A Digital Love Affair: Part 2

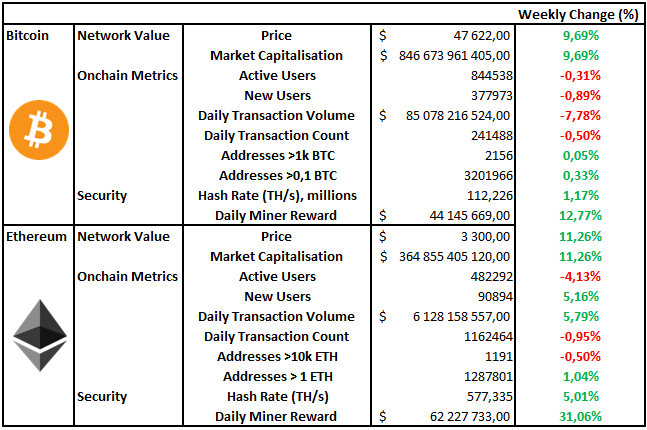

Market Recap

All-Time Highs, Is That You?

A Digital Love Affair: Part 2

Our digital love affair series covers the ongoing relationship, narratives and dynamics between Bitcoin and Ethereum. Our previous article, which you can find here, made a case for bitcoin as money and Ethereum as the internet of value. Our core view on this topic hasn't changed, bitcoin and Ethereum are complements to one another, and each is the apex predator in their respective ecosystem.

Part 2 will be dedicated to evaluating bitcoin and Ethereum on three core aspects. Decentralisation, issuance and leadership. It is in these areas where we can find distinct differences in both design and ideology.

Decentralisation

One of the first concepts introduced to anyone who enters crypto is the idea of "decentralisation", but what is decentralisation? The general attitude of market participants toward decentralisation is that it is binary, i.e., something is either decentralised or not. This outlook is short-sighted as, in truth, decentralisation exists on a spectrum. The binary view comes from an idealistic understanding of Satoshi Nakamoto's vision of decentralisation.

Satoshi's vision of decentralisation is that your average everyday individual should have the ability to run their own bitcoin node with minimal resources. Nodes, after all, are the true validation power of any crypto network; miners only order transactions into a block and propagate this block to nodes. Nodes can then decide the validity of that shared block. The power of decentralisation rest with us, the nodes.

Most hardcore bitcoiners believe that if you can't run a bitcoin node on a home PC, then bitcoin has failed to deliver on the vision of decentralisation. Don't get us wrong, this feature is incredibly important and is, to date, bitcoins biggest strength. The ability to run a full node with a complete record of bitcoin transactions allows users to easily verify the state of bitcoin at any moment in time.

"Trust, but verify" is what bitcoin enables for everyone.

This is precisely where the bitcoin community and Ethereum community disagree. Ethereum, whilst distributed, isn't decentralised in the eyes of hardcore decentralisation advocates. This is primarily because nodes require far more resources to process and store transactions of the Ethereum network. Most people just don't have the necessary resources required to run a full Ethereum node.

The inability of the everyday individual to store a full copy of Ethereums ledger and remain in sync with the rest of the network has led to people outsourcing these resource requirements to cloud services like Amazon Web Services. This need to involve intermediaries introduces single points of failure, something governments or adversaries could apply pressure on.

There are two caveats to what's been said above. Firstly processing power, bandwidth and storage are constantly improving and becoming cheaper. So in the future, we may see the resource limitations of the standard PC being solved for, enabling everyday people to run Ethereum nodes with ease. The second point is that this only really matters if you decide to see decentralisation as something that is binary instead of something that should be viewed on a spectrum and is gradually achieved over time.

Initial Distribution and Issuance

Bitcoin and Ethereum differ tremendously when it comes to how coins were initially distributed. Bitcoin had what many refer to as a "fair distribution". There was no ICO (Initial Coin Offering, akin to the IPO) for bitcoin or private funding rounds; instead, people who wanted to acquire bitcoin needed to provide resources to secure the network and, in return, were reward in BTC.

Ethereum has a different origin story, there was an ICO, and there was private funding. To bitcoiners, this is an "unfair launch". This also carries with it potential concerns that regulatory bodies such as the SEC will one day declare ETH a security, whereas bitcoin is unequivocally a raw digital commodity.

One thing that's obvious whenever you meet a bitcoin evangelist is that the issuance of money is the root of all evil. Bitcoin intends to remain religious about its 21 million fixed supply cap for very good reasons, reasons which can be found in any history book that tells the story of the rise and fall of empires across the globe. In this sense, bitcoin offers an alternative to the current monopolies on money and proposes to change Benjamin Franklins saying from "there are only two things certain in life, death and taxes" to "there are only three things certain in life, death, taxes and 21 million bitcoin."

Ethereum, however, takes a very different approach to issuance. Instead of a well-defined fixed supply and predetermined issuance schedule, Ethereum seeks something different, an approach referred to as "minimum issuance to secure the network". To those seeking certainty around supply and future issuance rates, this may seem scary because, to understand what Ethereums issuance looks like going forward, you are required to make assumptions, whereas, with bitcoin, no such assumptions are needed.

This is why we view bitcoin as the clear macro play if you are looking to bet that a fixed and certain money will protect you against government-imposed fiat devaluation. Ethereum is also a macro play but not for the same reasons as bitcoin; instead, Ethereum represents a significant technological trend toward a new financial system. This trend has captured the imagination of financial innovators who can write smart contracts and deploy them on the Ethereum blockchain from the comfort of their homes. These contracts can capture billions of dollars and hundreds of thousands of users. The only limitation to access is an internet connection; this will have a considerable impact on the world of financial services.

Combine the accessibility of smart contracts, the cloud-based nature of these services and lowered cost function of transferring units of value. You can probably begin to imagine the macro-economic implications of Ethereum.

Leadership

The last major difference between these network giants is leadership. Bitcoin was created by the pseudonymous identity Satoshi Nakamoto, a person or group who still to this day are unidentified. A man called Craig Wright claims he is Satoshi; however, he has provided zero real evidence and proving his claim would be as simple as signing a transaction from a known Satoshi wallet, something which he has failed to do.

Ethereum was created by a youngster called Vitalik Buterin, there were others involved, but he is the real figurehead. Vitalik clearly has a beautiful mind, and his focus on human coordination problems are evident in his blog, which you can find here.

For many in the industry, Satoshi's disappearance is incredibly important because it means bitcoin is essentially leaderless, and the disciples of its principles can be anyone. Its also strengthened by the fact that governments can't pin down and try to discredit Satoshis character. Vitalik, on the other hand, has a lot of power in the Ethereum ecosystem. Many would probably disagree on this, but the mere idea that Vitalik is the inventor of Ethereum introduces the risk that maybe someday he will attempt to exert his power to make changes to Ethereum.

Conclusion

Crypto and its communities have this unique binary feature to them. Many proponents in the space have adopted a winner take all type mentality, such as, for bitcoin to succeed, fiat must fail, or that for Ethereum to have value bitcoin must fail.

While these narratives speak to the enormous role these networks may serve, they don't necessarily hold true. The most likely outcome is that these networks and monies will coexist as complements to one another.

Notable Articles and News Stories This Week:

US Senate Passes $3.5T Budget Plan

The U.S. Senate voted 50-49 along party lines early Wednesday to support a $3.5 trillion blueprint for President Joe Biden's agenda. The budget will expand the government's spending on related social areas such as a reduction in poverty, the environment and healthcare. The budget even experienced some opposition from those within the Democratic party due to the high price tag that came with it. This followed the passing of the $1 trillion infrastructure bill that was contentious in the crypto community due to the blanket regulation is placed on many crypto service providers.

Read more about the budget here

Uniswap Has Now Generated More Than $1B in Fees For Liquidity Providers

Leading decentralised exchange Uniswap has become the first decentralised finance (DeFi) protocol to generate more than $1 billion worth of platform fees for liquidity providers. Uniswap incentivises users to add liquidity to trading pools by rewarding providers with the fees generated when other users trade with those pools. There is a 0.3% fee for swapping tokens. This fee is split by liquidity providers proportional to their contribution to liquidity reserves. The fees that have been produced benefit the users of the network and incentivise people to help the network grow by providing further liquidity to the protocol.

Read more about Uniswap here

The Biggest Hack in DeFi History, But...

This week the DeFi industry experienced its largest hack to date. Around $610 million was drained from the Poly Network. The hacker managed to identify an exploit in the smart contract code and took advantage of it. The hack was executed across several smart contract platforms, including Ethereum, Binance Smart Chain and Polygon. However, in a twist to the story, the hacker has returned almost all of the funds stolen. He even has turned down the bounty of $500 000 offered by Poly Network to people who find bugs in their code. A very interesting conclusion to something that went terribly wrong. These stories also highlight the importance of doing thorough due diligence on the crypto network you interact with.

Read more about the hack here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.