yearn.finance

Market Recap

Assets Fall on Hawkish Fed

yearn.finance

Decentralised Finance, or DeFi, has opened up possibilities for new ways of coordinating value. Networks like Ethereum allow those who build on them to not only create their own projects but also use successful projects that have come before. You can think about them as money "legos"; you can keep placing them on top of each other to make something that is greater than the sum of its parts.

yearn.finance is what we call a DeFi aggregator.

What Is Yearn Finance?

The launch of Yearn was essentially the industrialisation of yield farming. Yearn is technically a group of protocols running on the Ethereum, Arbitrum and Fantom blockchains. It aggregates the services of other DeFi products such as Aave, Curve and Compound and provides services such as yield generation and lending aggregation.

South African developer Andre Cronje launched it in 2020 without any funding. He came up with the idea while using DeFi lending protocols; Cronje became frustrated with the additional work and costs required to manually shift between different protocols to find the best yield. He coded his own Ethereum smart contract to automate his strategy and, during the whole process, realised that if he scaled it up and allowed anyone to participate, it would improve the strategy as a whole.

On July 17 2020, Cronje launched a governance token for the platform, YFI. This token had no presale or premine and had to be earned by using the protocol itself. It took only a month for the token to have a market cap of $390 million and was collectively earning holders around $20 million a year.

How Does Yearn Finance Work?

Yearn can be broken down into three core products.

Vaults: Yearn vaults are the core product used by the majority of Yearn users. Each vault is responsible for a separate asset and strategy and requires a user to deposit funds to earn yield. Once you have deposited capital into the vault, the Yearn Finance smart contracts will automatically help maximise your yield by shifting capital to different opportunities, rebalancing, and compounding your yield earned.

When Yearn launched, each vault deployed a single strategy; however, since the launch of V2, the vaults have become more complex and can use multiple strategies at once.

Labs: These are the more exotic and emerging strategies used by Yearn. They obviously, therefore, carry additional risk. It is always advised to research the strategy thoroughly before deploying any capital, as you will need to understand complex concepts like token locking and impermanent loss.

Iron Bank: The Iron Bank is one of the more "simple" services and allows you to borrow using your cryptoassets as collateral; it is the lending arm of the Yearn ecosystem, very Similar to Aave. It was launched in collaboration with C.R.E.A.M Finance and even launched its own token, IB. The Iron Bank can lend to both individuals as well as crypto protocols. Individuals have to collateralise their loans; as a protocol, you go through a whitelisting process and, once approved, take out uncollateralised loans.

How To Use Yearn Finance

Yearn now operates on three separate blockchains, Ethereum, Arbitrum and Fantom.

For the purpose of this guide, we will focus on using Yearn on Ethereum. However, if you would like to use it on Fantom, you can follow our guide to setting up a wallet here, or alternatively, if you want to use it in the Ethereum layer two solution Arbitrum, you can follow our guide to moving money between chains here.

Earn Yield In A Vault

Step 1: Set Up MetaMask Wallet

In order to interact with Ethereum, you require a wallet. Our wallet of choice is MetaMask, but you are free to choose your own. Please find our guide to setting up your own MetaMask wallet here.

Once you have set up and funded the wallet, you can now use Yearn.

Step 2: Visit the Yearn Finance Website

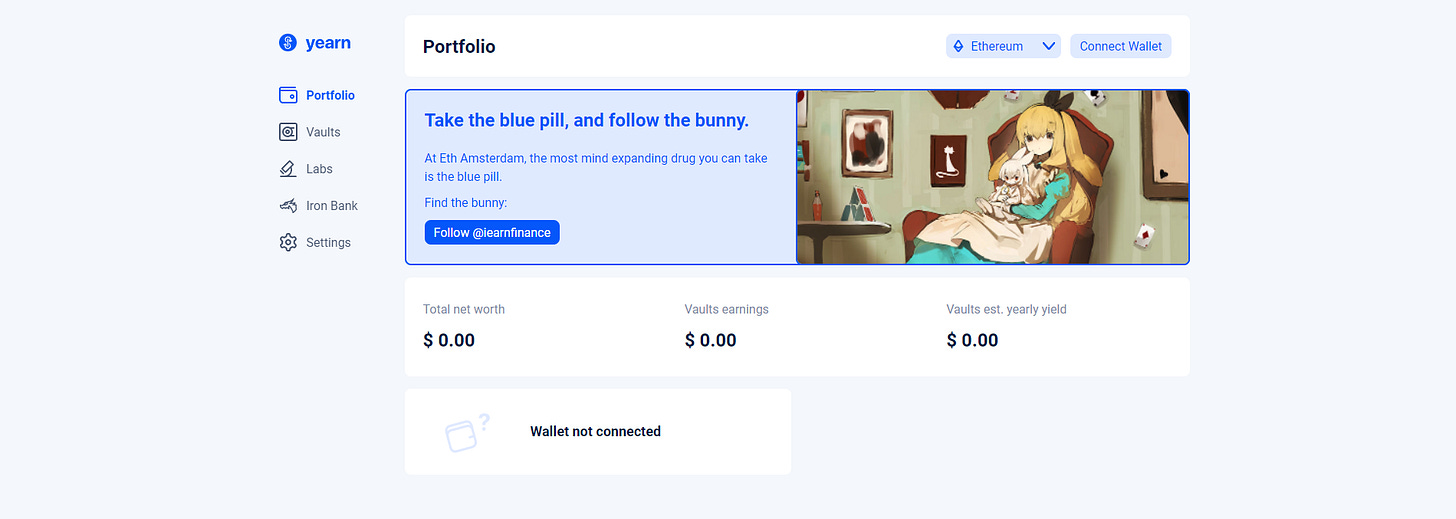

Visit the Yearn Finance Website

Make sure you land on "https://yearn.finance/#/portfolio"

You should see the below page:

Step 3: Supply Assets to a Vault

Click Connect Wallet

Enter your MetaMask password when prompted

You will now see your dashboard with assets available for deposit. You can also view a complete list if you click Vaults

Choose what asset you would like to deposit

Click Deposit

Enter the amount you would like to deposit. You will be prompted to approve the asset if it is the first time you are depositing to the specific Vault

Click Approve

Your MetaMask will open, and you will now be required to sign this transaction. Please note that it does carry a gas fee, so please check you are happy with this before proceeding

Step 4: Complete the Transaction

Once approved, click Deposit

Whenever prompted, click "Confirm" to sign the transaction on MetaMask if you are happy with the gas fees.

The transaction may take some time, so be patient. However, once it is done, you will notice that the balance of the token you have deposited on your MetaMask has reduced, and a new token has taken its place. The new token will depend on what you deposited. Here is a guide to adding the token if you can't see it automatically.

Take Out Insurance On A Vault

Yes, in crypto, it is possible to take out insurance. There are a growing number of insurance protocols emerging that allow you to cover yourself in the case there are problems with smart contracts or the contract gets hacked.

Just as insurance contracts come with their own terms and conditions, so do those that run on a blockchain. They also vary in cost, depending on the confidence underwriters have in the smart contract being insured and its performance over time.

There are a variety of options available to take out insurance, and we encourage you to do your own research. The protocol we will explore, Nexus Mutual, requires you to become a member and go through a KYC/AML process, which may not be for everyone.

Step 1: Visit Nexus Mutual Website and Become A Member

Visit the Nexus Mutual website

Ensure you land on the following webpage: "https://app.nexusmutual.io/home"

You are required to pay a once-off membership fee (0.002 ETH/ $7) to be a part of the Nexus Mutual DAO. Being a member gives you the ability to swap NXM tokens, buy cover, and earn rewards from staking, governance and claim assessment.

To pay this fee, you will require a wallet like MetaMask and some Ethereum. You can follow our guide to setting up your MetaMask here.

Once you have set up your MetaMask wallet, click Connect wallet in the top right hand of the screen

On the home screen, scroll to the bottom and click Pay membership fee

Confirm the transaction in your MetaMask wallet if you are happy with the gas fees

Follow the membership process and provide any necessary documents they may require

The process of becoming a member and getting your KYC/AML approved can take up to 24 hours to complete

Step 2: Review Terms and Conditions of Cover

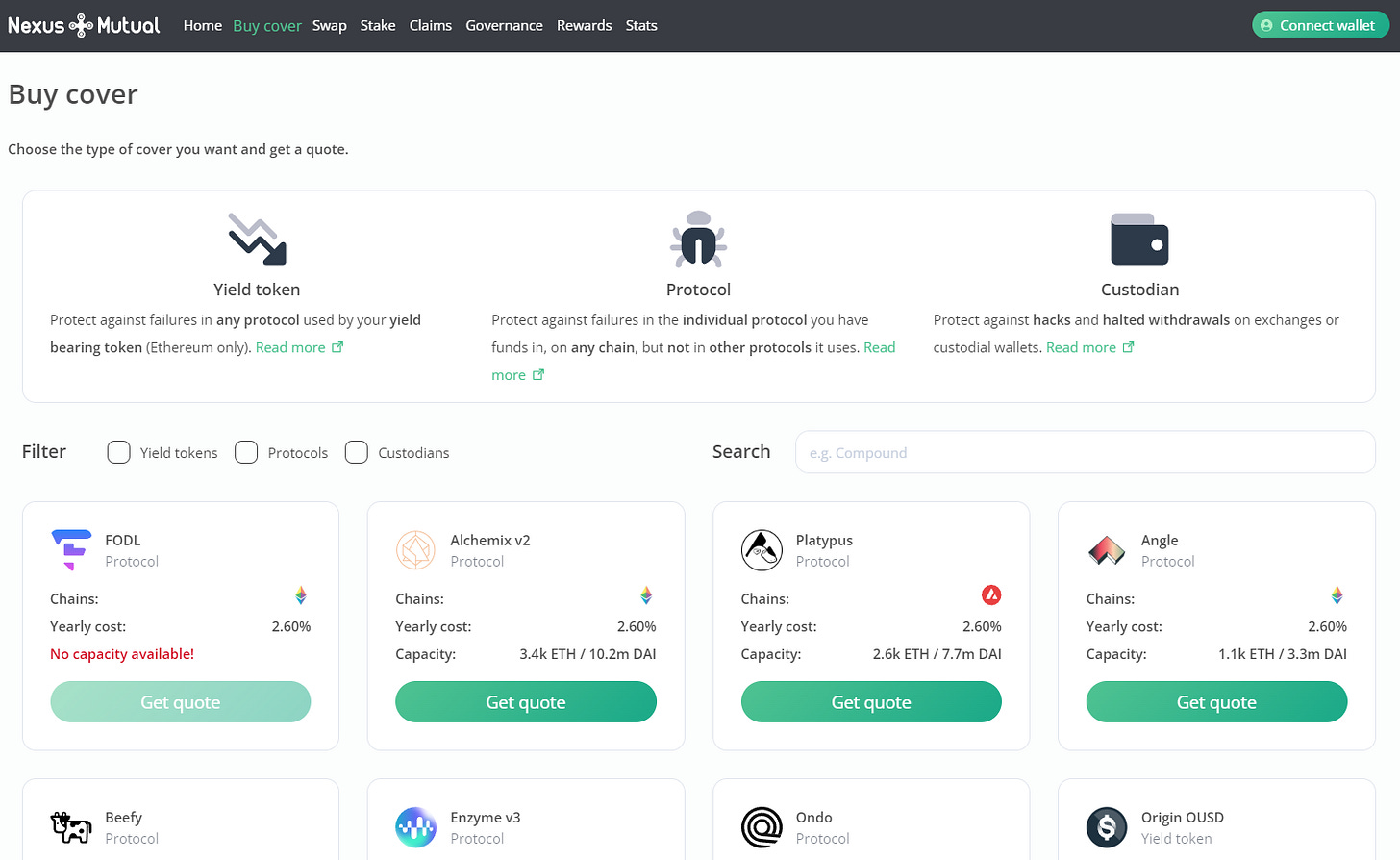

Once you have been approved, you can now benefit from Nexus Mutual's services, including insuring a variety of smart contracts and custodians. It is probably one of the very few places in the world where this is currently possible.

You should land on the following page:

In the Search tab, enter Yearn

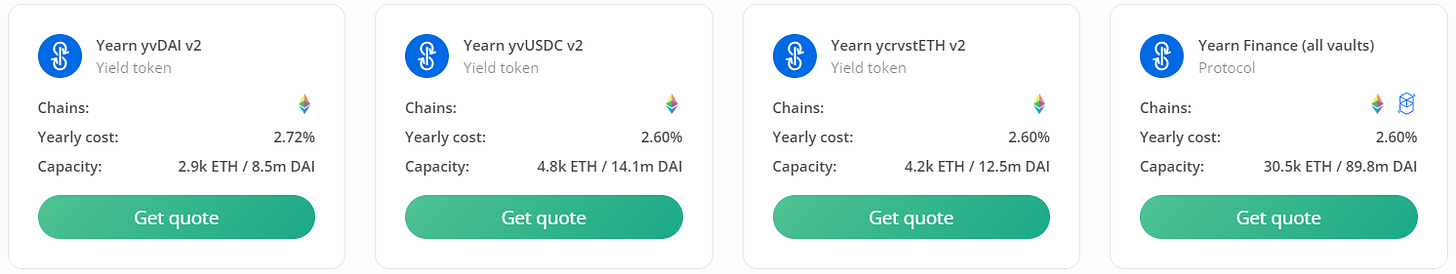

The different Vaults you can choose will now be displayed. You can select a specific one or take out insurance on all of them

Choose whichever is most suitable for your situation and click Get quote

This page will detail the insurance contract you are about to take out; you can customise the period and the cover amount you require.

The terms and conditions here are very important and explain in what instances you are covered and on what chains you are covered. The following are the terms of the Yearn Finance (all vaults) coverage:

Covered:

contract bugs

economic attacks, including oracle failures

governance attacks

Supported chains:

Ethereum

Fantom

Claiming:

You must provide proof of the incurred loss at claim time.

You should wait 72 hours after the event, so assessors have all details to make a decision.

You can claim up to 35 days after the cover period expires, given your cover was active when the incident happened.

Only covers Yearn contracts, not underlying protocols.

If your claim meets these terms, you will be paid out. However, this cover is provided on a discretionary basis, and the final say is made by the members of Nexus.

Step 3: Take Out Insurance

You can now proceed with taking out insurance. Decide on the period you would like to take and the amount you want to be covered. You can choose to take the cover in either ETH or DAI; you must select what is most appropriate to you. Please bear in mind the volatility of the underlying price of Ethereum as you get paid out in ETH and not a nominal value.

Once you have inputted the period and cover amount, click Get quote under the summary section

The next page will confirm you are a member of Nexus Mutual

If you are happy with the quote, click Continue

You will now be given your payment options (the policy can be paid in ETH or NXM)

The terms of the agreement will now be given. Read them carefully, and if you agree, click the tick box

Once you have agreed to the terms, click Buy cover

You will now have to sign the transaction in your MetaMask. Whenever prompted, click "Confirm" to sign the transaction if you are happy with the gas fees

Ethereum will now process the transaction, and once approved, you are covered!

You have now officially taken out an insurance policy on the blockchain. Projects like Nexus Mutual are working towards bringing traditional finance options to crypto and bridging gaps that have existed for years. They can make people feel more comfortable interacting with DeFi and will help onboard the millions of people who will come into the space and use the technology in the next decade.

Conclusion

Using these networks is the best way to learn about them. It shows and allows you to understand what blockchain networks are capable of. Each has its own unique advantages, disadvantages and user experiences.

Andre Cronje has been called the Satoshi Nakamoto of DeFi for a good reason. He pioneered new models and created exciting new ways for people to interact with DeFi protocols.

Yearn Finance and its vaults have only touched the tip of the iceberg when it comes to what is possible in the asset management sector of DeFi.

If you have any questions or have trouble using the network, please feel free to reach out and ask us questions. We always look forward to chatting with our readers. Otherwise, please feel free to share this article if you know anyone who is interested in using these networks.

Notable Articles and News Stories This Week:

Central African Republic Adopts Bitcoin as Legal Tender

Confirming rumors that had been around for a few days, the Central African Republic has become the second nation in the world to adopt bitcoin (BTC) as legal tender.

According to a statement from President Faustin Archange Touadera's office, the National Assembly passed, and he signed, a bill drafted by the minister of digital economy, Gourna Zacko, and the minister of finance and budget, Calixte Nganongo.

The legislation established a legal and regulatory framework for cryptocurrencies, and made bitcoin legal tender alongside the existing CFA franc.

Read more about the decision here

Edward Snowden Played Key Role in Zcash Privacy Coin’s Creation

Edward Snowden, the former U.S. defense contractor whose leaks ignited a worldwide debate about internet surveillance, played a secret role in the creation of the privacy-enhancing cryptocurrency zcash (ZEC).

The whistleblower, who was granted asylum in Russia and has lived there since 2013 after the U.S. charged him with espionage, was one of the six participants in the “ceremony” that established zcash’s so-called trusted setup.

His previously undisclosed involvement in the 2016 ceremony was revealed in a video set to be released Thursday by Zcash Media, an outfit that produces educational materials about the privacy coin.

Read more of the story here

Goldman Sachs Says It Is Exploring the Tokenisation of Real Assets

Goldman Sachs said it is examining non-fungible tokens (NFTs) and particularly the "tokenisation of real assets," as the investment bank dives deeper into the crypto space.

The metaverse where real world assets like real estate are bought and sold as NFTs has been garnering the attention of big names in financial services and a range of other industries.

"We are actually exploring NFTs in the context of financial instruments, and actually there the power is actually quite powerful. So we work on a number of things," Mathew McDermott, global head of digital assets at Goldman Sachs, said at the Financial Times Crypto and Digital Assets Summit on Wednesday.

Read more about the move here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.