Political Shifts and the ETH ETF

What an incredible month for the crypto and blockchain industry. If you asked us 18 months ago what the most bullish possible scenario for crypto would be, we would not have outlined recent events. The biggest stumbling block for the industry has always been regulation–or the lack thereof.

Over the last three years, the political and regulatory apparatus of the United States, namely Elizabeth Warren's Anti-Crypto Army and the Securities and Exchange Commission (SEC), has been openly adversarial to the blockchain industry.

This stance changed last month, when Warren's anti-crypto army and the SEC suffered significant losses. Many Democrats defected from the anti-crypto stance and instead supported bills that are broadly positive for the industry.

Crypto and blockchain are becoming bipartisan issues, with both sides of the political system realising their importance as voting issues. It's difficult to pin down the exact catalyst for this turn of events, but we believe it has something to do with the very contentious US election in November. Neither side can afford to lose votes over their stance on a new technology.

Trump is playing into the popularity game. You can watch his speech here. This is what stood out to us: "I will ensure that the future of crypto and Bitcoin will be made in the USA and not driven overseas," "I will support the right to self-custody," and "I will never allow the creation of a Central Bank Digital Currency."

There is much work still to be done on crypto policy, and the Financial Innovation and Technology for the 21st Century Act (FIT21) is by no means perfect and still leaves many unanswered questions for investors and entrepreneurs. But this is a step in the right direction and an indication that the political establishment is moving rapidly toward providing more clarity on crypto regulations. Whether this clarity is well received and truly supportive of crypto's core innovations is still to be seen, but we are more positive about it now.

Market update - Ethereum ETF approval surprise

The Polymarkets prediction market shows how wrong the market was about the odds of an Ethereum ETF being approved in the wake of the Bitcoin ETF approvals earlier this year. Prior to the 20th of May, the chance of ETF approval was hovering around 20%-25% and almost immediately the market repriced the odds to 75%, on the back of news flow from various Bloomberg analysts.

In lockstep, ETHUSD also repriced from $3072 to $3600 (+19%) and on the 23rd of May the Ethereum ETF was formally approved. These ETFs most likely won't be able to stake ETH, which perhaps makes the product less attractive to more sophisticated ETH investors, but as the BTC ETF has shown, these exchange-traded products can open crypto up to sources of inflows that weren't viable before and could well lead to meaningful inflows.

Since January 2023, Ethereum has been out of favour among investors. However, recent changes in regulatory sentiment and the approval of an ETH ETF represent a very bullish setup, potentially revitalising interest and confidence in ETH.

The market's interest in these developments wasn't just reflected in ETHUSD. LDOUSD, ARBUSD, and other Ethereum ecosystem projects also rallied on the news, with gains of 31% and 18%, respectively.

The ETHBTC ratio reversed course. The relative underperformance of ETHUSD to BTCUSD (-24% since January 2023) was regulation-driven, with Bitcoin seemingly having a more transparent regulatory status than Ethereum. We are now back in positive territory (+3.5%) for 2024 and believe that ETH will continue to outperform as the expansionary phase takes hold.

ETHBTC likely continues to appreciate in the expansion; we are still determining whether ETHBTC can post new all-time highs. A case could be made for this as Ethereum is more relatable to technology investors, less ideological than Bitcoin, produces yield for stakers, and holds the majority of liquidity and real activity in the industry.

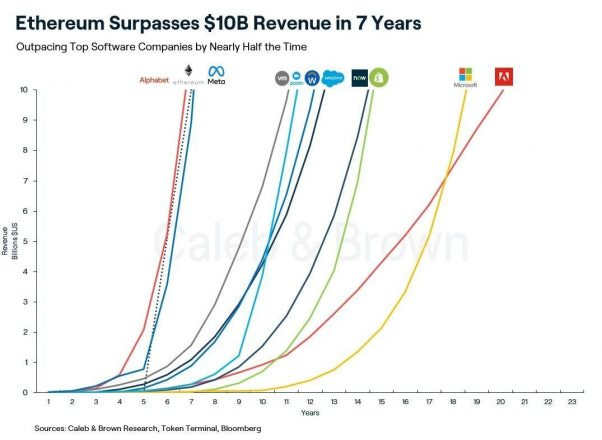

Ethereum is also a money-making machine; as depicted below, Ethereum reached $10b in revenue in a timeframe that is only matched by Google. If you add to this the realisation that the regulatory status of Ethereum will be considered the same as Bitcoin, we could see a complete reversal of the weakness seen from January 2023 to date.

Ethereum is the "onchain" narrative Wall Street will love, and they will use stories of the "online' era to explain why one should hold ETH.

Sure, it has real competition from Solana, but there is no reason to believe that both platforms can't capture market share and thrive simultaneously. Solana, too, will most likely get an ETF and a push from Wall Street. Both have made design choices that come with trade-offs, and you can be confident that another network with a different set of trade-offs will emerge as a real competitor in the future. There is no second best because these networks are about trade-offs, and we will only know suitable trade-offs once real production capital starts building on them.

An example that comes to mind is BlackRock tokenizing the BUIDL fund on Ethereum, but PayPal is launching a stablecoin (PYUSD) on Solana. Clearly, the BlackRock team prefers Ethereum’s trade-offs, and the Paypal team prefers Solana's trade-offs. In the future, both may change their minds for a variety of reasons. The point is that design choices are based on trade-offs, and trade-offs determine where certain use cases are best serviced. We really are still very early.

This is why our investment approach focuses on understanding the demand side of these networks; that's where to find the alpha. A new blockchain with X,Y, and Z specs only tells us about its capacity to execute transactions and store data. This is essential information because it gives you an upper bound of possible activity, but more important is whether people are using the network, whether developers are deploying useful applications, and whether the network is capturing fees. A network is only valuable when many people use it, so where users and developers decide to go, tells us more about the network than claims around transactions per second in their marketing material.

Ethereum and Solana are the dominant ecosystems for this cycle. Both of which are supported by improving key performance indicators.

Surging Adoption of Ethereum Layer Two’s

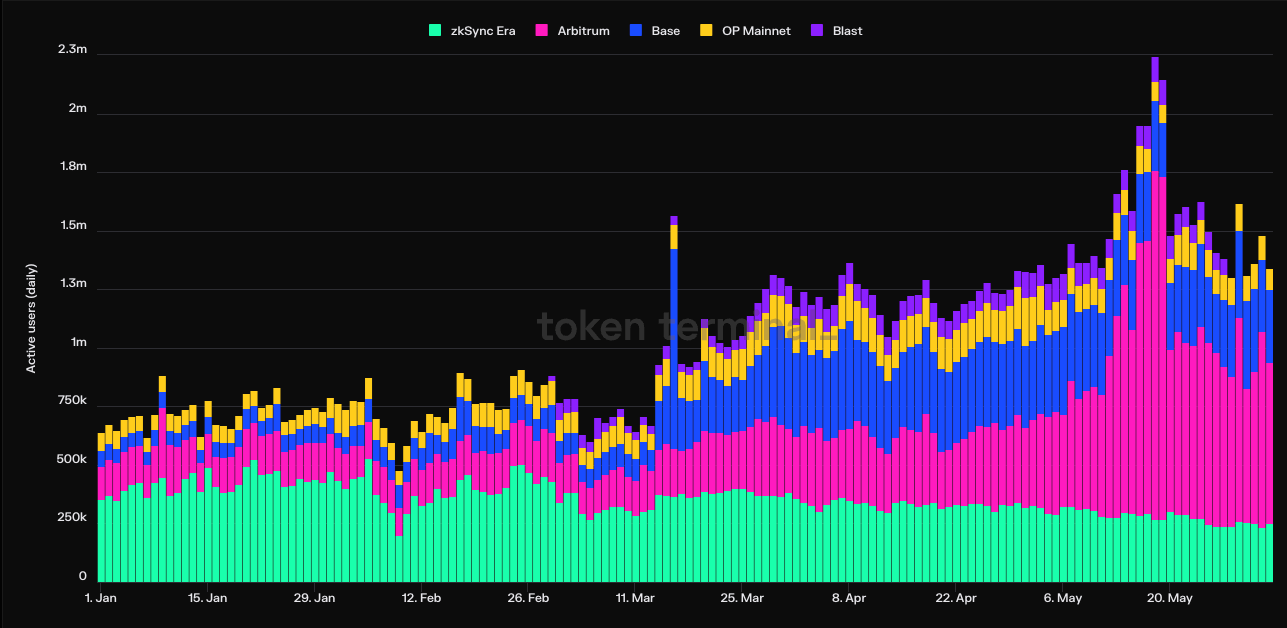

Ethereum L2s are expanding users in an impressive manner, with 10x growth (127k to 1.3m) since Jan 2023, and 103% growth (638k to 1.3m) year to date. Cyclically this growth peaked around the same time as the ETH ETF news.

As expected, Ethereum liquidity continues to be bridged to Ethereum L2's, with over $22b in bridging contracts. The primary reason L2's build on Ethereum is to tap into the existing user base, state, and liquidity of the Ethereum network. We are currently retesting all-time high bridge deposits, which peaked in March of this year. If L2s continue to make progress on their path to decentralisation, which you can track at L2beat, we expect these volumes to continue growing through the expansion.

Solana Resilience and Potential Beyond the Hype

Solana, too, has witnessed growth in active daily users, with an impressive 7.1x growth (122k to 1m) since Jan 2023 and 2.2x growth (306k to 1m) year to date. As we have expressed before, the verdict is still out on whether this is simply a flash in the pan and whether this increased activity eventually fades. Solana activity has slowed considerably since the meme coin mania in March of this year.

There is more to the story, and Solana's strengths, resulting from design trade-offs made by its core developers, could lend Solana well to use cases where Ethereum is less appealing, such as micropayments and exchanges.

A similar dynamic exists when looking at decentralised exchange (DEX) volumes, which peaked at an identical time to active user peaks. While, billions in DEX-traded volume for meme coins is nothing to be proud of, it does serve as a natural stress test of what Solana is capable of. Imagine if these meme coin volumes were for a stock exchange built on Solana. That's the underlying idea of where this is all going. At the peak of meme coin mania, Solana successfully facilitated $3.8b in daily volume traded.

Looking Ahead

We are in a more bullish position than we could have imagined a year and a half ago. We can't express enough how powerful of a tailwind positive movement on the regulatory front is for cryptoassets. This is what gets capital allocators to come to the table and can be viewed as a catalyst in itself, and it’s happening right on the cusp of the final expansion phase of this bull cycle.

Adding further fuel to crypto tailwinds, Central Banks are starting to cut interest rates again. The Bank of Canada was the first G7 nation to cut, lowering rates to 4.75% in early June 2024. The European Central Bank (ECB) followed suit with a rate cut on June 6th, bringing their key interest rate down to 3.75%. The Swiss National Bank and the Swedish Riksbank also joined the rate-cutting party earlier this year. The Swiss cut rates in May 2024, and the Swedes followed suit in early June 2024.

The Bank of England and the Federal Reserve could very likely be next, which the market is currently underappreciating. This will further bolster the bull case for cryptoassets and lead to surprises to the upside.

Below is an update on where we are in the context of the four-year halving cycle. The 2023 to 2027 cycle has been the strongest performance for BTCUSD we have seen in a recovery phase. This could be attributed to the excitement surrounding the approval of the BTC ETF.

The following graph shows returns over various time frames after halving. In the 2015-2018 and 2018-2022 price cycles, the bulk of returns came one year to eighteen months after the halving event. Forty-eight days have passed since Bitcoins last halving event, we are still very early in the expansionary phase.

One last chart of interest is BTCUSD market capitalisation as a ratio of US M1 Money Supply, which has broken above the previous monthly high set in 2017. The last time this happened, in April 2017, BTCUSD rallied 700% over the following 10 months. Of particular interest is that this ratio is breaking higher in an environment where money supply liquidity conditions have still been extremely tight, in stark contrast to 2017 when M2 money growth was running at 5-7% y/y. Should the monetary environment loosen from here, we could see a real surge higher as inflation hedges like BTC catch a bid.

This is why we maintain that the risk-reward of remaining long at this juncture remains very compelling to us. We are however ever-cautious of potential risks to our current bullish posture, and will continue to rely on key performance indicators to determine our next moves. Weakness in key performance indicators, reversal of political tailwinds, or weak ETF inflows may cause us to reevaluate our view. Currently none of these metrics suggest this adoption cycle is over. Going into June we maintain allocations to quality networks such as BTCUSD, ETHUSD, and SOLUSD, whilst finding tactical opportunities in cryptoassets exhibiting strong growth and adoption such as RNDRUSD, ARBUSD and LDOUSD.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.