5 Things You Need to Know About Bitcoin

Market Recap

Bitcoin hits $40,000

5 Things You Need to Know About Bitcoin

Bitcoin has risen +/-200% over the last 2 months. It is now the 14th largest currency globally and the largest financial service by market capitalisation. A remarkable feat for a 12-year-old software.

Whilst price action has been vindicating for bitcoin bulls, we think it is important to revisit why such huge price increases are possible in the first place. We want to remind you what exactly it is that you are buying.

Money is a Technology for Storing and Exchanging Time

Money has always been technology. It allows society to store time, effort and sacrifice today and redeem it for time, effort, and sacrifice in the future. Similar to how a title deed gives the holder a claim on a property, money is a claim on human time. When we exchange our time for money we hope that it can hold value for long enough to enable us to trade it for something we want.

Certain types of money give the holder freedom. Freedom in the sense that their time cannot be stolen from them, they own their time exclusively. Other forms of money have characteristics that allow the issuers of that money to enslave its users. Slavery in the sense that time is stolen from them, they do not own their time.

This point is illustrated by an example in a book called The Deficit Myth by Stephanie Kelton. This book explores the concept of Modern Monetary Theory, essentially the idea that governments don’t have to worry about debt or deficits because they are the sole issuers of money and can always just create more.

“In 1998, I visited Mosier at his home in West Palm Beach, Florida, where I spent hours listening to him explain his thinking. He began by referring to the US dollar as "a simple public monopoly." Since the US government is the sole source of dollars, it was silly to think of Uncle Sam as needing to get dollars from the rest of us. Obviously, the issuer of the dollar can have all the dollars it could possibly want. "The government doesn't want dollars," Mosier explained. "It wants something else." "What does it want?" I asked. "It wants to provision itself," he replied. "The tax isn't there to raise money. It's there to get people working and producing things for the government."

"What kinds of things?" I asked. "A military, a court system, public parks, hospitals, roads, bridges. That kind of stuff." To get the population to do all that work, the government imposes taxes, fees, fines, or other obligations. The tax is there to create a demand for the government's currency. Before anyone can pay the tax, someone has to do the work to earn the currency. My head spun. Then he told me a story. Mosler had a beautiful beachfront property with a swimming pool and all the luxuries of life anyone could hope to enjoy. He also had a family that included two young kids. To illustrate his point, he told me a story about the time he sat his kids down and told them he wanted them to do their part to help keep the place clean and habitable. He wanted the yard mowed, beds made, dishes done, cars washed, and so on. To compensate them for their time, he offered to pay them for their labor. Three of his business cards if they made their beds. Five for doing the dishes. Ten for washing a car and twenty-five for tending to the yard work. Days turned into weeks, and the house became increasingly uninhabitable. The grass grew knee-high. Dishes piled up in the sink, and the cars were covered in sand and salt from the ocean breeze. "Why aren't you doing any work?" Mosler asked the kids. "I told you I would pay you some of my business cards to pitch in around here." "D-a-a-a-a-ad," the kids intoned. "Why would we work for your business cards? They're not worth anything!" That's when Mosler had his epiphany. The kids hadn't done any chores because they didn't need his cards. So, he told the kids he wasn't requiring them to do any work at all. All he wanted was a payment of thirty of his business cards, each month. Failure to pay would result in a loss of privileges. No more TV, use of the swimming pool, or trips to the mall. It was a stroke of genius. Mosler had imposed a "tax" that could only be paid using his own monogrammed paper. Now the cards were worth something. Within hours, the kids were scurrying around, tidying up their bedrooms, the kitchen, and the yard. What was once considered a worthless rectangular calling card was suddenly perceived as a valuable token. But why? How did Mosler get the kids to do all that work without forcing them to do any chores? Simple. He put them in a situation where they needed to earn his "currency" to stay out of trouble. Each time the kids did some work, they got a receipt (some business cards) for the task they had performed. At the end of the month, the kids returned the cards to their father. As Mosier explained, he didn't actually need to collect his own cards back from the kids. "What would I want with my own tokens?" he asked. He had already gotten what he really wanted out of the deal —a tidy house! So why did he bother taxing the cards away from the kids? Why didn't he let them hold on to them as souvenirs? The reason was simple: Mosier collected the cards so the kids would need to earn them again next month. He had invented a virtuous provisioning system! Virtuous in this case means that it keeps repeating. Mosier used this story to illustrate some basic principles about the way sovereign currency issuers actually fund themselves. Taxes are there to create a demand for government currency.

The government can define the currency in terms of its own unique unit of account—a dollar, a yen, a pound, a peso—and then give value to its own otherwise worthless paper by requiring it in payment of taxes or other obligations. As Mosier jokes, "Taxes turn litter into currency."

Fiat is socialist/slave money. Bitcoin is not. Humans have historically had an evolutionary pull towards sound money, for sound money possess the characteristics that best preserve our exclusive rights to the fruits of our labour. Creating a truly virtuous cycle of compounding wealth through generations.

Network Effects

Before touching on elements specific to bitcoin we must discuss network effects. Networks are powerful connections that dematerialise real-world activities into virtual experiences. Amazon took hours of walking around shopping malls and created a global marketplace on your computer. Google took libraries of information scattered across the world and created an online network of information, where anything can be found. Facebook took your friendships and relationships online.

All these companies benefited from network effects. Networks become more powerful and therefore more valuable as the number of connections made continues to grow. Every new user increases the network’s overall utility. As more suppliers join Amazon, more users come. As more users arrive, selling goods on Amazon becomes more profitable, drawing in an ever-growing number of buyers and sellers.

Bitcoin too benefits from network effects and the feedback loop of an ever increasing user base. For every additional user, the networks utility increases.

The Difficulty Adjustment

Bitcoin was created by a pseudonymous person or group called Satoshi Nakamoto. The technologies that went into bitcoin however weren’t new. There were countless attempts at creating a peer-to-peer form of money native to the internet but all failed due to them requiring a centralised entity to coordinate trust. All these attempts had their own unique achievements from solving the Byzantine General’s Problem, public and private key encryption to reusable proof of work.

However, the real genius behind bitcoin was introduced by Satoshi Nakamoto, the difficulty adjustment.

“To compensate for increasing hardware speed and varying interest in running nodes over time, the proof-of-work difficulty is determined by a moving average targeting an average number of blocks per hour. If they're generated too fast, the difficulty increases.” – Bitcoin Whitepaper

The above might not mean anything to you but it’s probably the two most important sentences in the bitcoin whitepaper. The difficulty adjustment makes it impossible to mine bitcoin faster than its codified supply schedule and therefore makes unexpected inflation impossible.

How does it do this? Bitcoin mining is a number guessing game that starts, stops, and restarts every ten minutes. In order to earn the right to validate a block and commit it to the Bitcoin network, you have to find a target number. The only way to find this target number is by trial and error or guessing. The faster you can make guesses the higher your likelihood of guessing the right number.

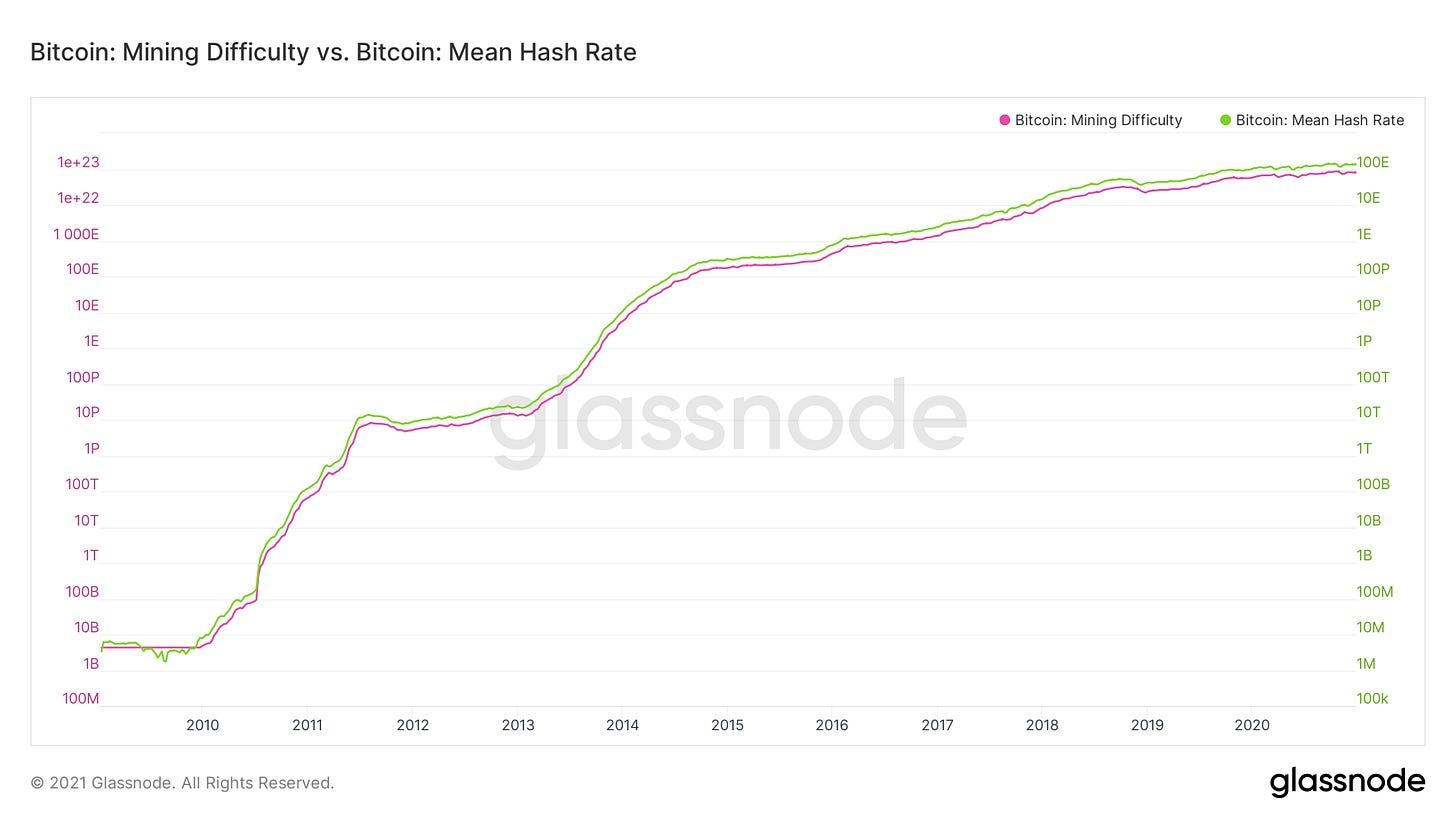

Miners contribute sophisticated hardware and computational power to find the target number. If they find the number first, they are rewarded with bitcoin and the transaction fees incurred in that ten-minute block. Below is a chart of the total computational power or total hash rate that has been committed to the Bitcoin network.

Without the difficulty adjustment, large explosions in demand for bitcoin would have been matched with increases in supply. Demand would increase the dollar-denominated reward paid in bitcoin therefore making mining more profitable. This in turn would attract additional miners/computational power resulting in blocks being found faster and more bitcoin being mined. This would result in large increases in supply rendering bitcoin as useless as government-issued paper money.

Enter the difficulty adjustment, the true genius behind Bitcoins past success and future trajectory. As the computational power of the network increases so too does the difficulty of guessing the target number. This is also true when the computational power of the network shrinks, the difficulty decreases. This keeps Bitcoins codified supply schedule intact.

This mechanism has been thoroughly tested over the past 12 years; it is an antifragile process for making bitcoin supply inelastic, where large demand shocks do not result in corresponding changes to supply.

Saleability

Saleability implies the implicit ability for a good or service to be sold. The most saleable good in society is one that best satisfies the law of least diminishing marginal utility.

Saleability Across Space

In order for money to be saleable across space, it must be easily portable and reach settlement in its final location quickly. This is one of the biggest issues with gold. It is expensive, slow and risky to transport over long distances.

The US dollar and fiat money, in general, marked a huge improvement on golds saleability across space. Utilising networks like SWIFT, payments can be made across borders for a small fee. However, this money doesn’t settle fast. When I instruct my bank to make a payment, they debit my account and credit the account of the bank the money is being sent to. It is only later when these banks perform final settlement and net off their debits and credits with one another.

This introduces counterparty risk into almost every transaction we perform through a bank using government-issued money. This final settlement usually takes 3-5 days. This doesn’t sound very much like a 21st-century technology.

Alternatively, Bitcoin settles every hour with no counterparty risk. It is orders of magnitude more saleable across space. It removes national borders and introduces a non-discriminatory financial network where the most vulnerable citizens can take refuge from hyperinflation. In the last one hundred years, there have been over fifty-six occurrences of hyperinflations globally. The institution of central banking and monetary debasement has destroyed the value of stored time for those who didn’t have an alternative.

Bitcoin settles faster than both fiat and monetary metals. It is, therefore, more saleable across space.

Saleability Across Time

Bitcoin is a new protocol for money, it is dematerialising our current financial system into a set of rules run by thousands of computers across the globe.

Saleability across time is only possible for goods that are exceedingly difficult to debase. Gold is our best example of a good that is saleable across time, it historically inflates between 1-2% yearly and has preserved purchasing power for thousands of years.

This is where fiat money falls short. It is not saleable across time. It is issued by a central entity and when printed goes first to those in favour with our political elite. Benefiting financial asset owners at the detriment of everyone else. This can be seen in wealth inequality figures. Surely if printing and injecting counterfeit currency into the system was good, it would benefit a large number of people? Then why, since 1970 have we seen wealth concentration to this extent?

When you hear about “government bailouts” don’t be fooled into thinking that they are injecting money into the system to help the little guy. Rather they are supporting financially irresponsible, over-levered companies and institutions who have outright abused the relationship between their clients and/or shareholders. Only to later expect the everyday citizen to accept this money at its old face value.

Bitcoin fixes this.

As discussed in the difficulty adjustment section, bitcoins supply is inelastic. There is no amount of demand for bitcoin that could result in it abusing its predetermined, codified supply schedule. Bitcoin actually trounces gold in terms of saleability across time as golds supply is not impervious to its demand.

Over the last three years, we at Etherbridge have lived and breathed the concepts of money. We first started buying digital assets in mid-2017. We then experienced a two-year bear market which challenged every assumption we held dear. Day in and day out we revisited our view that digital assets would bring with them tremendous wide-spread disruption.

We embarked on this journey with dollar signs in our eyes, licking our lips at the potential wealth this “magic internet money” could bring. Yet, on this journey, we have realised that the need for bitcoin is written in the story of every great empire. It isn’t just a speculative bet but rather the solution to a problem humans have been battling with for hundreds of years.

We thank you, our clients, and our readers for joining us on this journey. We truly believe this technology not only possess the characteristics of a great investment but could also transform our financial networks into something that enables our collective fight for freedom and equality.

Notable Articles and News Stories This Week:

Total Cryptocurrency Market Value Hits Record $1 Trillion

The total value of all cryptoassets surpassed $1 trillion this week. This is a significant milestone for the asset class. According to Jack Purdy, an analyst from the cryptoasset data and research provider Messari, “The $1 trillion mark cements cryptocurrency as an investable asset class that no longer sits on the fringes of Traditional Finance as a toy for retail investors. It demonstrates that this asset class is large enough to absorb large orders like we’ve seen recently with the slew of institutions entering over the last few months.”

Read the article here

Top Regulator Says US Banks Can Use Stablecoins for Payments

This week American regulator the Comptroller of the Currency (OCC) published a letter of guidance that has made it possible for US bank to use stablecoins for payment while operating as a node on the relevant network. This means that banks may now buy and sell stablecoins and issue their own stablecoins in order to facilitate payments or in other words banks may now use public blockchains as a form of infrastructure for settlement. According to the OCC, the benefits of stablecoins and other blockchain networks include enhancing efficiency, effectiveness and resiliency of payments provision.

Read the full story here and the guidance letter here

Former Fed Governor Kevin Warsh Flips on Crypto, Says He’s Now Bullish on Bitcoin

The one-time sceptic of Bitcoin Kevin Warsh has now stated that he is in fact bullish on the asset. In an interview with CNBC Warsh who once stated that bitcoin was too volatile to be useful believes that investing in bitcoin makes sense when considering the current economic conditions. He went on to state, “I think that Bitcoin does make sense as part of a portfolio in this environment where you have the most fundamental shift in monetary policy since Paul Volcker (former Federal Reserve Chair). This is a big shift that we’re seeing under the Powell Fed, rightly or wrongly.”

Read more here or watch the interview here

Bill Miller 4Q 2020 Market Letter

The team at Etherbridge thought it would also be appropriate to include the concluding remarks from Bill Millers’ Q4 2020 Market Letter. “Finally, a few thoughts on bitcoin, the best performing asset category in 2020. At this writing, it is trading at over $31,000, up more than 50% since the middle of December. It has outperformed all major asset classes over the past 1, 3, 5, and 10 years. Its market capitalization is greater than JP Morgan and greater than Berkshire Hathaway and yet it is still very early in its adoption cycle. The Fed is pursuing a policy whose objective is to have investments in cash lose money in real terms for the foreseeable future. Companies such as Square, MassMutual, and MicroStrategy have moved cash into bitcoin rather than have guaranteed losses on cash held on their balance sheet. Paypal and Square alone are estimated to be buying on behalf of their customers all of the 900 new bitcoins mined each day. Bitcoin at this stage is best thought of as digital gold yet has many advantages over the yellow metal. If inflation picks up, or even if it doesn’t, and more companies decide to diversify some small portion of their cash balances into bitcoin instead of cash, then the current relative trickle into bitcoin would become a torrent. Warren Buffett famously called bitcoin “rat poison.” He may well be right. Bitcoin could be rat poison, and the rat could be cash.”

Read the full letter here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge we aim to lower the barriers of understanding this fast-growing digital economy.

If you are interested in staying up to date please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.