A Dive Into DeFi

As technology continues to shape our lives and work environments, one significant innovation is ready to transform the financial landscape: smart contracts. These self-executing digital agreements, powered by blockchain technology, are set to redefine financial services by extending their availability, increasing their scope, and transforming the very foundation of how we manage our financial lives.

While still in the early stages of development, smart contracts have already begun to showcase their potential through promising use cases and working products, offering a tantalizing glimpse into the future of finance. This month we will explore how smart contracts will unlock new possibilities, democratize access to financial services, and ultimately reshape the financial landscape in ways we can only begin to imagine.

What Are Smart Contracts?

A smart contract is a digital agreement that automatically enforces its terms using computer code. Imagine it as a self-executing contract that follows a set of rules. When the conditions in the agreement are met, the smart contract carries out the specified actions without the need for human intervention.

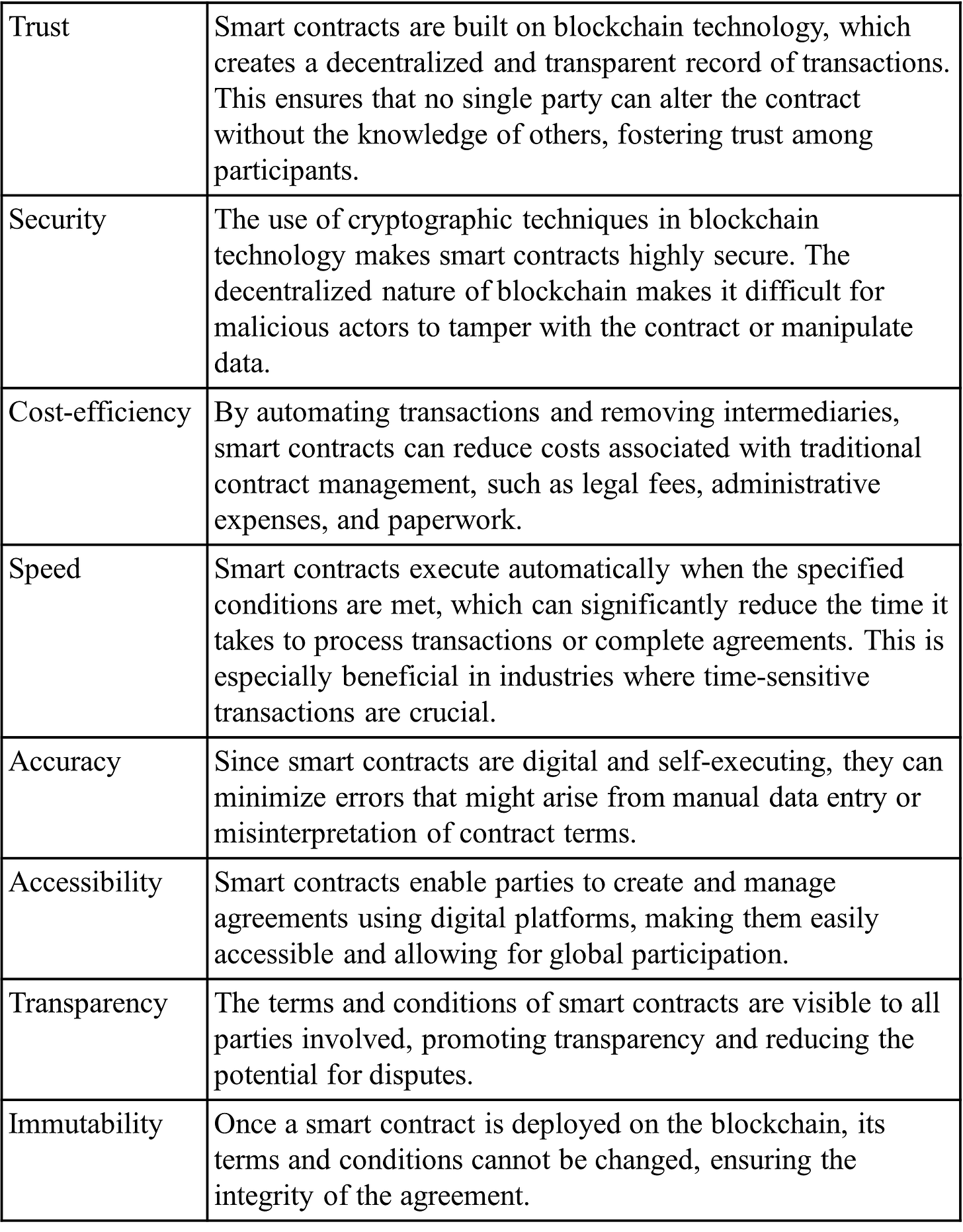

Smart contracts offer several benefits that make them an attractive option for various industries and scenarios. Some of the main advantages are outlined below:

Smart Contracts in the World of Financial Services

Smart contracts have the potential to revolutionize the financial services industry by automating processes and increasing efficiency. One of the key benefits is the streamlining of various transactions, such as transferring funds, settling trades, or processing loan payments. By eliminating manual processes and the need for intermediaries, smart contracts can speed up transactions and reduce the risk of human error.

Cost reduction is another significant advantage that smart contracts offer in the financial sector. Automation can help financial institutions cut costs associated with traditional contract management, such as legal fees, administrative expenses, and paperwork. Additionally, by removing intermediaries, smart contracts can reduce transaction fees and enable more cost-effective financial services.

Security and trust are crucial factors in financial services, and smart contracts can enhance both. Built on blockchain technology, smart contracts offer a secure and tamper-proof environment for financial transactions. The use of cryptographic techniques ensures the integrity of data, protecting it from potential hacks and fraud. Furthermore, smart contracts foster trust among parties by ensuring the transparency and immutability of transactions.

Smart contracts can also improve compliance and regulatory reporting for financial institutions. By incorporating compliance checks and automatically generating reports, smart contracts can simplify the regulatory process, leading to increased transparency, more accurate reporting, and reduced risk of non-compliance. This can be particularly beneficial in an industry that is heavily regulated and scrutinized.

Another area where smart contracts can make a difference is the creation of customizable financial products, such as derivatives, insurance policies, and investment portfolios. This can help financial institutions cater to specific client needs and improve customer satisfaction. Moreover, smart contracts can automate the management of assets, such as stocks, bonds, or real estate, by executing predefined rules and conditions, allowing financial institutions to offer more efficient and responsive asset management services.

The benefits of smart contracts in financial services are being seen in the early iterations of decentralized finance (DeFi) applications. Where the core tenants of financial markets are either being replicated on decentralised ledgers or reimagined from the ground up. Contrary to popular belief, we don't see DeFi as an existential crisis for traditional financial institutions but rather as an opportunity for these businesses to extend their capabilities and transparency they can offer to the market.

Practical Examples

In order to give you a better understanding of DeFi we thought it would be worthwhile to illustrate just how simple these applications are. For this, we will use two of our core projects in this theme, Uniswap and Aave. There is a plethora of more expressive financial applications and working products but to get started, we find these are great examples that illustrate the elegant simplicity of blockchain-powered financial applications.

If you are interested in exploring these examples make sure to click on the links below and follow the guides that you will find inside.

Swap USDC for ETH - if you would like to do the tutorial click here

Borrow USDC using ETH/USDC as collateral - if you would like to do the tutorial click here

Set up a savings account in USDC - if you would like to do the tutorial click here

How We Envision Mass Adoption for DeFi

Mass adoption of DeFi will occur through three distinct vectors. Firstly, DeFi will gain traction in emerging markets where the existing financial infrastructure is inadequate or underdeveloped. By providing access to essential financial services without relying on traditional intermediaries, DeFi can fill the gaps and empower people in these regions to participate in the global financial system. Smart contracts will play a crucial role in enabling secure, transparent, and efficient financial transactions, regardless of geographical boundaries.

The second vector leading to mass adoption of DeFi will be the increasing number of people earning crypto salaries from working in the industry, as well as those participating in incentivized crypto networks. As more individuals become involved in the cryptocurrency ecosystem, they will naturally gravitate towards utilizing DeFi services for their financial needs. This will further fuel the demand for and adoption of smart contracts in financial services.

Lastly, smart contracts and DeFi will be incorporated into existing developed market financial infrastructures. By integrating these advanced technologies, established financial institutions will be able to streamline processes, reduce costs, and offer more innovative services to their clients. This integration will not only enhance the efficiency and security of financial services but will also drive their widespread adoption.

Our Thesis on DeFi

TL;DR - DeFi minimizes the need for trust in financial services which in turn minimizes costs associated with delivering or utilizing said services. Over time we expect DeFi to take meaningful market share from current financial market infrastructure providers and banking institutions.

At Etherbridge, we firmly believe that trust-minimized financial services (DeFi) will not only expand the accessibility and scope of financial services but, over time, will also outcompete traditional financial services that rely heavily on trust. As smart contracts facilitate secure, transparent, and efficient transactions, they will gradually reshape the financial landscape, paving the way for a more expressive and inclusive ecosystem.

Trust-minimized financial services, enabled by smart contracts, will democratize access to financial services for people across the globe. By leveraging the power of DeFi and the versatility of smart contracts, these services will break down barriers, empowering individuals and businesses alike to participate in a more open and accessible financial system.

As per the data from Messari, a reputable market research and data analytics firm, the DeFi segment of the cryptoassets market boasts a total market capitalization of $15 billion. This figure stands in contrast to the FinTech industry's total market valuation, which is slightly above $115 billion, and the global banking sector's market capitalization, which is approximately $8.3 trillion. This could quite easily be the fattest pitch any analyst will ever see in the world of financial services. It represents a distinctly asymmetric prospect that holds significant potential for discerning investors.

How Do We Play DeFi?

Although we maintain a long-term positive outlook on DeFi, we advise caution in the short term. As an experimental field, DeFi has many challenges, inefficiencies, and technical hurdles that need to be overcome before it can fully serve a global audience. Here are a few key factors we're currently observing:

The creation of a comprehensive regulatory framework is crucial for DeFi's progress. This is less about debating whether DeFi requires regulation and more about enabling entrepreneurial ventures within the space. From our discussions with various DeFi project founders, the lack of clarity in the regulatory landscape poses significant challenges for those who aim to launch new products.

The development of a committed user base for DeFi. Over the past three years, DeFi adoption has seen two major waves, driven by innovative user acquisition strategies like liquidity mining and the wealth effect created by Bitcoin and Ethereum. However, this user base hasn't proven to be particularly loyal. We're looking for signs of genuine demand for basic financial services beyond speculative activities. As mentioned in our discussion on adoption, we anticipate that early adopters will likely emerge from underserved markets and the expanding crypto ecosystem.

Enhancements to the underlying blockchain networks, particularly in terms of scalability, are necessary to enable DeFi to reduce costs for end users.

Our current focus is on identifying DeFi applications that are well-governed and growing, and that demonstrate the capability to manage their token issuance versus burn/dividend or treasury accumulation. It's important to remember that DeFi applications are more akin to businesses than to traditional cryptocurrencies like Bitcoin. If they can provide a useful service and monetize their offerings, they have a potential shot at joining the major league.

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.