The US Election and Its Impact on Crypto Markets

We are only days away from the U.S. election, historically BTCUSD has shown strong performance in the 200 days following the election. Will the trend continue, or will this time be different? Let’s unpack the set up.

I have no clear read on who will win but markets seem convinced that Donald Trump will take it. This sentiment is evident across equities, prediction markets, and crypto.

Why the Election Matters

The election is a central topic for crypto investors because U.S. regulators have taken an aggressive, regulation via enforcement approach to this emerging industry, setting precedents that influence global standards. Crypto holders are hopeful that a new administration—whether Republican or Democrat—will foster a more constructive relationship between regulatory agencies and the crypto sector.

A Trump victory is potentially bullish for crypto across the board. I would expect a broad market expansion.

A Harris victory could be bullish for Bitcoin and Ethereum but may present challenges for altcoins and experimental projects. I would expect a more muted expansion with a wider dispersion of returns in altcoins. DeFi for example would not be an area I would like to play in the event of a Harris victory given its high regulatory risks.

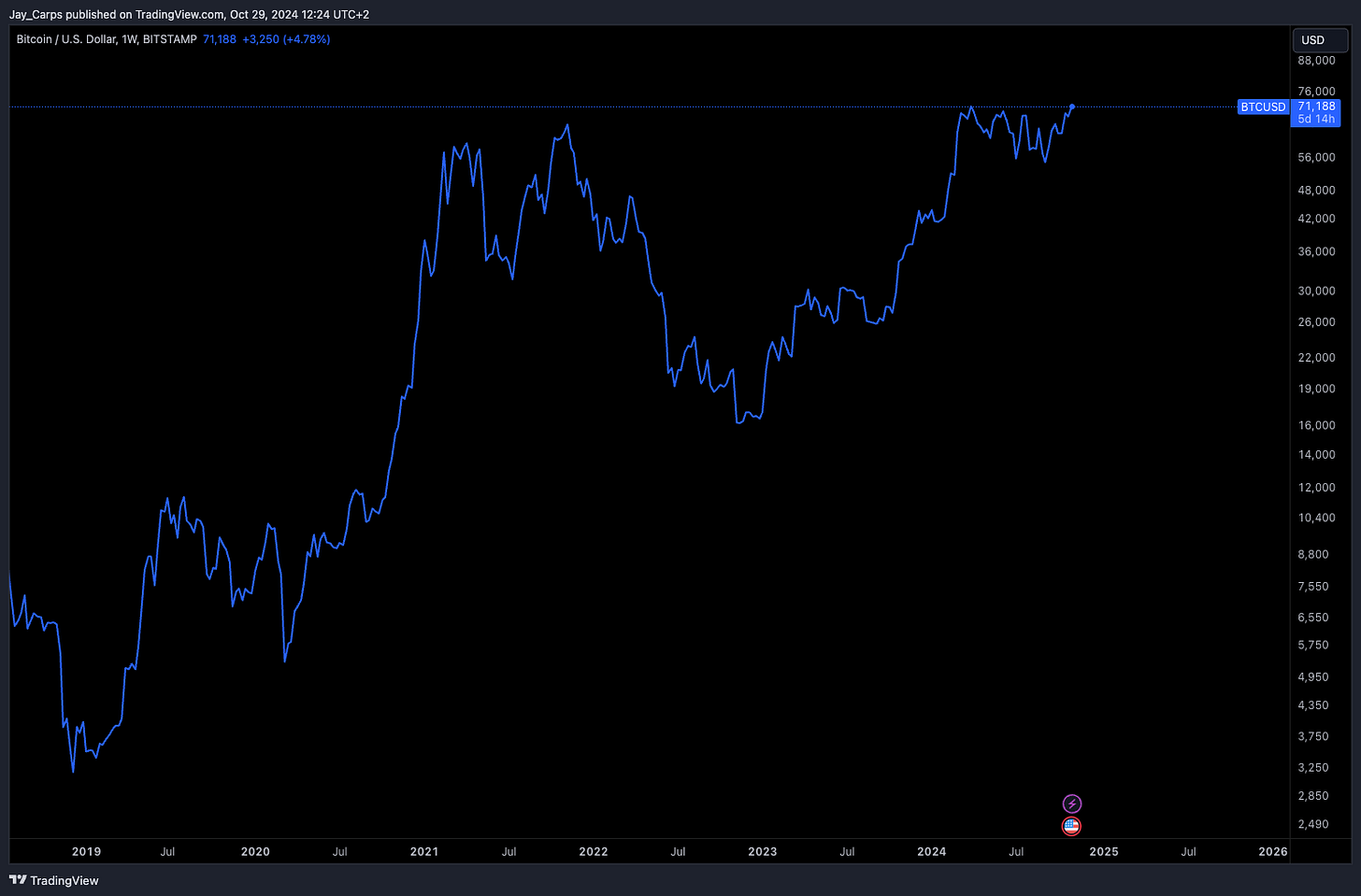

Bitcoin

After a 230-day consolidation, BTCUSD is showing bullish market structure and trades only $1000 off of all time highs. Investors are placing bets on accommodative financial conditions, growing global liquidity, a potential pro crypto election victory and downplaying recession concerns.

Ethereum

ETHUSD is now the contrarian bet in crypto markets, trading 35% of all time highs. After months of disappointing price action and ETHBTC constantly losing ground we might be on the verge of a reversal.

Vitalik Buterin, the creator of Ethereum has been more vocal of late on social media platforms like X.com, recently he has released six blogs covering the development roadmap in detail, you find these blogs here. Ethereum needs more of this clear messaging to compete in the attention economy and this is a good first step.

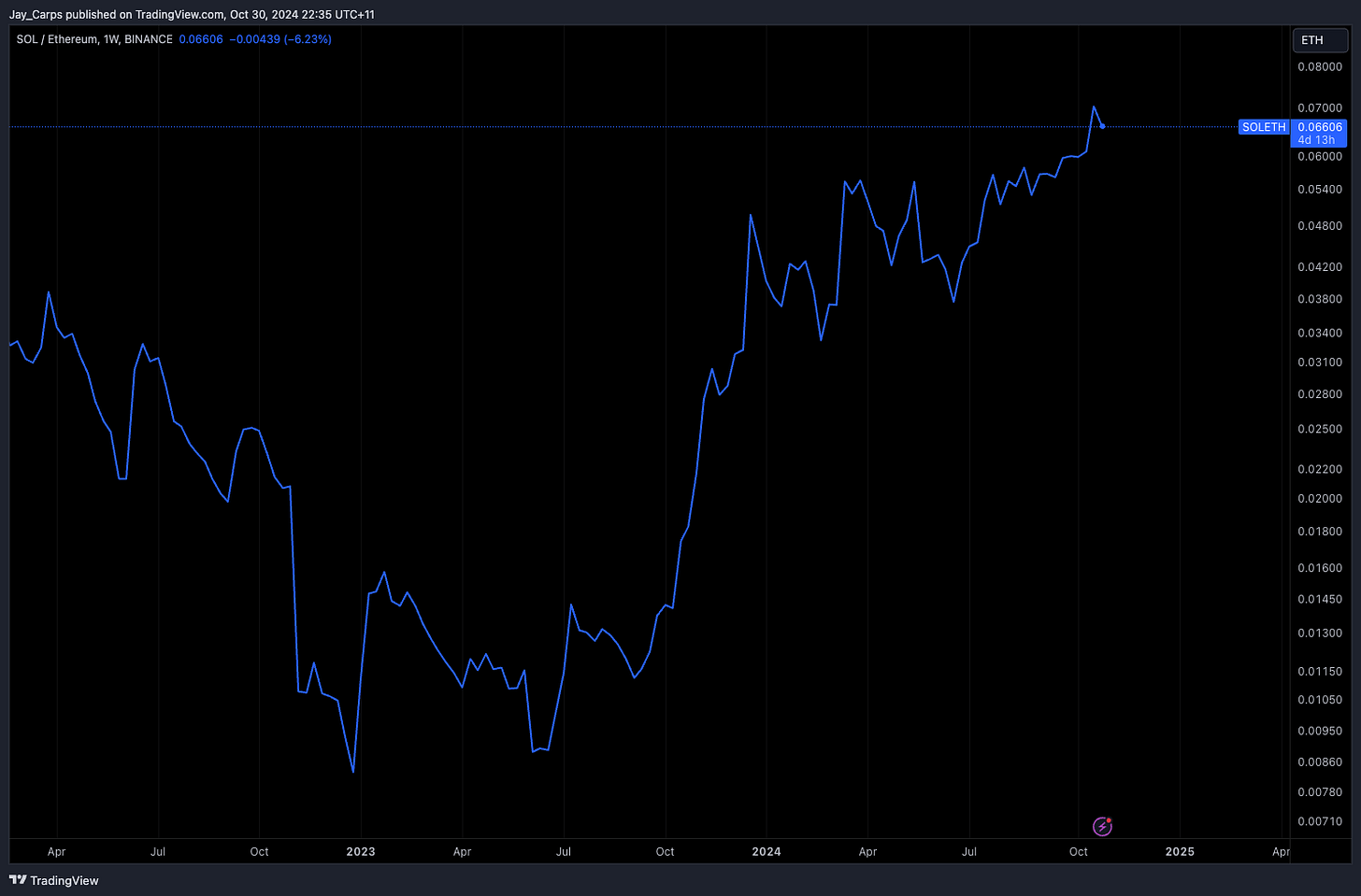

Solana

Solana opinion leaders have put the Ethereum crowd to shame, using clever, simple and well reasoned messaging. This messaging has successfully repaired much of the damage caused by the FTX implosion and Solana’s close proximity to bad actors. SOLUSD price action has been constructive, up 1600% since 2023s lows and it currently trades just 30% off all time highs.

It's not just SOLUSD price that has improved, Solana's fundamentals have strengthened meaningfully since the lows in 2023. It has become the primary venue for the recent memecoin mania and has successfully flipped Ethereum in real economic value generated through execution and MEV. This is reflected well in the SOLETH chart which has made new all time highs this year.

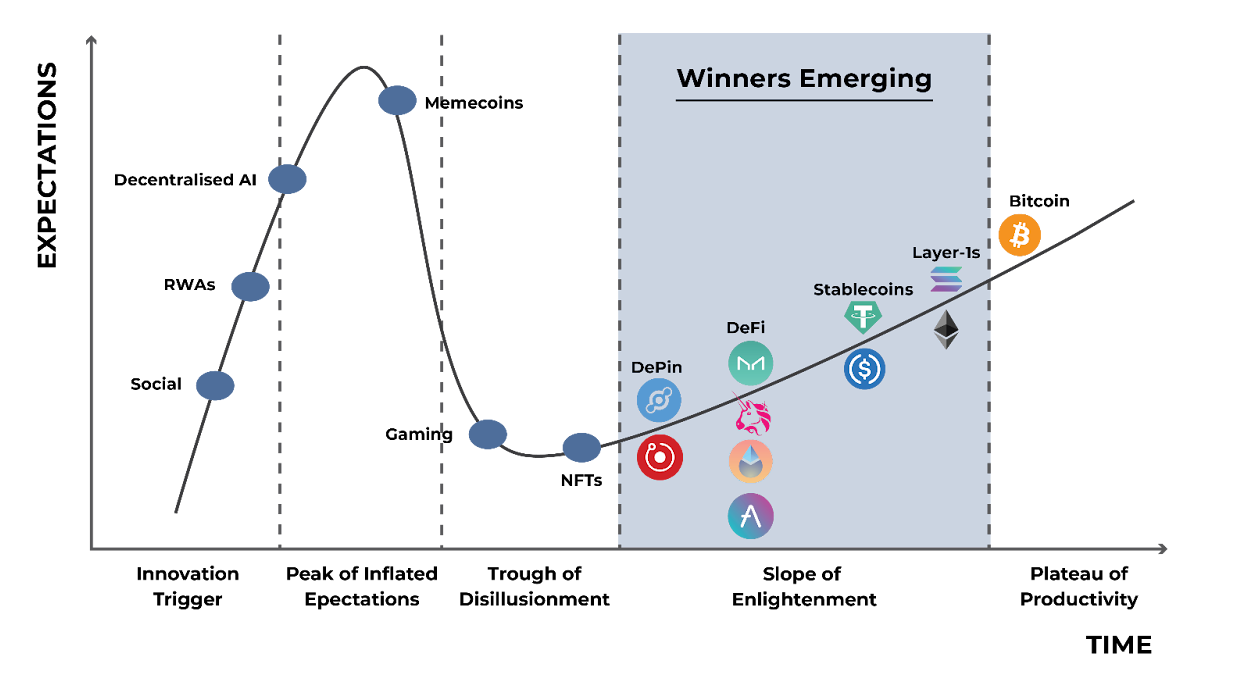

Altcoins

The OTHERS index which tracks the crypto market excluding the top 10 coins is trading 50% off of all times.

While the OTHERS index certainly tracks many projects that could be considered as vaporware or ghost town networks, there are pockets of the altcoin market we believe have matured significantly since the previous bull market of 2021 and sector winners are beginning to emerge.

Market cycle progression

From a time based perspective, we are firmly in the expansionary phase of the crypto market cycle. It's in this phase of the cycle that the majority of price appreciation takes place.

Our market cycle composite also suggests that we have just entered a second expansion for this cycle. The first of which ran from November 2022 and came to an end May 2024.

When is altcoin season?

Altcoin season is what crypto traders live for, a short period of the four year cycle where achieving excess returns above and beyond what BTCUSD can offer are possible. Previous altcoin seasons were in 2017, 2020 and 2021. Below is OTHERS/BTC, illustrating previous altcoin seasons.

If we view this from the perspective of the time based market cycle we can see that the bulk of excess returns comes in the phase we are in today (500-1000 days), the expansion.

Altcoins also tend to perform very well post US election outcomes, albeit we have a small sample size. The below depicts OTHER/BTC (ie: excess returns) in the 200 days following the election.

It's crunch time for the expansionary phase. As I alluded to in last month's memo, this is the most bullish set up for crypto I have seen since mid- 2020. Once uncertainty around the election outcome is cleared, there will be opportunities to position intelligently in key compounders to take advantage of the expansion.

Until next time, all the best.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.