The Crypto Pendulum

It's difficult to identify another asset class or industry that possesses such a violent sway in public opinion and investor sentiment as that of crypto. For the entirety of this technology's existence, it has swung viciously back and forth between “a revolutionary technology” and “a nothing burger”.

The revolutionary view cites the end-use cases of blockchain technology in finance, banking, payments, media, gaming, and cloud computing as trillion-dollar markets and firmly believes that the engineering challenges of realising a dominant share of these markets will be solved.

The nothing-burger view are headline readers, commonly cited phrases from this crowd are “but there’s no intrinsic value”, “solution looking for a problem”, “the industry is filled with frauds” or “look at FTX, so much for decentralised finance”.

The battle between these views is fought out between extremists on each side in the depths of crypto Twitter and financial media. In our view, the relationship between these polar opposite views is fuelled by factors such as:

A new asset class: When was the last time we saw a new asset class? And no, wrapping up shares of private companies in a fund structure is not a new asset class, allowing people to speculate on baskets of properties in the form of a REIT is not a new asset class. Crypto is new, the assets are complex and the market could be loosely defined as liquid venture capital. This liquid and early-stage market possesses the early access of venture but the liquidity of secondary markets, it's no surprise that these markets are volatile. This volatility is at the heart of the disagreements between the respective views, it fuels each of their biases and reinforces the stories they choose to tell themselves.

Essential yet hardly discussed infrastructure: Any conversation about blockchain technology and cryptoassets is inevitably between either two parties who have zero understanding of the internet protocols or the settlement systems of our modern financial system, or one well-studied party and one that is oblivious to the infrastructure that holds our modern world together. This asymmetry of knowledge or lack thereof leaves both parties unsatisfied as collectively they lack the necessary background knowledge to grok, let alone articulate such a technological marvel.

The political nature of decentralisation: We are not geopolitical experts by any means but it doesn't take a genius to realise that the decentralisation of core internet protocols and financial infrastructure is deeply political. Free market people celebrate it, authoritarians hate it and couldn't imagine a world without elected and unelected officials making decisions in our best interest. The success of decentralisation will mean that the powers that be lose their ability to finance without consent the world they envision, they lose the power to censor the words they don't want to be spoken and the ability to block people they deem unworthy from networks that are essential to our modern way of life.

So what does this mean for where we are today? Quite simply any investor who allocates to these markets needs to develop a thick skin to survive the swings of the pendulum. This is why we believe so deeply in education before execution because once you get it, once you can see the bigger picture you can allocate with confidence on solid grounds. Knowledge is how you can develop this thick skin and allocate knowing that just like all other investment opportunities the future is simply ever-changing probabilities of possible outcomes.

We needed to discuss the pendulum for the sake of this month's memo, as April was BTCUSD’s worst month since the implosion of FTX. While April would shake anyone’s conviction we are no tourists and this kind of pullback is nothing out of the ordinary.

As is depicted below, BTCUSD's rise through 2021 had multiple double-digit pullbacks.

The same is true for the aggregate market excluding BTCUSD and ETHUSD.

In the context of the current market cycle, we have already witnessed three 20%+ pullbacks in BTCUSD.

Again, the same is true for the aggregate market excluding BTCUSD and ETHUSD.

This is what volatility looks like, this is what the rise of a new technological paradigm looks like. It's bumpy and filled with tests of conviction. Imagine the scepticism horse riders might have expressed about the automobile when only a small fraction of the population had access to cars. Similarly, consider the initial resistance from librarians, newspaper publishers, and postal services to the early, cumbersome iterations of the Internet.

This is the first pullback of the expansionary phase and it will not be the last. This pullback like the three we witnessed in the recovery phase offers a buying opportunity to those looking to get off zero or those who are looking to add to their existing allocation.

Predicting short-term price action in crypto markets is an extremely difficult endeavour, but making predictions with outlooks of 2-4 years is much easier. In our view, there is nothing about today's price action that suggests the expansionary phase won’t materialise. The bear market produced multiple incremental advancements in user experience, and scalability and broadened the overall design space for public blockchains. The conditions for the onboarding of the next cohort of blockchain users are perfect. Of course, there are existing and future technical challenges that the industry will have to resolve. Every challenge to an army of open-source developers is another business idea or problem worth solving.

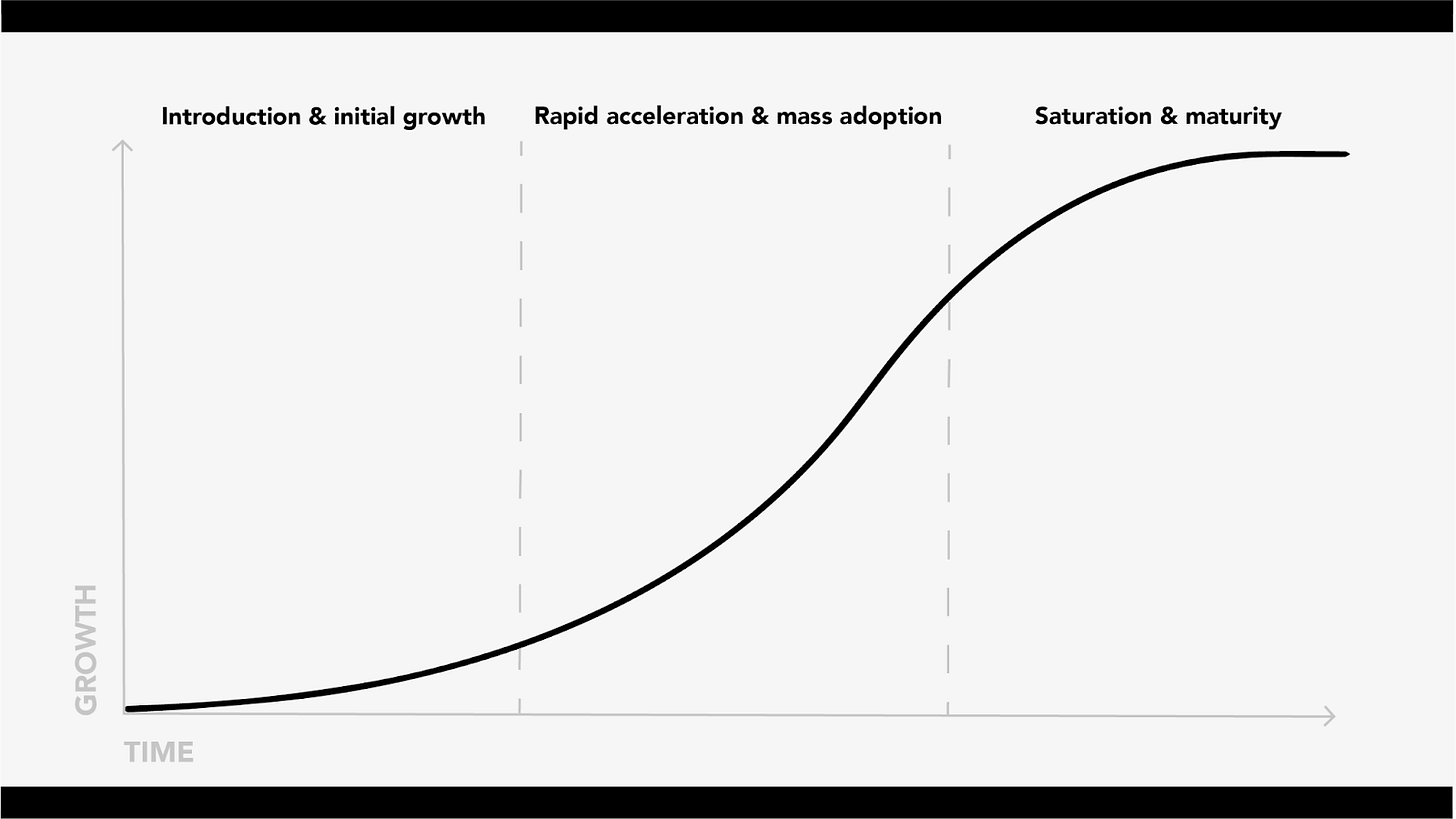

Zooming out can be useful when the pendulum swings like it has in these current market conditions. Technological revolutions such as Steam and Railways, Steel, Electricity and Heavy Engineering, and the Internet all followed S-curve-like patterns as their innovations diffused through society. Our base long-term expectation is for blockchain to follow a similar path, which looks a bit like this.

However, on this path to adoption, we will experience shorter-term cycles. These cycles we refer to as hype cycles or innovation cycles. Hype cycles are how the market digests and eventually accurately price incremental advancements of the underlying technology. They look like this.

Now let's map these frameworks which did not originate in crypto but rather represent years of study and experience of technological revolutions and their adoption.

Crypto is diffusing through society as many technological innovations have done so before. Crypto deserves the hype and attention of the revolutionists' views and the grounding criticisms of the nothing burger views. It has built a completely independent financial network from scratch with only lines of code, it has captured the imagination of millions of entrepreneurs and technical talent and it is growing at a rate comparable with the rise of the internet.

Stablecoins settlement volumes also depict this high growth environment and are evidence that users of blockchain technology are increasingly using crypto rails for payments. In less than 10 years stablecoin payments have surpassed PayPal and Global remittance volumes. In the next 10, it will surpass Visa and national settlement systems such as Fedwire and ACH.

We remain steadfast in our bullish stance on blockchain technology and cryptoassets for the next 18 months as the expansionary phase takes hold. We remain allocated to blockchains' big ideas namely, asset ledgers such as Bitcoin, Ethereum, Solana, Matic, and Near, Decentralised finance protocols such as Uniswap, Lido, and Aave, Decentralised compute networks such as Render and Oracle networks such as Chainlink. We are currently exploring new investments in categories such as telecommunications and gaming, but have made no changes to the portfolio going into May.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems that require due diligence to comprehend and operate in. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.