Recession or Expansion, What's Next?

August proved to be a challenging month for crypto markets. The BOJ announced a rate hike, causing a brief unwind of the Yen cash and carry trade, which sent risk assets plunging. Crypto majors were hit hard by an adjustment in global risk positioning. BTCUSD (-8.99%), ETHUSD (-22.25%), SOLUSD (-22.93%), and OTHERS (-14.71%) all closed the month down.

We remain broadly positive on crypto going into the back end of the year and view calls for a recession as overblown. Dovish Fed commentary points to the first set of rate cuts in four years, and a crypto-friendly presidential candidate is the front-runner for the US election.

BTCUSD, along with ETHUSD and SOLUSD, has been caught in a multi-month range as the market overlooks the incoming monetary easing and the chances of a positive election outcome over fears of a looming recession.

This price action is reminiscent of the 2019 price action. The early run-up in 2019 was after the 2018 ICO hangover, similar to the more recent recovery since the FTX implosion in late 2022. Similar to today, the recovery saw markets reaching a peak in June 2019 and then trading downward in a channel until selling climaxed during the March 2020 COVID-19 scare.

Much of this downward chop in price can be put down to recession fears and the US election.

Is the US headed toward a recession?

I don't know. Nobody really does.

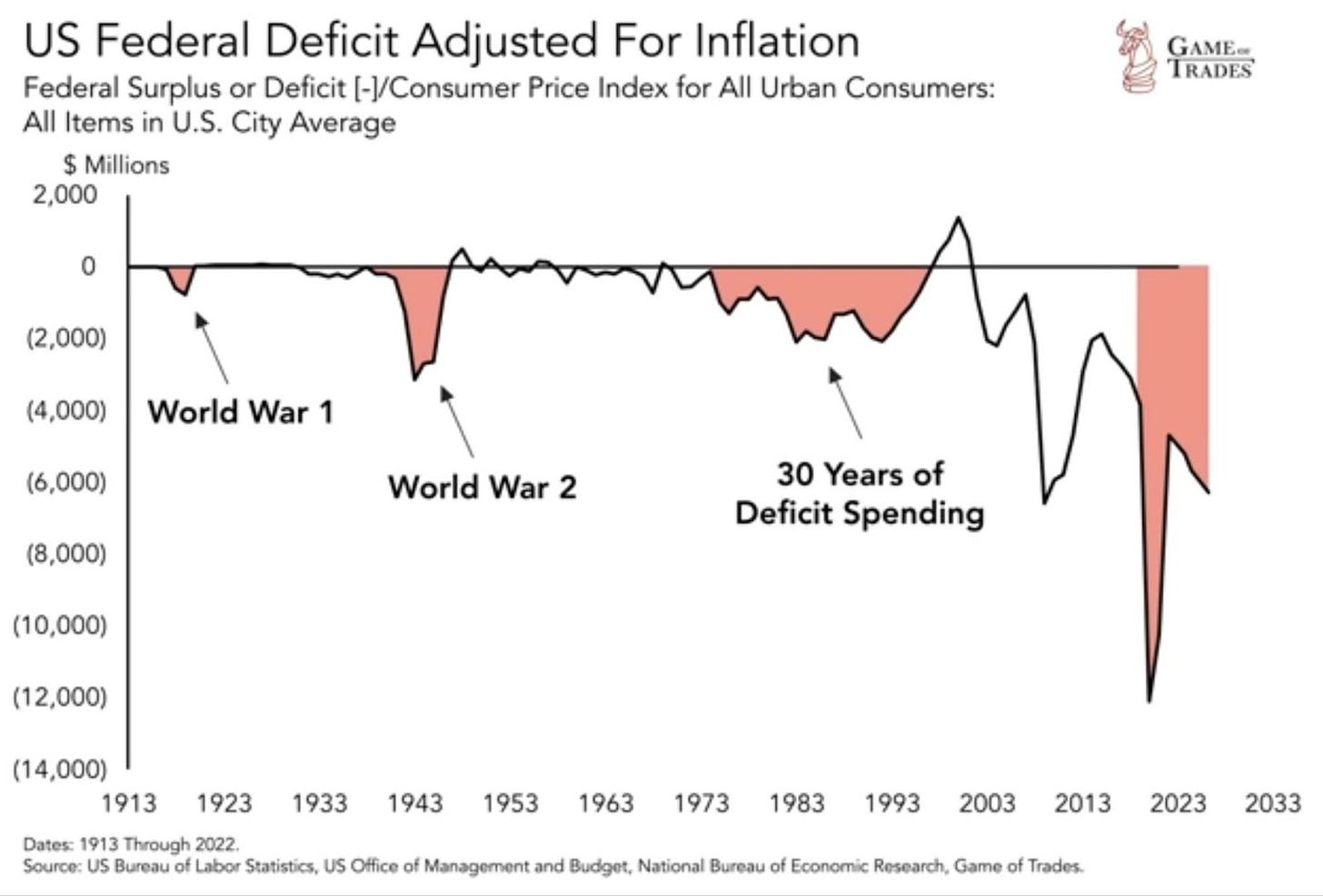

I find it hard to see a recession when Government deficit spending is 7% of GDP, and there are no plans to curtail such spending.

However, many bears point to the yield curve normalisation. As illustrated below, the 10y2y yield is back to the 0 line, historically predictive of a recession.

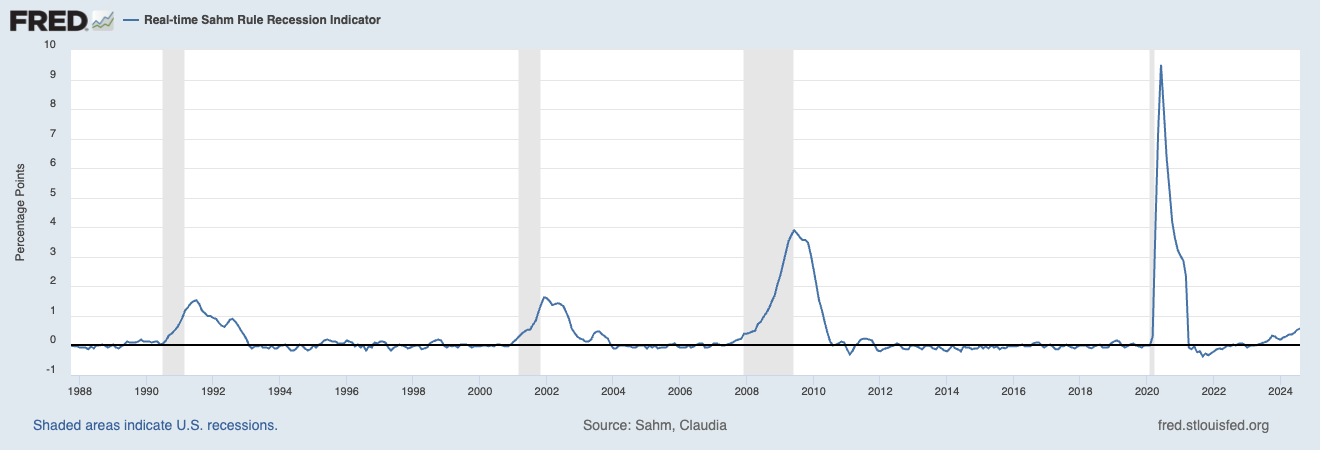

Another cause for concern has been the Sahm rule triggering a recession warning. The rule states that a recession is likely underway if the three-month moving average of the national unemployment rate rises by 0.50 percentage points or more relative to its lowest level over the previous 12 months.

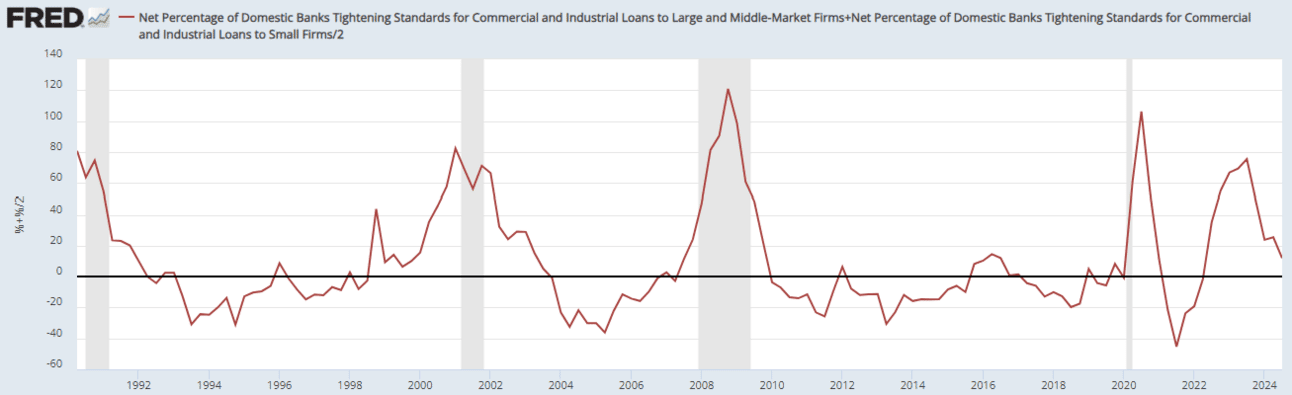

However, looking at credit markets suggests that a recession may not be as imminent as others predict.

Banks aren't tightening lending conditions in anticipation of a recession.

Spreads remain tight, suggesting that higher-risk companies can still get financing at rates that are not that much more expensive than their more stable counterparts.

The concerns may be overblown as lenders seem unphased by the ominous un-inversion of the yield curve and the triggered Sahm rule. What we are seeing, however, is signs of wild government spending and increasing global liquidity. Which is supportive of cryptoassets.

The spending is crazier than I can actually believe. The graphic below illustrates that, in less than four years, inflation-adjusted US government spending has exceeded the combined spending of World War I, World War II, and the 1970s to late 1990s.

This is exceptionally concerning for the long-term health of the US economy but not a signal of an imminent recession. It is a signal, however, that one should own protection or something not contingent on someone else paying down their debts, especially the government.

Global liquidity is also on the rise, and the 5-6 year cycle suggests it will continue rising into mid-2025.

The US dollar has weakened considerably over the last 3 months, creating further global easing.

The US Election

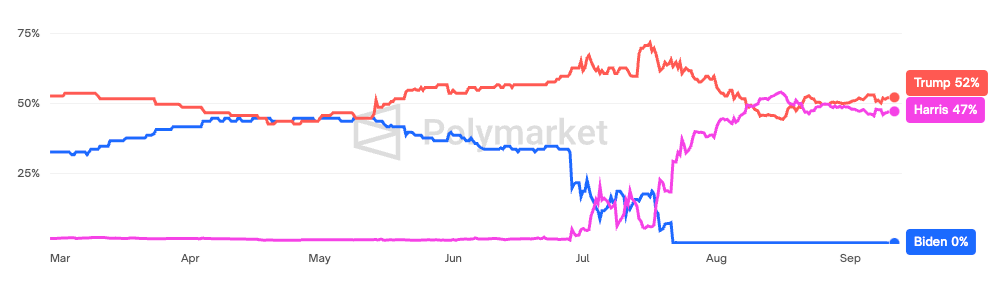

Biden dropping out just increased the uncertainty in an already uncertain race. Investors are fearful that another four years of a democrat administration will extend the time required to achieve regulatory clarity.

Trump is the pro-crypto candidate whose victory would serve as a real upside surprise; cryptoassets are on a fire sale at these prices if he does, in fact, win. According to Polymarket, Trump is the front-runner, but the race remains tight.

The debate on the 10th of September will provide more clarity on both candidates' policies.

We don't have a policy stance on crypto from the Harris campaign yet. The platform they released made no mention of crypto whatsoever. All we have to go by is the previous actions of those Harris has chosen to surround herself with, and on that basis, it doesn't look good for crypto.

Unfortunately, the election will significantly shape crypto's next four years and perhaps even longer. But I cannot overstate just how vital a clear and fair set of regulations would be to crypto markets. It's easy to forget that crypto rose out of nothing and has grown into a 2 trillion dollar asset class in 15 years, it has achieved this with the entire global regulatory apparatus against it.

A regulatory framework would end this hostile environment and its negative externalities on crypto investors. I believe the single biggest unlock for the crypto market will be a regulatory regime that allows the passing through of fees generated by blockchain networks and smart contract applications to token holders.

Firstly, this will transform the business models of many existing successful applications into return-on-capital machines. Secondly, it will inspire non-crypto natives to explore launching businesses that leverage blockchain technology as viable business models become clearer.

Whats next for crypto?

I find it difficult to be bearish, given that 1) a pro-crypto candidate is the front runner for the election and 2) we are about to see the first rate cut in 4 years. Not being long here because you got scared into selling by a fear-mongering recessionista would be a mistake.

Volatility does crazy things to people's convictions, but just zoom out. There is not much difference in this cycle from the previous cycles. If anything, we had an exceptionally strong recovery, and it may take a bit longer for the expansion to materialise.

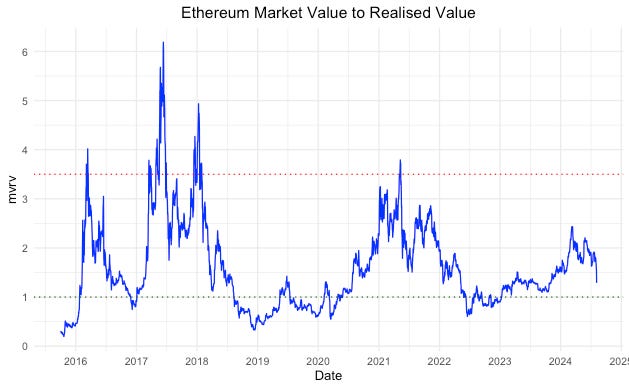

Both BTCUSD and ETHUSD trade only slightly above their realised values. They are by no means overbought at these levels. BTCUSD currently trades at 1.8x its realised price.

ETHUSD at 1.23x its realised price.

Both tend to reach cycle tops around 3.5-4x realised price, which implies $120k for BTCUSD and $8k for ETHUSD as current realised prices are $31k and $1.9k, respectively. Current prices imply a risk-reward ratio of 1:10 for ETHUSD and 1:2.4 for BTCUSD.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.