Smart Contract Platforms: Part One

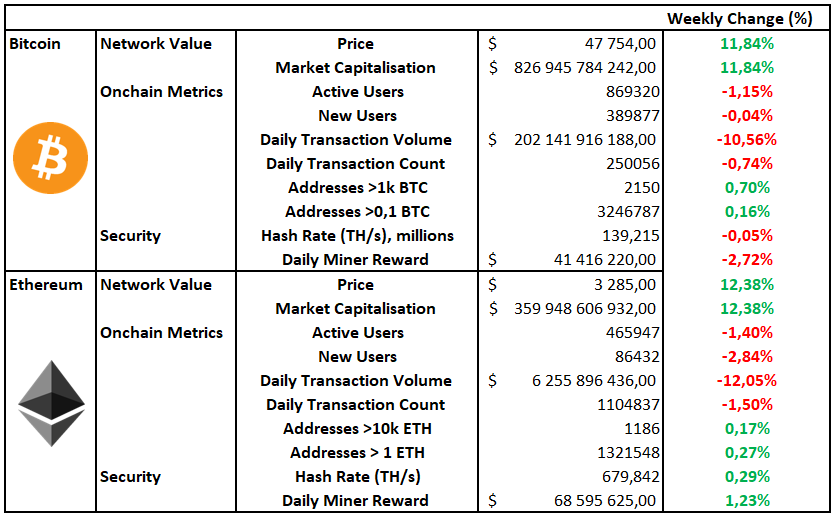

Market Recap

Positive Week For Crypto

Smart Contract Platforms: Part One

This week we explore how to analyse and compare various smart contract platforms, often referred to as Layer 1. A layer 1 platform is the underlying settlement system for any digital economy. Most of our writing has focused on the most well-known smart contract platform Ethereum, but there are numerous others in existence today. Today we will provide a framework for assessing and comparing these different platforms.

Decentralisation and Nodes

At the core of smart contract platforms lies the concept of decentralisation. We have previously written about decentralisation existing on a spectrum as opposed to a binary classification here. The ability for a smart contract platform to be classified as decentralised rests heavily on the network's nodes.

What are Nodes?

Nodes are physical hardware that act as the endpoints of a network that enable users to access and interact with blockchains and blockchain applications.

They vote on and validate blocks of transactions.

They communicate with other nodes in order to establish an agreement on the state of a network.

They store the history of the blockchain itself.

Nodes are integral to understanding how decentralised a platform is as well as understanding how decentralised it could be in the future. To assess this, we look at the resource requirements necessary to run a node and how distributed these nodes are.

Resource requirements are twofold. The first is the actual physical hardware required to run blockchain software, and the second is the minimum financial stake required to take part in the validation of transactions. "Perfect decentralisation" can occur when the average joe can afford the necessary hardware and the minimum financial stake.

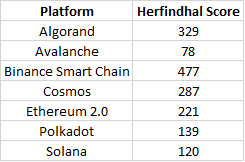

You can use the Herfindahl score to understand the current distribution of stakes in any given project. The Herfindahl score, which is, in this case, the sum of the squares of each validator's stake, approximates the distribution of the networks validator set. A higher score implies centralisation, and a lower score suggests a more distributed system.

Network Architecture

While decentralisation is an important component, it doesn't exist in isolation; performance and usability also play into the strength of any smart contract platform. The way these networks are architected or designed has implications for how security is provisioned and where transactions are executed.

Like any design choice, developers are faced with tradeoffs. You can think of these tradeoffs in the same way we think about evolution. As species evolve, they make clear evolutionary tradeoffs that allow them to thrive in their chosen environment whilst closing off other environments. The design space for smart contract platforms is broad, but there currently exists three main network architectures:

One Validator Set and One Chain

This is the most straightforward, tried and tested approach. Execution of transactions occurs on one chain, which lends itself well to composability. Composability is the ability to layer one function on top of another and creates an environment where network effects can occur easily.

The problem with this approach is that positive network effects invariably increase demand for block space and therefore increase the costs associated with using that network. To alleviate these costs, networks can either centralise (to an extent) the validator set, which would dramatically increase the cost of running a node, or rely on layer 2 solutions to scale beyond current block space requirements with lower security and more complexity.

One Validator Set and Multiple Chains

This approach still provides a predictable source of security to the network. There is one validator set, and this provides networks with huge throughput gains (the ability to process more transactions per second). However, this approach introduces untested challenges. We still don't know precisely how well a network with multiple chains will be able to deliver on composability without dramatically increasing complexity and lowering security.

Multiple Validator Sets and Multiple Chains

This approach may lead to an "internet of blockchains". Networks like Cosmos and Avalanche have pioneered this network design. It allows developers to use a highly customisable network to create their own blockchains, which in theory should be able to communicate with other blockchains on the same network.

There is no concept of shared security between these chains in this system and, therefore, low predictability in overall network security. Communication between these chains is still largely unproven, and composability will be incredibly complex to achieve, which creates additional potential security issues.

Consensus Mechanisms

A consensus mechanism stipulates the rules of how truth is determined by the network. Truth being the shared ledger or state of the network agreed upon by all those who contribute resources to it. Consensus mechanisms differ on when and how they reach finality, whether they favour liveness over safety and whether chain reorgs (reorganisations) are possible.

Finality is defined as "the fact or impression of being final and irreversible". Finality gives users assurances that their transactions have settled and will not be reversed at a later stage. Finality in blockchains is achieved in two ways. Time to finality is important for the user experience and tells us how long, on average, a user will need to wait to achieve settlement assurances.

Probabilistic finality arrangements used in a consensus like Proof of Work achieve finality once more blocks are layered on top of previous blocks, and the probability of another longer chain being discovered becomes sufficiently low. You can read more about probabilistic consensus here in Nic Carter's, "It's the settlement assurances, stupid".

Deterministic finality is different in that it ties finality with execution. These networks require, at execution, 2/3 of network validators to be in agreement. Finality, in this sense, is achieved when the agreement is made.

Blockchain networks are also designed to favour either liveness or safety in finality. Favouring liveness means that even if validators can't reach an agreement, they will still continue propagating new blocks. These networks execute transactions optimistically and finalise them after they have been sufficiently and provably audited.

Favouring safety means that if validators can't reach an agreement, the network will stall, and transactions won't be executed until an agreement is made. Choosing between safety and liveness affects whether a chain can be reorganised or not. Chains that can be reorganised could result in poor user experiences as user transactions run the risk of being reversed.

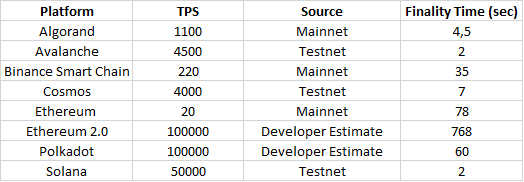

Performance

Performance of layer 1 blockchains can be assessed by examining a network's throughput and time to finality. Throughput is traditionally measured in transactions per second (TPS), and finality is measured in seconds. Since the birth of Ethereum, we have seen the rise of "Ethereum killers" who endeavour to challenge and potentially replace Ethereum because they have high transaction throughput and fast finality.

However, we need to take care when making assumptions about the throughput of a network. Many of the claims these "Ethereum killers" make have not been proven in real-time or live production environments. Many networks will state their TPS achieved in highly controlled testnet environments, or even worse, they disclose the TPS predictions of core developers. We assign a much higher degree of certainty to network TPS in live production environments and take testnet results and developer estimates with a sceptical pinch of salt.

Conclusion

This article focused on design choices, the tradeoffs they present, and how to quantify what's possible on these networks. Please remember that as these networks scale, go into live production environments, or their network token price changes, many of the above numbers will also change. Next week we will expand on these projects by diving into on-chain data and analysing the network tokens of each respective platform. We hope you all have a fantastic weekend, and we look forward to answering any questions you may have.

Sources:

Notable Articles and News Stories This Week:

Fed Chair Powell Says He Has 'No Intention' of Banning Crypto

U.S. Federal Reserve Chairman Jerome Powell said he does not intend to ban crypto, but said stablecoins need greater regulatory oversight. Powell made the comments in a two-hour-long House Financial Services Committee meeting on Thursday. The meeting, meant to serve as a forum for representatives to ask Treasury Secretary Janet Yellen and Powell about the Treasury Department's and Federal Reserve's pandemic response, featured several questions about cryptocurrencies.

Rep. Ted Budd asked Powell to clarify statements he had made during a July hearing that the development of a U.S. central bank digital currency (CBDC) could undercut the need for private crypto and stablecoins. When asked by Budd directly whether or not he intended to "ban or limit the use of cryptocurrencies," Powell's response was a resounding "No."

"[I have] no intention to ban them," he said.

Read the full story here

Visa Proposes Interoperability Platform for Digital Currencies

Visa has shared insights on a theoretical system that would connect different blockchain networks to allow central banks, businesses and consumers to transfer digital currencies. "As the number of [distributed ledger technology] networks increases, each with varying design characteristics, the likelihood that transacting parties are on the same network decreases," Visa wrote in a recently published whitepaper. "Thus, it is crucial to facilitate payments that are universal across networks, scalable to massive loads and highly available."

Read more about the announcement here

Value Locked in DeFi Grows 936% in One Year

New research by analytics platform DappRadar has revealed the extent to which decentralized finance (DeFi) and nonfungible token (NFT) markets have grown this year. In its Thursday "Value Flow Report," DappRadar reported that recent trends have seen sizable growth in NFTs and blockchain gaming but that DeFi is also still generating substantial value. DappRadar currently reports a total value locked of $114.8 billion, which is an increase of 936% since the same time last year. The report added that the industry's total value locked (TVL) grew 75% between July 23 and Sept. 5, reaching a peak of $195 billion across all chains.

Read the report here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.