On-Chain Financial Analysis

Market Recap

Assets Pull Back Again

On-Chain Financial Analysis

Last week in our Bear Market Tactics series, we covered how to read and interpret on-chain data.

On-chain analysis can provide investors with an edge when it comes to assessing where the market is and where it may go, providing better risk/reward opportunities than someone who is just purely looking at price.

However, most of the data that is currently available focuses on layer one protocols. This leaves a huge gap when it comes to assessing projects further up the blockchain stack.

This is where something like Token Terminal fits in. Token Terminal is a platform that aggregates financial data on blockchains and the decentralised applications that run on a blockchain.

What Is Token Terminal?

Long before PCs and the Internet became ubiquitous, Michael Bloomberg launched the Bloomberg Terminal. This terminal provided market participants with a level of uniformity and transparency that wasn't previously available. It provided investors with understandable and, therefore, actionable data that revolutionised investing as we know it.

For a long time, crypto has struggled without a uniform place where financial data on blockchains is collected and transformed into actionable insights. Token Terminal is attempting to rectify this issue.

Token Terminal provides common standards on which to conduct relative analysis. This is highly beneficial for investors as many have struggled to visualise and understand how these networks accrue value.

What Data Is Available?

There is a variety of valuable data available on Token Terminal. However, as expected, it is more limited compared to the Bloomberg Terminal.

Borrowing volume

Borrowing volume is equal to the total value of outstanding loans of a lending protocol.

Capital deployed

Capital deployed is the total value of funds invested to generate yield by an asset management protocol.

Circulating market cap

Circulating market cap (short for capitalisation) is equal to the number of tokens in circulation multiplied by the token price. It measures the total valuation of a project.

Fully diluted market cap

Fully diluted market cap (short for capitalisation) is equal to the maximum supply of tokens multiplied by the token price.

Price-to-earnings (P/E) ratio

Price-to-earnings ratio is equal to the fully diluted market cap divided by annualised protocol revenue. Annualised protocol revenue is calculated as the protocol revenue over the previous 30 days multiplied by 365/30. It is worth noting that this is not the same as the conventional definition of price-to-earnings ratio, in which earnings are calculated as the difference between revenue and costs and expenses. This is because the majority of currently listed projects record their costs and expenses off-chain, and we only have access to on-chain data.

Price-to-sales (P/S) ratio

Price-to-sales ratio is equal to the fully diluted market cap divided by annualised total revenue. Annualised total revenue is calculated as the total revenue over the previous 30 days multiplied by 365/30.

Protocol revenue

Protocol revenue is equal to the amount of revenue that is distributed to token holders.

Supply-side revenue

Supply-side revenue is equal to the amount of revenue the project pays to the supply-side participants (for example, liquidity providers).

Token incentives

Token incentives refer to the value of tokens distributed to the users and supply-side participants as rewards.

Total revenue

Total revenue is equal to the total fees paid by the users. It is calculated over a given time period. For example, total daily revenue for a given day is equal to the fees paid during that day (24 h).

Token trading volume

Token trading volume is equal to the trading volume of the token.

Total value locked (TVL)

Total value locked is the value of assets deposited in the project's smart contracts.

Trading volume

Trading volume is equal to the total value of trades on a trading protocol.

Transaction volume

Transaction volume is equal to the total value of transactions on a blockchain.

All the above metrics can be very helpful on their own; however, just like assessing traditional equities, using a few in combination can be more powerful. Token Terminal helps you combine them and visualise them in detail.

How To Use Token Terminal

Token Terminal has both a free and paid-for version. The free version is enough to do basic analysis and will cover what we will do in this guide.

Step 1: Visit the Token Terminal Website

Go to the Token Terminal Website

Make sure the URL you land on is "https://tokenterminal.com/"

Click on Go to our free dashboard

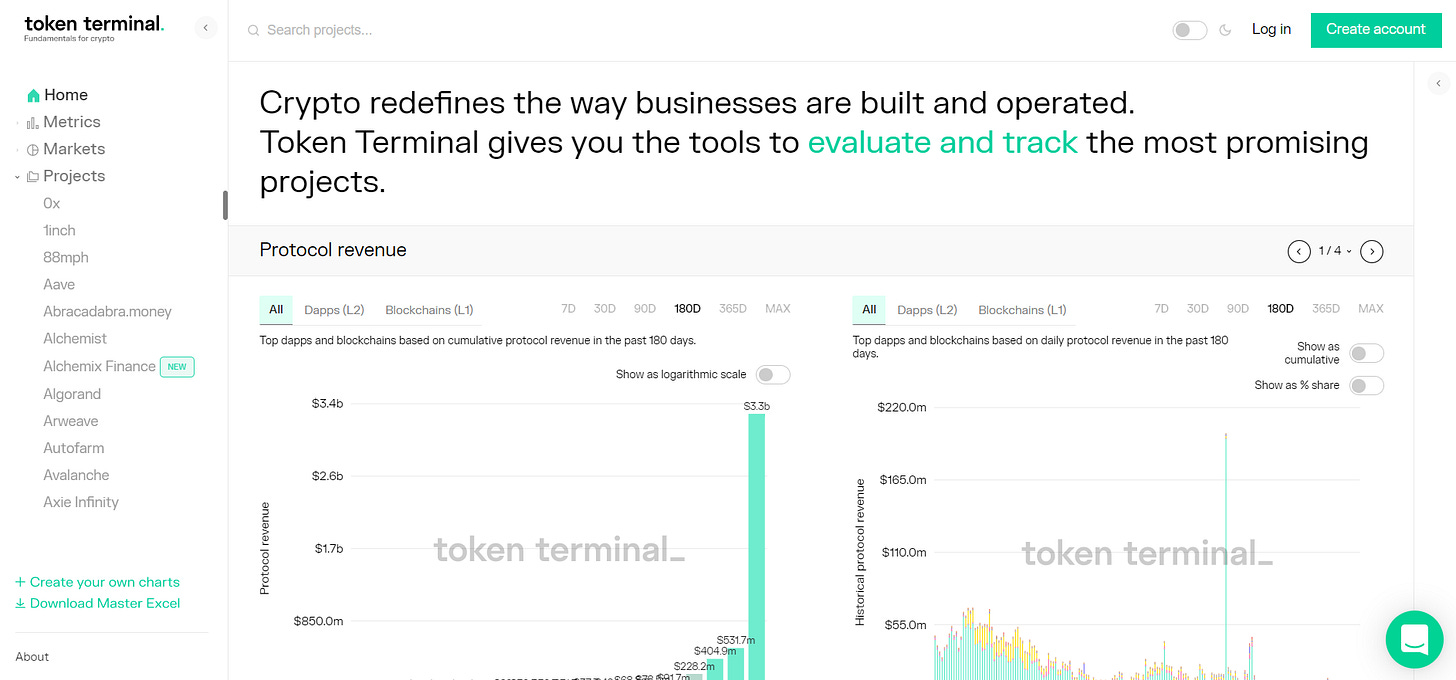

You should see the below screen:

Step 2: Create A Token Terminal Account

Click Create account in the top right hand of the page

You will now have to select a username and password as below:

Choose a username, enter your email and choose a secure password

You will now have to verify your email

Token Terminal will send you a verification email as below:

Click Verify my email

You will be redirected back to Token Terminal, where you can log in with the details you have just used

Token Terminal automatically gives you a Pro plan trial for a month

While handy, for basic analysis the free package is more than enough

Step 3: Use Token Terminal For Analysis

Now comes the exciting part, actually looking at financial data.

There are a few metrics that are important to look at, but two of the most significant are protocol and supply-side revenue. This data shows how much revenue the project generates for users and investors. A well-designed crypto project will generate revenue as would any other well-functioning traditional company.

As with traditional companies operating in different sectors, different metrics can carry more weight.

Analysing Uniswap

Uniswap is a decentralised exchange operating on Ethereum. Uniswap charges a fee for every exchange that happens on the platform. Currently, this is paid to those who provide liquidity to the exchange pool; this is called supply-side revenue. Uniswap doesn't generate any protocol revenue (revenue paid to token holders); this is a conscious decision made by the holders of the UNI token in order to encourage and reward people for providing liquidity to different markets. This can change with a vote if the token holders decide it is appropriate. With this data, we can start creating more traditional ratios that investors use, such as Price to Sales (P/S).

With this data, we can see that as the price has been coming down, the revenue Uniswap has been producing remained somewhat consistent, improving the P/S ratio. It also allows us to compare a project like Uniswap to more traditional companies such as the New York Stock Exchange or the London Stock Exchange. Uniswap's P/S ratio is about double that of the examples mentioned.

While comparisons with traditional companies can be helpful, this data allows you also to compare different crypto projects on similar metrics.

Uniswap clearly leads when it comes to the total revenue generated. This has been a consistent theme over the last two years; at one point it even generated close to $250 million in a day ($163 million more than its closest competitor). Uniswap still has the highest daily revenue, over a million dollars more than any other exchange.

We recommend you play around with the comparisons tab and understand how projects compare with one another on different metrics.

Layer One Blockchain Analysis

Token Terminal also allows you to compare layer one blockchains. This can be super helpful when it comes to understanding if an underlying blockchain is producing revenue and operating as a settlement system should.

Over the last 30 days, Ethereum produced a total revenue ten times that of its closest competitor. From a P/S ratio perspective, Ethereum is also the clear market leader. Second to it is Helium, a project-specific blockchain, so its next real competitor is Fantom which has a P/S ratio that is almost double that of Ethereum.

There are many other different metrics you can use for analysis, so we encourage you to explore these.

Conclusion

Analysis of public blockchains is just starting to become standardised. For the first time, we can access real-time financial data on projects. These projects will operate very similarly to traditional companies in many cases and change the way people value publically traded entities.

In this guide, we have just touched the tip of the iceberg regarding the data available and what we can do with it. If you have any questions or have trouble using the network, please feel free to reach out and ask us questions. We always look forward to chatting with our readers. Otherwise, please feel free to share this article if you know anyone who is interested in learning more about on-chain financial analysis.

Notable Articles and News Stories This Week:

Singapore Central Bank Reprimands Three Arrows Capital for Providing False Information

Singapore's central bank, the Monetary Authority of Singapore (MAS), reprimanded embattled hedge fund Three Arrows Capital for providing false information.

MAS said the fund gave misleading information to the regulator and exceeded the threshold set for assets under management, the regulator said in a statement published on Thursday.

3AC, as the fund is also called, was allowed to manage funds for 30 investors up to S$250 million ($180 million) when it registered as a fund management company in Singapore in 2013, MAS said. The fund had notified MAS that it had changed its management to the British Virgin Islands.

Read more here

Grayscale Sues SEC Over Bitcoin ETF Application Rejection

Grayscale Investments has sued the U.S. Securities and Exchange Commission (SEC) barely an hour after the regulatory agency rejected its application to convert its flagship Grayscale Bitcoin Trust product to an exchange-traded fund (ETF).

The SEC rejected Grayscale's application earlier Wednesday, citing concerns about market manipulation, the role of Tether in the broader bitcoin ecosystem and the lack of a surveillance-sharing agreement between a "regulated market of significant size" and a regulated exchange, echoing concerns the regulator has expressed for years in rejecting other spot bitcoin ETF applications.

Read more about the lawsuit here

Crypto’s Correlation to Equities Dips Following All-time Highs in May

Bitcoin and ether prices have decoupled from their previous all-time high correlations with equities, but experts say traders shouldn’t write off stock prices just yet.

In May, the correlation coefficient between bitcoin and the tech-heavy Nasdaq broke 0.8 for the first time — bitcoin’s correlation to the S&P 500 also hit similar levels in early May. In June, the correlation between bitcoin and the S&P 500 fell to around 0.5, according to data from Coin Metrics. A coefficient of 1 means the assets are moving in tandem, while a -1 signals the opposite.

“Previous all-time highs were reached in the aftermath of the March 2020 crash, where all financial assets experienced extreme drawdowns, which saw BTC’s correlation with the S&P 500 hit 0.76,” said Clara Medalie, strategic initiatives and research director at data provider Kaiko.

Read more about the correlation here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.