Aave

Market Recap

Flat Week for Most Assets

Aave

Decentralised Finance, or DeFi, offers opportunities that don't currently exist in traditional financial markets.

Similar to Anchor Protocol, which we have written about previously, Aave is a decentralised lending and borrowing protocol. However, Aave differs through the number of different markets in which it allows people to participate and offers a much more comprehensive range of opportunities.

What is Aave?

By technical definition, Aave is a liquidity market protocol. This means that it allows depositors to lend otherwise idle assets to those looking to borrow them. In order to borrow assets from the Aave protocol, a borrower must put up collateral that is worth more than the loan they are going to be taking out; this is called overcollateralisation. This requirement significantly reduces the lender's risk and gives them confidence in supplying liquidity to the market.

Aave was one of the first DeFi lending and borrowing protocols to gain significant traction; while yields may not be as high as some other protocols, it is generally considered much safer and has additional benefits such as being able to borrow at a stable interest rate. Aave currently has over $19.838 billion locked in its protocol; this puts it in 1st place when it comes to DeFi projects from a total value locked perspective.

The Aave team has always prioritised security, and the current version of Aave, V3, has gone through 5 separate code audits over two rounds and a formal verification by Certora. While no DeFi protocol can be considered 100% safe, Aave has tried its best to give people confidence in using the project by mitigating as much risk as possible.

How Does Aave Work?

Aave works as most money markets work; they have a borrower and lender. Lenders are those looking to earn a decent yield on their cryptoassets, and borrowers want to borrow against the assets they have put up as collateral.

With Aave, to take out a loan, you will need to deposit crypto as collateral. The cryptoasset you are depositing will depend on the pool you want to participate in. The amount a borrower needs to lock up is determined by the loan amount they want to take out (Loan to Value), which is very similar to how you would take out a loan in the traditional world. You would need to collateralise your house or something else to receive cash from the bank, and in the situation you didn't pay back or service your loan, the bank would seize your house and sell it on the open market to recoup the value of the loan. However, in this case, the collateral is liquid and is automatically sold by the Aave smart contract on a decentralised exchange so that there is very limited risk to the lender.

As a lender, you can deposit your idle asset into a market of your choice. In return, you will receive aTokens. These aTokens receive continuous earnings from the protocol; the amount you earn will adjust depending on the interest payment rate paid by those taking out loans. Each asset will have its own unique market, and therefore the APY (Annual Percentage Yield) will differ depending on supply and demand factors. The aTokens you receive can be redeemed at any time for the original asset you put into the lending pool, without any lockup periods or redemption notices.

How To Use Aave

Aave is available on several different chains, including Ethereum, Avalanche, Optimism, Arbitrum, Polygon, Fantom and Harmony. This is an exciting approach as Aave has tried to spread itself out over a different number of blockchains; however, all are Ethereum Virtual Machine (EVM) compatible.

For the purpose of this guide, we are going to use Aave on Ethereum and in order to do this, you will be required to set up and fund a MetaMask wallet. If you want to use it on any other chain, we have guides for Avalanche and Fantom. If you want to move funds on to a layer two like Optimism, Polygon or Arbitrum, you can follow our guide here. All will offer different interest rates as each market is unique so you can pick which is best for you.

In this guide, we will show you how to both supply assets to the Aave protocol as well as borrow assets against your collateral.

Earn Yield on Assets

Step 1: Set Up MetaMask Wallet

In order to interact with Ethereum, you require a wallet. Our wallet of choice is MetaMask, but you are free to choose your own. Please find our guide to setting up your own MetaMask wallet here.

Once you have set up and funded the wallet you can now use Aave.

Step 2: Visit the Aave Website

Visit the Aave Website

Make sure you land on "https://aave.com/"

Click Launch App in the top right hand of the screen

You should see the below page:

Step 3: Supply Assets

Click Connect wallet

Enter your MetaMask password when prompted

You will now see your dashboard

Aave should automatically display what assets you can supply to the market, or else click the Markets tab at the top of the page

Click Supply on the asset you want to put to work

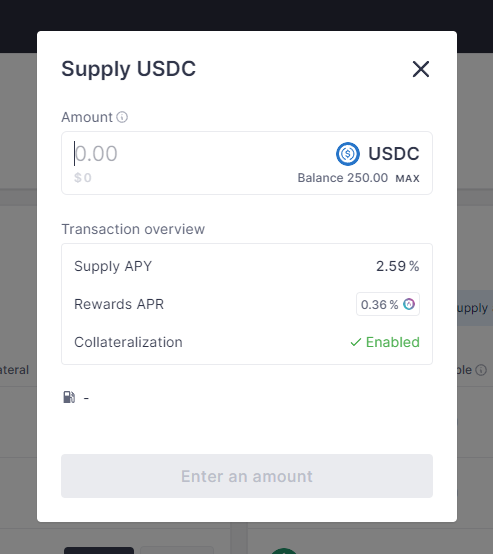

You should see the box below pop up:

Enter the amount of the asset you would like to supply to the market. Also, bear in mind that if you plan on borrowing against it, you will have to put in enough to satisfy the Loan to Value requirements previously explained. You can find those requirements here

You will be prompted to approve the asset if it is the first time you are supplying liquidity to the specific market

Click Approve to continue

Your MetaMask will open, and you will now be required to sign this transaction. Please note that it does carry a gas fee, so please check you are happy with this before proceeding

Step 4: Complete the Transaction

Once approved, click Supply USDC (your token will be here and not USDC)

Whenever prompted, click "Confirm" to sign the transaction on MetaMask if you are happy with the gas fees.

The transaction may take some time, so be patient. However, once it is done, you will notice that the balance of the token you have deposited on your MetaMask has reduced, and the new aToken has taken its place (i.e. aUSDC or aETH).

Borrow Assets on Aave

Once you have supplied assets to the market, you can let them sit there and earn a yield, or you can actually now borrow more of that asset against what you have supplied to the market.

Step 1: Go To The Aave Dashboard

You have already set up your MetaMask wallet and supplied your chosen asset into the Aave pool. Now you can borrow against it.

Navigate to your dashboard page

Aave should automatically display the assets you have available to borrow against on the right-hand side of the screen

Step 2: Borrow Your Selected Asset

Click Borrow next to the asset you have already supplied as collateral

You should now see the following box pop up:

Enter the amount of the asset you would like to supply to the market

You will only be able to borrow up to a certain amount, which is determined by the amount of collateral you have supplied. We never recommend borrowing the maximum amount because it significantly increases your chances of being liquidated if markets move against you quickly

Step 3: Select Your Interest Rate

The next thing to decide is what interest rate you would like to borrow at. You can choose either a variable rate or a fixed rate. While the variable rate may seem lower, there is the risk that supply and demand factors may change, and you end up paying a lot more than the stable rate. Therefore this should continuously be monitored and understood

Once you have chosen your interest rate, you will now see your borrowing details, including the health factor, which indicates how close you are to being liquidated

Step 4: Complete the Transaction

Click Borrow USDC (your token will be here and not USDC)

Whenever prompted, click "Confirm" to sign the transaction on MetaMask if you are happy with the gas fees.

This transaction may take some time, so be patient. However, once done, you will see the token appear in your MetaMask wallet.

You can now take these assets and use them in other markets or hold them as investments. You just need to ensure that your collateral is always sufficient to cover the position, or you run the risk of having the Aave smart contract liquidate and sell your collateral to cover the loan.

While this sounds scary, it is what makes the Aave protocol safe for users and ensures that you won't lose the money you have chosen to supply to the market.

Conclusion

Using these networks is the best way to learn about them. It shows and allows you to understand what blockchain networks are capable of. Each has its own unique advantages, disadvantages and user experiences. Aave is one of the oldest and most respected DeFi protocols available to use; it is considered a Blue Chip for good reason.

Projects like Aave were what caught people's attention and showed them the possibility of what blockchain could do.

Aave has successfully managed to navigate the DeFi sector and has continuously improved to offer clients what they need most. We have even seen Aave launch an institutional-grade lending platform where participants are KYC'ed and known to the users.

If you have any questions or have trouble using the network, please feel free to reach out and ask us questions. We always look forward to chatting with our readers. Otherwise, please feel free to share this article if you know anyone who is interested in using these networks.

Notable Articles and News Stories This Week:

Goldman Says Apple, Meta Lead in Developing Metaverse Technology

The metaverse – a digital world created by the combination of virtual reality (VR), augmented reality (AR) and the internet – is based on a transition to new “immersive hardware interface platforms,” Goldman Sachs wrote in a research report Tuesday.

The bank is more positive on VR than AR because usable products already exist and it expects development of more hardware in the near term.

The “main race” for VR is between Apple and Meta, the report said. Apple is likely striving for an extension to its ecosystem, and Meta is looking to build a base of users through “attractive hardware pricing and compelling experiences,” it said.

Read more of the report here

Germany Is the Most Crypto-friendly Country

Germany has unseated Singapore as the most crypto-friendly country, according to a report by Coincub.

The company’s first quarter 2022 report ranked 46 countries based on a range of factors, including newly added categories such as the number of initial coin offerings (ICOs) in each country, fraud case prevalence and the availability of crypto courses by leading institutions.

“As events develop, we go beyond legislation or pure numbers and introduce new dimensions that are crucial for defining a country’s crypto friendliness or maturity,” Coincub CEO Sergiu Hamza said in a statement.

Read more about the report here

Ethereum Foundation Holds $1.3B in Ether, $300M in Non-Crypto Investments

The Ethereum Foundation held more than $1.6 billion in treasury assets at the end of March, the non-profit said Monday.

Almost $1.29 billion was held in ether (ETH), the world’s second-largest cryptocurrency by market capitalization. That represented over 0.297% of the total ether supply as of March 31. Some $11 million was held in other cryptocurrencies.

The foundation funds research and development on Ethereum and related technologies. It spent in excess of $48 million on various teams, funding and bounties last year, the report said.

Read more about the foundation here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.