headwinds in recent months, we believe that digital assets fundamentals remain strong and that the institutionalisation of the market over the past several years has positioned it to weather recent events,” Fidelity Digital Assets President Tom Jessop said in a statement.

The survey included 1,052 institutional investors across Asia, Europe and the US.

See more findings from the survey here

Apple Takes Bite Out of App Store NFTs in Hunt For Revenue

Apple has taken a swipe at the fledgling NFT ecosystem growing in its App Store — less than a month after the tech giant approved tokens to be bought and sold on the platform.

Following an update to its Review Guidelines on Monday, Apple said approved apps may allow viewing NFTs only if they don’t unlock content or offer additional functionality. Apple cited banned content and functions including license keys, augmented reality markers, QR codes, cryptocurrencies and cryptocurrency wallets.

NFT-related functions in-app — such as sales, mints, listings or transfers — are OK, but that’s as far as it goes.

Read more about the move here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.