January Market Comments & Celestia (TIA)

The Etherbridge fund closed the month -2.37% outperforming the benchmark, Bloomberg Galaxy Crypto Index (BGCI) -6.3%.

January witnessed a pivotal moment in the crypto landscape with the approval of the much-anticipated Bitcoin ETF on January 10th. This milestone, while fueling optimism, also triggered a 'buy the rumour, sell the news' scenario. The market, already evidencing signs of exhaustion, reacted with a mixture of enthusiasm and caution. Part of the price action since the ETF approval is attributable to outflows from the Grayscale Bitcoin Trust (GBTC), the rate of outflows seems to have slowed for now and we believe this situation will begin to stabilize. Notably, the BTC ETF’s launch was broadly a success, accruing $1.2bn in net flows, on the back of $5.4bn of GBTC outflows, making total flows to BTC ETFs excluding GBTC $6.7bn.

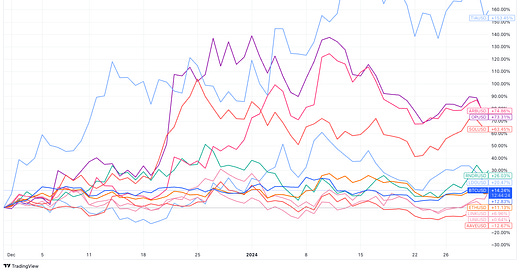

Following the ETF's approval, the market experienced a broad sell-off. Key cryptoassets such as BTCUSD(-2.5%), ETHUSD(-11.73%), SOLUSD(-5%), and the aggregate market TOTALUSD(-5.71%). This price action doesn’t concern us, the market roared into the ETF approval and this correction is just the first in many shakeouts we expect to see as the cycle unfolds.

The ETHBTC ratio, a key indicator of Ethereum's strength against Bitcoin, presented a mixed performance. Leading up to the ETF approval, the ratio weakened but surged by an impressive 20% in the three days following the approval. This surge, however, was short-lived, as it retraced most gains since January 14th. ETHBTC is essentially flat over the month, whilst ETH outperformance isn’t expected in the late recovery period. We do consider this as a signal that sentiment around ETHUSD remains low.

Worst Performers: The month saw a negative performance from several portfolio assets including LDOUSD (-0.06%), ETHUSD (-2.11%), RNDRUSD (-2.12%), BTCUSD (-3.5%), SOLUSD (-9.56%), UNIUSD (-20.73%), MATICUSD (-21.06%), NEARUSD (-23.63%), OPUSD (-25.42%) and AAVE (-25.6%).

Best Performers: On the brighter side, TIAUSD (18.82%), ARBUSD (3.49%), LINKUSD (0.67%). emerged as the month's top performers in the portfolio.

Source: Tradingview. Performance from 2023-12-01 to 2024-01-31. January’s performance numbers in the context of the broader rally.

As we step into February, our strategy pivots towards preparing for the expansionary phase. This involves a strategic increase to the weighting of the 'bomb squad' (altcoin allocation) in comparison to core holdings in BTC and ETH. We are adjusting our portfolio to be firmly overweight on ETH relative to BTC, acknowledging positive tailwinds for ETH in the form of a potential ETH ETF approval and the Dencun upgrade coming later in Q1. We are cutting our allocation to OP which is driven by a stronger conviction in ARB. Broadly this decision is a move away from stradling the two front runners in Layer 2’s but it's also a reflection of our higher conviction on Arbitrums roadmap. We are adding to our exposure in ARB, SOL, and TIA, aligning with our confidence in their potential for growth.

With the crypto market 80 days from the Bitcoin halving, we anticipate a phase of broad excess returns, especially post-halving and considering the March/May rates decision. Our confidence in the transition to the expansionary phase of the crypto market cycle remains steadfast. This phase is characterized by increased on-chain activity (adoption cycle) and rerating of incremental advancements in Layer 2’s, alt Layer 1’s and new design paradigms presented by data availability networks such as Celestia.

Source: Coingecko, Etherbridge

Bullish Celestia

The design space for blockchain networks has evolved enormously since we first started investing in the industry. Today, we can broadly separate blockchain designs into two camps, monolithic blockchains and modular blockchains.

This month we will focus on the modular blockchain stack. The modular era deconstructs a blockchain to its core components. This deconstruction inspires specialization and allows component builders to push innovation of any given component to its limits. Assuming these components remain composable with one another we imagine a future where application developers can stitch together the optimal technology stack to accommodate their needs. Modularity to us means specialization, flexibility, and increased competition in solving the biggest problems faced by this technology.

Source: Celestia

Below we explore each component and describe their core role in the context of a blockchain network.

Source: Celestia

Before going into the bull case for modular blockchain designs and more specifically our investment in Celestia we just want to make it clear that whilst modular offers a plethora of benefits it does present new and unique challenges that we will address below in the risk section. One of the core tenets of our risk management framework is that we diversify our exposure across technological approaches and therefore continue to hold positions in leaders of the monolithic paradigm such as Solana as well as the modular paradigm such as Ethereum, Celestia, and Arbitrum. Chris Burniske eloquently describes the difference between monolithic and modular as similar to the difference between building on IOS vs Android, you can read his description here.

This month we will explore our investment in Celestia(TIA). For ease sake, we provide a summary of our thesis:

A large addressable market: The rise of roll-ups (layer 2’s) and Ethereum's roll-up centric roadmap suggest we are still in the early stages of scaling via layer 2’s, we expect to see more project teams launching layer 2 variations. There is an obvious demand for cheap, secure, and scalable data availability networks. This is evidenced by the costs associated with publishing data to Ethereum versus publishing data to networks such as Celestia, Near, or EigenLayer DA. Furthermore, the core value proposition of public blockchains in our view is decentralisation which we believe is heavily strengthened by the use of data availability sampling.

Core competitive advantages: Celestia has pioneered innovations around data availability sampling and namespaced merkle trees. Together these low-level protocol innovations offer a superior and simple solution to the data availability problem. Celestia’s core team exhibits a unique blend of brilliant developers that gives us confidence in their ability to achieve the vision of a low-cost, scalable, and secure data availability network. Lastly, we view the modular airdrop programs to reinforce upward price pressure TIA, Celestia’s network token.

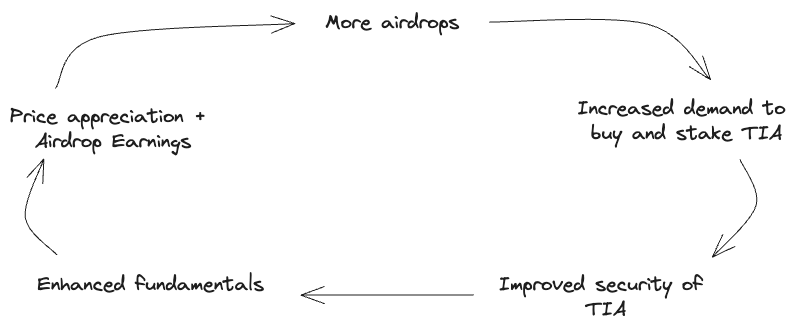

Value accretion: TIA is the fee token of the Celestia network. It is a transactional token that holders need to stake to access rewards such as Inflation, ecosystem airdrops, and fees which are distributed to TIA holders directly in TIA or the airdropped cryptoasset.

A Clear Demand for Scalable and Secure Data Availability Networks

Data availability (DA) refers to the determination of whether data has been made public. Specifically, when a new block is introduced to the blockchain, a node checks if the data is accessible by attempting to download the transaction information within the block. Successful data retrieval confirms the data's publication on the network.

DA is vital for blockchain security, ensuring the transparency and verifiability of transaction records. However, as blockchains scale and block sizes increase, downloading all transaction data becomes infeasible for average users, complicating the verification process of the blockchain's integrity.

Celestia has a new and unique feature called data availability sampling (DAS) which greatly increases participants' accessibility to verify that data has been published and made available to the public. DAS enables light nodes to check if block data is accessible without needing to download the entire block. This process involves light nodes randomly selecting small segments of the block data across several rounds of sampling. As a light node conducts more sampling rounds, its assurance in the data's availability grows. Once it achieves a certain level of confidence, such as 99%, the light node deems the block data to be available.

This places Celestia in a category not yet explored by other blockchains. DAS makes it possible to scale blockchains without having to greatly increase the costs associated with verifying the network. The majority of existing networks focus on marketing their potential transactions per second (TPS), however, real scale goes deeper than TPS, and improvements to the throughput of a network are often offset by the rising costs associated with verifying the network, making decentralisation a second thought. DAS gives Celestia a considerable advantage over both existing solutions and new DA solutions across scalability, security, and most importantly decentralisation.

The clearest signal of the market's excitement for data availability networks can be seen in the price action of TIAUSD. Since its launch in late October 2023 it has risen over 650%, making it one of the top performers for 2023 and one of the few network tokens in positive territory for 2024.

Source: Tradingview

Over the last four years, we have gone from layer 2’s being an idea to one of the fastest-growing themes in the world of public blockchains. L2 Beat a resource for all things Layer 2 now lists close to 40 different projects. We expect this number to continue growing over the next year, we wouldn’t be surprised to see hundreds if not thousands of layer 2's in five years.

Source: thirdweb

Layer 2’s have attracted much attention which is reflected in onchain fundamentals. Since late 2019 to date, we have seen over $21bn bridged to various Layer 2’s.

Source: L2beat

Layer 2 collectively executes more transactions than Ethereum, which is understandable due to the much lower transaction fees for users on Layer 2.

Source: Artemis, Etherbridge

Users are also slowly migrating away from performing their activities on Ethereum and rather opting to be users of Layer 2.

Source: Artemis, Etherbridge

Layer 2’s present an interesting opportunity set for application developers. Running your own execution layer affords flexibility when it comes to transaction ordering, what to do with MEV, and decisions around what virtual machine you would like to run. It also creates a whole new path to value accrual for applications. It's for these reasons that we believe we will see many more layer 2’s both general in purpose and application-specific launch in the coming years.

The majority of layer 2’s that exist today can be placed in the standard Ethereum Layer 2 bucket. These are independent execution environments that post data about their transactions and proofs that state changes have been executed to the Ethereum network. We expect to see more Ethereum and Alternative DA layer 2’s emerge this cycle.

Source: Delphi Digital Research, Dba (Jon Charbonneau)

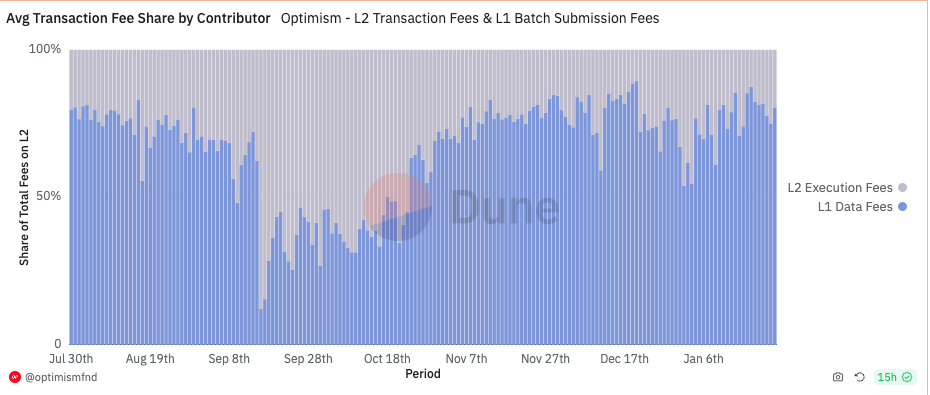

We expect to see more Ethereum and Alternative DA layer 2’s emerge this cycle mainly due to the cost advantages of using an alternative DA network such as Celestia. As a starting point, the below image shows the average transaction fee share paid by layer 2’s, the majority of which (+70%) is costs associated with posting calldata to Ethereum.

Source: @optimismfnd

In $ terms, layer 2’s pay an enormous fee for publishing transaction batches to Ethereum. In December 2023 layer 2’s paid over $30m and about $20m in January of 2024.

Source: @niftytable

To put Celestia’s cost advantage into perspective we refer to Numia Data’s report, The impact of Celestia’s DA layer on Ethereum L2s. Here are some of the highlights from their report. We can start with the historical calldata costs compared to what they would have been using Celestia. $49m compared to $29k is a remarkable cost saving (+500x), which we are confident will be very appealing to Layer 2 developers.

Source: Numia Data

Another great example in the report looks at the cost associated with performing 10m Uniswap V3 swaps.

Source: Numia Data

TIA

TIA is a transactional token that holders need to stake to access rewards such as inflation, ecosystem airdrops, and fees which are distributed to TIA holders directly in TIA or the airdropped cryptoasset.

Source: Etherbridge

Outside of what is illustrated above TIA can also be used as the gas token for Layer 2’s, highlighted benefits refer to the airdrops that Celestia stakers can gain access to.

Celestia has shown early signs of becoming a new hub for token airdrops. Airdrops have become the go-to market strategy for token generation events. Every major crypto cycle has coincided with mass token distribution events ICO boom of 2017 and the liquidity mining frenzy of 2020, airdrops attract attention and often lead to holders of the underlying networks token to reap the benefits as newly issued tokens are recycled into the network token.

Risks and areas for further investigation:

The most glaring risk is the fragmentation of the modular paradigm. Modular tends to fragment liquidity, developers, and users. This in our view is the most likely reason why monolithic designs would win over the long run. We will closely monitor improvements to the composability and interoperability of modular stacks as resolving these issues gives it a fighting chance against its monolithic equivalents.

There is certainly a risk that data availability as a service commoditizes as more solutions come to market. We already have Celestia, EigenDA, Avail DA, and Near DA. Competition is heating up and this will ignite a race to the bottom in the fees these solutions can charge. Projects will have to differentiate on core technical properties and this is why data availability sampling is core to our Celestia thesis.

Another risk is that Ethereum at its core innovates quickly and scales its network, eventually offering very cheap DA. We are already seeing Ethereum make moves in this direction with the Dencun upgrade and EIP 4844. However, if Ethereum’s history teaches us anything it's that meaningful step changes on this front are years away.

Low fee structure and unit economics imply Celestia would need to reach economies of scale. However, our read is that as Celestia becomes more integral to the modular stack its pricing power will grow too.

Monitoring criteria for Celestia:

Broadly Celestia aims to be the home of the modular blockchain stack. Celestia’s integration can come in many flavours, so there is certainly scope for Celestia to obtain high levels of adoption. Below are key performance indicators that we will monitor to affirm or invalidate our thesis.

Percentage of total roll-ups using Celestia for DA. ie: Celestia Dominance

Transaction volume on Celestia enabled roll-ups vs non-alt DA layer 2’s.

Transaction count on Celestia enabled roll-ups vs non-alt DA layer 2’s.

Dex volume on Celestia enabled roll ups vs non-alt DA layer 2’s.

NFT volume on Celestia enabled roll ups vs non-alt DA layer 2’s.

Airdrop total $ value on Celestia Ecosystem.

Staking participation rate of TIA.

Staking yields on TIA.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems that require due diligence to comprehend and operate in. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.