Crypto Wallets

Market Recap

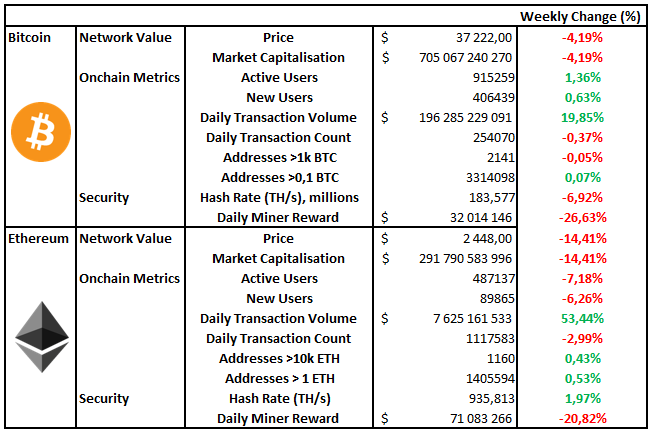

Assets Dive on Hawkish Fed Comments

Crypto Wallets

Crypto wallets store your private keys and are, therefore, the way you interact in the world of blockchain. A wallet allows you to have a unique identity, use different blockchain networks, and they are where you 'store' your assets.

What is important to remember is that, unlike a regular wallet where you can hold cash, a crypto wallet doesn't technically store your crypto, your crypto or assets live on the blockchain. Your wallet contains the private keys that allow you to prove ownership or 'unlock' those assets and make transactions.

Many different types of wallets exist, and choosing a wallet will depend on your specific needs and the level of security you require.

This week we will go through the different types of wallets and their benefits and drawbacks.

Exchange Wallets

Exchange wallets are probably the most common for the average investor. This is simply due to the fact that most people who have bought crypto have purchased it on a centralised exchange and left it there.

Exchange wallets and their internal processes vary from exchange to exchange, but generally, they have a significant portion of their crypto that they keep in 'cold storage'. Cold storage refers to the practice of keeping the private keys offline. This means that they are either written on a piece of paper or some form of hardware wallet (which we will get to later) disconnected from the internet and therefore much more challenging for a hacker to gain access to. The other smaller portion is kept in a 'hot wallet' that allows faster withdrawals as it is connected to the internet, however, it can therefore be more susceptible to attackers.

Exchange's have been a notoriously dangerous place to keep your assets, and this is because so much crypto in one place acts as a honeypot for bad actors. Exchanges are, however, on average getting more secure and even going as far as implementing their own insurance funds, such as Binance's SAFU fund that promises to return funds in the case of hacks or other problems they may experience.

Exchanges still offer benefits such as the ability to access an assortment of assets across many different blockchains (which can be expensive and complicated to do yourself). They also often offer the convenience of being able to get back into fiat more efficiently and can be cheaper depending on which blockchain you would want to trade on (e.g., Ethereum).

Hot Wallets

Hot wallets or online wallets are probably the second most used wallet. These include wallets like MetaMask (we have done a tutorial on setting up your own MetaMask wallet here), Coinbase Wallet, Trust Wallet, Electrum and others.

These wallets store your keys within the application itself. They make it extremely easy and convenient to make and receive payments, interact with dApps or even shop at places that accept crypto.

With these wallets, you have the exclusive right to sign with your private key, whereas with an exchange wallet, they do it on your behalf. However, this comes with additional responsibilities, such as the fact you need to look after the seed phrase you receive when setting up your wallet. A seed phrase is a random string of 12 or 24 words created by some very clever cryptographer who realised they could convert words into numbers that can then create your private keys.

These words are what you store and can help you recover your wallet if you ever lose access. Most people have heard the horror stories of people losing access to their crypto; therefore, it is essential to store them in a secure place because if you lose them, no one in the world can access your assets. There are no call centres or ways to 'reset' the password. While this may sound scary, it is also truly exciting because we can control our assets the way we see fit.

Choosing an online wallet comes down to the user experience you expect and ensuring that the wallet provider has adequate security; looking for wallets with options like two-factor authentication is always a plus.

Hardware Wallets

Hardware wallets represent a blend of the convenience of a hot wallet with cold or 'offline' storage. As the name suggests, it is a physical device, often resembling a USB stick or something a bit larger depending on the make. Two of the most popular hardware wallets are Ledger and Trezor.

The way these wallets work is that the private keys are stored within a specially designed secure offline chip that is contained within the device. This means that even if you plug the hardware wallet into a computer with a virus, it will not affect your wallet or result in you losing your crypto. That being said, your computer is still susceptible to being hacked, so double-checking the address which you want to send crypto to or interact with should always be double-checked. Hackers can change what you see on your computer screen or what you copy and paste (this is always a good habit with any wallet).

Hardware wallets, however, really do offer the self-sovereign individual the best balance of convenience and security.

Custodians

As in the traditional world, businesses that specifically focus on the custody of cryptoassets have started to emerge. We have had custodians who have looked after financial assets for a long time to minimise the chances of loss. These range from shares and commodities to bonds, generally any type of security. It seemed like a natural leap for companies to become custodians of crypto, especially with the risk that comes with managing your own assets.

These companies have also emerged because financial institutions, especially ones involved in holding or investing in cryptoassets on clients behalf, are required by law to have third parties controlling them. These are things like mutual funds or trusts, however, these are some of the more tightly regulated financial institutions that exist, and the rules are by no means limited to these types of structures only.

Housing your crypto investments in structures like mutual funds and trusts can come with their own advantages that don't exist in any other wallet, such as tax benefits, insurance and the legal security of the traditional world. These benefits differ between jurisdictions and structures chosen. These are generally long-term investments, and therefore the frequency of being able to move in and out is one of the slowest when it comes to ways to secure your crypto. You also need to ensure that the custody solution you choose is safe and that they have appropriate security practices in place. For long term investing, however, these new world assets, housed in the structures of the traditional world, can offer significant advantages when, not if, regulation catches up.

All these types of wallets appeal to the end-user for very different reasons. There is no one-size-fits-all approach, from speed and security to tax; this just depends on you. The super exciting thing is that the options are expanding rapidly, and the ability to interact with the world of blockchain has never been greater.

If you have any questions about setting up a wallet or want to know about any specific brand, please feel free to reach out to us. We would be more than happy to help!

If you liked this article, please share it with friends, family or community. Any support would be greatly appreciated!

Notable Articles and News Stories This Week:

Fidelity Seeks SEC Approval for Metaverse ETF

Fidelity Investments has filed an application for a Metaverse ETF, aiming to track public companies with exposure to the blockchain-based network of three-dimensional, virtual realities.

The Fidelity Metaverse ETF will track the Fidelity Metaverse Index, which tracks ""the performance of a global universe of companies that develop, manufacture, distribute, or sell products or services related to establishing and enabling the Metaverse,"" according to the filing. Fidelity'sFidelity's application is the latest among companies looking to address skyrocketing interest in the metaverse. Last December, ProShares filed a metaverse ETF application with the SEC.

Read more about the ETF here

Rio Official Explains Why City Is Putting 1% of Its Treasury Reserves Into Crypto

By investing 1% of its treasury reserves in crypto, the Brazilian city of Rio de Janeiro seeks to become a global crypto hub and lessen locals'locals' distrust towards cryptocurrencies, Rio de Janeiro'sJaneiro's secretary of economic development, Chicão Bulhões, told CoinDesk TV on Thursday.

""We know that [bitcoin] is volatile, that some people criticize us for that, but it is the future, and Rio wants to be a reference for the world as a cryptocurrency-friendly city, like Miami or Zug in Switzerland,"" Bulhões said.

Read the full story here

Warner Music Group to Launch' Launch' Concert Theme Park'' in Sandbox Metaverse

Warner Music Group (WMG) is entering the metaverse with a music-focused theme park in The Sandbox, the company announced Thursday.

WMG is the owner of a slew of popular music properties, including record labels Atlantic, Warner Records, Elektra and Parlophone.

The virtual theme park will feature ""concerts and musical experiences"" from the music company'scompany's star-studded roster of artists, which includes the likes of Ed Sheeran, Bruno Mars, Dua Lipa and Cardi B, according to a press release.

As part of the announcement, The Sandbox will be hosting a LAND sale for virtual properties adjacent to the prospective festival site for fans to purchase in March. Consider it the latest corporate foray into the immersive experiences that some are calling the future of the internet.

Read more about the plans here

Market Recap: Fed Holds Rates Near Zero, For Now

Fed Chair Jerome Powell held a press conference today regarding the Federal Open Market Committee'sCommittee's (FOMC) meeting about policy changes in light of increased inflation. Markets were significantly volatile with bitcoin jumping as much as 5.3% in the moments leading up to the meeting only to fall into the red after the meeting.

In a similar fashion, the S&P 500 jumped as much as 0.70% just before the meeting only to drop in the negative later in the day.

Traders and investors had been anxiously awaiting the Fed'sFed's plans for the federal funds rate. While the Fed had already announced that it would stop asset purchases by March, many expected the Fed to begin increasing rates immediately given increased inflation. Instead, Powell revealed that the Fed would keep interest rates the same for the time being.

Read more of the Fed'sFed's announcement here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.