How to Get Your Dad into DeFi

Market Recap

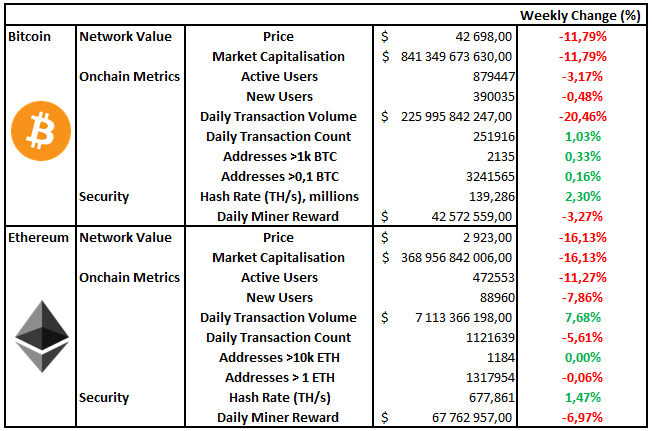

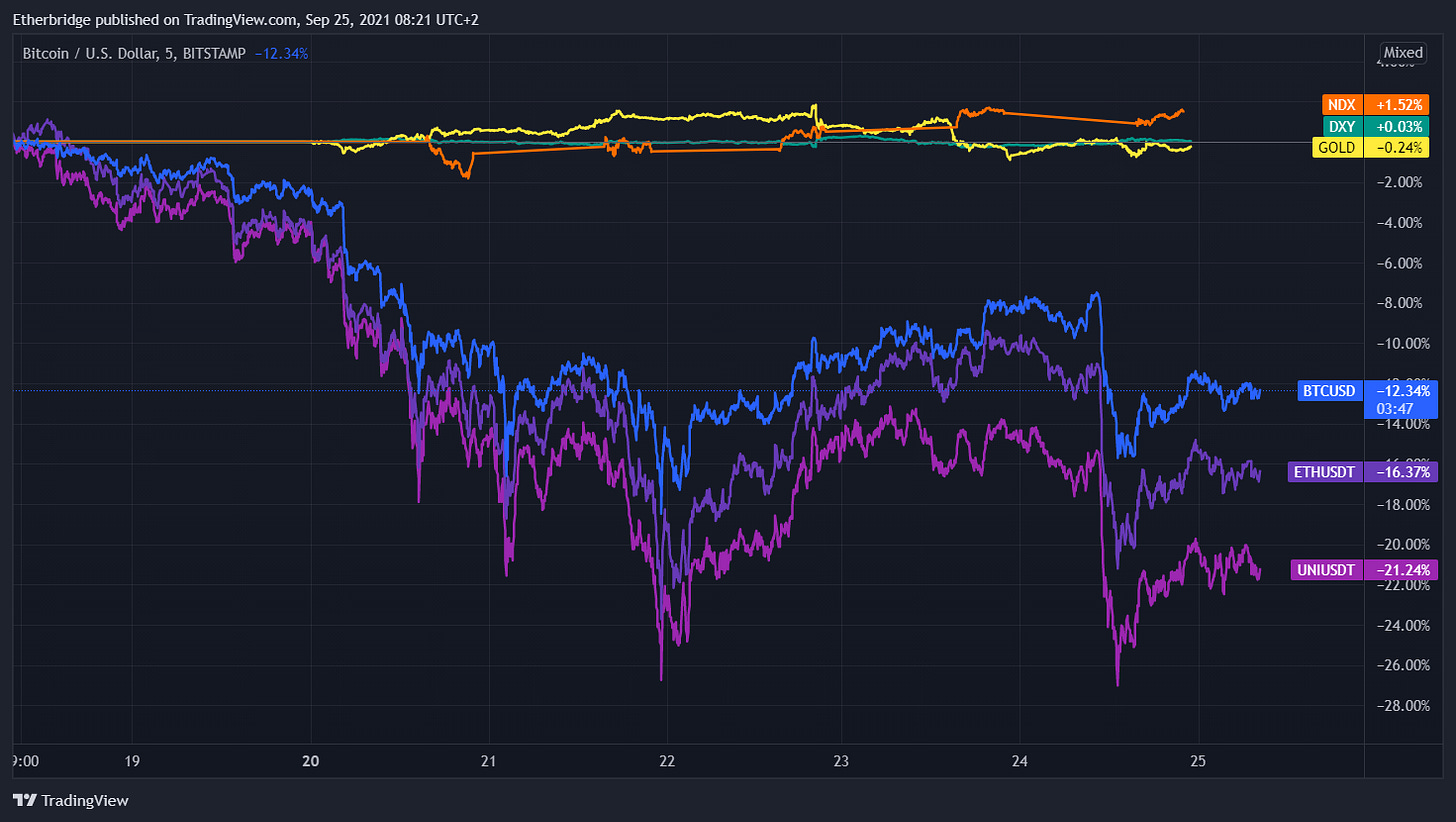

Crypto Pulls Back

How to Get Your Dad into DeFi

DeFi is in the news these days. Cathie Wood is talking about it, and The Economist is trying valiantly. This is good news of a slightly different type for those in crypto: usually, the subject is Bitcoin, and the attention means higher prices, but the difference here is that the emergence of DeFi into the public consciousness means liquidity and adoption. Bitcoin needs people buying it (oversimplification); DeFi needs people participating in it.

Like all fledgling implementations of blockchain-based technologies, DeFi will take time to mature into a more stable and user-friendly experience and build out the use cases that will allow it to earn its name more completely. As for its adoption, however, this does not mean waiting until the broader populace is comfortable using wallets.

In this article, we will discuss and contextualise the Voyager High Yield DeFi Fund, which has been created to bridge the gap and offer a solution for those facing hurdles in accessing DeFi profitably. Whether they are deeply experienced or simply taking their first step.

What is DeFi When Taking the First Step?

The list of DeFi’s available capabilities is growing nearly every day, from derivative products to on-chain insurance. Still, most of these are only useful to those already in the environment. There is one capability that is attractive to everyone: lending assets in exchange for yield; assets that range from bitcoin to digital dollars (stablecoins), the latter being by far the most utilised.

Stablecoins are blockchain-based assets that are often pegged to USD. The standard creation process involves a centralised party issuing stablecoins at a 1:1 ratio with USD held in reserve at a bank. Read our article on stablecoins here.

Looking at the yields available in DeFi from the outside can elicit mixed reactions. The nascence and exponential growth of the space, the volatility of cryptoassets and the at-times wild need for liquidity can induce supply and demand dynamics that deliver rather spectacular yields, frequently in the 10% to 20% range on a risk-adjusted basis. If nothing else, getting involved in DeFi offers better rates than any bank.

The Lending Markets

We can break down yield by looking at two different earning mechanisms: interest and reward.

Interest

Interest is earned in DeFi lending markets by supplying liquidity in the form of stablecoins for others to borrow. Fundamentally this is possible because smart contracts, which live on a blockchain (like stablecoins), are capable of holding assets and performing functions themselves. These contracts are publicly transparent and, of course, execute precisely as written, ensuring that what you see is what you get. By linking smart contracts to manage different functions, thereby forming a protocol, and adding peripherals to improve the user experience, we arrive at a branded lending market where pools of lenders and borrowers can interact.

Depositing a USD stablecoin into a lending protocol increases the liquidity available to borrowers, who may withdraw it strictly in exchange for collateral. This is the key difference between lending in a traditional context, which usually involves credit risk, and allowing lending in a trustless environment. Under absolutely no circumstances can lenders be exposed to default risk, which is solved by borrowers not only collateralising their debts but overcollateralising them.

Overcollateralisation is a feature of the broader strategy aimed at preventing non-repayment. Given that collateral in a blockchain environment is usually a cryptoasset, it is volatile. Securing a $100 loan with $100 of Bitcoin would not work as the collateral value could very likely fall below the loan value. To combat this, the smart contract managing the loans must have overcollateralised positions with liquidation thresholds to ensure that if the value of the collateral gets too close to the loan value, there is time to sell that collateral before lenders are exposed to any risk.

This is how we arrive at secured lending markets where interest can be earned with the peace of mind that the loan is backed by an asset.

With an eye to current development, there are several projects that hope to expand on this fundamentally simple financial process. In the future, one might borrow against collateral in the form of a tokenised title deed or by reference to a decentralised credit score.

Reward

DeFi protocols, especially the lending protocols/markets, are highly competitive when attracting lenders and borrowers. New markets need liquidity to function, and they need to acquire users to get it. This has created an environment with extremely efficient fee structures, but of further importance is the ownership and governance of DeFi protocols which are represented in the form of tokens (assets). These governance tokens have financial and practical value and can therefore be used to attract users by issuing them in return for liquidity. A common approach for yield-first investors is to consistently sell these tokens, thereby collecting interest from a protocol as well as additional income. The sum of which is the total protocol yield.

It is worth noting that there is no point at which earning yield requires converting the principal liquidity provided into a volatile asset. Supplying USD will result in a deposit denominated in USD, always. Supplying USD results only in the earning and compounding of USD.

How to Get Into DeFi Yield Responsibly, Without the Fuss

Managing one’s own funds in a blockchain environment is becoming more accessible and safe over time, but it remains a relatively sophisticated endeavour and capitalising on the best opportunities will always require a high level of capability. Whether looking at getting in for the first time or at consolidating a sprawling DeFi yield strategy, a fully managed solution might fit.

Enter Voyager

The Voyager Fund is a regulated mutual fund that provides all the oversight and safeguards one would expect. This is very important because when trying to make DeFi accessible, the focus needs to be on taking only one step - which is gaining comfort in where one’s capital is being deployed - and not on introducing layers of additional complexity.

Voyager provides, with a subscription to the fund, professional management of an ecosystem of independent service providers as well as vetting and due diligence on protocols to produce optimal risk-adjusted returns.

Risks and Risk Management

The risks involved when earning yield in DeFi are quite different to those in traditional markets. There is no credit risk per se, and there is substantial distance from systematic capital market risk. The alternative risks one assumes are technological in nature and represent a diversification away from the more traditional types.

Technological risks associated with DeFi lending are centred on the proper functioning and calibration of smart contracts and their ecosystems. These contracts are vulnerable to bugs, they rely on externally sourced information to function correctly, and it is possible to miss novel potential vectors of attack.

Underlying sources of risk also include the stability of the blockchain itself and of the assets being used as principal (stablecoins) or collateral.

The basis of risk management in DeFi is due diligence and monitoring. For stablecoins, we need to be sure that they are 100% backed, where that backing is attested to by a professional and independent party. For protocols, we need deep verification of code integrity, but more importantly, we need long periods of battle testing and the management of significant capital (usually 100s of millions in US$).

Benefits of the Voyager High Yield DeFi Fund

There are fully managed alternatives to using a fund, including centralised platforms where one typically can earn 7% - 9% fixed interest. These suffer the drawbacks of limited upside, legal and regulatory uncertainty, and credit risk. They remain, however, a possibly good option for individuals looking for a very simple offering. They are less suitable for anyone looking to deploy significant capital or who otherwise would prefer the clarity of tested structures.

DeFi is here

DeFi has matured to the point that it makes it possible for regulated entities to remove all hurdles and offer a completely traditional investment onramp to the types of low-risk yield opportunities that are simply not available anywhere else.

The real benefit lies, however, in taking the first step into the internet of value. DeFi is rewriting finance, currently at low speed but high acceleration. The infrastructure will introduce major change in society, much like the internet did, and we all need something motivating and driving us to understand this change. The first step for many could simply be testing the water by earning great yield.

This piece was written in collaboration with Ciaran MacDevette from Bakari, who manages the Voyager Fund.

Notable Articles and News Stories This Week:

Miners Have Accumulated $600M Worth of Bitcoin Since February

Bitcoin miners are accumulating bitcoin as the network hash rate continues to recover, according to on-chain analytics provider Glassnode. In its September 20 Week on Chain report, Glassnode stated that miner BTC balances are increasing, with wallets associated with miners having stockpiled 14,000 BTC (worth roughly $600 million) over the past six and a half months. The report also noted that the bull markets of 2020 and 2021 have seen miners hold onto a larger portion of their rewards than in previous market cycles. Miners usually sell BTC to cover their expenses, including electricity bills and hardware.

Read the story here

Federal Reserve Could Taper ‘Soon’ as Officials See Interest Rate Hike Next Year

The U.S. Federal Reserve said it will keep interest rates near 0% and continue to purchase bonds at the same $120 billion-a-month pace it has been doing, but the market now has clarity on how the central bank will start to unwind, or taper, its stimulus program. The Federal Open Market Committee (FOMC), the central bank’s monetary policy panel, said Wednesday in a statement that tapering the bank’s bond purchases “could be warranted soon,” because the economy has made progress toward its goal of maximum employment. The panel said it will keep the target rate for federal funds in a range of 0% to 0.25%.

Read the full article here

Franklin Templeton Prepping Blockchain Fund

Franklin Templeton has so far raised $10 million for a blockchain fund, according to a regulatory filing, and the firm is looking to raise an additional $10 million before launching. The offering will be a venture capital fund that requires a minimum investment of $1 million, the September 14 document indicates. It’s the San Mateo, California-based fund group’s latest step into the crypto space. The firm, which managed $1.56 trillion in assets as of the end of July, posted job listings earlier this month to hire a cryptocurrency-focused trader and research analyst.

Read the full story here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.