Sweet Sweet Liquidity

September showed positive returns, bucking the seasonal negative returns we have seen in previous years. BTCUSD (6.79%), ETHUSD (2.99%), SOLUSD (10.51%) and OTHERS index (15.86%) were green across the board.

The odds of an explosive expansionary phase significantly increased in September. The Fed cut interest rates for the first time in four years and didn't hold back with a 50bp cut. China came out with a liquidity bazooka that included a fruit cocktail of stimulus (cutting interest rates, cutting existing mortgage rates, easing home buying requirements, $114B in liquidity support for stocks, and lowering bank reserve requirements), all of which support views for increasing global liquidity.

If you want to benefit from increasing global liquidity, crypto should be your first port of call. Global M2 is breaking out and usually coincides with BTCUSD bull markets.

Lyn Alden and Sam Callahan elegantly illustrate that Bitcoin is strongly directionally aligned with global liquidity. You can read the full report here. Given the shift in monetary policy in the US and the stimulus being rolled out of China, it could be a good time to bet on further increasing liquidity.

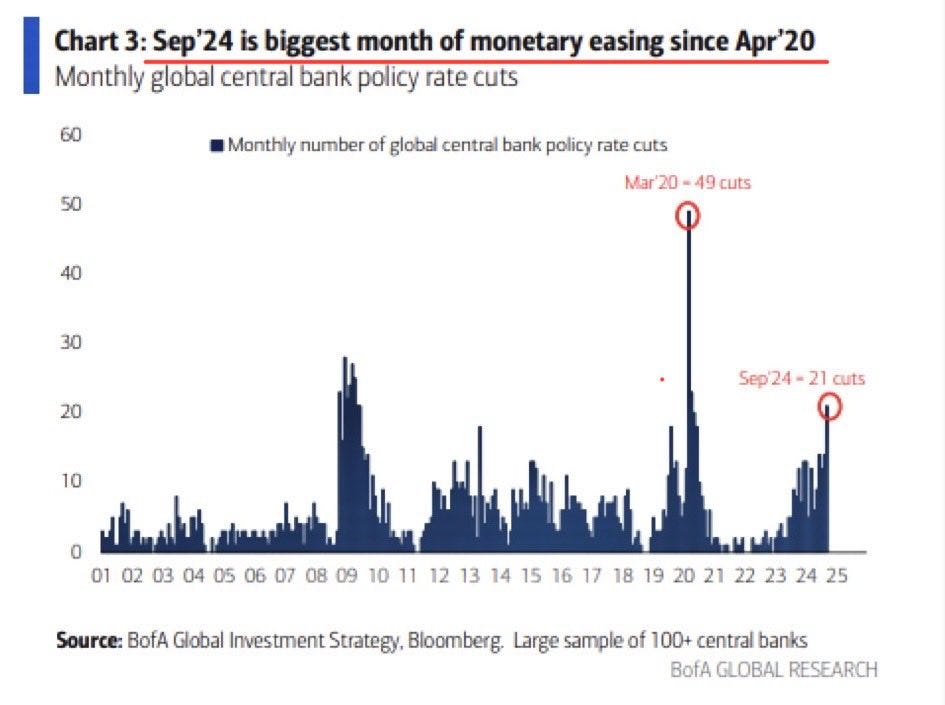

It's not just the US and China that are easing, though. As depicted below, September saw the biggest month of monetary easing by central banks since the COVID-19 panic.

Bitcoin's relationship with Wall Street was further strengthened by BNY Mellon's approval to custody Bitcoin. The decision was met with no objection from the SEC, which signals 1) that BNY Mellon has found a bankruptcy remote way of holding client crypto and 2) that the SEC is becoming less adversarial to crypto.

I expect many banks to follow suit. Increasing the variety and competition of custody solutions will be vital to the long-term success of the asset class. Currently, Coinbase custodies 8/10 BTC ETFs.

Looking forward, we still have to contend with a possible recession. While indicators such as the Sahm rule and the yield curve normalisation suggest a recession is imminent, credit conditions and spreads suggest that concerns of a recession materialising in the short run are overblown. If a recession were to occur, I don't think crypto would hold up well, so we are closely monitoring labour and credit market conditions to manage this risk.

We are also quickly approaching the 5th of November and the US election. To my surprise, Harris has recently released what many Democrat faithful suggest is a positive commentary on crypto. "I will encourage innovative technologies like AI and digital assets while protecting our consumers and investors".

My base view on the election's impact on crypto remains consistent with the past. Trump would be a great accelerator for crypto. Harris's stance remains unclear, but regardless of who wins, I think we will be better off than with the existing regime. According to the poly-markets prediction market, the race is highly contentious with no clear leader, and the 5th of November promises to be a close showdown.

Our market cycle composite indicator has retaken the zero bound, suggesting the expansionary phase is ready for continuation. Our composite below encompasses onchain metrics as well as financial cycle metrics.

Excess returns are most likely obtainable in the expansionary phase. I am confident that the expansion will materialise. We have central banks easing globally, China pumping money into its economy, positive advances on crypto policy, and improving crypto fundamentals. Barring a recession, the set-up for crypto is the best it has been since the 2020s.

Here is an snapshot of the four year cycle, from a time based perspective we are firmly in the expansion phase.

This optimism is reflected in the recent uptick in altcoin prices; altcoins are long-duration opportunities that are highly sensitive to interest rates and liquidity. The path forward suggests lower interest rates and more liquidity; naturally, we are on the hunt for great opportunities in altcoins.

Our return profile (a core element in our asset selection process) identifies what we like to call compounders. Compounders in traditional finance talk are high-quality growth assets, we screen 450 cryptoassets to find these compounders. Below is a list of some compounders we are watching closely.

Until next time, all the best.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.