Safe

The Web3 era, characterised by a decentralised internet and blockchain technology, presents opportunities and challenges in equal measure. Prominent among these challenges are security and usability issues, which demand a high degree of attention and innovativeness. Safe, formerly known as Gnosis Safe, a programmable smart contract account, stands at the forefront of this innovation, offering a multitude of benefits that greatly enhance the user experience overall. In this article, we delve into the essence of Safe, its importance, utilisation, and future plans, with particular emphasis on Account Abstraction. Furthermore, we unpack this technology's opportunities while highlighting potential risks one can look for when using new technology.

Safe: A Paradigm Shift in Account Management

At its core, Safe is a programmable smart contract account designed to streamline and bolster the usability and flexibility of Web3. It emerged from the Gnosis Safe project, a project on a mission to redefine the standard for ownership in the context of smart contract accounts. Safe's objective is to consolidate the number of account types from two – the Externally Owned Account (EOA) and the smart contract – to just one, the smart contract. This transition involves shifting transaction validity conditions from the core protocol level to the Ethereum Virtual Machine (EVM) smart contract level, an approach referred to as Account Abstraction.

Safe has rapidly carved a niche for itself as a reliable decentralised custody protocol and a collective asset management platform compatible with multiple Ethereum Virtual Machine (EVM) chains. Since its inception in 2018, Safe has accrued over $39 billion in assets, facilitated 4+ million transactions, and set up over 1.5 million Safe accounts. Furthermore, its smart contracts have passed some of the most stringent industry security standards, including Formal Verification, thereby further building user trust. Safe's governance is anchored on SafeDAO, a decentralised collective comprising core contributors, backers, users, and other ecosystem contributors, otherwise known as Safe Guardians.

The Importance of Safe

The importance of Safe lies in its capability to manifest many of the benefits that Account Abstraction seeks to realise, even before we achieve its full implementation. Features such as native multi-signature authorisation (multisig), seedless logins, social recovery options, batched transactions, streamlined wallet migrations, and hybrid custody arrangements form part of its unique offering.

Moreover, Safe's compatibility with native Account Abstraction enables these features to be activated without the necessity of EOAs or specific contract amendments. This flexibility means that Safe is not just a toolbox for managing digital assets but also a strategic player that aligns with the future trajectory of blockchain technology by anticipating and accommodating the implementation of Account Abstraction.

One of the major pain points in the crypto industry is secure access and management of assets, a challenge faced by decentralised autonomous organisations (DAOs) and individuals alike. Safe has emerged as a secure and customisable solution for digital asset management, earning adoption by several DAOs, digital businesses, and individuals, including Ethereum's Vitalik Buterin.

The Future of Account Abstraction and Safe

As we look towards the horizon of blockchain technology, the future shines brightly with Account Abstraction and projects pioneering the approach, such as Safe. The evolving dynamics of the crypto landscape and the ambitious strides Safe has planned are set to revolutionise our digital interaction with financial systems.

As a novel concept within the blockchain sphere, Account Abstraction holds immense potential to transform the interaction between blockchain networks and their users. The primary goal of Account Abstraction is to detach the conditions for transaction validity from the core protocol layer and integrate them at the EVM smart contract layer. This decoupling promotes flexibility, enabling developers to customise transaction logic according to their specific needs and enhancing the overall security and efficiency of the system.

Safe has projected its unwavering support for EIP-4337, a key standard for Account Abstraction. EIP-4337 aims to enrich the user experience and enhance security by separating the object possessing tokens (the account) from the object sanctioned to move them (the signer). It facilitates the creation of smart contract wallets and introduces features such as password recovery and multi-party signing, adding another layer of security and usability to the blockchain ecosystem. These functionalities are instrumental in easing onboarding for newcomers to blockchain, reducing technical entry barriers, and mitigating the risk of loss due to easy errors such as lost passwords or private keys.

However, implementing EIP-4337 and Account Abstraction isn't without potential challenges. The main concerns revolve around the complexity of the upgrade and the sustainability of the economic model for relayers. The upgrade could involve intricate technical processes, and successful implementation will require careful planning and testing. As for the relayers, the entities that relay transactions from users to the blockchain, their role will be vital in the Account Abstraction architecture. Therefore, creating a sustainable economic model that incentivises relayers without compromising network security will be critical.

Safe's proactive approach to championing Account Abstraction's successful integration is exciting; Safe plans to financially support developers through grants and hackathons to facilitate and speed up the realisation of Account Abstraction's potential. This initiative encourages innovation and stimulates community engagement, fostering a robust and vibrant ecosystem around Safe and Account Abstraction.

Safe's roadmap also underscores its commitment to staying ahead of the curve in integrating innovative technologies. By supporting Account Abstraction, Safe strategically positions itself to adopt and lead the next wave of blockchain technology innovations. This alignment with the future trajectory of blockchain technology emphasises Safe's adaptability, foresight, and ambition to continue improving the user experience and security within the blockchain space.

In essence, the future of Account Abstraction and Safe is characterised by promise and potential, underscored by a commitment to innovation, security, and usability. As these technologies continue to evolve, they hold the potential to redefine how we interact with blockchain technology, shaping the future of the decentralised financial landscape.

How to Use Safe

Safe enables users to create a multi-sig wallet with any number of owner addresses and to determine the number of owners required to authorise a transaction. This feature provides added security by necessitating a minimum number of users to approve a transaction before execution. This is especially useful for projects with multiple owners, thereby preventing a single owner from compromising the project funds by acting unilaterally. Moreover, it eradicates the risk of custodial service companies interfering in the management of your project, as the deployed smart contract is trust-minimised and under your control.

To get started with Safe, you need to access the Safe website and click 'Launch Wallet' to reach the main landing page.

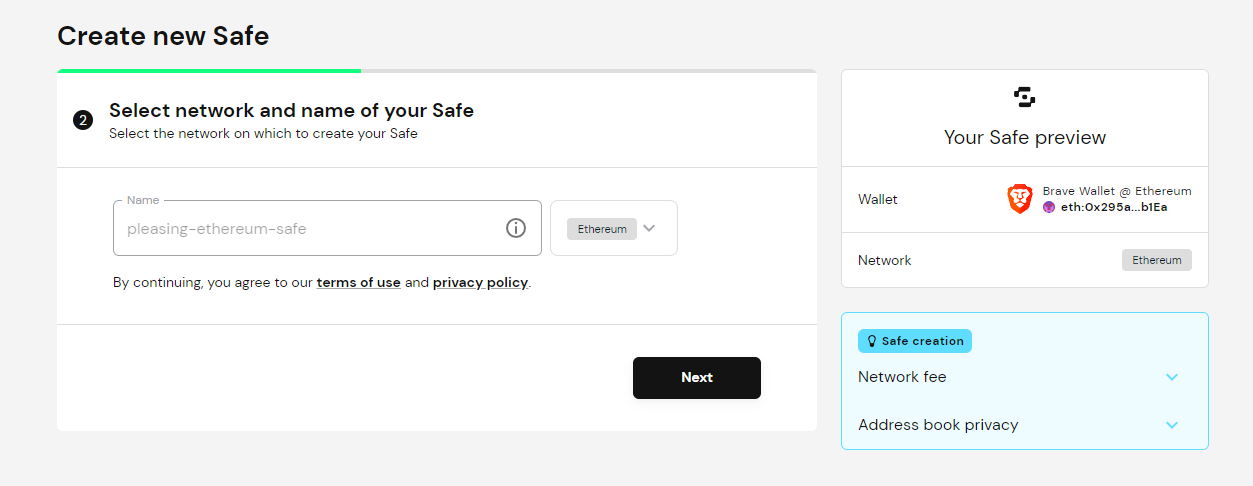

From there, connect any of the supported wallets, for instance, MetaMask, and choose a blockchain network to deploy your Safe to. You then click on the button labelled 'Create new Safe', give your Safe a name, add the owner addresses, and specify the number of confirmations required for any transaction to be approved.

Once you have gone through the process and input the details for your custom Safe, click 'Create' and approve the transaction, which will deploy a smart contract and create your Safe. After creating the Safe, you can transfer funds into it from another wallet. You are now free to use these funds with the other owners of the Safe as you see fit.

Conclusion

Safe has emerged as a robust solution for digital asset management, offering a secure and customisable platform for individuals, businesses, and DAOs. By leveraging smart contract technology, Safe enhances security and provides self-custody over funds, ensuring no single member can compromise project funds. Looking ahead, Safe plans to support EIP-4337 and native Account Abstraction, underlining its commitment to improving user experience and security in the blockchain space. With its innovative features, user-friendly interface, and secure infrastructure, Safe is poised to continue leading the way in decentralised asset management and custody.

Notable Articles and News Stories This Week:

ERC-6551 Turns Any NFT Into a Web3 Wallet

Cookie, cloud, web, spam — they're all expressions connecting internet phenomena to relatable experiences.

Part of the process of developing technology is deciding on the vocabulary that connects human understanding to the purpose of new mechanisms. But sometimes, it's difficult to encapsulate complex ideas in simple words.

The word "wallet," used to label a common Web3 account tool like MetaMask, is often considered a bit of a misnomer. It just doesn't quite fit what the tool is capable of doing.

Like a Web3 wallet, a real-life wallet can hold identity information, currencies and maybe a photo or two, but it doesn't have an address or keys, it doesn't connect a user to activities or act as a passport to places or events — and it generally doesn't store hundreds of collectables or works of art.

Now, to make things even a little more complicated: The ERC-6551 protocol introduces token-bound accounts, enabling any individual NFT to be a "wallet," for lack of a better term.

Read more about ERC-6551 here

What Crypto Builders Have to Say About Goldman Sachs' New Blockchain Bid

Goldman Sachs, Microsoft, Deloitte and Cboe Global Markets are collectively embracing a blockchain system aimed at interconnecting various institutional applications.

The Canton Network endeavours to be a system that brings together different applications used by banks and other financial companies, connecting them in a way that allows them to work together more easily and securely, according to a statement from May 9.

The network says it links independent applications developed with DAML (Digital Asset Modelling Language), Digital Asset's purpose-built smart-contract programming language that was introduced back in 2016.

Starting in July, network participants plan to initiate comprehensive testing of interoperability capabilities across a diverse set of applications and use cases.

Read more about the plans here

Crypto Attractive to Family Offices But Regulatory Clarity Needed: Survey

Family offices across the globe are showing heightened interest in digital assets, a new study commissioned by Ocorian, a global provider of services to high-net-worth individuals, has found.

Though those same individuals struggle to find the necessary support to navigate regulatory and reporting obligations, according to a statement on Thursday.

The study, which included 134 family office professionals managing around $62.4 billion in assets, found 90% of participants had noticed a client-driven push to include crypto in their investment strategies.

Ocorian’s findings provide a contrast to a recent Goldman Sachs survey, which suggested that the interest in crypto has plummeted among family offices. The Goldman Sachs report indicated that those with no interest in the crypto sector had increased from 39% to 62% over the last two years.

Read more about the survey here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.