Chainlink

Market Recap

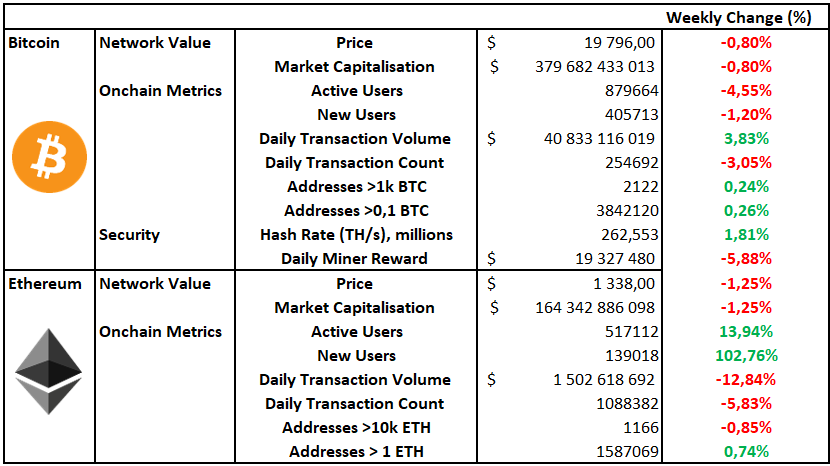

Assets Recover On Hopes Of Fed Pivot

Chainlink

Over the past few weeks, we have dived into interoperability and the projects pioneering the approach, including Polkadot and Cosmos.

Interoperability is the idea that two or more systems can communicate with one another and share data in an understandable format. In blockchain, this is exceedingly important as it will enable a multi-chain world where people can choose to use the chains that best serve their needs while being able to leverage the unique advantages of others.

There are several different approaches to creating a solution that makes blockchains interoperable. Yet, it is incredibly complicated in practice as the world of blockchain is currently fragmented due to different designs, consensus mechanisms and programming languages.

Chainlink has taken a unique approach to solve the interoperability problem, attempting to do it without a blockchain.

What is Chainlink?

Chainlink is an oracle service. Oracles feed smart contracts with external information. They serve as the bridge between a blockchain and any outside information. Oracles will play a crucial part in the general success and adoption of blockchain as the industry matures and develops, allowing blockchain to achieve its full potential.

According to the Britannica, an oracle is defined as:

Oracle, (Latin oraculum from orare, "to pray," or "to speak"), divine communication delivered in response to a petitioner's request.

The word or idea of an oracle can be traced back to ancient times. The most famous is that of the ancient Greek oracle Apollo at Delphi. They served as the bridge of communication between gods and humans. This core concept hasn't changed; instead of gods and humans, it is now blockchains and external information.

In 2014, Sergey Nazarov and Steve Ellis launched a company called SmartContract.com to establish a way for blockchains to connect with external data sources. The company's first project, Chainlink, was launched soon thereafter. It enabled smart contracts to interact with data fed through an API from any website or other source of information. However, it soon became apparent to the founders that with this approach, a significant problem would arise, the centralisation of oracles. One can imagine that if one person/organisation was responsible for supplying reliable information to a smart contract, they could easily manipulate the data for their own gain.

Therefore, in 2017, they proposed a more decentralised version of the project that would address the problem of oracle centralisation by making it possible for several people to attest to and cross-reference data, ensuring its accuracy. In the same year, they funded the project through an ICO, where they raised $32m.

It wasn't until 2019 that the Chainlink project went live and immediately found traction, exponentially growing their partnerships and increasing the number of oracles providing data. Being blockchain agnostic meant they could serve almost any blockchain's needs, proving a differentiating factor contributing significantly to their success.

It was in April 2021 that the Chainlink team released their second whitepaper titled "Chainlink 2.0: Next Steps in the Evolution of Decentralized Oracle Networks". As the vision they had set out in their first whitepaper was close to being fulfilled, they wanted to articulate the next steps in Chainlink's evolution as they saw an increasing role for oracle networks in the industry.

In August of the same year, they introduced the Cross-Chain Interoperability Protocol (CCIP), the culmination of years of research and development that dated back to the original whitepaper. The approach described was novel and proposed a way to provide a generalised cross-chain communication protocol that blockchains could use to support cross-chain hybrid smart contracts.

How Does The Cross-Chain Interoperability Protocol Work?

The CCIP provides a messaging format that blockchains can use to communicate and understand one another, secured by Chainlink's Decentralised Oracle Network. To understand how this works, we can touch on how Chainlink oracles work in the first place.

Chainlink has created a system where any individual or organisation can provide information to a smart contract and earn a fee for doing so. As a reward is attached to supplying data, it can be a lucrative business; therefore, many people participate and compete to provide the most accurate data available. To keep these data providers honest, they are generally required to put up some form of financial stake (in the form of the network's native token, LINK) that will be taken away and distributed to the honest data providers if they are found to be lying. This creates a system where providing accurate data is in your best interests and keeps everyone in check. These oracle networks will be used to develop Chainlink's interoperability solution.

Three core components will assist the CCIP in supporting cross-chain messaging, the Decentralised Oracle Network, Anti-Fraud Network and the Programmable Token Bridge.

Decentralised Oracle Network

As explained above, Chainlink has a large group of independent data providers acting as oracles in their system. The data that these oracles provide can be any arbitrary data, from weather or asset prices to payment confirmations and sporting outcomes. In the case of the CCIP, Chainlink will use its network of oracles to provide cross-chain data and ensure its validity.

As part of their plan to achieve this, the Chainlink team leveraged the Off-Chain Reporting protocol (OCR), which allows for off-chain computations to be performed. As the OCR's capabilities expand, they can create more expressive off-chain computations that result in advanced cross-chain capabilities. This is also an integral part of creating a system where the data transferred between chains is constantly accurate and flexible in what it can allow smart contracts to do.

With secure off-chain computation, the CCIP can scale the number of nodes that sign messages between chains into the hundreds, resulting in a more secure system, further increasing user confidence. The system will also improve the cost-effectiveness of using blockchain as the OCR will aggregate oracles' off-chain responses and report them as a single transaction on the destination chain.

Anti-Fraud Network

The Anti-Fraud Networks' primary responsibility is to provide security and fraud protection by monitoring the Chainlink network and automatically pausing the service if malicious activity is detected.

This network is an industry first and provides a robust risk management system to prevent hacks and exploits. The Anti-Fraud Network will also consist of Decentralised Oracle Networks; however, their core responsibility will be monitoring the CCIP and identifying any malicious activity. These oracles will have to be independent of those that attest to the legitimacy of cross-chain messages, separating the cross-chain services and the fraud detection function.

The Anti-Fraud Network will provide "heartbeat checks" when the system is operating as intended. However, if these messages stop or the oracles notice any unusual activity, the services for the specific network will automatically be paused, ensuring that user funds are protected.

Implementing a checks and balances system where responsibility is separated and everyone is economically motivated creates a scenario where no single group has control, making it more reliable and secure.

Programmable Token Bridge

The Programmable Token Bridge is one of the last core components that allow Chainlink to provide interoperability to disparate blockchains. The bridge is built on the CCIP and will enable developers to build cross-chain applications that can move their tokens across any blockchain. As with all Chainlink services, it will rely on the Decentralised Oracle Network to create a unified bridge system where assets can be sent between blockchains in a trustless manner. They have designed it so that the bridge will automatically support most existing token standards, meaning liquid tokens built on different chains can be used straight away.

One of the exciting uses of the Programmable Token Bridge is the ability to not only send tokens between chains but also run customised logic around how the application interacts with other blockchains. This will allow users to use their blockchain of choice while being able to leverage the smart contacts of others, all executed through an atomic transaction. This will also provide the ability to create hybrid smart contacts.

Hybrid Smart Contracts

Hybrid smart contracts combine on-chain code and off-chain computation and data. The ability to run code directly on a blockchain while using data and computation power from outside the blockchain can provide significant flexibility and benefits not possible when using only one.

On-chain computation and storage are notoriously expensive, which limits what blockchains can do. This is for a few reasons, mainly that on-chain code is designed to run in a highly secure environment with limited functionality, as this provides users with a high degree of certainty that their code will run as written and that the corresponding data will be stored by the nodes of the network forever. Running code off-chain is the opposite; it is not a secure environment. However, it provides you with a high degree of flexibility and optionality. By combining the two and using OCR and the Chainlink oracle network, you can create new types of smart contracts and enable use cases that weren't previously possible.

In the following video, Sergey Nazarov does a good job describing how hybrid smart contracts will enable feature-rich applications:

Conclusion

Through the CCIP, Chainlink has proposed a new and novel way of creating interoperability between different blockchains and other Web2 systems. Interoperability will play an evermore critical role in enabling blockchains to achieve their full potential.

The CCIP solves several problems that currently exist in blockchain today. Its approach is unique and moves away from having a blockchain sit as an intermediary between two systems. While this approach still has to prove its effectiveness, it does seem to be a viable one that could work with huge success.

With Chinlink's supporting technology, such as the OCR protocol, the Decentralised Oracle Network and Programmable Token Bridge, it is positioned to potentially disrupt the current approach to interoperability in the industry.

Hybrid smart contracts also represent a step forward in blockchain capabilities and may produce a new generation of DeFi and Web3 protocols, all supported by Chainlink technology.

Chainlink has positioned itself well to capture a significant portion of the data market in the industry, and we look forward to observing it over time.

Notable Articles and News Stories This Week:

BNY Mellon Moves To Let Institutions Hold Bitcoin, Ether

Certain institutional clients of America's oldest bank, BNY Mellon, can hold and transfer bitcoin and ether on its new crypto custody platform now live in the US. The bank in February 2021 formed a digital assets unit tasked with developing a client-facing prototype of a multi-asset custody and administration platform for traditional and digital assets.

BNY Mellon teamed up with Fireblocks and Chainalysis to help meet technology, security and compliance needs for institutions, the company said Tuesday. The platform is set to onboard select investment fund firms this week, the Wall Street Journal reported, while the bank expects to expand the offering to other clients going forward.

Read more about the move here

OECD Releases Framework to Unify Global Crypto Tax Reporting

The Organization for Economic Cooperation and Development (OECD) presented a new global tax transparency framework for the reporting and exchange of cryptoasset information.

Cryptoassets are unlike traditional financial products in that they can be transferred without intermediaries like banks, increasing the chances of their use in tax evasion, the agency said in a statement on Monday.

It states that cryptoassets aren't covered under the scope of the Common Reporting Standard, designed to prevent international tax evasion. Developments in crypto "have reduced tax administrations' visibility on tax-relevant activities carried out within the sector, increasing the difficulty of verifying whether associated tax liabilities are appropriately reported and assessed," the agency said.

Read more about the framework here

FTX Seeks to Roll Out Crypto-Linked Visa Cards Globally

Crypto exchange FTX is set to begin offering Visa debit cards to its customers internationally as part of an expansion to its global partnership with the payments giant.

Debit cards linked to a user's FTX accounts are currently available in the US, as the company now intends to launch the offering in 40 more countries.

The exchange plans to roll out the FTX Card in Latin America before bringing it to Europe and Asia, Adam Jacobs, the company's global head of payments, told Blockworks.

Read more about the story here

Whilst we all have the option to look, to seek to understand, it’s often easier not to. Bitcoin, Ethereum and distributed ledger technology are complex systems that require significant due diligence. At Etherbridge, we aim to lower the barriers to understanding this fast-growing digital economy.

If you are interested in staying up to date, please subscribe to our newsletter at etherbridge.co

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments.