Adulthood And Underpants Gnomes

Crypto is experiencing a painful transition from niche “dot-crypto” to a mainstream asset class. Much of what drove crypto markets in the early days, such as speculative token launches untethered from viable business models, has dissipated, giving way to a more sustainable dynamic rooted in institutional adoption and regulatory clarity. While the short run remains unclear, the long-term trajectory for crypto has never been brighter.

Over the years, I’ve pointed out that crypto bull markets tend to coincide with mass token generation events: the issuance of assets on blockchains. Mirroring how bull markets in traditional markets align with waves of IPOs, private funding rounds, and the launch of new businesses.

2017: The ICO Boom – Thousands of initial coin offerings flooded the market, fuelling speculative frenzy.

2020/2021: The Beginning of DeFi – Decentralised finance protocols exploded, promising high yields and finance without intermediaries.

2021: NFTs – Non-fungible tokens turned digital art and collectables into a multi-billion-dollar phenomenon.

Each of these mass token generation events sparked bull markets not just in prices, but in user adoption, developer activity, and ecosystem growth. While past cycles were fuelled by the thrill of groundbreaking native crypto tokens, many of those tokens were speculative by design and launched without robust business models. Leaving their prices and fundamentals vulnerable to the ups and downs of crypto’s overarching hype.

Crypto’s early days remind me of a classic South Park episode of the Underpants Gnomes. In it, gnomes run an elaborate underground scheme to collect underpants in pursuit of profits. When the boys uncover the Gnomes’ plan, they discover it’s comically incomplete.

The parallel in crypto’s early days is strikingly similar: Step one: launch a token loosely tied to a big idea; step two: figure it out; step three: profit.

The combination of zero-interest-rate policies in the developed world during 2020 and 2021, coupled with crypto’s enormous addressable market, turned many of these projects into funding magnets, drawing in billions of dollars. As interest rates normalised and central banks began tapering their balance sheets, a reckoning for crypto ensued.

This is why the prices of most crypto projects have endured prolonged drawdowns even as crypto wins on regulation, adoption, and institutional participation. Consider this snapshot of the top 50 cryptoassets listed on Binance at the height of the 2021 mania; most are now trading below the lows hit during the FTX collapse in late 2022.

Dot-crypto’s deflated asset bubble has soured sentiment among crypto natives, breeding nihilism and driving many into the escapist chaos of memecoin gambling. It echoes the thesis I laid out in “The Great Divergence“. Interest in crypto has fragmented into bullish institutions piling in with production capital and battle-weary crypto natives retreating from the fray.

This month, I’ll double down on that argument. We’ve reached the end of the “dot-crypto” era, defined as an insular, niche internet subculture obsessed with experimental tokens.

We are now in a post-”dot-crypto” era, where dot-crypto has become a misnomer, as every financial service comes onchain, but with that maturation come higher expectations for crypto to deliver on its promises of the future.

Big ideas are no longer good enough; speculative capital has dried up and is now chasing opportunities in AI, quantum computing, and nuclear. Like a teenager coming of age, these years will represent significant change as crypto enters adulthood.

I am bullish on crypto’s adulthood. Here is why:

Institutions are Embracing Crypto

Source: a16z State of Crypto 2025

Nearly 1 in 5 of Fortune 500 executives say onchain initiatives are a key part of their company’s strategy moving forward (up 47% year on year).

6 in 10 Fortune 500 executives say their companies are working on blockchain initiatives.

1 in 3 SMBs use crypto, twice as many as in 2024. More than 4 in 5 (82%) SMBs believe crypto can help address at least one of their financial pain points. (up from 68% a year ago)

Financial institutions are steadily advancing their crypto adoption, beginning with trading and custody services, expanding into private funds and ETPs, and evolving toward crypto-enabled payments and tokenisation as new foundational rails for global capital markets.

We are entering a financial services productivity boom, banks, payment companies, and asset managers are coming onchain, leveraging blockchain’s benefits to extend the scale, scope and variety of their financial services.

Regulatory De-Risking and Clarity for Entrepreneurs

9 in 10 Fortune 500 executives agree that clear US regulation of crypto is needed to support innovation.

I can’t stress this next point enough. Crypto builders have operated under extremely adversarial conditions, facing regulation by enforcement and debanking. If you doubt it, dive into Operation Chokepoint 2.0, the US government’s tacit campaign to choke off banking access for crypto firms, which even the administration later admitted went too far.

Those dark days are coming to an end.

The GENUIS Act (Signed into law):

Establishes requirements for permitted stablecoin issuers.

Defines reserve and backing standards

Provides transparency and disclosure rules that bolster consumer protections.

The CLARITY Act (Not yet signed into law):

Create a clear regulatory pathway for digital commodities

Enable oversight of blockchain-based intermediaries

Protect consumers with strong safeguards, while fostering innovation.

A Multi-Trillion Dollar Mass Token Generation Event Has Begun

Unlike past hype cycles, this one’s backed by trillions of dollars in real-world value flowing onchain.

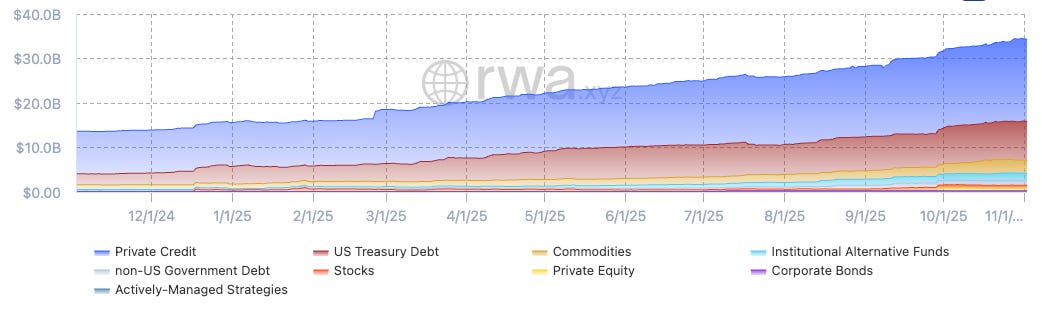

151% year-on-year growth in real-world asset tokenisation to over $34B in November 2025.

BCG projects asset tokenisation to grow 50x to a $16T opportunity by 2030, unlocking global distribution, automating back-office work, and bringing liquidity to private markets and real estate opportunities.

161m stablecoin holders worldwide, more than the population of the 10 largest cities in the world.

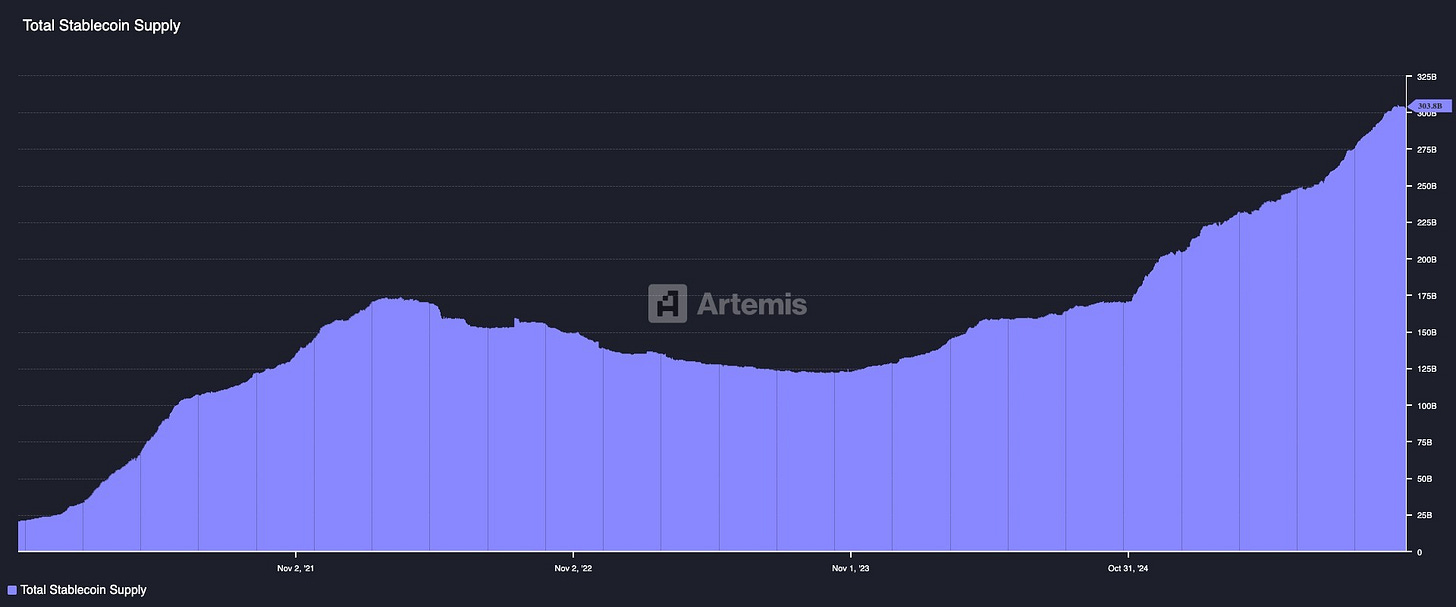

70% year-on-year growth in stablecoins to $303B in November 2025.

Citi Group forecasts $1.9T (6x) to a bull target of $4T (13x) in stablecoin supply by 2030.

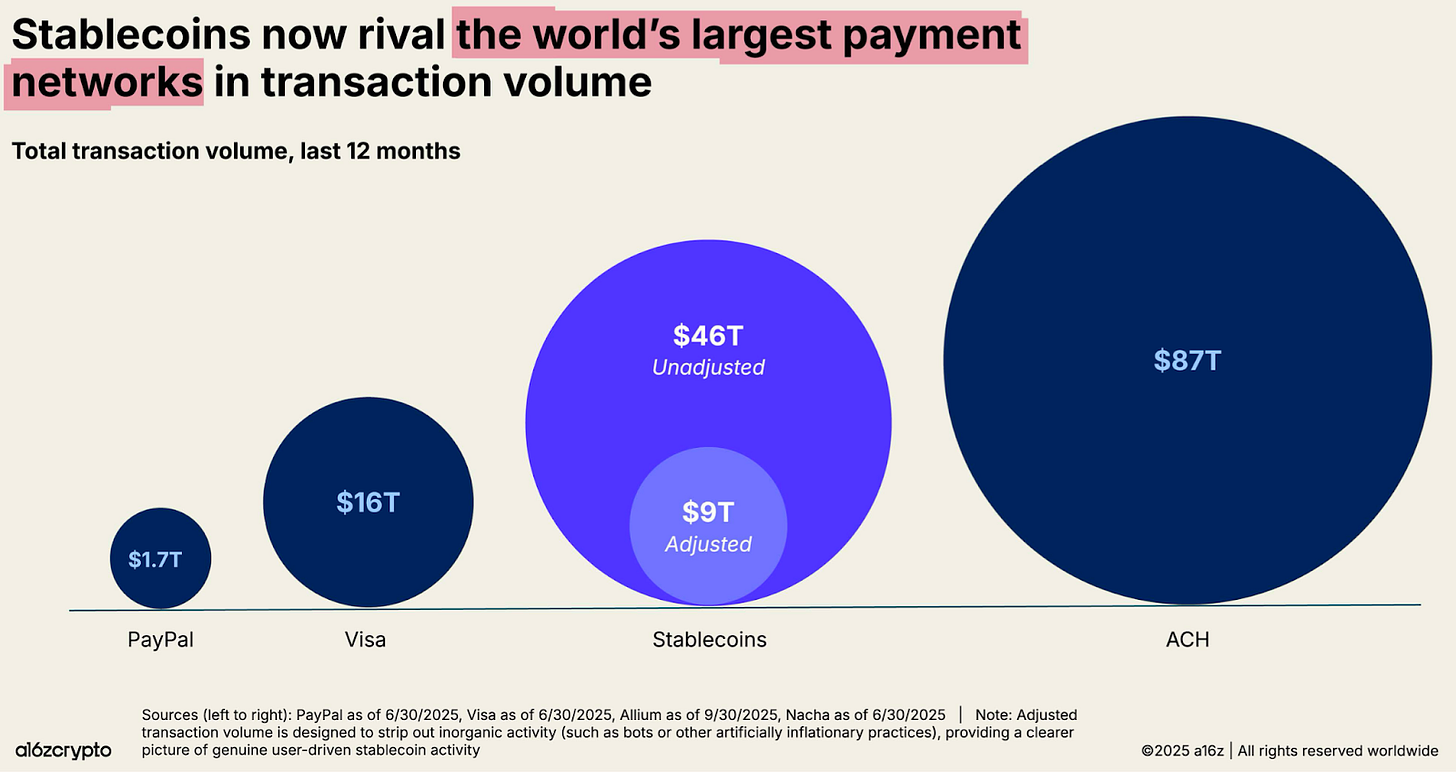

Even setting aside future projections, stablecoins are already competing head-to-head with the world’s biggest payment networks, such as Visa and Mastercard. From here, we expect them to claim an even larger slice of the pie.

High-Quality Liquid Assets will Supercharge DeFi

Finance isn’t an end in itself, without productive assets to serve, it’s just a zero-sum peer-to-peer casino. High-quality liquid assets (HQLA), such as stablecoins and RWAs, will change everything for DeFi.

These HQLAs will cascade into DeFi protocols, transforming them from zero-sum games into engines of productive finance. Users will lend, borrow, and loop HQLAs through lending platforms, earning interest while managing liquidation risks. They’ll add liquidity to swap venues to capture exchange fees. They’ll stake and lock them for rewards. And they’ll strip and split them, isolating yields while inventing novel structured products.

HQLA’s are assets worth serving, and as they flow into DeFi protocols, the world will begin to see the next “big thing” in crypto, financial services without intermediaries. We hold a high conviction that as these assets move on-chain, volatility in DeFi protocol fees will decrease. In contrast, overall fee capture will increase, driven by a more stable and productive asset base.

DeFi will transform payments, exchanges, lending, borrowing, derivatives, and asset management into simple, global, always-available utilities like email and instant messaging.

Solving the Underpants Gnomes Dilemma

Crypto embodies a true free market with no circuit breakers, no bailouts, just raw price discovery. The signals are brutal but honest. Crypto protocols (especially in DeFi) without business models or value accrual won’t survive.

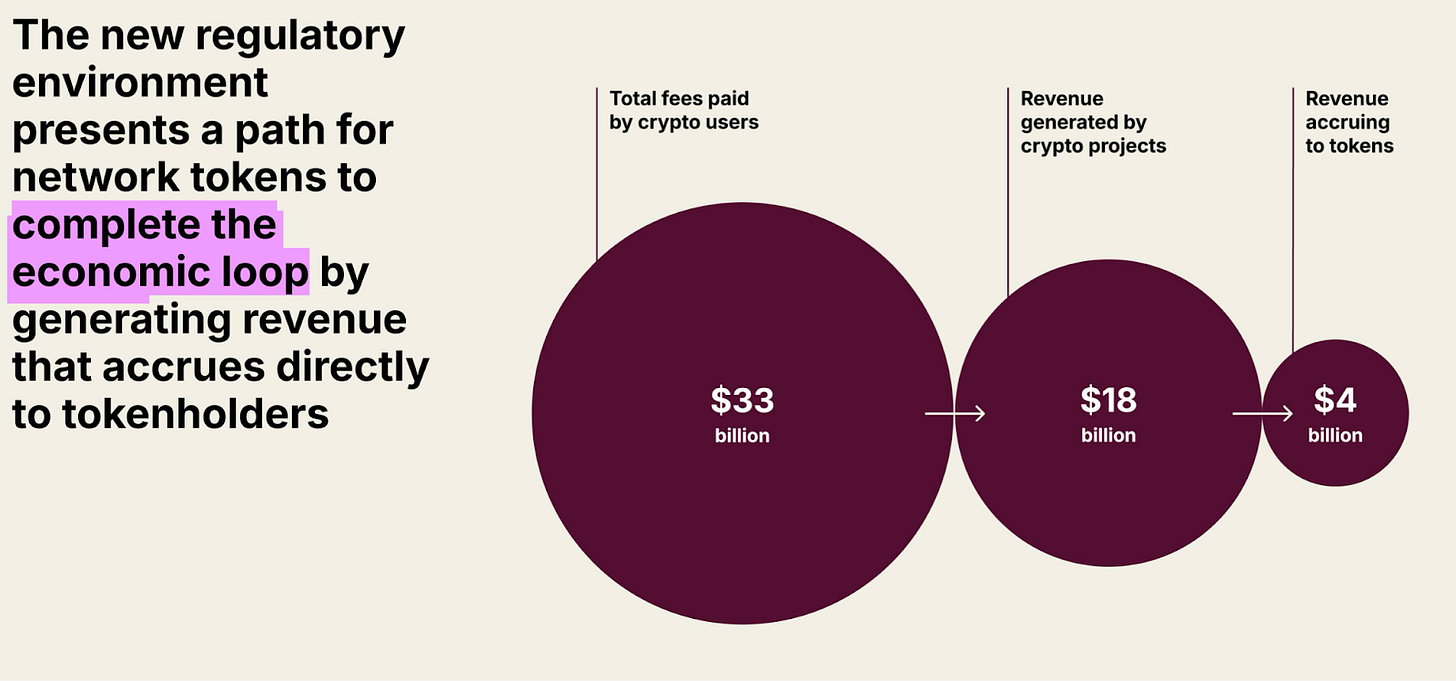

A16z highlights the Underpants Gnomes dilemma well in their State of Crypto 2025 report. The ratio of total fees paid by crypto users to revenue accruing to tokens stands at 8.25 to 1.

DeFi entrepreneurs are responding fast: we’re already seeing upgraded token models that capture a greater share of protocol fees, aggressive buyback-and-burn programs to reduce supply, and diversified treasury strategies to build lasting reserves.

Adaptive DeFi teams will get back to the basics: provide a service, charge a fee, accumulate residual interest, allocate that capital to growth or tokenholders.

The adaptive survivors, especially those drawing HQLAs, will be cash cows. Think digital vending machines with low marginal costs, infinite scalability, and recurring fees from lending spreads, swap volumes, or assets under management.

The passionate days are behind us, the pragmatic days have arrived. Crypto entrepreneurs must deliver or fall into irrelevance.

The Road Ahead

This mass token-generation event for stablecoins and RWAs will unfold over years, not months. It will be more sustainable, regulatory-compliant, and institutionally anchored. It will be decoupled from crypto’s boom-bust speculation, rooted instead in rewiring the plumbing of the global financial system.

The Underpants Gnomes meme captured the raw enthusiasm of crypto’s early days. Today’s builders bring that same fire, plus the hard-won lessons from past cycles, fortified by regulatory clarity, institutional buy-in, and high-quality liquid assets.

Our plan at Etherbridge remains unchanged. The best investments in crypto are Compounders: liquid, measurable, high-quality cryptoassets with growth above their peer-group average. We will continue to search for Compounders and their network effects.

“In the short run, the market is a voting machine, but in the long run, it is a weighing machine,” Benjamin Graham

Today, this insight resonates powerfully in crypto. While rampant speculation, unprecedented wealth creation, and painful wealth destruction have defined crypto’s adolescence, the underlying forces shaping this technology unmistakably point towards a more profound, structural transformation.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.