Cosmos

Market Recap

Assets Have A Better Week

Cosmos

Over the last few weeks, we have been investigating the topic of interoperability and the crypto projects attempting to solve the problem, such as Polkadot.

Interoperability is the idea that two or more systems can communicate with one another and share data in an understandable format. In blockchain, this is exceedingly important as it will enable a multi-chain world where people can choose to use the chains that best serve their needs while being able to leverage the unique advantages of others.

As previous articles explain, this is an exceedingly complicated issue to address in practice. In the world of blockchain, different design approaches, coding languages and consensus mechanisms have resulted in a fragmented industry with many blockchains existing in silos, lacking the ability to communicate with each other.

Cosmos is a project founded to solve these issues by creating a trustless interoperability solution, enabling a multi-chain world where blockchain can achieve its full potential.

What is Cosmos?

Cosmos is a self-described "internet of blockchains" that operates as a network of independent parallel blockchains. It was built to connect and secure a variety of customisable blockchain networks through the Cosmos Hub. They have taken a flexible approach to the design of the independent blockchains, which provides developers with the freedom to create a wide variety of applications while leveraging the Cosmos Hub's security and the benefits of the other connected chains.

Cosmos was the brainchild of Jae Kwon, the first person to apply Byzantine Fault Tolerance (BFT) research to a public Proof of Stake (PoS) blockchain network. Through this research, he launched Tendermint BFT, an implementation of BFT consensus and PoS. The idea behind this was that it addressed some of the perceived shortcomings of the then-dominant Proof of Work (PoW) consensus algorithm.

In 2015 Kwon met Ethan Buchman and further developed the Tendermint consensus algorithm, managing to successfully implement the Ethereum Virtual Machine (EVM) on top of the Tendermint BFT, creating Ethermint.

However, it was only in 2016 that the Tendermint cofounders published their whitepaper titled: "Cosmos: A Network of Distributed Ledgers". This was the first time they presented their idea of using Tendermint BFT to create an interoperable world to the general public. The reception was significant, even winning the Shanghai Blockchain Week "Most Innovative Project" award. It was also in 2016 that the Interchain Foundation (ICF) was founded with the explicit purpose of supporting the research and development of Cosmos and its ecosystem as a whole.

In April 2017, they conducted their Initial Coin Offering (ICO), where they raised $16.8 million within 30 minutes, which then was one of the most successful to date. With additional funding, the developers continued with research and improvements to the Tendermint BFT consensus and focused efforts on developing the Cosmos Network architecture.

In 2018 they introduced the concept of the Inter-Blockchain Communication (IBC) protocol, which would allow different blockchains to pass data and transactions through the Cosmos Hub. They implemented this in practice through various testnets and the launch of Game of Stakes, an adversarial testnet where BFT, in a live environment, could be thoroughly tested.

It was in March 2019 when the Cosmos Hub officially launched, and with that, the mainnet went live for the first time. Kava Labs was the first project to launch its blockchain using the Cosmos software, which proved successful.

2020 was a challenging year for the Cosmos project as the founder, Jae Kwon, stepped down; he had instead decided to focus on helping the non-profit foundation Virgo and the ICF, believing this move would strengthen the Cosmos ecosystem as a whole.

In 2021, Cosmos launched the project Stargate, an upgrade to the network. Stargate was the first public release that included the IBC protocol, a significant step towards creating an interoperable blockchain world.

The network has since had over 263 apps and services connect to the Cosmos Hub using the IBC protocol, achieving the vision set out in the 2016 whitepaper. Nevertheless, as with Ethereum, development wasn't complete, and with that in mind, the developers behind the project proposed Cosmos Hub 2.0, the next phase of the Cosmos Hub.

How Does Cosmos Work?

Cosmos works as a network of independent blockchains operating in parallel. These separate chains are built as application-specific blockchains called "Zones" in the Cosmos ecosystem. This is a shift in paradigm from the virtual machine approach we have seen used by projects like Ethereum.

When a project uses a virtual machine, decentralised applications exist on the network as smart contracts. These smart contracts can be created by adhering to the rules of the virtual machine and are, therefore, in some cases, limited in terms of flexibility and performance. Application-specific blockchains are different in that the blockchain can be customised to operate a single application. This allows developers to decide what tradeoff they want to make when creating their application to ensure it runs optimally. This potentially allows for a much more expressive and robust project that can fulfil a particular use case. To achieve this, the Cosmos network is built using three core components:

Tendermint - the networks consensus protocol

Cosmos SDK - a development kit that allows developers to build applications on Tendermint-based chains

Inter-Blockchain Communication protocol (IBC) - the end-to-end communication protocol that allows blockchains to "talk" with one another

Tendermint

We have touched on Tendermint briefly; however, it is one of the core building blocks of the Cosmos ecosystem and can be explored in greater depth.

Tendermint has been developed as open-source software that blockchains can use to achieve Byzantine Fault Tolerance. The term comes from the Byzantine Generals problem, a game theory thought experiment. In the context of blockchain, it refers to a blockchain's ability to continue operating securely and achieve consensus even in a situation where there are malicious or missing actors in the system.

Using Tendermint reduces the number of decisions and work developers will have to do to launch their own blockchain; it specifies how nodes operate, how they reach consensus and how the blockchain is written. Developers only have to decide on their application logic. Essentially, what Tendermint does is separate the consensus layer from the application layer, making the barriers to entry for a developer significantly smaller.

Tendermint and its flexibility allow for these application-specific blockchains to be created with their own logic. Therefore, as long as it abides by the consensus, you can create private or public chains with their own rules.

Cosmos SDK

The Cosmos Software Development Kit (SDK) is an open-source tool created by the team that allows any developer to easily build on Cosmos. This will help developers to quickly deploy blockchains without vast amounts of complexity and coding on their side. The SDK enables this by breaking up a blockchain into composable modules that can be used for specific purposes.

If developers choose to use the Cosmos SDK, it also makes it easier for them to integrate into the Cosmos Hub and be natively interoperable with other blockchains already connected. The Cosmos SDK also allows developers to freely contribute modules to the SDK, which will further benefit the Cosmos ecosystem as a whole.

Through the SDK, the Cosmos team have managed to create an easy way for both new and veteran developers to start building on their network and benefit from the knowledge of others.

Inter-Blockchain Communication (IBC) Protocol

The Inter-Blockchain Communication Protocol is the way that blockchains in the Cosmos ecosystem communicate with one another. This is one of the most significant parts of being interoperable.

The IBC creates a standard format or "language" in which messages are sent so that when they are received by the destination chain, it is understood and actionable. In more technical terms, it makes chains interoperable by specifying a set of data structures, abstractions and semantics that can be implemented by any application connected to the Cosmos Hub.

Making chains interoperable through the Hub makes it possible to build a wide range of cross-chain applications. As Cosmos wants to focus on application-specific blockchains, many chains will need to leverage the service provided by others; this is where the IBC will be exceedingly helpful.

Together these three core pieces of technology have made it possible to achieve what Cosmos has. As the developers look forward, they also realise that they can strengthen what Cosmos is and also further integrate their native token ATOM into the network; this is the focus of the Cosmos Hub 2.0.

Cosmos Hub 2.0

On the 26th of September this year, members of the Cosmos community released a new whitepaper. The paper was co-authored by some of the most respected in the Cosmos community, including Ethan Buchman. In it, they describe the next step in Cosmos's evolution.

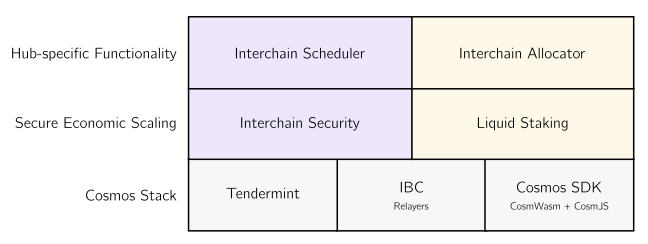

They believe that the original vision set out in the 2016 whitepaper has been achieved, and as the chain's needs evolve, Cosmos's next step can begin. There are two core pieces of architecture they want to address: secure economic scaling and Hub-specific functionality.

Secure Economic Scaling

Cosmos, as with many blockchains, has a layered architecture called its Stack. One layer above the IBC, Tendermint and SDK is how they can achieve secure economic scaling.

With the move to Cosmos Hub 2.0, the Cosmos team has decided to introduce Interchain Security and Liquid Staking.

Interchain Security

Within blockchain, your level of assurance is arguably the most critical part of using them. If you submit a transaction, you need to know that it will be executed as you intended it. When a network reaches some form of critical mass, it can become costly for malicious actors to attack it and alter transactions. Networks like Ethereum and Bitcoin already provide high settlement assurances as many people are competing over the opportunity to be validators and earn a reward for doing so. However, when a chain is very new and fewer people are supporting it, the opportunity for hackers to take advantage rises.

As newer, independent chains join the Cosmos Hub (in the absence of shared security), they would be required to provide their own set of validators to increase the chain's security. Suppose the chain is public, and anyone is welcome to validate. In that case, they run the risk of malicious actors being present in the system and altering transactions before reaching a point where it would be economically unfeasible to do so. Interchain Security intends to reduce this risk.

Interchain Security is a simple concept but complex in practice. At a high level, Interchain Security will allow validators operating on the Cosmos Hub to also produce blocks on the connected chains. The validators would be required to run two nodes, one of the Cosmos Hub and one of the connected chain and would receive rewards and fees from both. Validators would be able to use the ATOM they have staked on the Cosmos Hub for the connected chain as well, essentially doubling up. However, as with all PoS networks, if they are found to be acting maliciously on either chain, they will have their stake slashed. This system will significantly lower the barrier to launching and running a chain as security, which should be the number one priority, can be bootstrapped easier.

Liquid Staking

Within a PoS system, if you aren't staking your assets, you essentially lose out on the network inflation and have your proportional share diluted. However, if you are locking your tokens up to stake, there is an opportunity cost involved as you may have found better yield elsewhere. The catch here is that if the yields are better elsewhere, people will move their tokens there instead, resulting in less security and potentially leaving the network vulnerable.

Liquid Staking will allow you to tokenise your stake (think stETH) and use the derivative elsewhere in the ecosystem while maintaining your original position.

While it remains to be seen if this is good for the token and ecosystem, it will provide an interesting case study for all other PoS crypto networks.

Hub-Specific Functionality

One level above secure economic scaling is the Hub's functionality. The two core focus areas here will be the Interchain Scheduler and the Interchain Allocator. These two pieces of architecture will act as tax enforcement and treasury management, respectively. The idea is that together they will optimise the native token, ATOM's, value capture.

Interchain Scheduler

In blockchain, a common problem is the Maximal Extractable Value (MEV). It was initially called "miner extractable value", as it first emerged when talking about Proof of Work chains; however, it is a problem that applies to most consensus algorithms.

It specifically refers to the value extracted from block production in excess of the standard block reward and gas fees. This is done by including, excluding and changing the order of transactions in a block.

The Interchain Scheduler intends to address this problem by creating an on-chain marketplace for MEV. It should, in theory, provide a more transparent and fair system for returning revenue to the protocols connected to the Hub and the respective token holders.

The way that it accomplishes this is by separating transaction inclusion and ordering. The ability to order transactions is represented as NFTs and sold off to validators in an auction. The NFT represents a reservation for future block space on a specific chain connected to the Hub. Once you own a portion of block space as a validator, you can lock in arbitrage opportunities or schedule cross-chain settlement transactions with a high guarantee they will be executed. Once a successful MEV transaction goes through, the revenue is split between the validator and the connected chain.

Interchain Allocator

The Interchain Allocator will focus on providing new Cosmos projects with an easier path to user acquisition, liquidity and ensure long-term ecosystem alignment. It will also ensure that ATOM is the primary cross-chain reserve asset in the ecosystem.

It will achieve this by coordinating economic development between staking users and new projects built in the ecosystem using two tools: the Covenant and Rebalancer.

The Covenant is a system for establishing agreements with specific chains and IBC-enabled entities. The Rebalancer is a system for automatically managing asset portfolios with public liquidity (voting on proposals to fund) like a DAO.

These two tools together can be used to create collateralised agreements between the Cosmos Hub and other entities. Examples that the Cosmos team provided included:

Mutual stakeholding and protocol-to-protocol collaboration

Providing guarantees on auction price floors

Expanding liquid-staked ATOM markets by entering into AMM pools with liquid-staked ATOM or ATOM-backed assets such as collateralised stablecoins

Rebalancing reserves and tuning the monetary properties of ATOM with diversified collateral backing in order to make ATOM a more desirable collateral asset

Participating in other chain's governance as a delegate of the Cosmos Hub by voting as a block on proposals from tokens held by the DAO or third parties

Cosmos Hub 2.0 has introduced secure economic scaling and increased Hub-specific functionality. The upgrades that the network will have to undergo are significant, and they will take time to realise their full potential. However, it is good to see continuous innovation occurring in the space. Nevertheless, the main asset of the network, the ATOM token, ties it all together, so where in the system (besides the new uses mentioned above) does the token find use?

The ATOM Token

The ATOM token holds the whole system together. We have touched on many of its use cases in passing, but what are its core functions within the Cosmos ecosystem?

ATOM has three functions in the network:

ATOM is used to pay gas fees. Similar to Ethereum, the greater the amount of computation work required, the more ATOM you will be required to pay

ATOM is used by validators as their main collateral when staking. ATOM is staked or "bonded" to secure the Cosmos Hub and ensure transactions are processed, executed and settled correctly. They will also now be used for shared security of the connected chains and in the Allocator.

ATOM is used for governance. Each ATOM represents a vote in the system, and users can vote on the various proposals made.

These uses should create a need for ATOM within the system and ensure it becomes the principal reserve asset of the network.

Conclusion

Cosmos is a project that has been around for a while. It has consistently remained one of the industry's top projects over time, which is generally a good sign.

Interoperability is a problem that needs to be addressed in the industry if blockchain is ever to achieve its full potential. Cosmos has positioned itself as one of the pioneers in the field and a clear market leader.

The move to Cosmos Hub 2.0 is a significant step forward, and we look forward to seeing how the network develops over time.

Notable Articles and News Stories This Week:

BNB Smart Chain Resumes Operations After $100M Exploit

The BNB Smart Chain (BSC) resumed operations at around 06:40 Coordinated Universal Time (UTC) as chain validators adopted a software update that would close the exploit used by hackers to drain funds off-chain. BNB Chain, a blockchain closely linked to the crypto exchange Binance, is composed of BNB Beacon Chain and BNB Smart Chain (BSC). The BNB Chain was halted earlier after an exploit was discovered that drained $100 million in crypto from the platform. $7 million of the total crypto has already been frozen. BNB Chain announced that it will hold a series of on-chain governance votes that will decide whether the hacked funds should be frozen. There will also be a vote on a bug bounty reward system to prevent future hacks from happening.

Read more about the exploit here

Instagram and Facebook Users Can Now Share and Crosspost NFTs

Meta first enabled select creators and NFT collectors to post their NFTs on Facebook and Instagram at the end of August. Now, the digital collectables feature is available to all Facebook and Instagram users in the US and 100 international countries where the Instagram roll out initially took place. Users can unlock the feature by connecting a supported digital asset wallet to their social media accounts, including Rainbow, Trust Wallet, Dapper, Coinbase Wallet and MetaMask wallets.

The main perk is getting to share NFTs to Instagram or Facebook feeds, and crosspost any digital collectables across both platforms for zero fees. Credit can be given to the artists behind an NFT by tagging them in the post.

Read more about the move here

Uniswap Labs Reportedly Raising Over $100 Million in New Funding

Uniswap Labs, the de-facto backbone of the Uniswap Protocol, is reportedly gearing up to raise a venture capital round of $100 million to $200 million. The creator of the Uniswap Interface, Hayden Adams, is engaging with a Singapore sovereign fund, as well as crypto-focused investment firm Polychain, TechCrunch reported. Post-fundraise, Uniswap Labs is said to be valued at $1 billion, though the final valuation could change, pending negotiations once the capital raise progresses to later stages. Uniswap Labs previously raised an $11 million Series A round led by Andreessen Horowitz, with investors from Paradigm Venture Capital, Union Square Ventures and ParaFi also participating. Its latest moves to seek funding likely indicate plans to further expand its offerings.

Read more about the raise here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.