Getting Started With NEAR Protocol

Market Recap

A Good Week For Digital Assets

Getting Started With NEAR Protocol

Our previous articles in the Getting Started series have covered Avalanche, Fantom, Binance Smart Chain and Solana. This week, we will cover NEAR Protocol and explore what it is and how you can use it.

What is NEAR Protocol?

NEAR Protocol is a smart contract platform that is very similar to Ethereum in that it can power a wide variety of applications; these can be anything from DeFi to Web3.

NEAR was founded in 2018 by Illia Polosukhin and Alexander Skidanov. One of their primary motivations for the creation of the NEAR Protocol was that they perceived the developer tooling of Ethereum to be unintuitive for traditional developers. One of the main features of NEAR is that it supports WebAssembly and therefore allows developers to code their applications in languages like Java, Go, Rust, and others. This means that they don't need to learn a new coding language like Solidity if they want to start creating blockchain applications; it also means that they have the added bonus of potentially porting over some existing applications they have already coded and running them on a blockchain.

The NEAR Protocol isn't inherently Ethereum Virtual Machine (EVM) compatible; however, a project built on NEAR called Aurora has brought EVM compatibility to the blockchain and has since found more traction from a Total Value Locked (TVL) perspective than the NEAR blockchain itself. This is a fascinating observation and shows how EVM compatibility is still a gold standard in blockchain development and how it can attract existing protocols.

How Does NEAR Protocol Work?

NEAR Protocol uses a Proof of Stake consensus, more specifically called Threshold Proof of Stake. NEAR uses sharding as their approach to scaling, which is the same approach as Ethereum 2.0; however, it does have nuanced differences. With Ethereum 2.0, validators are randomly assigned to a shard to reduce the chances of collusion. NEAR has taken a different approach, and validators can choose to stake on a specific shard, the developers of NEAR have designed it so that the network can tolerate up to two-thirds of the validators being bad actors before the protocol is compromised.

Currently, there is space for 100 validators to secure the NEAR network. However, the team do plan to increase the number of validators in the near future, which will further decentralise the network. As validators will be able to stake on a specific shard, the requirements to stake and the reward will also differ. They hope that this will encourage new or existing validators to move and stake on less popular shards, therefore increasing the entire network's security.

NEAR will also leverage the Octopus network to increase its scalability in the future. Octopus allows developers to launch their own chains, which will work in parallel with the mainchain. These come prebuilt so developers can concentrate on their user-facing front-end.

NEAR have taken a developer-first approach to blockchain design, and they have managed to gain traction due to their technology and VC backing.

How to Use NEAR Protocol

As with Fantom, Avalanche, BSC, and Solana, there are several wallet options to choose from. This also depends on what you intend on using the wallet for. A wallet allows you to store your assets, participate in the network through governance and staking/delegating, and it can enable you to interact with both DeFi and Web3 projects.

NEAR have an official wallet that can be accessed from your desktop.

Creating a Wallet

Step 1: Visit the NEAR Wallet Website

Go to the NEAR Wallet Website

Make sure the URL you land on is "https://wallet.near.org/"

You should see the below screen:

Click Create Account

Click Get Started

It will now prompt you to choose your security method. In our case, we will use a Passphrase.

Step 2: Create A Key/Pass Phrase

You will now have to create a new wallet. Your pass/key phrase is how you recover access to your account if something happens to your wallet. Therefore, it is crucial to concentrate during the next few steps.

Select Secure Passphrase

Click Secure My Account

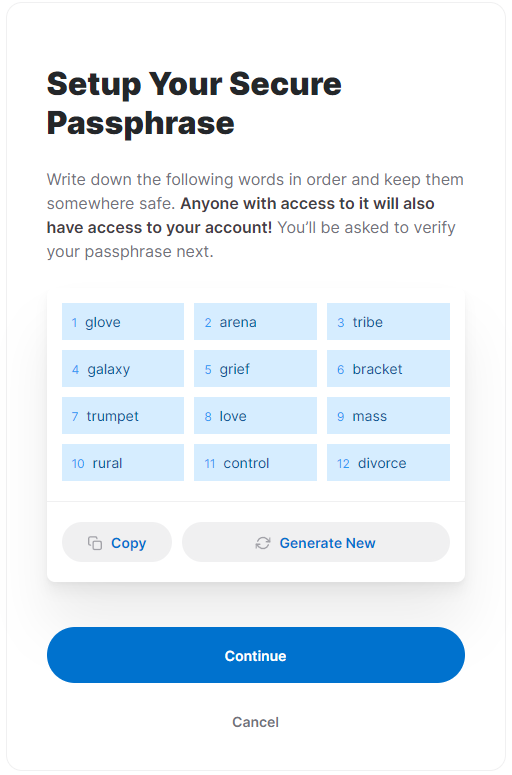

You will see 12 words on your screen as below:

This is your Key or Secure Phrase. We have previously written about the importance of storing a key phrase correctly. You can access that article here to follow best practices. Copy your 12 words down in order and ensure that they are accurate, store them as suggested in our article. You can never be too careful with your seed phrase.

Once you have copied them down and stored them securely, click Continue

You will now have to verify your phrase and prove you have copied the words down correctly

Enter the words they have asked for and click Verify & Complete

Step 3: Use your Wallet

NEAR automatically prompts you to fund your wallet with at least 0.1 NEAR to pay for gas. We will cover the different ways to fund your wallet in the next section.

Funding Your Wallet

NEAR Protocol is not an Ethereum Virtual Machine (EVM) compatible blockchain. Therefore a native integration with MetaMask and the option to fund it through an EVM cross-chain bridge will not work as it has for Avalanche, Fantom and BSC. Therefore, a centralised exchange is the main way to fund your wallet. However, they do have the EVM compatible Aurora mainnet, which means you will be able to transfer your Ethereum assets to this chain using MetaMask and a cross-chain bridge. The Aurora team has managed to set it up so that you can pay your gas fees in ETH, and an underlying relayer will convert it to NEAR and pay the fee on your behalf. You can read more about that here.

Exchange

You can fund your wallet directly using an exchange like Binance or any other exchange that offers NEAR as a trading pair. This will differ from exchange to exchange, so giving specifics is hard. But it will involve you withdrawing the NEAR token directly to your NEAR Wallet that you have just set up. Be careful during this process and make sure that you select the appropriate chain when going through the withdrawal procedure; this will be the NEAR mainnet in our case. Always double-check that the address you are sending to matches the one from your wallet exactly. Sending to the wrong address will mean you lose access to your funds.

You can see this address on the last page of the wallet setup:

We always recommend moving the native asset of the destination chain because once it lands, you require it to pay gas. In this case, it will be NEAR; when transferring from an exchange, you should transfer the NEAR token as opposed to any other asset, but you can do a combination as well.

Cross-Chain Bridge

This process has a couple more steps and involves setting up a MetaMask wallet. You can follow our guide to setting up your MetaMask here. MetaMask generally has more integrations into different DeFi and Web3 protocols and, therefore, a more comprehensive range of uses within the crypto industry.

This will also allow you to connect to the EVM compatible Aurora, which means you can use the EVM compatible applications built on the Aurora network.

Step 1: Add Aurora Mainet To MetaMask

Adding a custom chain to MetaMask is relatively straightforward. You can see a detailed explanation here under Step 3.

However, to add Aurora to MetaMask, simply go into Settings -> Networks -> Add a Network, and paste the following details:

Network Name: Aurora

New RPC URL: https://mainnet.aurora.dev/

ChainID: 1313161554

Symbol: ETH

Block Explorer URL: https://explorer.mainnet.aurora.dev/

Always ensure those details are entered exactly as above. This will be for Aurora as this is the chain that works with the MetaMask wallet. Also, bear in mind this will have a different address from the address given by your NEAR Wallet.

Step 2: Use Cross-Chain Bridge

Now you will need to bridge assets from the Ethereum network to Aurora.

You should land on the following page:

Under transfer from select Ethereum and under transfer to Aurora.

Connect your wallets

Click Begin new transfer

It automatically gives you a list of your tokens with a balance. Select the token you want to transfer; in this case, we recommend ETH to pay for gas on the Aurora mainnet.

Enter the amount you want to bridge

Click Continue

You will now have to confirm the transactions in your MetaMask wallet.

Whenever prompted, click "Confirm" to sign the transaction on MetaMask

The transfer will now begin. This can take some time, so don't worry if the funds don't reflect right away. However, once it is done, you will notice that the balance of ETH on your MetaMask has adjusted. If you now navigate to the Aurora on your wallet, you should see the balance you transferred minus any fees.

Step 3: Use Aurora

Now that you have bridged your assets, you can start using Aurora's DeFi and Web3 applications. You can view a list of the projects you can use here. You can also use the protocols available on NEAR using your NEAR Wallet, with a list of them available here.

Conclusion

Using these networks is the best way to learn about them. It shows and allows you to understand what blockchain networks are capable of. Each has its own unique advantages, disadvantages and user experiences.

NEAR Protocol has taken a new approach to scalability, employing a very similar technology to Ethereum 2.0. It has found a lot of traction with VCs, and its developer-first approach may appeal to new entrants to the crypto space. We look forward to seeing it grow and how projects built on it like Aurora can help push it forward.

If you have any questions or have trouble using the network, please feel free to reach out and ask us questions. We always look forward to chatting with our readers. Otherwise, please feel free to share this article if you know anyone who is interested in using these networks.

Notable Articles and News Stories This Week:

BlackRock Looks to Offer Crypto Services as Client Demand Rises: CEO

Larry Fink, the CEO of BlackRock (BLK), has confirmed that the world's largest asset manager is exploring how to serve clients with digital currencies.

Fink cited increasing interest from clients around digital currencies in a letter to shareholders Thursday.

Fink's comments are at sharp odds with his previous assessment of client interest in crypto. In July of last year, Fink said in an interview that he is not seeing much demand for digital assets.

Fink also wrote that the Russia-Ukraine conflict will push countries to reassess currency dependencies and look to means of payments that can bring down the costs of cross-border transactions.

Read more about the announcement here

Ray Dalio’s Bridgewater Investing in Crypto Fund

Bridgewater Associates is preparing to back its first crypto fund.

The world’s largest hedge fund is planning to back an external vehicle, two people told CoinDesk. It has no current intention of directly investing in crypto assets itself, one of the sources said.

It’s the clearest signal to date that the world’s largest hedge fund, currently with $150 billion in assets under management (AUM), is taking crypto seriously as an asset class – aside from founder Ray Dalio’s announcement in May 2021 of a personal investment in bitcoin (BTC).

Read the full story here

US Senate to Consider Bill Examining El Salvador's Bitcoin Experiment

The full U.S. Senate will vote on a bill looking to mitigate risks to the U.S. financial system from El Salvador's adoption of bitcoin (BTC) as legal tender, after the bill was passed out of committee on Wednesday.

The “Accountability for Cryptocurrency in El Salvador (ACES) Act” was introduced by Sens. James Risch (R-Idaho), Bob Menendez (D-N.J.) and Bill Cassidy (R-La.) on Feb. 16.

“As El Salvador has adopted [b]itcoin as legal tender, it’s important we understand and mitigate potential risks to the U.S. financial system,” Risch said in a statement on Wednesday. He added the legislation would require the State and Treasury departments, among other federal agencies, to mitigate risks such as potential empowerment of China and organized criminal organizations.

Read more about the bill here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.