The End of the Recovery Phase

As the recovery phase of the crypto market cycle draws to a close we look forward to what we expect to change, sectors that we believe have a strong chance of relative outperformance and we discuss the battle of ecosystems that will come to define this market cycle.

Bitcoin Dominance:

Bitcoin dominance rose steadily throughout the recovery phase, from 41% to 53%. Bitcoin dominance refers to Bitcoin market capitalisation as a share of the total crypto market capitalisation. We expect that Bitcoin dominance is topping out here at 53%.

There is certainly a scenario where Bitcoin dominance continues to march on higher given the sheer amount of capital inflows from BTC ETFs. But even in this scenario, we would expect the higher beta tail of the market to perform strongly.

ETFs have changed the flow of capital into crypto, in the 2017 cycle the primary assets were BTC and ETH. If you wanted to trade crypto you would need to acquire these assets first as most trading pairs were BTC or ETH denominated, this was true for both secondary market trading as well as the primary funding assets for ICOs. 2020/2021 we saw a change to this dynamic, with an increasing amount of trading pairs becoming USDT, USD, and USDC. But this cycle represents a more structural change. ETFs can’t be easily traded out of and reinvested in a basket of altcoins on a crypto exchange, this is a departure from the market structure investors are accustomed to and could produce some surprises.

Crypto AI Coins:

The release of ChatGPT ignited a hype cycle in artificial intelligence, this hype which originated in traditional equity and venture capital markets poured into crypto markets. Crypto assets with the slight hint of an AI flavour have been massive beneficiaries of this hype cycle. We expect these opportunities to persist in the expansionary phase. There's always a bubble somewhere in crypto and the crypto AI crossover is primed to be that sector this cycle. Make sure to check out AkashChat, a ChatGPT-like product that runs on Akash’s decentralised computing network.

Base and Layer 2’s:

In September 2020 Binance launched Binance Smart Chain (BSC), an EVM compatible smart contracting platform. Binance successfully enticed developers and entrepreneurs with sizable subsidies to build on their platform and what followed was a boom in BSC on chain activity. We see the same dynamic playing out with Coinbase’s, Base, an Ethereum layer 2. We assign a high probability to Base becoming the largest Ethereum layer 2 by the end of this year. Unlike Binance, which many view as shady and opaque, Coinbase is a listed US company and commands a much higher level of trust in the crypto sphere.

Base daily active users have sharply increased in March.

Daily transaction volume mirrors the growth in daily active users.

Exchange volumes on decentralised exchanges show a similar trend too.

Stablecoins to the Moon:

The primary use case for blockchains is asset ledgers for trading and financial activities. Stablecoins serve a core role in this use case, stablecoin growth has been hindered by a lack of regulatory clarity but we believe the conversation is moving in the right direction for an explosion of on chain stablecoin market capitalisation. We would expect stablecoin market capitalisation to at the very least double over the next 18 months. This will strengthen the decentralised finance use case and contribute to increasing activity on chain.

Battle of the Ecosystems:

The Etherbridge fund is focused primarily on networks with clear and demonstrable network effects. In our view, there are currently only three ecosystems that fall into this camp, Bitcoin, Ethereum, and Solana.

We believe that over the long run, winners will emerge as a by-product of growing network health. Successful networks will have plenty of users, liquidity, developers, and robust fee generation. These metrics are simply the battleground for ecosystems, they allow us to see through the hype and disillusionment present in every crypto cycle.

Bitcoin is at an obvious disadvantage here as it lacks smart contracting capabilities but this too is set to change with plenty of ongoing experimentation around bitcoin scaling solutions. You can find a list of these ongoing projects here.

As has always been the case, scaling is at the centre of development for all of these ecosystems. Technologists continue to wage verbal wars on X.com about the approaches each ecosystem has taken. The Ethereum camp believes that the only way forward is through modularisation and horizontal scaling through layer 2’s, the Solana camp believes the only way forward is by scaling and maintaining a single unified layer.

Both camps think the other camp is completely wrong in their technological approach, from our point of view both methods have merits and tradeoffs to be aware of, but only time will separate the winners from losers. The tribalism between technologist groups is not a new phenomenon and was present in the early days of networking which is outlined brilliantly in Eric S. Raymond’s book The Cathedral and the Bazaar.

ETHBTC and SOLETH are the Most Important Ratios in Crypto Right Now:

ETHBTC has been stuck in the same range between 0.06 and 0.05 for almost three years, currently retesting the lower bound at 0.05. We are positioned for a reversal in this trend and a return back to 0.06 and potentially higher depending on how key performance indicators play out through the expansionary phase. An ETH ETF approval would also bolster this view but recently sentiment has soured around an approval in May, so we may have to wait a bit longer to get our second crypto ETF.

Ethereum is in a unique position this cycle. Firstly it pulled off a speculator turnaround in profitability during the 2022 bear market after the Merge (Ethereums transition to PoS from PoW, September 2022). Before “The Merge” token issuance far outweighed fee generation, as illustrated below in Ethereum's financial statements. Earnings of the Ethereum network in 2021 was -$9.62bn, turning positive in 2023 at $623m. What makes this even more impressive is that fees collected in 2021 when network activity was high were $9.91b compared to the 2023 low activity environment where total fees of only $2.41b were collected.

Secondly, Ethereum is finally starting to see traction on tokenisation. BlackRocks choice to tokenise their BUIDL fund on Ethereum is a watershed moment in our view, for two reasons. The first is that they choose to build on a public blockchain and not a glorified Excel spreadsheet permissioned chain. And secondly, they choose Ethereum, most likely because of its network liquidity and stablecoin market capitalisation but perhaps it's also a vote of confidence on the scaling roadmap of Ethereum.

Lastly on Ethereum, the most recent Dencun upgrade changes the competitive position of Ethereum layer 2’s. Dencun was a broad update that included EIP 4844, which introduces a new transaction type called blobspace. This update significantly reduces the costs associated with using Ethereum layer 2’s, this diminishes the “low cost, new blockchain” narrative of alt layer 1’s and increases the chances that new users flow to Ethereum layer 2’s.

SOLETH has recovered all the losses from 2022 and the FTX unravelling. We are impressed by Solana’s rise from the ashes and developer grit but remain cautious given its historical track record of unethical behaviour and affinity with some of the worst actors in crypto. Much of these risks have been cleared during the 2022 correction but it's wise to keep them in mind when making allocations.

If we zoom in to what is going on under the hood much of SOLETH’s rise makes sense.

Monthly active users on Solana stand at 1.4m while the Ethereum ecosystem (including Arbitrum, Optimism, and Base) comes in at 1.2m. This is a phenomenal feat for Solana given most would have considered it dead only 18 months ago. However, much of the active user growth can be attributed to the recent memecoin mania that has taken place on Solana. If Solana successfully retains these new users then it's becoming a solid contender, we will only get a real stress test again in the contractionary phase of the cycle but we will be watching this closely.

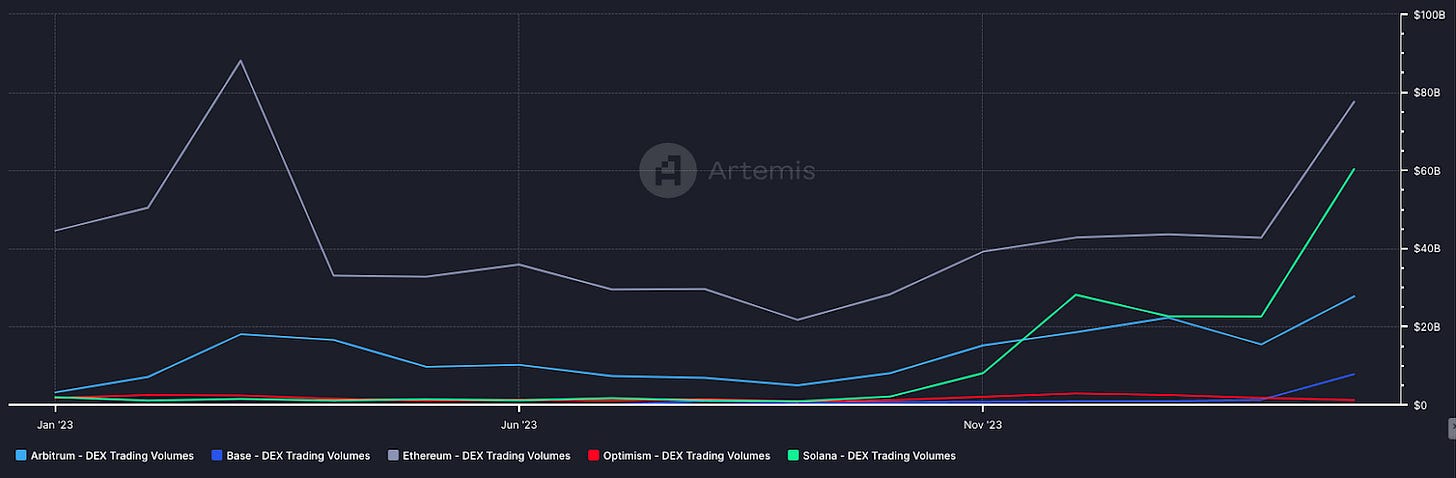

On the back of memecoin mania trading volumes on Solana have also exploded, $60b in decentralised exchange volumes for March. The Ethereum ecosystem remains ahead in decentralised exchange volumes at a cumulative $114b. Similar to our comments on users, it will be interesting if Solana can retain these volumes.

The bull case for SOLETH is that Solana on chain fundamentals continue to strengthen and liquidity in Solana financial contracts expands dramatically. Further, in the bull case we expect a rise in stablecoin market capitalisation on Solana and tokenisation of financial products, something we are only seeing on Ethereum at the moment. This scenario would see SOLUSD significantly outperform ETHUSD and trend further toward parity of SOLETH.

The base case for SOLETH is that Solana on chain fundamentals continue to strengthen but that they struggle to gain liquidity, stablecoins, and tokenisation projects as investors and builders remain cautious over ongoing issues of the network. This scenario would still see SOLUSD outperform ETHUSD but to a lesser extent, and we certainly would not see parity of SOLETH this cycle. This is the scenario we are positioned for, Solana currently makes up 13% of the fund, while Ethereum makes up 35%.

The bear case for SOLETH is that the improving Solana fundamentals are merely a reflection of memecoin mania and crypto influencer engagement. More network outages would translate to less likelihood of SOLETH ever reaching parity and would certainly stall any efforts to onboard production capital.

The reason we lean toward the base case over the bull case for Solana is due to a variety of factors. The first is ongoing network outages, a network outage in our opinion unacceptable for a platform that aims to claim its place in the future of finance. For example in the event of a network outage all of the guarantees users believe they have in lending protocols fall away, as liquidation events cannot take place as required when the network is done.

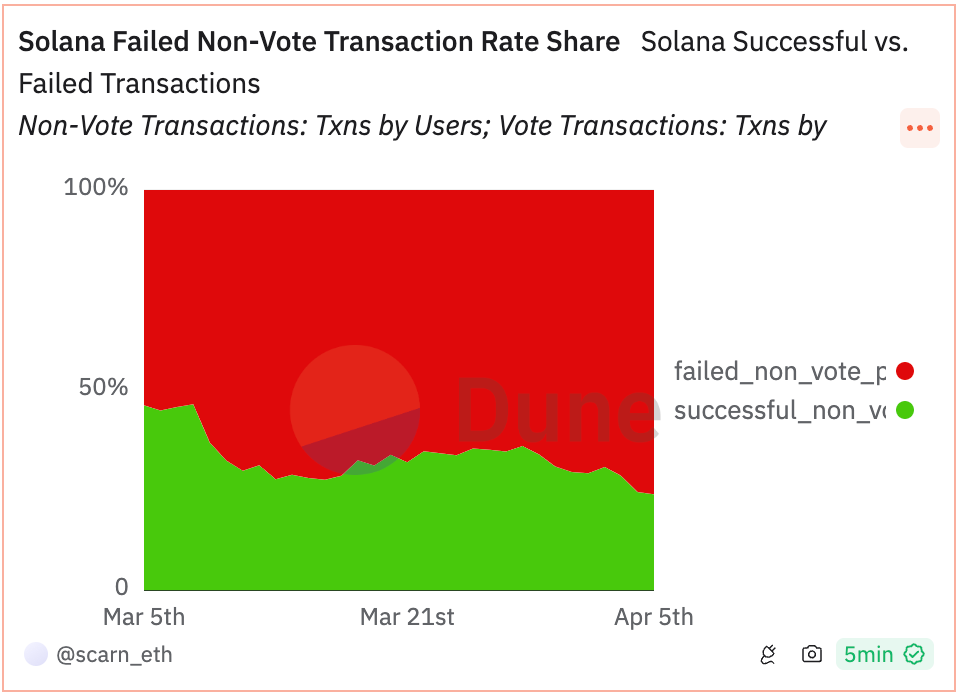

Another issue that we have with Solana is the percentage of failed transactions. Currently, 75% of nonvote transactions fail to be included in new blocks. This dampens the Solana narrative of cheap and fast, because even though this may be true, a user may need to send four transactions before completing one.

Solana metrics are also often misinterpreted, while we don't believe this is intentional we remain sceptical. Transaction count, which is an input of transactions per second (TPS), is one the main talking points of Solana bulls, however a closer look at Solana’s transaction count reveals that 65% of transactions are vote transactions as required by Solana’s consensus.

We have spent a lot of words discussing problems with Solana and would remind readers that Ethereum isn’t perfect and has its own set of issues that are as mission-critical as those we have discussed for Solana. Both networks will need to make engineering leaps forward to remain dominant, failure to do so will further open the door for emerging networks to earn market share.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems that require due diligence to comprehend and operate in. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.