The Metaverse

Market Recap

Volatile Week for Digital Assets

The Metaverse

This week Jason did a podcast for Moneyweb with one of our advisors JonJon Clark. It is worth a listen as they gave a detailed explanation of what Ethereum is and why it is essential to the digital asset ecosystem.

To follow on from this, we thought it would be appropriate to elaborate on some of the different use cases that Ethereum enables and focus on the expanding Metaverse built on top of the network.

Currently, there is a whole Metaverse building out on the Ethereum Network. Firstly, however, we need to understand what a Metaverse is. According to Wikipedia a Metaverse is "a collective virtual shared space, created by the convergence of virtually enhanced physical reality and physically persistent virtual space, including the sum of all virtual worlds, augmented reality, and the Internet."

Last year Etherbridge published a piece titled Web 3.0. In it, we discussed the evolution of the web and how we will see the internet morph into a ubiquitous geospatial layer that we interact with daily. Ethereum and other blockchain networks will be the new web's backbone and facilitate the blend of both a physical and metaphysical world.

We have seen how popular virtual worlds already are, even without the use of blockchain. You can think of games like Fortnite, which generates $1.8 billion in revenue per year or World of Warcraft, which produces $200-300 million per year (both mostly selling in-game items). These games or Massively Multiplayer Online game's (MMO's) as they are known already generate a total of $31 billion in revenue per year. However, this revenue flows to privately-owned companies and not the players themselves; the items are also challenging if not impossible to trade and are never truly owned by the players themselves. Imagine we could flip that model on its head. Gaming, nevertheless, is only one of the first use cases in the Ethereum Metaverse.

As an increasing number of projects launch on the Ethereum Network, we create a more robust, interactive Metaverse - or virtual world. Some of these projects use virtual or augmented reality, and some don't. However, the core value proposition is that whatever you create, buy, catch or interact with can truly be yours.

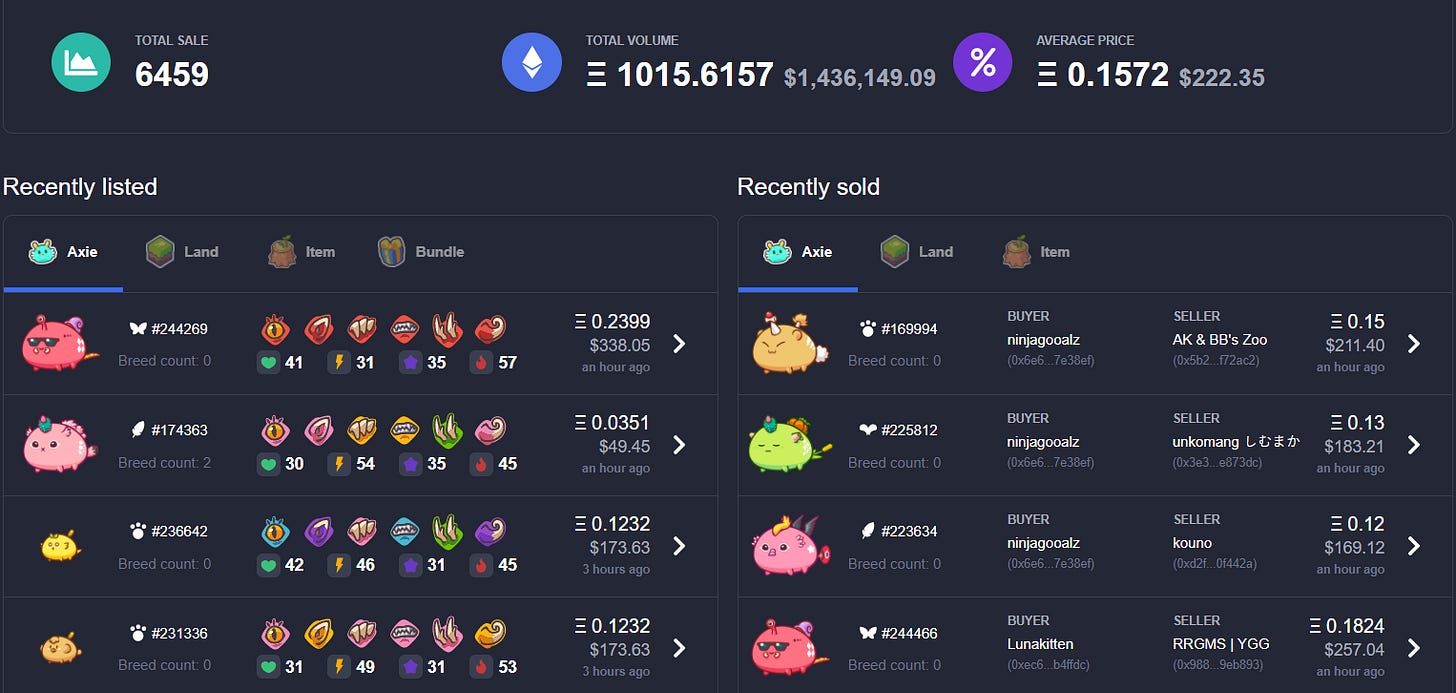

In 2020 we saw a rapid rise in the value and number of items or objects traded within the Ethereum Metaverse:

The above graphic includes the five largest Metaverses (only digital land and in-game items in this case) on Ethereum. What’s even more exciting is that these world's and their integrations are building out rapidly. The possibilities of what you can do in these worlds are also expanding. As an example, in Decentraland, you can own and trade land, build houses, trade wearable items and have the ability to vote on how the virtual world develops over time. We have even seen companies like Binance and Kraken create virtual offices, and you can now even attend virtual conferences within Decentraland.

Another example is Axie Infinity; a world inhabited by Pokemon-like creatures. Within this Metaverse, you can collect, raise and battle "axies". Different axies have varying attributes and strengths, and some sell for hundreds of thousands of dollars. Yes, they may be speculative at this stage and still building out their world and proving their use case, but it shows you the demand that people anticipate for these types of assets.

These examples though are just the first attempts in creating truly robust and engaging virtual worlds. If you start to think of the broader applications, there is a wealth of opportunity. As we enhance our reality, we can begin creating our dream homes that we can sell, attending virtual art galleries and museums displaying scarce digital art, entering virtual stores with a vast range of options that we can try on, buy and have delivered directly to our house. We could even have virtual meet-ups with friends worldwide and feel like we are sitting in a coffee shop in Paris. The way we deliver entertainment might also change, apart from gaming we may have virtual sporting events, casinos, we may even start attending virtual movie houses. We have already seen virtual concerts, Fortnite, in collaboration with Travis Scott hosted the largest ever online concert where more than 12 million people attended. Last year Oprah even did a ‘face-to-face’ interview with Obama.

These examples just scratch the surface; the possibilities indeed are endless.

As the world continues down its path of digitalisation, these virtual worlds are an eventuality. Understanding where both the disruption and opportunities lie no matter the industry you are involved in is paramount. Metaverses have the potential to create real economic value for all users involved; this value will be derived from both the ability to have real, codified ownership of the assets and the network effects that will stem from social interactions within the Metaverses themselves.

Notable Articles and News Stories This Week:

Harvard, Yale, Brown Endowments Have Been Buying Bitcoin for at Least a Year: Sources

According to two sources familiar with the subject, the Endowments of Harvard, Yale and Brown three Ivy League universities have been purchasing bitcoin directly through digital asset exchanges over the past year. This is an exciting development as these institutions, and their students are known to be early adopters of technology. This also often signals that they believe that it has longevity and a high chance of success and suitable institutional infrastructure to securely buy and hold their assets.

Read the story here

Dalio Expects to Soon Offer Alt-Cash Fund, Says ‘Bitcoin Won’t Escape Our Scrutiny.’

Ray Dalio, the head and founder of Bridgewater Associates, the world's largest hedge fund has released his first full public statement on bitcoin. Firstly he believes that bitcoin is "one hell of an invention" and praised the ingenuity of creating a digitally native form of money and store hold of value. He further goes on to state that "there aren't many alternative gold-like assets at this time of rising need for them" and says that "there exists the possibility that Bitcoin and its competitors can fill that growing need [gold-like storehold of wealth assets that can be held in privacy]". However, he further states that he views bitcoin as "a long-duration option on a highly unknown future that I could put an amount of money in that I wouldn't mind losing about 80% of". Dalio also goes onto state "believe me when I tell you that I and my colleagues at Bridgewater are intently focusing on alternative storehold of wealth assets and expect Bridgewater to soon offer an alt-cash fund and a storehold of wealth fund in order to better deal with the devaluation of money and credit that we consider to be a major risk and opportunity, and Bitcoin won't escape our scrutiny".

Read his full letter here

Hard-Hit Argentinian Farmers May Get Boost From Trading Platform for Tokenised Produce

Argentinian farmers struggling with high inflation and the economic devastation wrought by the coronavirus pandemic may have been given a break. CoreLedger has launched a peer to peer platform where farmers can tokenise and trade their produce in what they hope will form the countries' first digital barter economy. Farmers will come to the platform and exchange their produce for other tokenised assets, including other currencies or produce. According to the CEO of the platform, "Agricultural-backed tokens solve volatility and liquidity issues inherent in cash and stock-based saving plans."

Read about it here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.