Reading On-Chain Data

Market Recap

A Flat Week For Most Assets

Reading On-Chain Data

Over the next couple of weeks, we will cover a new series titled Bear Market Tactics. Bear markets are never easy to navigate as an investor in crypto; more often than not, you have to deal with price swings greater than those in the traditional market and sift through a wider variety of investment options that may have very little to no investment value.

So how does one begin to understand where this market is headed, or when is a good time to start investing?

This is where looking at on-chain data can become exceedingly helpful. While still not an exact science, researchers and investors have come together over the past few years to look at the blockchain and understand what the underlying data is telling us.

What is On-Chain Data?

On-chain data is simply the record of all transactions that have occurred on a specific blockchain network. The data itself can be broadly categorised into three separate classes:

Block data - examples include miner fees and rewards or timestamps

Transaction data - examples include transactions between addresses or the value of tokens sent

Smart contract code - any smart contract running on a blockchain

This data can provide insights that generally haven't been replicable in the traditional world, and this is due to the open nature of public blockchains. Through the process of on-chain analysis, one can understand and analyse an asset in more depth than ever before.

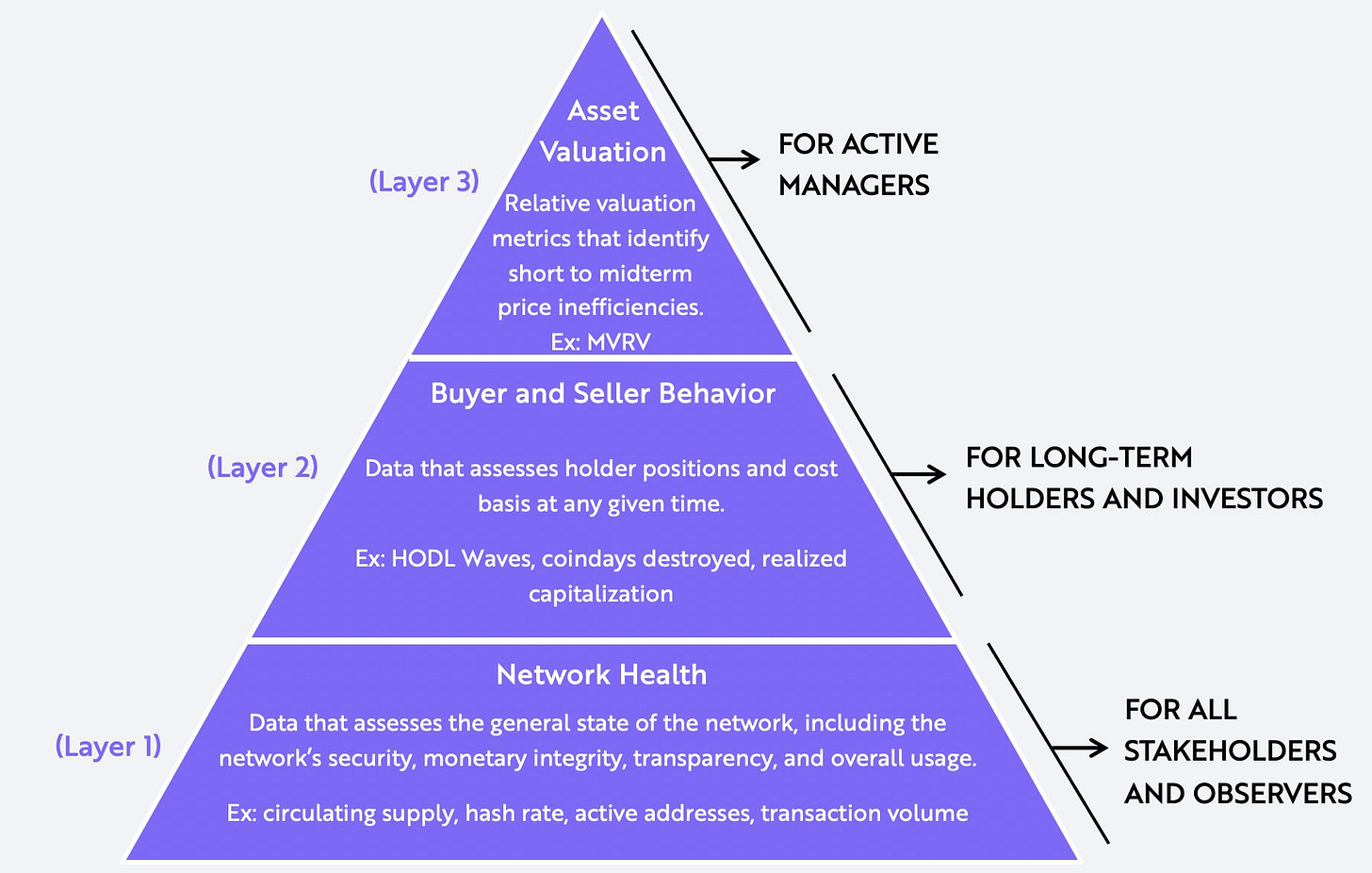

ARK Invest has proposed a three-layer pyramid that represents the depth of analysis you can employ for on-chain data.

In this guide, we will go through each layer and look at a few of the metrics one can use.

Network Health

At the bottom of the triangle is the general health of the network; this serves as the base and shows if the network is operating as it should. Important metrics here are things such as security and usage, which should constantly be increasing.

Hash Rate

For Proof of Work (PoW) networks such as Bitcoin, the hash rate represents the level of security. A higher hash rate means more miners are contributing hash power to the network and, therefore, the more secure it is.

The hash power of Bitcoin's network has continued to increase over time, with the notable exception of June and July 2021; however, this came on the back of the mining ban in China. What has been good to see is the rapid recovery in hash power and how people are still contributing scarce resources (electricity) to the network because they have confidence in its long-term outlook.

Active Addresses

Active addresses also provide a good proxy for the health of the network. This metric can be volatile and experiences significant increases when markets start making or reaching previous highs. However, what we look for is a consistent increase over time, making higher highs and higher lows.

Currently, the Bitcoin network sits shy of one million unique daily active users, representing a compound growth rate of around 52% over the last ten years. This is what we expect to see over time and shows an increasing network usage, which is positive.

Buyer and Seller Behaviour

Once you have analysed the network's general health, you can start diving deeper. This is generally done by looking at individual wallets on the network and understanding their circumstances.

The two core stakeholders that are most important to monitor here are investors and miners.

Miners

Miners are simple to monitor. Mining as a business operates at a long-term equilibrium where the marginal cost of mining is equal to the market value of the bitcoin mined. However, there can be extended periods where miners, on average, can experience profitable and unprofitable conditions.

Puell Multiple

A great way to monitor changes in miner profitability is by using the Puell Multiple. The Puell Multiple tracks daily bitcoin issuance in dollars verse a 365-day moving average. Significant deviations from the norm often signal that a change in profitability is approaching. When mining is highly unprofitable, the weak and inefficient miners capitulate, whilst strong miners become exceedingly profitable. When mining is highly profitable, more computational power enters the system to compete over the daily fixed issuance; weak and inefficient miners survive but become susceptible to price changes.

Historically the Puell Multiple has signalled the beginning of market bottoms and can be a short-term price signal. We have recently touched one of the lowest points in its history, only being this low on four previous occasions. As with all on-chain indicators, it may not necessarily mean there won’t be more downside, but it means it is a good time to start thinking about allocating.

Investors

Monitoring investors can be done through several different metrics.

Net Unrealised Profit and Loss (NUPL) and Reserve Risk are two of our favourites.

Net Unrealised Profit and Loss

NUPL sets out to answer the following question: if all bitcoins were sold today, how much would investors stand to gain or lose?

It allows us to understand how much of Bitcoin's circulating supply is in profit or loss at a specific moment in time.

To calculate this, they find the difference between Relative Unrealised Profit and Relative Unrealised Loss, this involves some mathematics that is beyond the scope of this guide, but for more information, you can read the following primer here.

As you can see, we are currently in a state of capitulation. There have only been four other periods in Bitcoin's history where investors have reached a stage of capitulation and are experiencing a high degree of Relative Unrealised Loss. Historically, when entering this period, it has been a good time to buy. The last time we saw NUPL at a similar score was during the March 2020 pullback to below $4000. While we may still experience some downside, it generally marks a good time to start averaging into a position for the long-term.

Reserve Risk

Proposed by Hans Hauge, Reserve Risk allows us to gauge the confidence of long-term holders at any given price. It is defined as Price/HODL Bank.

HODL Bank is defined as "the cumulative opportunity cost that made the decision to hold rather than sell over the lifetime of the Bitcoin network (scaled down to a single Bitcoin value terms)." When the HODL Bank shrinks, it signals less confidence at current prices; when it grows, it shows investors are forgoing the ability to sell now to sell at some point in the future. This signals confidence in bitcoin's future price.

Reserve Risk allows us to compare changes in HODL Bank to changes in price. When the price is low, and the HODL Bank is increasing, risk relative to reward is low, and when the price is high and HODL Bank is decreasing, risk relative to reward is high.

Currently, Reserve Risk is sitting at the second-lowest point in its history. The last time it was at a similar level was in 2015. This metric tells us that long-term holders are confident in bitcoin's current price and are forgoing the chance to sell now for the ability to sell at a point in the future. Historically this has marked an excellent risk to reward opportunity.

Asset Valuation

The final and top layer of the triangle leverages the lower layers to help identify short to medium-term price inefficiencies.

One of the most popular metrics here is Market Value to Realised Value, or MVRV.

MVRV

Created by David Puell and Murad Muhmudov, the MVRV ratio is defined as an assets market capitalisation divided by its realised capitalisation. It provides investors with an indication of bitcoin's "fair price". Bitcoin's realised cap is calculated by valuing each UTXO by the price when it was last moved (therefore "realised"). We suggest reading the following article to understand how to calculate this and get a better idea of what MVRV is.

Currently, the MVRV ratio is sitting below one. This is an indication that current prices provide a decent buying opportunity. MVRV can stay below one for an extended period of time, similar to NUPL. Therefore, it is best to follow a dollar-cost averaging approach.

Conclusion

The nature of Bitcoin's open ledger provides unparalleled transparency. This is a first for any asset that has ever existed. While on-chain analysis is far from perfect, we are seeing the first attempts to understand how the crypto markets work and are valued.

On-chain analysis can provide investors with an edge when it comes to assessing where the market is and where it may go, providing better risk/reward opportunities than someone who is just purely looking at price.

In this guide, we have just touched the tip of the iceberg regarding the data available and what we can do with it. If you have any questions or have trouble using the network, please feel free to reach out and ask us questions. We always look forward to chatting with our readers. Otherwise, please feel free to share this article if you know anyone who is interested in learning more about on-chain analysis.

Notable Articles and News Stories This Week:

Wallet That Helped Trigger UST Implosion Linked by Analysis Firm to Terra Developer

A blockchain transaction that contributed to the collapse of Terra's UST stablecoin has been linked by a South Korean analysis firm to the ecosystem's chief developer, Terraform Labs.

CoinDesk Korea reported the findings by the blockchain analysis firm Uppsala Security earlier this week.

The findings have been shared with legal authorities in South Korea, where Terra enjoyed a huge following partly due to its Korean founder Do Kwon. The Seoul Southern District Prosecutors' Office is “tracking the flow of problematic wallets and coins” and is aware of the wallets flagged in the report, according to CoinDesk Korea.

Read more about the findings here

Coinbase Launches First Crypto Derivatives Product Aimed at Retail Traders

Coinbase Derivatives Exchange, formerly known as FairX, is launching its first crypto derivatives product this month, hoping to attract more retail traders.

The CFTC regulated futures exchange will launch its derivatives product, Nano Bitcoin futures (BIT), on June 27, according to a statement sent to CoinDesk. “The crypto derivatives market represents $3T in volume worldwide and we believe that additional product development and accessibility will unlock significant growth,” the statement said.

Coinbase said it's also awaiting regulatory approval on its own futures commission merchant (FCM) license to offer margined futures contracts for its clients.

Read more about the move here

Harmony’s Cross-Chain Horizon Bridge Hacked for $100M

Horizon Bridge, a cross-chain interoperability platform between Ethereum, Binance Smart Chain (BSC) and Harmony blockchain networks, has been hacked for $100 million.

The Harmony team, stewards of the bridge, said Thursday it has been made aware of the theft and has begun working with national authorities as well as forensic specialists to identify the attacker in an attempt to retrieve the stolen funds.

The team also said the hack did not impact the trustless Bitcoin bridge as funds and assets are stored on decentralized vaults and are considered “safe at this time.”

Read more about the hack here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.