Cryptoasset Taxonomy Part 2

November 2023 Market Update

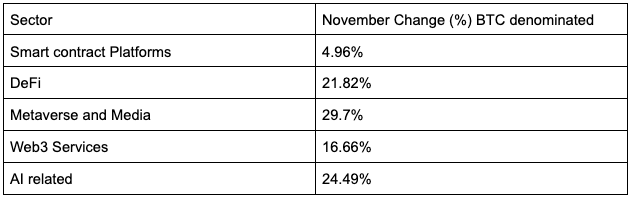

November saw continued price appreciation across the themes of blockchain. The Etherbridge fund was up 13.66% whilst BTC (8.7%) and ETH (11.5%). Sector performance in BTC terms was as follows:

The big news for November was the settlement between Binance and DOJ. CZ, an industry veteran and founder of Binance, pleaded guilty and stood down as CEO of Binance this month. The market welcomed this news as expected. Binance remained a perceived systemic risk to the market, with many concerned that Binance would be FTX 2.0. Safe to say we can put those concerns into a long list of risks that have now sufficiently been unearthed and settled.

Crypto may finally be sufficiently de-risked for what we expect to be a very positive 2024. It's evident that participants' risk appetite is coming back to crypto markets, buoyed by growing global liquidity, dollar weakness, excitement for both the BTC ETF approval and the up and coming BTC halving. We have a confluence of positive signals across the financial cycle and innovation cycle, while the adoption cycle continues to lag behind.

The Etherbridge fund is slowly scaling into an aggressive posture, reducing overall allocations to BTC and ETH and upweighting allocations to the tail end of assets or what we call “the bombsquad”. We still think this is just the beginning of the bull cycle and have about 18 months before we begin reversing in the opposite direction. Any pull backs in this phase will be bought by adjusting the funds exposure to bombsquad assets.

Our conviction in getting more aggressively allocated is indicative of stabilizing on chain fundamentals, favourable positioning in the financial cycle and pent up innovations not yet reflected in price. October was very much an off chain rally but it seems that November has seen a broad stabalisation across theme key performance indicators. Notably Fee revenue earned by crypto projects ticked up, while we still wait to see meaningful improvements in the user and the developer base.

ETH continues to struggle to make meaningful ground on BTC performance, which isn't unusual for the recovery phase of the market cycle. We expect ETHBTC will strengthen as we go into the halving and as the market begins to price the approval of an ETH ETF.

AI and metaverse sectors displayed solid strength, echoing the start of year rally. There seems to be a convergence across these themes, for AI there are plenty of reasons to see why decentralised architecture and governance may be seen as important. For the metaverse, gaming and entertainment we await the release of many games that have been in active development for years now. We expect these sectors to be strong plays for 2024, however we acknowledge the difficulty and idiosyncratic risks of finding winners in these sectors.

The big looming question going into 2024 is what activity will ignite the next leg up in the adoption cycle. DeFi has made meaningful strides forward but the bulk of activity remains speculative in nature and therefore continues to be highly reflexive or cyclical following crypto prices. DePin is promising but the demand side of these networks remains muted. Stablecoin payments could be this cycle's main adoption driver as regulation is moving swiftly on this topic and fintechs around the world move to make this service available to their customer base.

Cryptoasset Taxonomy Part 2

This is the extension and deeper dive on an early article “Cryptoasset Taxonomy”, we recommend that the reader reads the first article before going through this deeper dive.

As a refresher:

Cryptoassets facilitate funding, coordination, and alignment of different forms of capital, all aimed at developing open source software. The end result is that open source software now has a sustainable funding and incentive structure.

Every cryptoasset has an issuer, a governance structure, uses a particular token type and has a financial or non financial value flow.

Existing token types are asset backed cryptoassets, transactional cryptoassets and non transactional cryptoassets.

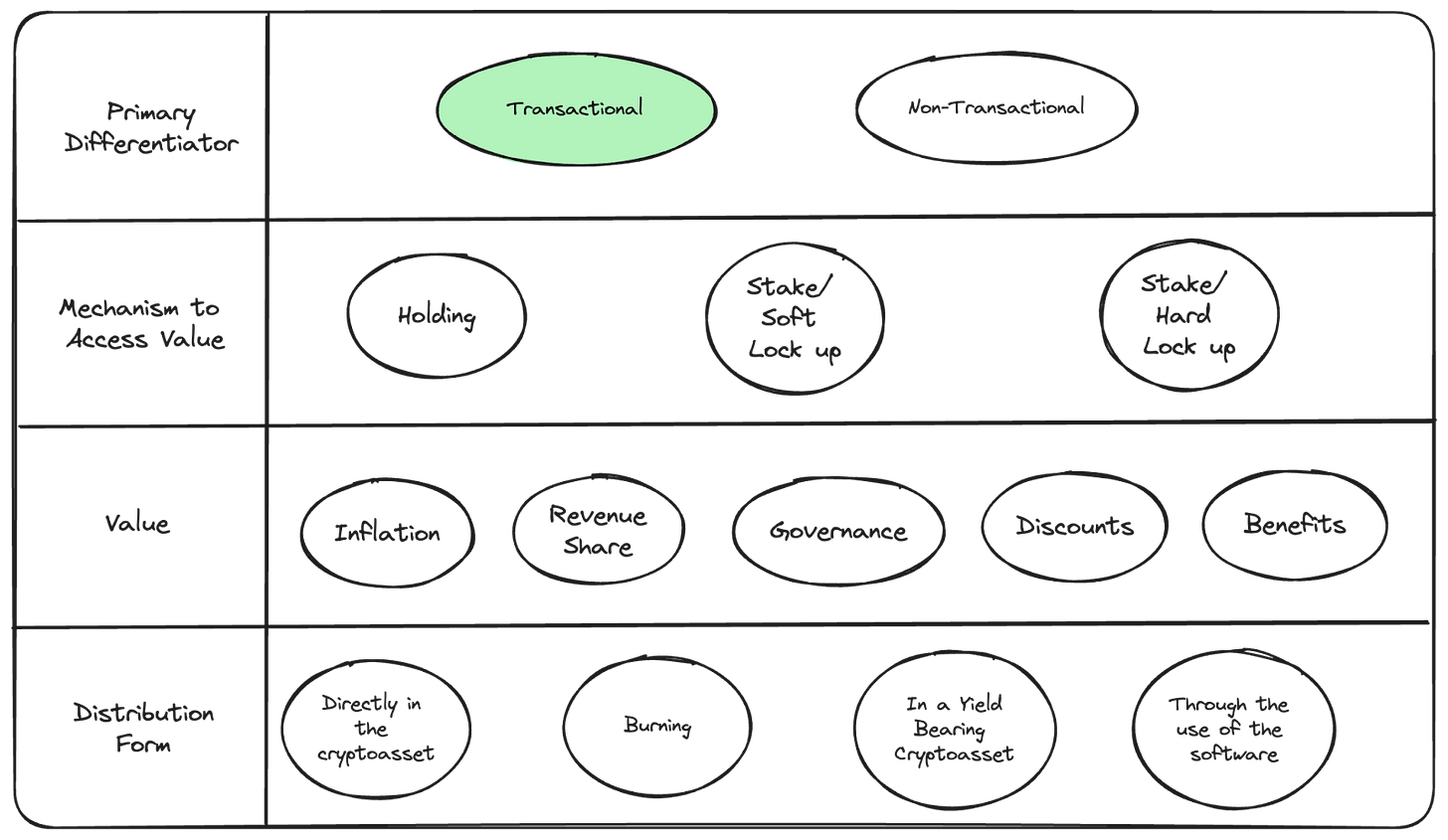

The role a cryptoasset serves within the operations of the software it coordinates is the primary differentiator between these new assets.

Transactional cryptoassets = Cryptoassets that are essential to the operations of the networks within which they function. Users are required to pay in these cryptoassets when using the service or network.

Non- transactional cryptoassets = These are cryptoassets that are not required in the provision of a service.

This article will zoom in on transactional and non transactional cryptoassets and serve as a complete framework for classifying any cryptoasset you may encounter. This article and its insights stand on the shoulders of the Three Sigma teams research.

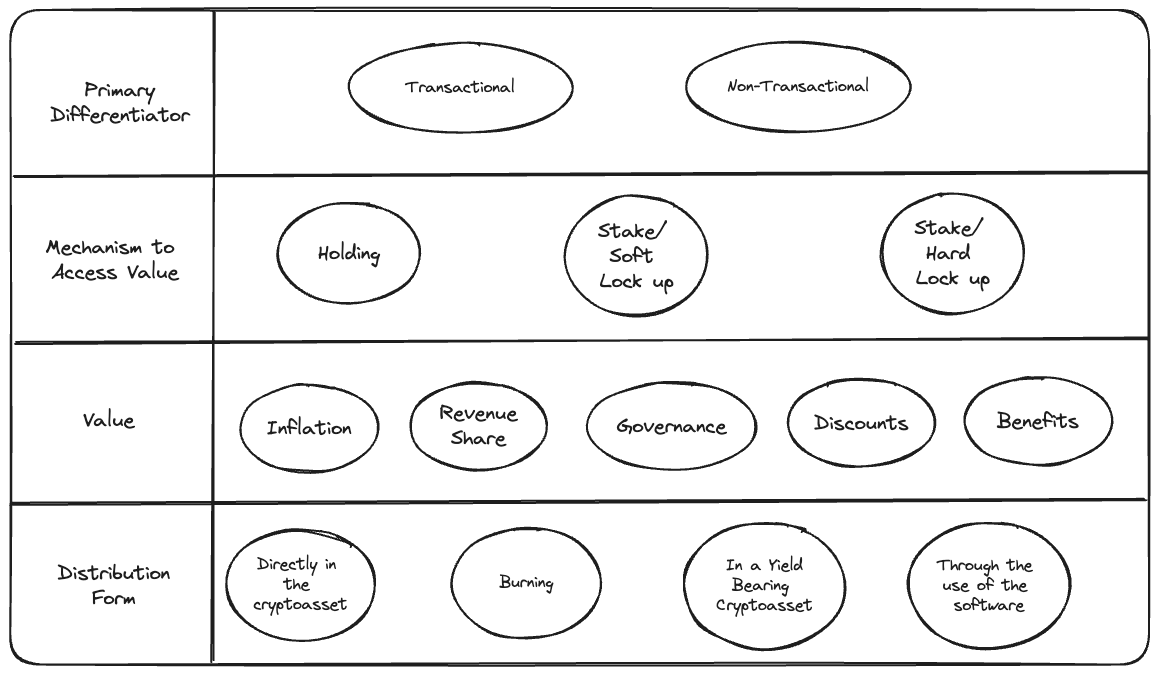

The second part of the framework requires one to ask three questions:

What is the mechanism to access value generated by the software?

Every token whether transactional or non transactional offers access to value primarily through these mechanisms:

Holding: by simply holding the token

Staking and/or Soft lock up: By contributing a stake to the network or to a delegate who stakes on your behalf without a defined lock up period.

Staking and/or Hard lock up: Where cryptoassets have to be locked up for a defined period of time.

What value is generated by the software?

The software can generate multiple sources of value which can later be distributed. The main forms of value identified are the following:

Inflationary token rewards: This represents newly issued units of the cryptoasset.

Revenue share: For every transaction a portion of the revenue generated is available for distribution.

Discounts: the ownership of some cryptoassets affords the holder with discounts on the fee of the service. Ie: a discount on trading fees on Binance for holding BNB.

Benefits: the ownership of the cryptoasset affords the holder with exclusivity, early access or boosted rewards when participating in the service. Boosted yield on a gauge emissions for staking CRV.

Governance rights: the cryptoasset may confer rights to contribute to the governance of a network or smart contract. Governance can take place as a periodic gauge vote or for major upgrades.

How is this value distributed to holders of the cryptoasset?

Directly in the underlying cryptoasset: Value is distributed in the cryptoasset held. Eg: Ethereum stakers are rewarded directly in ETH.

Through burning of the cryptoasset: Value is distributed by removing cryptoassets from supply, therefore decreasing the overall supply and enriching existing holders. Eg: When operating in a surplus MKR to the value of the surplus is removed from supply.

In a yield bearing cryptoasset: Some protocols may pay out rewards in yield bearing tokens such as a LP token or staked token.

Through the use of a service: discounts and benefits are only materialised through the use of the software. Ie: Discounts to BNB holders are worth nothing unless the holder actually trades on Binance.

Now we have a unified framework for classifying almost any cryptoasset based on its primary differentiator, how value is accessed, what value can be accessed and how this value is distributed to holders.

Source: 3 Sigma Research

A follow up to this article will cover how this framework aids in the valuation process, we remind our readers that crypto is a new asset class, a completely new beast. While it remains foreign today we expect the market to converge on acceptable and agreed upon valuation methodologies.

At the birth of joint stock ventures there was no agreed upon valuation methodology, and while most see this as scary we see it as an enormous opportunity for active managers. The whole point of active investment management is seeing today what others will come to see later on and allowing prices to converge on that thesis.

Helpful Examples

Just to solidify this framework we are going to run through a couple of our positions in the Etherbridge Fund. Before we go through the examples, it may be helpful to make some generalisations:

There is no silver bullet/optimal asset design. There may be theories as to what design is superior but there is no obvious predictive benefit of one design relative to another. (as an example: there is no evidence to suggest that dividend paying protocols outperform exclusively governance protocols)

As crypto matures we believe that the underlying design or “business model” will matter more. Participants are becoming increasingly more sophisticated and informed by fundamentals.

Our overarching goal is to identify cryptoassets, where increased demand and usage of the underlying service translates to increased value for the cryptoasset. We believe that the classification framework helps us better understand the relationship between the service provided and the cryptoassets that coordinate that service.

Bitcoin:

Bitcoin is always an interesting place to start because it illustrates that BTC is very much the exception to the rule, an anomaly in the world of cryptoassets. Proof of Work is interesting because it separates cryptoasset holders from value flows associated with the network and aswell as governance of the network.

Bitcoin in this regard is just a transactional crypto asset. Value generated in the network is only accessible by those who provide hardware to secure and maintain the network and this value is distributed not to BTC holders but to miners.

Ethereum:

Ethereum has also been called a triple point asset, based on the framework discussed by placeholder VC here and the bankless community here. A triple point asset as defined by Placeholder and Bankless is an asset that has capital asset like properties (ie: a yield), has commodity like properties (ie: burning/removal) and store of value properties as it has predictable and low inflation.

We can see the triple point asset below as Ethereum Staker earn a share of revenue (Tip) of the ethereum network and ETH is burnt as it is used in transactions (Base fee). Stakers also earn a proportional share of newly issued ETH.

Uniswap:

Uniswap is an interesting case. It is a Non-transactional governance asset. A UNI holder has no claim on fee revenue, only the ability to participate in governance.

There is much debate about Uniswaps token model and whether governance should approve a fee share with UNI holders. But for now Uniswap remains a glorified public good for the exchange of assets, the only rent seeker in this model are liquidity providers who earn fees from aiding in making markets.

Aave:

Aave is a real display of a thoughtful cryptoasset with plenty of utility. Aave is a Non transactional cryptoasset, it can be staked in order to.

Share in fee revenue (margin on the loans it issues) and inflation of Aave

Act as a first loss (equity like) buffer to Aave’s money markets

Gain access to higher borrow limits and fee discounts

Participate in protocol governance

Rewards in the Aave protocol are distributed to Aave holders in the form of AAVE tokens. These tokens can be claimed or restaked by the holder.

In conclusion, our exploration into the classification of cryptoassets, particularly focusing on transactional and non-transactional types, provides a robust framework for understanding this complex and evolving landscape. Through examining the mechanisms to access value, the nature of value generated by software, and the distribution methods to holders, we gain clearer insights into the intrinsic characteristics of different cryptoassets.

Our case studies of Bitcoin, Ethereum, Uniswap, and Aave demonstrate the practical application of this framework, offering valuable perspectives for crypto investors. As the crypto market matures, our comprehensive approach positions us to capitalize on the opportunities presented by this new and dynamic asset class, much like the early days of joint stock ventures. Our framework doesn't just categorize; it displays pathways for strategic investment decisions in a market ripe with potential.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems that require due diligence to comprehend and operate in. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.