Crypto Expansion Loading...

The euphoria of positive regulatory sentiment faded quickly, with BTC and ETH down -10.41 % and -11.23 %, respectively, for June. Altcoins as a collective continue to underperform the majors. The OTHERS index, which illustrates crypto total market cap excluding the top 10, was down -19.22%. The market's focus remains on large, well-established networks, ETF applications, approvals, and flows.

It's important to zoom out here, even after this correction, BTCUSD is +32%, ETHUSD +33% and the OTHERS index is -4% YTD. I think we are in one of the most obvious buying opportunities I have seen in my time in crypto, especially for investors with a 6 to 18-month time horizon. We have a path to regulatory clarity, a structurally bullish election, ETFs of major crypto networks entering the mainstream, a complete reset in sentiment since all-time highs, the worst of miner selling behind us, and BTCUSD is only 20% off its highs.

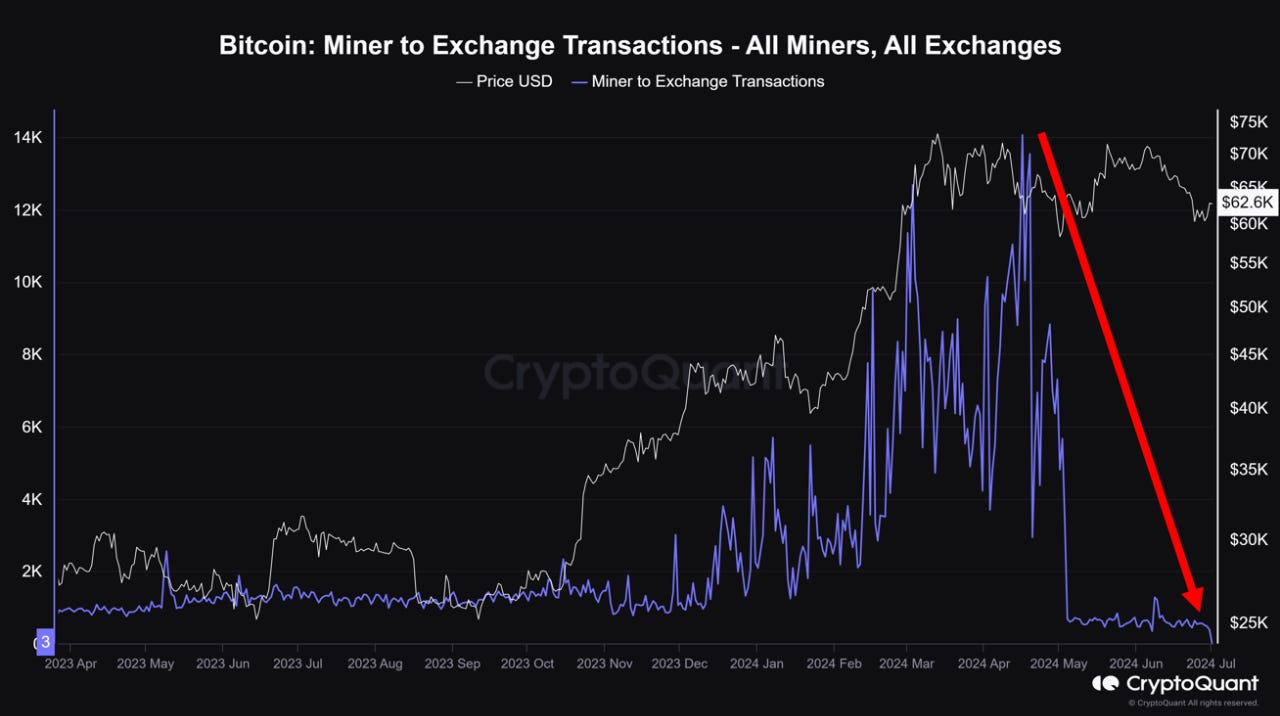

The main drivers of the correction in BTCUSD were miner sales, German-seized BTC selling, and the upcoming transfer of Mt. Gox coins. Miners continue to go offline after the bitcoin halving; historically, the correction concludes once inefficient miners have capitulated (see red shaded areas in the illustration below). Miners tend to capitulate after significant declines in the price of BTCUSD or when prices are near the cost of the production (post-halving events); the scenario we are in today is a combination of both.

Our base case from here is a ranging market for Q3 with the chance of further downside; this will be heavily influenced by how much longer the miner capitulation takes. Every day that the hash rate trends downward is a day toward less sell pressure from inefficient miners, as they liquidate their mined BTC to cover operational expenses at a loss. We are starting to see the very first signs that the miner capitulation is coming to an end.

Firstly, we can look at the hash rate drawdown to put this miner capitulation into perspective. The 2024 Bitcoin halving event created a drawdown in hash rate comparable to the situation we faced during the FTX implosion, which offered a great buying opportunity and marked the end of the 2022 correction.

The amount of BTC miners have been sending to exchanges has plummeted since its peak in May, this suggests the majority of sell pressure is already behind us.

BTC trading only 15% off all-time highs after such a massive miner capitulation suggests there are plenty of willing buyers in this $60-$70k range. Short-term fears of the Mt Gox distribution and the selling of German-seized BTC could take us lower into the $50k- $60k range.

Ethereum in the Spotlight

Our focus has now turned to ETHUSD. ETH has been out of favour since the market cycle top in 2021 and has trended down in BTC terms for several months.

I'm increasingly convinced that investors are underallocated to ETH, and the market is primed for an upside surprise. ETH doesn't have to face the headwinds of Mt Gox and the German Government selling. According to Coinshares, the total outflows in the last two weeks of June from ETH investment products totalled $119m. The slump has made Ether funds the worst-performing asset year-to-date in terms of net flows, with $25 million withdrawn so far.

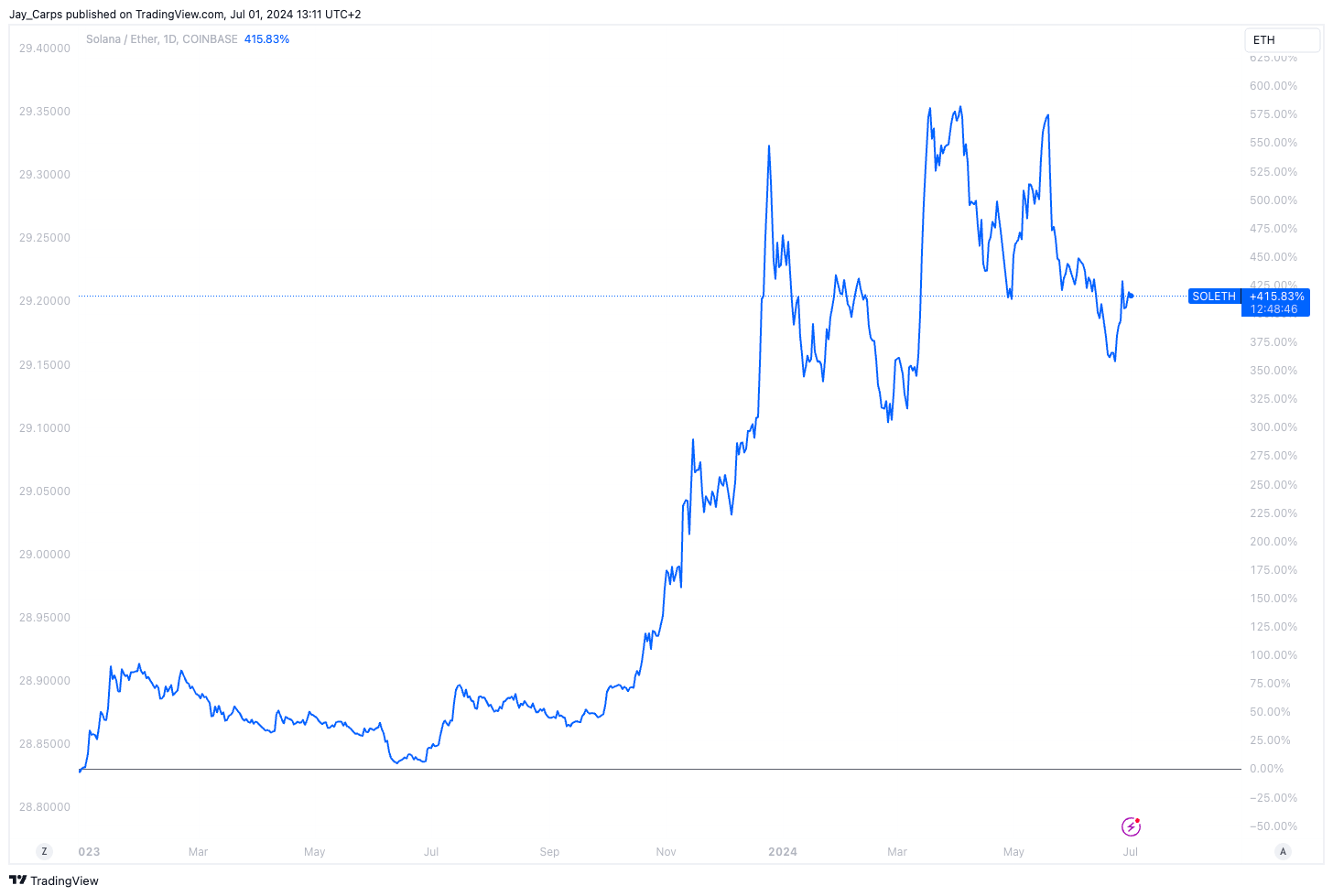

Adding to the general negative sentiment around Ethereum has been the massive run-up and rerating of SOLUSD, which has once again brought into question the end-game market structure for blockchains, swaying from a winner-take-all market to a multichain ecosystem.

In BTC terms, SOL has caught up with ETH since its lows during the implosion of FTX.

Ethereum L2s have further complicated ETHUSD as there are now multiple avenues through which investors can express a view on ETH. Adding further pain to the trade, Ethereum L2s have yet to progress toward full decentralisation. The majority of them still require "training wheels". The majority of L2s are still at Stage Zero (fully centralised and controlled by the team), with only a handful (ARBUSD, OPUSD) progressing to Stage One (where smart contracts control some aspects of the L2).

It's vital that L2 teams progress on their path to decentralisation; below are the checkpoints that need to be achieved to realise this vision.

We have decided to favour ETHUSD over L2 tokens as the risk to reward is more favourable for ETHUSD. We are open to this changing over time, but L2s and the broader ETH ecosystem have significantly underperformed ETHUSD. There are just too many L2s coming to market (about five just this month!); they need to be more differentiated, and their key performance indicators are blurred by airdrop farming, making them a challenging sector to express a high-conviction view. More risk and worse performance are things we want to avoid; L2s, as high beta ETH, are a good tagline, but they haven't traded this way.

We are waiting for an official launch date for the ETH ETF, which we predict will be a success similar to the BTC ETF. Estimates by Bitwise, Galaxy and Gemini suggest ETH ETF inflows in the range of $5b to $15b in the first 18 months of trading. Ethereum is differentiated from Bitcoin and arguably has an addressable market far more extensive than "Digital Gold".

Think about it this way: the Bitcoin network is designed to secure BTC. The Ethereum network is designed to secure any asset or application. Ethereum's network will secure global equity markets, financial products of all flavours, personal data, media, and resource markets for computation and storage. Further to this, entrepreneurs will encode their business logic in smart contracts and rely on Ethereum to process, execute and settle transactions with their customers for which they will pay ethereum validators in ETH. Ethereum is the infrastructure for the modern economy, while Bitcoin is the digital equivalent of Gold.

The race to frame Ethereum to investors has been intriguing to watch, I will speed run through some of the ideas:

"ETH as UltraSound Money" is my least favourite framing. It focuses on ETH as money and highlights the connection between using the Ethereum network and the deflationary force of ETH token burn. More usage equals less circulating ETH over time.

"Ethereum is the web3 Apple App Store" - This one is great, practical and probably the easiest to digest. Imagine if every app on the Apple store had to be purchased in Apple stock and every function or action an app performed resulted in Apple doing a share buyback, lowering the supply of circulating Apple shares; that's Ethereum. Ethereum will compete with the likes of Apple on Take Rates. The take rate is the percentage of revenue passing through a network that the network owners take for themselves instead of passing on to network participants. For example, the Apple app store take rate is as high as 30%, Facebook, Twitter, TikTok, and Instagram take rate is 99%, and YouTube takes 45%. Not only will Ethereums' take rate be lower, but applications built on Ethereum will share more of the pie with network participants, creating compelling reasons for users and developers to migrate to Web3.

"Ethereum, an emerging market" has not worked so well in my experience, but it's a decent metaphor. It's too big of an idea for now. Ethereum is a nation-state in cyberspace. The validators serve as its military, its consensus allows participants to reach an agreement on who owns what and how much of it they own. It has citizens in the form of users and businesses in the form of applications. Like a nation-state, it has a formal system of governance and sets its monetary policy.

Between these three, there is a powerful story to tell future ETF buyers. Bitcoin is brilliant, don't get me wrong, but it's a doomsday asset; it's one of the most powerful economic narratives ever told and leans heavily on the thousands of books written on the demise of the US dollar and our problems with monetary policy.

Ethereum is different; it's a technology play that will compete on economic terms with Web2 giants. It's a bet that just as software has eaten the world, secure and credibly neutral software will eat the rest of the world.

While an emerging market could embrace BTC as a reserve currency, it could embrace Ethereum as the technological underpinning of its entire financial system, a platform for sharing information, an identity system, and a coordination point for physical and virtual infrastructure.

Ethereum is just more exciting and is capable of so much more. We are positioned very aggressively in ETH as we prepare for the ETF to go live and expect our positioning to show the bulk of its gains in Q4 of this year and into 2025.

When is Altcoin season?

While I refer to altcoins as a collective, I think there are some high-level criteria one can apply to avoid buying junk:

1. Low future dilution - there may be exceptions, but be careful!

2. Low take rates.

3. Token isn't already overcrowded.

4. Expanding fee generation.

In crypto circles, there is a realisation that many altcoins won't develop meaningful network effects. My expectation is that we will get an altcoin boom, but there will be a wide dispersion of returns. Tokens with no product market fit and poorly designed token economics must be avoided at all costs.

With that in mind, how do we get to altcoin season? My read is that altcoins will remain range-bound, underperform the majors BTC and ETH and provide poor risk-reward opportunities until:

We have much higher prices for the majors (1-2x from current prices).

We get the first interest rate cut, and there is confidence more cuts will come.

Adoption numbers continue to trend upward. (new users, new developers, new differentiated projects and applications).

Confidence in a pro-crypto US President continues to grow.

Another component that makes this time different is the 4.5% treasury yield. The cost of capital is almost 5x higher than in 2017 and 2021. We would need aggressive easing from here to get a broad altcoin to blow off top.

Altcoin season is most prominent at the extremes of market sentiment; they underperform most when the market is near its cycle low and outperform most when the market is near its cycle high. So don't be surprised if the bulk of altcoin returns occur once BTCUSD has breached $100k. There is some truth to the crypto wealth effect; rising majors make crypto investors feel wealthy, enticing them to participate further out on the risk curve.

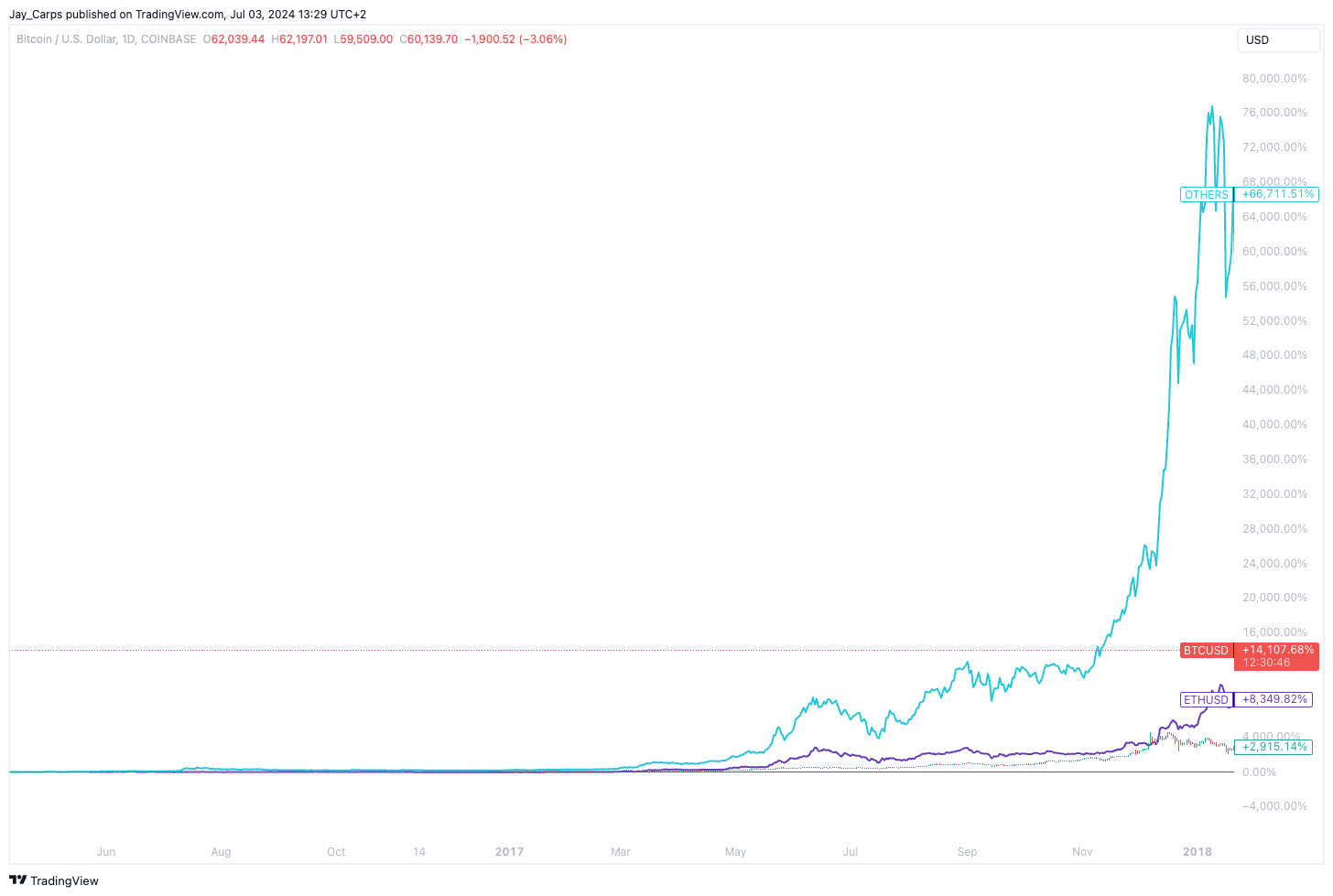

There hasn't been many surprises in this cycle relative to the past. BTCUSD outperformed both ETHUSD and OTHERS crypto index which excludes the top 10 through the recovery, which aligns well with previous cycles. We are now in the expansionary phase, historically this is where the alpha is.

The 2015-2019 cycle expansion saw ETHBTC and OTHERS index significantly outperform BTCUSD.

The same was true for the 2019-2023 cycle.

Source: TradingView. BTCUSD vs ETHUSD vs OTHERS index during the expansion of 2021.

Patience is crucial here, and election-induced volatility will only make the road bumpier. But investors should not ignore the structurally bullish backdrop. The base for the next leg up is being established here. Below is an update on how the 2023-2027 cycle compares to previous crypto market cycles. We are firmly in the expansionary phase.

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.