Web3 Mini Report

Market Recap

A Rough Week For Digital Assets

Web3 Mini Report

In 2021 Web3 projects gained significant traction and really came into the limelight for the first time. Collins Dictionary even named "NFT" as their Word of the Year. Several notable subsectors, including NFT's, have exploded in popularity; however, we have also seen critical infrastructure projects quietly building in the background. These projects will form the new backbone of our internet and will be necessary for the proliferation of a blockchain-based, internet native economy.

NFT's

Non-fungible tokens or NFT's have seen mainstream adoption in 2021, from Ellen DeGeneres, Jimmy Fallon and Jack Dorsey to Snoop Dogg, Tom Brady and Post Malone, celebrities and regular folk alike have entered the NFT industry.

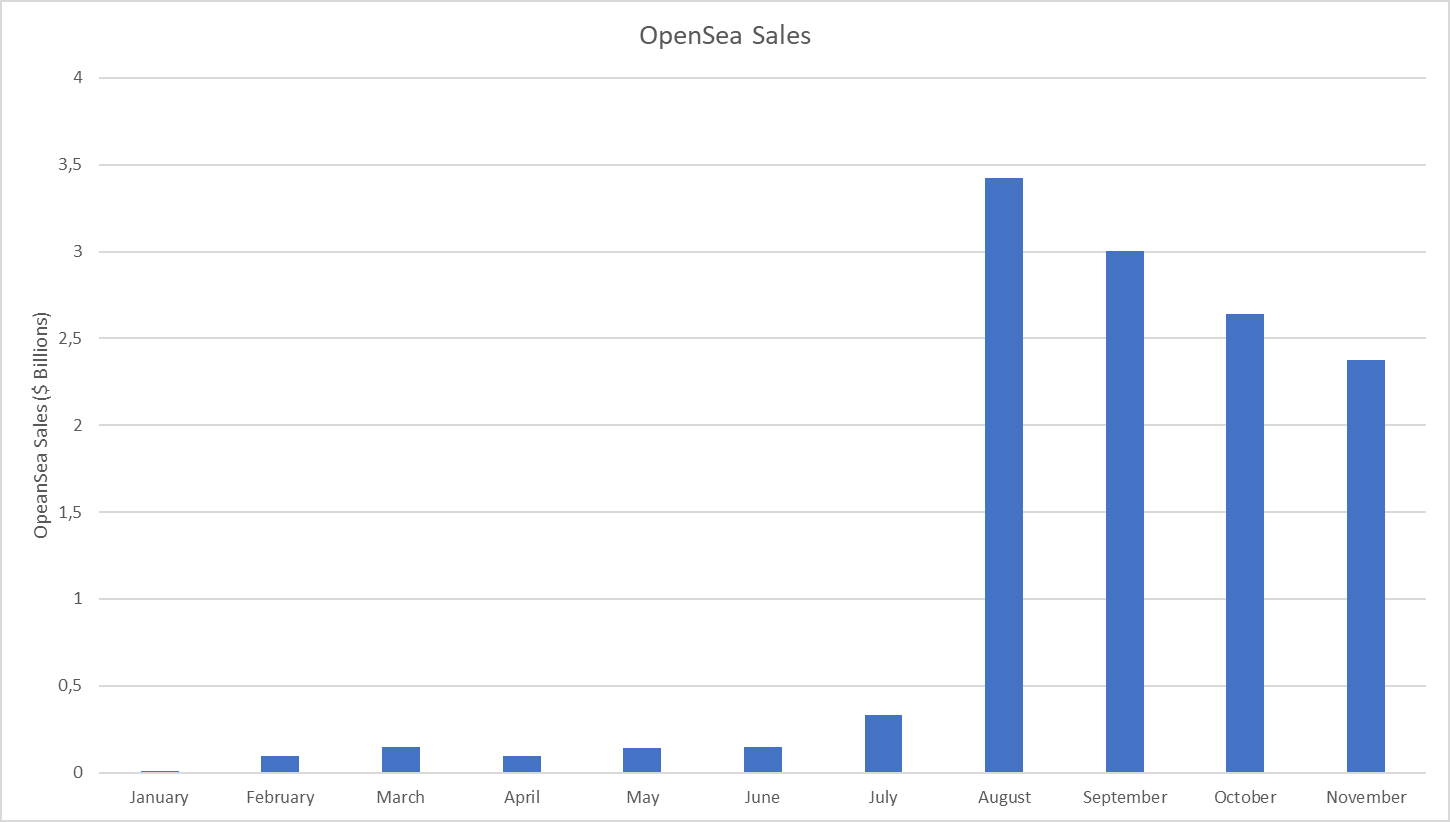

NFT interest really took off in August 2021, and this can be seen by the increase in volume on platforms like OpenSea, the worlds largest NFT marketplace by volume.

We saw NFT trading volume go from around $328 million in July to a peak of $3.42 billion in August, over a 10x increase. However, since then, we have seen a steady decline in trading volume on the platform. One notable point is that the number of individual NFT's bought remained somewhat constant until November.

The above shows that people were still buying a similar number; however, they were paying less for each on average. This was probably due to retail buyers coming in and trying to pick up smaller, less-known projects with the hope of them appreciating in value.

As it currently stands, there are over 8892 unique NFT collections on Ethereum, and we have seen over $14.6 billion traded between around one and half million unique buyers.

At Etherbridge, we believe that NFT's have been a major catalyst for crypto adoption in general. By buying an NFT, individuals had to set up a wallet, purchase some ETH or Ethereum based asset and use that to purchase their NFT. This now opens them up to the possibility of using other Ethereum based services.

As we advance into 2022, we expect to see the launch of NFT projects that provide real utility to the end-user and are more than just jpegs on the internet.

Metaverse

The Metaverse has also been in the limelight this year. From Facebook changing its name to Meta and the 277-year-old Sotheby's launching a virtual auction house in Decentraland, to Barbados preparing to legally declare digital real estate sovereign land with the establishment of a Metaverse embassy. These are things that would have been unthinkable this time last year.

Over the last three decades, the internet as we know it has changed significantly. Most notably, the way we interact with it, from static web pages to interactive online communities such as Facebook and Instagram and now finally fully immersive digital worlds. These immersive worlds or "Metaverses" have the ability to change how we interact with one another on a day to day basis; they will become our new virtual world economies.

As with most things blockchain, the success of other sectors often leads to success in others. The Metaverse has benefitted from the emergence of DeFi, NFT's, DAO's and the new decentralised cloud. These protocols have enabled a more robust and interactive Metaverse. These sectors have contributed to the Metaverse in their own ways, and these are evident in specific metrics we can look at to understand better where the Metaverse currently stands.

Active Market Wallets

This year we have seen a steady rise in wallets actively engaging with Metaverse related projects. We began the year with around 1 613 daily active wallets, and we are currently sitting on 11 237; this represents an increase of 597%. This is significant growth for any industry; however, it is still significantly smaller than many other crypto sectors such as DeFi and is dwarfed by some Web2 incumbents such as Facebook. If this growth, even halved, remains on the current trajectory, we expect to see the Metaverse becoming a mainstream conversation in the near future.

Total Metaverse Sales

There are several Metaverses in existence today built on different chains; however, as it stands, there are four leading virtual worlds built on Ethereum: The Sandbox, Decentraland, CryptoVoxels, and Somnium Space. These projects have made significant progress in 2021, both from a valuation and development perspective.

At the beginning of 2021, Decentraland was the clear leader in the Metaverse space; however, The Sandbox, from a sales perspective, has rapidly caught up and surpassed Decentraland. In January of 2021, Decentraland and The Sandbox had cumulative total sales of $38 397 215 and $4 497 206, respectively. Fast forward to today, and that figure stands at $100 499 665 and $190 701 977, a 162% and 4140% increase. The Sandbox has clearly taken over as the leader when it comes to sales in the Metaverse. Something to note is that a large portion of these sales is for land within these worlds. Owning virtual property has become a new top commodity in the crypto industry.

Another thing worth noting was the sudden increase in Metaverse sales when Facebook announced its name change to Meta. Since October, we have seen the sharpest increase in sales, which coincides with the name change and, therefore, signals to the market that these Metaverses should be taken seriously.

The Metaverse is here to stay. Whether it will be decentralised community-owned Metaverses or centralised controlled systems owned by our current internet incumbents such as Facebook still remains to be seen. However, we expect people to continue building in these virtual worlds and create an immersive, exciting experience for those who come to use them.

Gaming

Gaming in another sector that has taken off in 2021. While gaming may be technically included under the Metaverse or NFT sector, we believe it deserves its own mention with its exceptional growth this year.

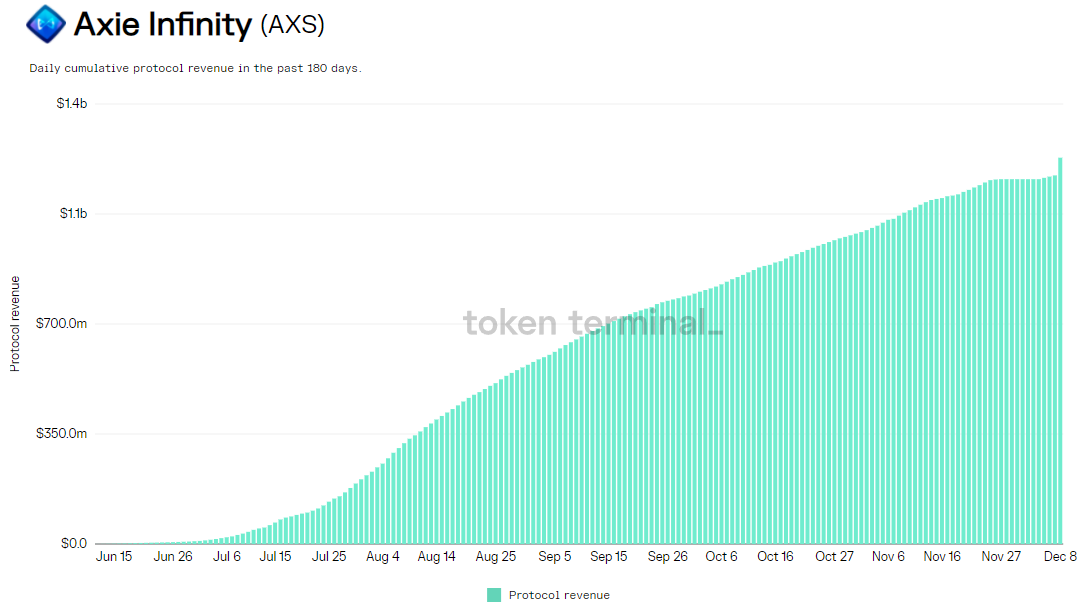

Gaming in the crypto sector has taken off, and Axie Infinity, who pioneered the Play-to-Earn model, has led the charge. When you start looking at the numbers, you begin to understand why.

In the last half a year alone, Axie has produced over $1.229 billion in protocol revenue. Protocol revenue is the share of breeding, pre-sale and marketplace fees that go to the players and the protocols treasury; this revenue is split 95% and 5%, respectively. Due to this massive share that players can earn by simply playing the game, there has been notable adoption in countries such as the Philippines, where players have been earning above their minimum wage, and the only thing they require is a smart device and an internet connection.

Player Growth

This year we have seen an increasing number of gamers coming to play NFT based games. There were several that existed before 2021; however, they struggled to find traction. Axie Infinity and its revenue model changed the way value was redirected back to the players, and this had profound effects on the way people designed game economics going forward.

We saw games that had traction from a player perspective from early on in 2021; an excellent example of this is Alien Worlds. However, we didn't see a significant increase in price; this may have been because it was based on the WAX blockchain, a gaming-specific blockchain that may have made it harder for people to interact with or use their assets earned while in-game.

This was a theme that existed through 2021, games trying to find the most appropriate blockchain to build on, dictated mainly by the cost of gas. Games like Axie Infinity moved off Ethereum onto Ronin, an Ethereum sidechain. We saw Gods Unchained move from Ethereum onto Immutable X, an Ethereum rollup created explicitly for gaming and NFT's. Binance Smart Chain (BSC) ended up gaining traction, and a few of 2021's notable projects launched on the BSC. Currently, there isn't a specific chain that can be considered the winner of the gaming sector, and we expect to see this closely contested in 2022.

Middleware

In 2021 middleware projects have continued to build, albeit quietly in the background. Middleware projects are crucial if we want to see any form of actual adoption of blockchain in the real world. They form part of the backbone of the digitally native economy, and generally, people don't even know they are using them. The middleware sector encompasses a broad group of sectors and projects; therefore, we have selected two that have made significant progress in 2021.

Oracles

Oracles are the way in which the real world can interact with blockchains. Blockchains inherently cannot access data outside their respective blockchain, which obviously severely limits their number of addressable use cases. Yes, it is easy to feed information to a blockchain; however, the problem becomes significantly more complicated when you want to do it in a trustless, decentralised fashion.

In 2021, the main application for oracle services was in DeFi. With the explosion of DeFi came the problem of how to feed reliable prices to DeFi smart contracts, so they executed correctly. We saw different oracle projects approach it in various new and innovative ways; however, they still need time to prove their approach and gain market traction.

As it stands, the clear leader in the market is Chainlink; this is obvious from a partnership perspective and a total value secured perspective.

Partnerships

In 2021 Chainlink has been adding an average of 1.75 partnerships a day. Their total at the beginning of 2021 stood at 367, and they currently have over 1009; this represents a growth rate of 175% over the course of the year.

They have also established partnerships not only in crypto but in the traditional world as well, bringing companies such as Google SWIFT and Oracle on board.

To put the number of partnerships Chainlink has managed to create in perspective, two of Chainlinks biggest competitors, such as Band Protocol and API3, have 6 and 27 partnerships, respectively.

We don't think that Chainlink's growth in partnerships has any reason to slow down in the future, and with the additional features and continued development of the protocol, we believe that they are in a position to be the default oracle for many projects within crypto.

Total Value Secured

Total Value Secured (TVS) is the value of the smart contracts that Chainlink is responsible for providing price feeds to. This metric is important as it underpins a smart contracts ability to maintain integrity and function effectively. The more value secured by the Chainlink Network, the greater confidence people have in the oracles ability to feed reliable data into their smart contracts.

Chainlink this year has also seen significant growth in its TVS. At the beginning of the year, Chainlink was responsible for securing around $7 billion in value; they recently announced that it had surpassed $75 billion. The growth in TVS is hugely positive and again cements Chainlink as the leader in oracles services.

Chainlink has served over 600 million data points to over 10 different blockchains. They have expanded their service offerings over 2021 and now provide more than just data delivery. From interoperability to verifiable randomness and privacy, Chainlink continues to expand the capabilities of blockchain in general.

2022 will see these new services Chainlink offers further integrated into new use cases such as NFT's and the Metaverse to provide an even more expansive virtual world.

Decentralised Cloud

The decentralised cloud comprises two offerings, both computing power and data storage. Currently, companies like Google Could Platform, Amazon Web Services, Microsoft Azure, IBM Cloud, Oracle Cloud, and Alibaba Cloud have a complete monopoly in these markets. However, leveraging blockchain technology, everyday people can now rent out their spare digital resources and be paid for them in return and effectively challenge the incumbents that be.

Decentralised data storage and computational power are going to become a significant part of the Web3 middleware. If an application is to be genuinely decentralised, it will need to store and compute the data and information necessary to operate in a distributed, secure and fault-tolerant way. Blockchains such as Ethereum excel at storing or replicating small amounts of data on millions of computers across the globe; however, storing or computing vast amounts of data and information on-chain can very quickly become prohibitively expensive.

Data Storage

There are two general approaches within this subsector: on-demand storage (Filecoin and Sia) and permanent storage (Arweave). Filecoin has long been the leader in the decentralised data storage market; however, this year, Arweave and Sia emerged as strong competitors. Filecoin has the largest file storage space available, currently sitting at over ten exbibytes or the equivalent of 45 000 Wikipedias between 3158 storage providers; yet, only around 34.95 petabytes are presently being used. They also have over 155 organisations building on their network and 430 projects entering their ecosystem.

Arweave's approach is different and comes with additional complications; as one can imagine, creating a permanent storage solution is challenging as you have to incentivise people to continue storing the data over time. As NFT's have risen to popularity this year, so has the need to store them in a secure way; Arweave has been the solution for many NFT projects and individuals. While Arweave's total storage isn't significant as it currently sits around 33.61 terabytes, it started the year off at 4.15 terabytes, so it has grown by 710%.

Computational Power

Shared compute power is still finding its market fit and real adoption in the crypto industry. However, we have seen some projects start to focus on specific use cases, such as Livepeer who have created a video streaming network on Ethereum. This allows people to share their unutilised compute and bandwidth to act as a node and power video streaming applications.

We have seen projects like Ankr let people share their computing power to run blockchain nodes and staking solutions.

These are the projects that we are getting excited about; however, in 2021, they weren't used as much as storage projects, and this is because of other subsectors such as NFT's gaining significant traction. In 2022 and beyond, we expect to see them being used within a greater number of projects.

Middleware projects are crucial for a future where blockchain is our defacto settlement system. They aren't as flashy or in your face as other projects and, therefore, often overlooked. Nevertheless, they are quietly building in the background and will continue to open up use cases that weren't previously possible.

DAO's

A DAO leverages blockchain and a collection of smart contracts to facilitate the mechanics of governance whereby allowing a decentralised group of participants to fund and produce community-owned goods and services collectively. Or, more simply, a DAO is an internet native coordination structure governed by code that allows like-minded people to come together and pool their resources to achieve some common goal.

A DAO itself isn't that different to the corporations and businesses of today. They can provide both digital and real-world based goods or services; however, the governance structure can be significantly more decentralised and provide stakeholders with the chance to participate meaningfully in the system. A DAO uses economic incentives to align the interests of everyone within the organisation as the rules are transparent and written in open-source software governed by mathematics and computer science.

DAO's have certainly made progress in 2021. As it stands, DAO's manage $13 billion in their treasuries.

At the beginning of the year, there were only 12 DAO's with more than $1 million in their treasury, currently we sit at 58; in addition to this, there are 6 with between $100 000 - $1 million and 100 that sit below this level.

DAO membership has also seen a significant increase sitting at 1.7 million organisation members and token holders, with 356 000 added in November alone.

The number of DAO's with over 100 members sits at 71, which represents an increase of 14x since the beginning of the year.

The diversity of DAO's has also increased, and we currently have a large variety servicing different niches. The below diagram should give you a good idea of the areas of focus for DAO's:

DAO's represent the new frontier in human coordination. They have started to find a market fit and actual use within the broader crypto ecosystem; however, there is still regulatory uncertainty associated with them. Nonetheless, we still expect to see further growth of DAO's in 2022, and as DAO tooling builds out, we expect there to be even further adoption and use.

Legal and Policy Updates

Navigating the cryptoasset industry requires understanding and monitoring the legal and regulatory landscape. 2021 will mark the year when regulators really started to take digital assets seriously. The topic became a major talking point in the American Congress and even delayed the approval of the much anticipated bipartisan infrastructure bill by several days.

There was both good regulation and bad regulation, but 2021 offered us some more clarity over how we can expect crypto to be regulated in the future.

Wyoming

On the 1st of July 2021, a law came into effect that legally recognised DAO's as companies in the State of Wyoming. DAO's can now be registered there and receive the same rights and legal power as a limited liability company. This is a massive step in bridging digitally native organisations and traditional companies' legal protection and benefits. We expect more jurisdiction to follow suit in 2022 and provide DAO's a legal framework in which to work and operate.

FATF Guidance

In October, the FATF published additional guidance around digital assets. They have said that Virtual Asset Service Providers (VASPs) are subject to the same measures that apply to financial institutions.

There was additional clarification around DeFi. Previously under the FATF, DeFi projects were not considered VASPs as their standards "do not apply to underlying software or technology".

Under the new guidance, developers and maintainers of these protocols can be considered VASP's depending on circumstance:

"Creators, owners and operators or some other persons who maintain control or sufficient influence in the DeFi arrangements, even if those arrangements seem decentralised, may fall under the FATF definition of a VASP where they are providing or actively facilitating VASP services."

Infrastructure Bill

In November, Biden signed a $1.2 trillion dollar bipartisan infrastructure bill into law. One of the primary considerations of the bill was how they were going to fund this $1.2 trillion spending spree. Tucked away in the bill was language that increased the tax reporting requirements for crypto transactions. Starting in 2023, crypto brokers will be required to record transactions and report them to the IRS. The controversial part of the bill is that the definition of a "crypto broker" is far too broad as it essentially includes any entity that provides a service "effectuating" the transfer of digital assets. Therefore it could be argued that miners and developers may even be now liable to report information about transactions they actually can't access.

While we welcome regulation, broad, blanket type regulation can do a lot more damage than good and significantly stifle innovation in the industry.

Resources

https://www.chainlinkecosystem.com/ecosystem/

https://chainlinktoday.com/chainlink-announces-its-total-value-secured-tvs-is-now-over-75-billion/

https://api3.org/

https://viewblock.io/arweave/stat/cumulativeWeaveSizeHistory

https://storage.filecoin.io/

https://deepdao.io/#/deepdao/dashboard

https://dappradar.com/rankings/category/games

Notable Articles and News Stories This Week:

Crypto Industry Will Move Offshore If Congress Doesn’t Act, Executives Warn

As US policymakers continue to wrestle with how to regulate the growing digital asset industry, executives from major cryptocurrency companies appeared before Congress on Wednesday to provide, and request, clarity.

Bitfury CEO Brian Brooks, who formerly acted as comptroller of the currency under President Donald Trump, pleaded with lawmakers to look past the investment side of the industry.

Lawmakers must consider the innovation that blockchain technology can bring to governments, businesses and citizens, he said. The present financial system is not without risks, costs and safety problems, Brooks said.

“Shouldn’t we take seriously the possibility that algorithms and open-source software that take a measure of human error, greed, negligence, fraud and bias out of the system might actually make the system better, on net, even if there are some new risks being presented that need to be understood and regulated?” he asked the committee.

Read more about the hearing here

Bill Gates: Office Meetings Will Be In the Metaverse Within Three Years

The year is 2024 and most of your office meetings will take place in the metaverse, according to Microsoft co-founder Bill Gates. Gates predicts that office jobs will be revolutionised by the Metaverse, adding that virtual meetings will go from 2D images like the “Hollywood Squares model” to full-on 3D avatars, the tech billionaire said in a year-end note on Thursday.

“The idea is that you will eventually use your avatar to meet with people in a virtual space that replicates the feeling of being in an actual room with them,” Gates said. The 66-year-old, who stepped down from the company’s board in 2020, said that most people will have an avatar they can interact with online.

These avatars can meet in virtual spaces to connect, allowing coworkers to share virtual offices from thousands of miles away via virtual reality headsets and motion capture gloves “to accurately capture your expressions, body language and the quality of your voice.”

“People shouldn’t assume that the quality of the software that lets you have virtual experiences will stay the same. The acceleration of innovation is just starting,” Gates said.

Read his full prediction here

Miners Look Away From Kazakhstan for Growth Opportunities

Crypto miners operating in Kazakhstan are looking to the U.S. and Russia to grow their business as the government is restricting the industry in the central Asian country.

“The whole market [in Kazakhstan] has dried up so fast in terms of available capacity,” said Denis Rusinovich, co-founder of CMG Cryptocurrency Mining Group and Maverick Group, adding that he is looking into Russia to expand his operations.

Since flocks of miners from China and beyond soaked up Kazakhstan’s spare energy capacity, the government has been dealing with severe electricity shortages.

The government proposed a limit to the development of new mines of a total of 100 megawatts (MW) nationwide in October, setting an upper boundary for the potential of crypto mining growth in Kazakhstan.

Read more about the story here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.