2024 Market Outlook

2024 is poised to be an exceptional year for blockchain technology and cryptoassets. The fruit cocktail of positive tailwinds have come together to create a setup that is not difficult to be excited about. There are of course headwinds which may dampen a massive crypto surge but I think the odds are in our favour here.

In 2024, several significant events could impact the markets. These include general elections in the US and UK. Additionally, a more favourable macroeconomic environment is expected for crypto assets. Key developments include the recent approval of institutional Bitcoin ETFs, the Bitcoin halving event, and significant technological upgrades on the Ethereum platform. Our 2024 outlook will delve into each of these topics in detail.

We are paying attention to the following key upcoming events:

Source: Etherbridge

Macro Backdrop

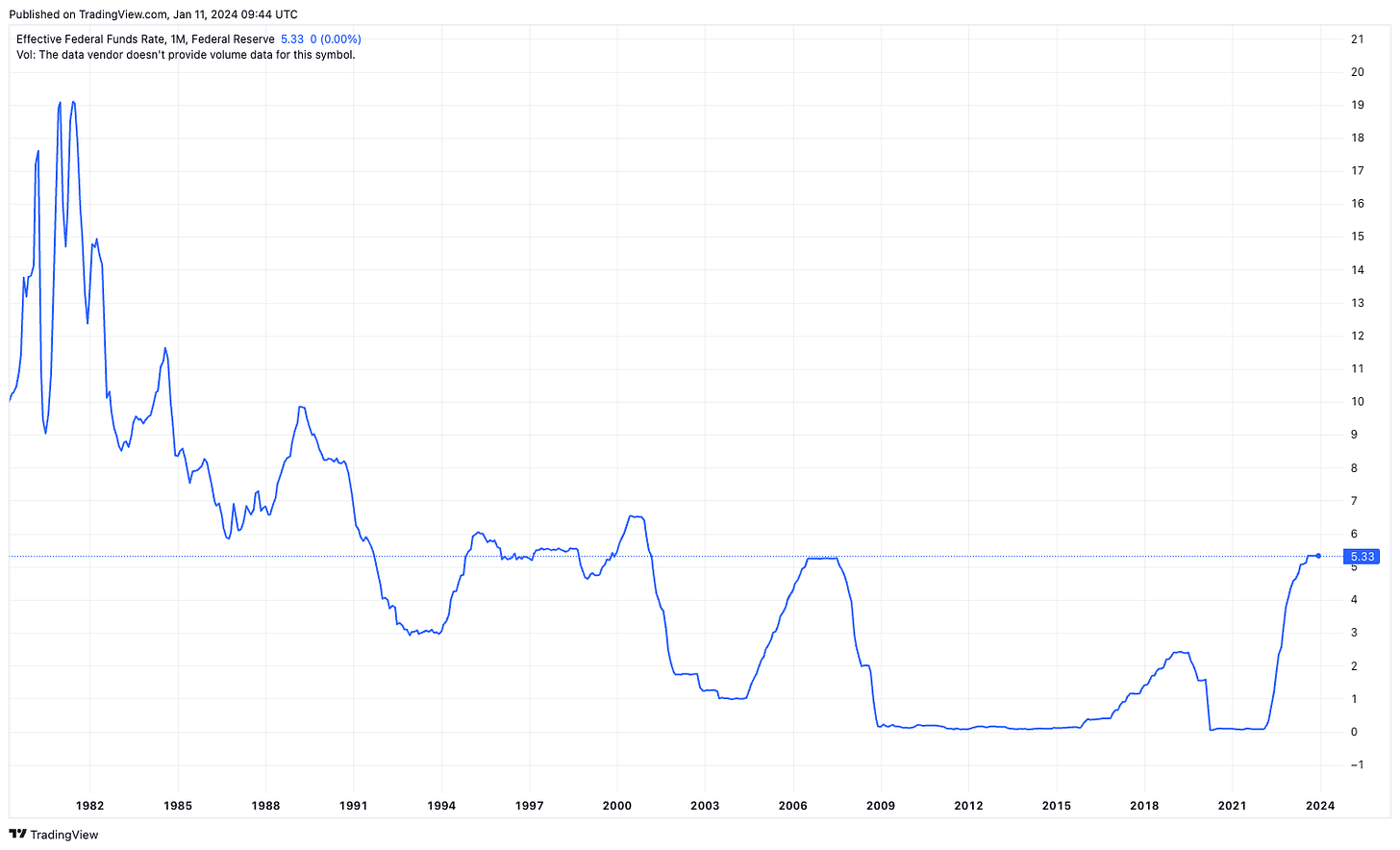

Over the last two years we have witnessed one of the most aggressive rate hiking cycles ever. The percentage increase of policy rates off the zero bound means the second derivative of the hiking cycle has never in history been more aggressive. Central bankers got caught completely offside and took extreme measures to squash inflation which they initially believed to be “transitory”. Crypto, equities and the bond market got crushed all through 2022. In 2023 the dust began to settle and both crypto and equities witnessed broad and rather impressive recoveries.

Source: TradingView

The total market cap of the crypto industry saw a substantial rise during 2023, moving from $795 billion at the start of the year to $1.67 trillion by the end, a 110% increase. This growth significantly outpaced traditional markets, with the Nasdaq Composite growing 44%, the S&P500 increasing 24%, and gold, rising by only 13%.

Source: TradingView

In mid-January 2023 Bitcoin trades at $45000, still ~30% off its 2021 highs. The S&P500 is kissing previous highs around $4700 having recovered pretty much all its 2022 losses last year. The Nasdaq shows a similar scenario trading at 2021’s highs of $16600.

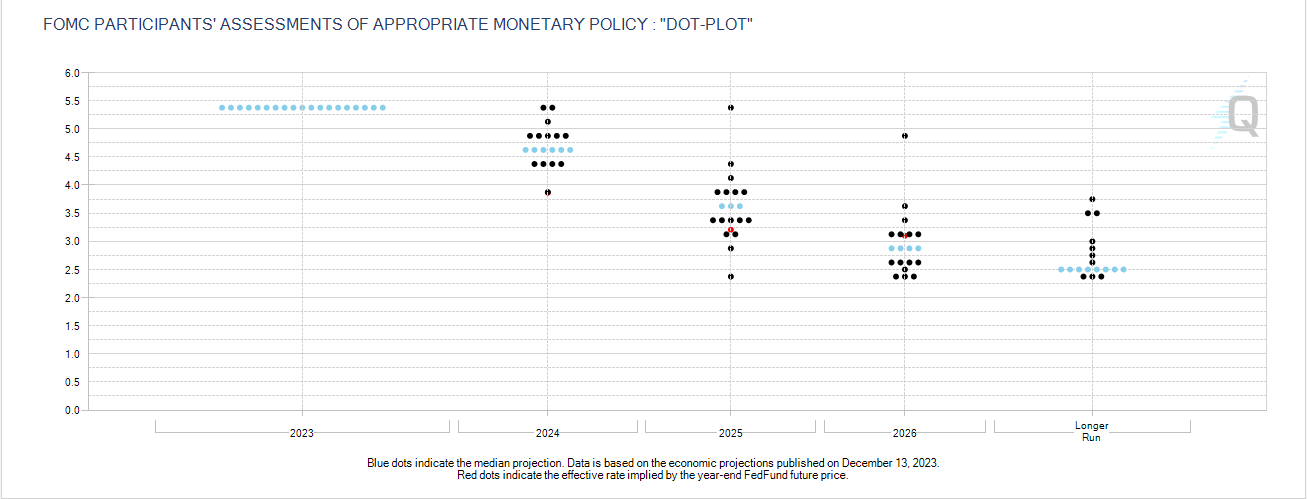

The market clearly likes what it see’s going into 2024 as macro conditions seem to be signaling the end of the rate hiking cycle and a move toward a more accommodative policy path. Projections for interest rates see a high likelihood of multiple cuts in 2024. Even if we do not see as many rate cuts as the market currently expects, rates are likely to remain flat. The risk of further aggressive hikes from here is extremely low. This change in posture alone is enough to keep risk assets supported from here.

Source: CME group

There is a strong positive correlation between BTCUSD price changes and central bank-induced liquidity cycles. We have already seen an uptick in net liquidity globally off historical lows. Our view that the marginal effect of flat rates or fewer rate hikes in 2024/25 translates to a continued loosening of liquidity conditions, this is bullish BTCUSD.

Source: Delphi Digital Research

Global tensions continue with the twin wars going on in Ukraine/Russia and Israel/Palestine. It's also an election year in the US, UK and many other nations, but the obvious focus for global crypto is likely to be US elections.

The views of US politicians on Bitcoin and cryptoassets vary greatly, which is why this election is likely to be a key focus of crypto markets. Elizabeth Warren and her anti crypto army have made their stance very clear, while Republicans generally have had more favourable and open minded takes on the space. We expect if current polling numbers are anything to go by, that if confidence in a Republican victory continues to build this will be interpreted as a positive for crypto markets in general.

A great illustration of this divide can be seen in the difference between SEC Chairman Gary Gensler’s comments on the Bitcoin ETF approval vs SEC Commissioner Hester Peirce’s comments.

Bitcoin

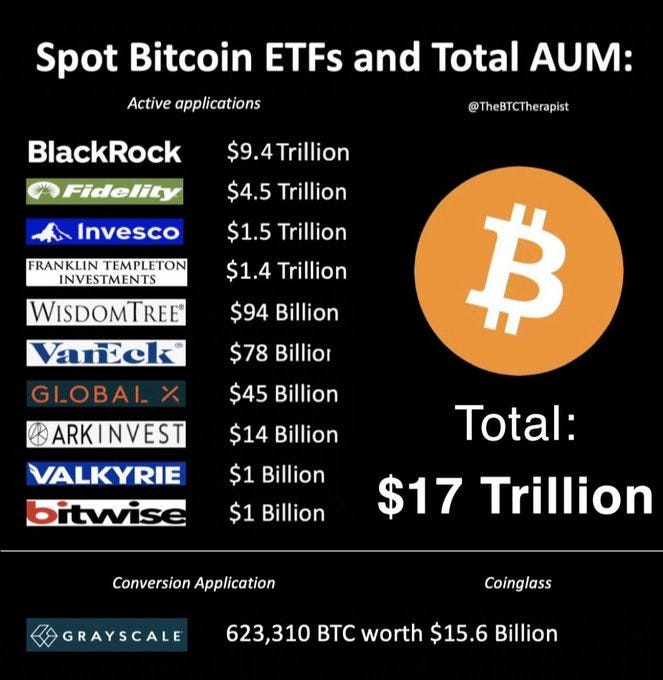

All eyes are on the ETF approval, which was approved on the 10th of January. This has been a long awaited product that will make it much easier and arguably safer for the traditional world of finance to participate in Bitcoin. The ETF signals institutional acceptance from some of the biggest players on the street, abstracts the difficulties associated with the custody of BTC, and puts BTC on all major brokerage platforms. This will explode the distribution force for BTC.

The following institutions have applied for a BTC ETF. Their cumulative AUM exceeds $17tn, suggesting BTC inflows are on the way. These institutions will have sales forces who are incentivised to distribute BTC to their clients. In a scenario where BTCUSD starts to behave like it did in 2020 in another hype cycle, we could potentially see a massive marketing campaign for Bitcoin. The nature of this cycle might have a very different flavour to prior cycles.

Source: @theBTCTherapist

But the ETF is only one part of the story for BTC in 2024, we are also quickly approaching the bitcoin halving estimated to occur in April 2024. This time will be different because it won't just be crypto-native firms like Etherbridge explaining the halving to its self-selected audience but also the likes of Blackrock, Van Eck and Fidelity explaining the event to their investor client universe.

Source: @TheBTCTherapist

Bitcoin top and bottom signals also look good from a historical context, Market Value to Realised Value (MVRV) sits at only 1.9 compared to previous market tops >3. Suggesting room for further a price rise.

Source: Glassnode

We have also breached new all time highs in the percentage of Supply that hasn't moved in over 2 years, which historically has preceded large reratings in BTC price.

Source: Glassnode

BTC has also broken the downtrend out in gold terms.

Source: TradingView

As Well as in SP500 terms…

Source: TradingView

It's very likely that BTC will yet again be the fastest moving horse in capital markets. This brings us to the real bull case for BTC in 2024 and extending into 2025. Capital allocators seek to improve, through diversification, risk adjusted returns on their portfolios. With low single digital allocations, BTC can provide that to a portfolio. The case to allocate to BTC is greatly strengthened following the introduction of the ETF.

It's no longer about whether allocators think BTC is digital gold, or whether they value BTC’s predictable issuance schedule, or concerns with the fragile position of global fiat currencies. The data speaks for itself. Incorporating small allocations to BTC in a well diversified portfolio significantly improves return profiles, and this will incentivise allocation.

Source: Blackrock ;)

Ethereum

Whilst out of favour in 2023, we remain optimistic on ETH in 2024. There are two very important rules to bear in mind when it comes to Ethereum. Some may say that these are the universal laws of the Ethereum community.

1. The developers are brilliant and consistently pull off amazing engineering feats.

2. They always deliver these feats later than expected.

Technical progress on Ethereum over the years has been slower relative to some of the alternative layer ones, but this must be viewed in the context of their broader and very ambitious roadmap, and the fact that there is way more capital at risk on Ethereum than on any other smart contract blockchain. At Etherbridge we believe that moving fast and breaking things, Terra Luna or FTX-style, is not worth it. We practice this value ourselves, and recognise this in the Ethereum vision, which is to build a blockchain system that lasts for decades or centuries.

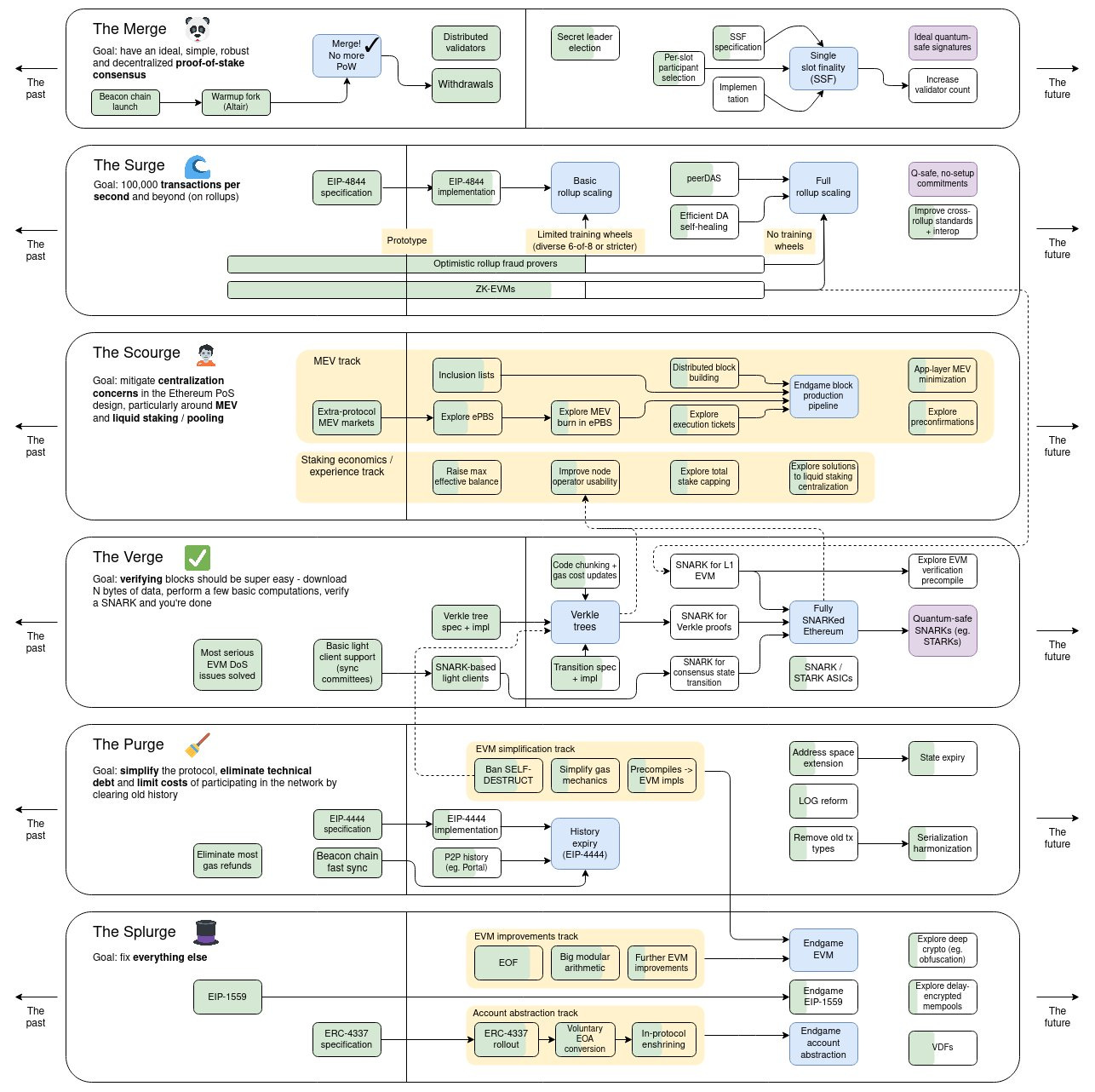

Vitalik Buterin, one of the key founders of Ethereum, released the latest snapshot of the overall Ethereum roadmap. This can be found here but we also share an excerpt below.

Source: Vitalik Buterin

This slower-than-expected progress is reflected in the ETHBTC price which failed to break 2017 mania highs in 2021 as well as the recent underperformance of ETH relative to the new breed of smart contract platforms such as Solana (which we will get to later). The ETHBTC price looks very depressed at 0.05, touching lows made in June 2022.

Source: TradingView

So given the recent underperformance all eyes will be on the Dencun upgrade coming in Q1 which contains the much awaited EIP 4844. Failing to deliver on this timeline might throw salt on the wound of ETH’s current sentiment. The pressure is certainly on for developers to deliver.

EIP 4844 will be a significant move forward in Ethereum’s roll-up-centric roadmap. It represents a set of changes to utilize Ethereum as a trustless proof of publication layer without imposing extreme data burdens on the network. It achieves this through a new transaction type which decouples data publication from data storage.

“Because it's not storing the data, Ethereum can cheaply price the use of this new transaction type and the amount of data it can hold, given it does not contribute to the state and history growth” - Delphi Digital, The year ahead for Infrastructure report

Layer two networks (aka L2’s) stand to gain here as fees for publishing data to Ethereum collapses, making L2's cheaper to use and expanding their overall capabilities and potential scale. The data costs associated with L2’s far outweighs the costs of execution, so we expect this to be a meaningful improvement to overall costs. This is happening in lock step with the release of data availability solutions such as Celestia, Near and EigenDA, which offer another alternative.

Source: Dune Analytics @optimismfnd

We will also get a better picture of what upgrades will be included in the Prague Electra upgrade which we expect to go live in the second half of 2024. (but remember Ethereum’s universal laws) This will give investors another catalyst going into the end of the year.

Another potential tailwind for ETH could be an ETF. Following the approval of the BTC ETF, the market has clearly shifted focus to the likelihood for an ETH ETF, and ETH has rallied accordingly. Blackrock has already thrown their hat in the ring and their application now awaits comments and approvals of regulatory bodies. The first deadline is coming in May.

Lastly and in our view most importantly is the new concept of restaking, pioneered by Eigen Layer. Restaking is liquid staking (think Lido) but orders of magnitude more interesting and potentially dangerous. If Ethereum had an income statement it would have looked something like this:

Sale of Blockspace +

MEV

= Total Revenue

The introduction of restaking introduces a third line item to Ethereum's income statement. Ethereum stakers through restaking will be able to secure applications outside of the Ethereum ecosystem, further boosting the rewards attributable to stakers.

Perhaps this is the new narrative Ethereum needs to regain the attention of market participants. Since the inception of EIP 1559 (burning of the base fee) Ethereum has been evangelized as “ultra sound money”. It's this idea that Ethereum is somehow a superior form of sound money to Bitcoin because of the potential for its issuance to be deflationary as a function of usage (ie: New issuance < base fee burnt from usage.)

We have always found this meme to be weak, as it places ETH in the shadow of Bitcoin's sound money principles. We don’t see these networks as competitors, Ethereum shouldn't be trying to be a “better Bitcoin”, it simply can't. Restaking in our view will transition ETH into a much more interesting asset, a productive and highly useful asset for the internet of value. One that bears yield, a sort of “internet native dividend paying network”.

Restaking isn’t without its risks and many have likened restaking to rehypothecation, and we all know how that could play out. The main concerns surround risks pertaining to a large and catastrophic slashing event on an application secured by ETH and EigenLayer. Delphi Digital outlines succinctly in the diagram below illustrating how this kind of event could result in cascading liquidations in DeFi.

Source: Delphi Digital Research

Solana

We underestimated how much the market was going to love this ecosystem in 2023. Solana has emerged as a real candidate in the smart contract platform wars. The majority of Alt Layer 1’s are EVM’s with some tweaks and “we are better than Ethereum because of [insert marketing slogan here]”. Solana however is one of the few non-EVM based blockchains to obtain meaningful adoption metrics and investor attention.

Solana has come leaps and bounds since its "death" during the FTX meltdown, I think much of the melt up we saw in 2023 was simple reversion to the mean as SOL sold off hardest out of the smart contract platforms in 2022. There's no doubt that SOL was the “back from the dead trade of 2023”.

Source: TradingView

Not only did SOL outperform its big brothers BTC and ETH but adoption metrics for Solana are becoming undeniably impressive, in December Solana surpassed Ethereum in both Dex volumes and NFT volumes. A real indication that users are enjoying the sleek and efficient of the Solana ecosystem. Bear in mind that much of this activity on Ethereum is moving to L2’s and therefore if we considered them as unified ecosystems, which to an extent they are, then these numbers wouldn’t look so impressive.

Source: Artemis

There's a meme going around in the Solana community, "only possible on Solana" (OPUS), whilst we would normally laugh off such a high octane marketing slogan, it's become evident just how different Solana is to ecosystems like Ethereum, Avalanche, Cardano, Polkadot to mention a few.

One area where this OPUS meme really makes sense to me is in payments and the data supports this. SOL is one of the few "bigger" ecosystems where the promise of instant and cheap payments is possible. It’s amazing how in 2023/4 we still haven’t seen a huge success story for blockchains and payments but perhaps Solana will usher this in.

Most chains can perform high value payments at reasonable fees, however what's so impressive in the solana ecosystem is that the bulk (62%) of USDC transfers are for sub $5 amounts. Imagine the array of use cases that micropayments at the speed of light could unlock. We will be watching closely how the Solana payments ecosystem compares to Bitcoins lightning network, our expectation is that SOL payments will be alot more performant.

Source: Dune Analytics @vetalx

Solana is officially in the big leagues and we expect its relative outperformance to persist against alternative smart contract platforms in 2024.

Layer 2

Much like the Ethereum network, Layer 2’s technical progress has been underwhelming with very few L2’s making progress towards technical ideals for building robust and trustless execution environments for the Ethereum network. All L2’s today are centralised and susceptible to the very problems the industry seeks to solve. Nonetheless we are confident that we see progress on multiple fronts from decentralized sequencers to permissionless fraud proofs in 2024.

Source: L2Beat

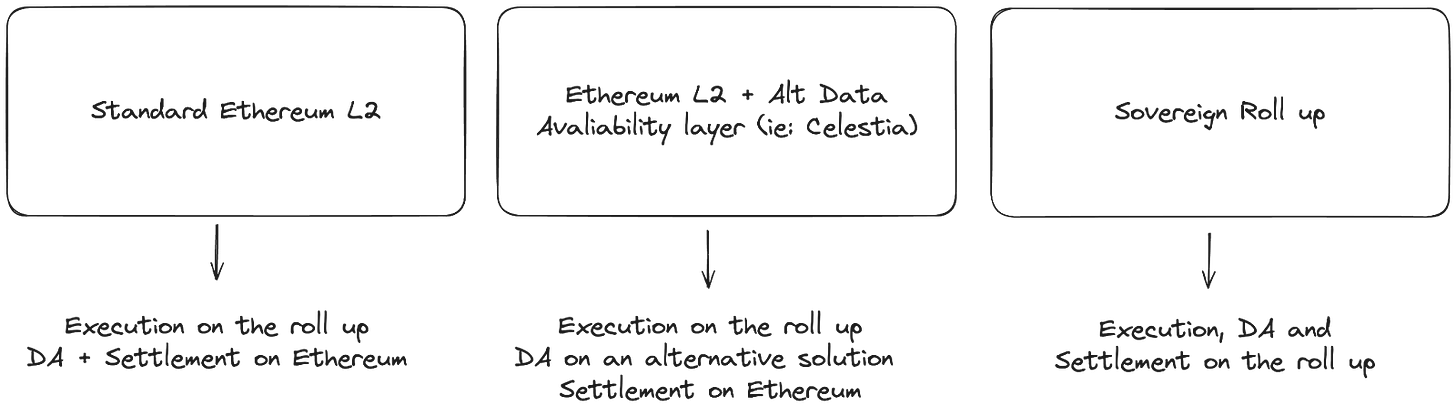

The L2 ecosystem is enormously complex, this new modular/ roll up centric approach of the Ethereum network certainly isn't easy to grow. This is definitely a headwind for Ethereum and its L2’s, not to mention the terrible current user experience of migrating from Ethereum to L2’s and the risks associated with doing so.

We are beginning to witness a variety of designs, which will further complicate the investment decision making process. The good old days of just two options Optimistic roll ups and zk roll ups are behind us, the ecosystem is tinkering and experimenting across a range of potential design choices. Below are the three broad archetypes of the current roll up design space.

Source: Delphi Digital Research, Dba (Jon Charbonneau)

The roll up ecosystem can be thought of as an open innovation environment where the mission is simple: scale the Ethereum network. The uptake of L2’s has been good in our view given the complexities and unfinished development process.

A total of $5,9bn and $3,3bn has been bridged to Arbitrum and Optimism, respectively. Arbitrum has attracted north of 150k daily active users, while Optimism's numbers are slightly less impressive with just over 60k daily active users.

Source: Dune Analytics, @blockworks_research

Arbitrum has seen impressive growth of stablecoins with just over $2bn on the L2, Optimism again disappointing with just over $500m. However, it's important to keep in context that Solana only has $2bn in stablecoin market capitalisation. Stables are the heartbeat of DeFi so where the stables go is a good indication of where DeFi action will be.

Source: Artemis

The rest of the pack including zkSync, Base, Starknet, Linea, Mantle, Polygon zkEVM and Zora are also slowly building bridged volumes totalling $1,2bn. Token incentives and airdrop programs certainly play a role here and we expect users to rotate between L2’s as incentives to do so become available.

Source: Dune Analytics @tk-research

Closing Thoughts and Fund Positioning

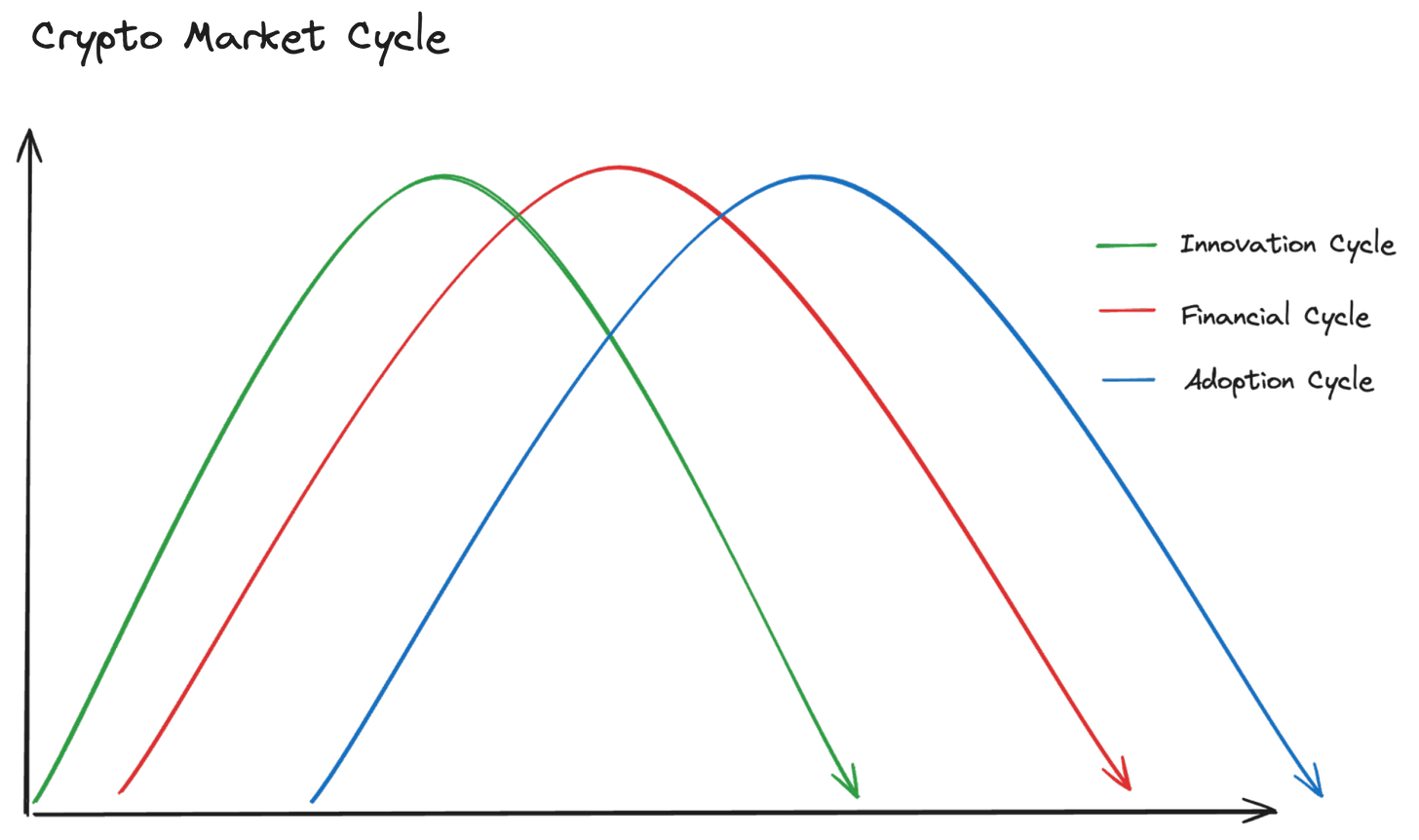

2024 stands to be a big year for crypto markets. The industry has eaten glass over the last 3 years but meaningful innovations have been accumulating whilst their popularity has waned. The financial cycle is becoming more accommodative and prices are up across the board. This should usher in the next large scale wave of adoption.

Source: Etherbridge

The Fund remains fully allocated with no cash position as our macro outlook is positive for Crypto markets, we are also only 97 days out from the historical expansionary phase of the crypto market cycle, our read is that current conditions are ideal for building a high conviction portfolio.

Relative to our benchmark, the Bloomberg Galaxy Crypto Index (BGCI), we are positioned overweight ETH and underweight BTC. Our overweight ETH position reflects our positive outlook on the Dencun upgrade and potential ETH ETF, which will translate to positive tailwinds for Ethereum ecosystems tokens such as LDO for Liquid staking, UNI and AAVE in DeFi and Ethereum L2’s such as ARB, OP and MATIC.

Outside of the Ethereum ecosystem we have positions in SOL, which is pioneering the monolithic blockchain design paradigm, showing solid adoption growth and the opportunity to become a leader in payments. TIA and NEAR are our high conviction investments in data availability solutions (DA), whilst positive on Ethereum L2’s and EIP 4844 we recognise the primary bottleneck for scalability is costs associated with call data which are only partially resolved by the Dencun upgrade, both TIA and NEAR stand to gain from L2’s shifting DA responsibilities from Ethereum. We continue to be bullish on LINK given the Cross Chain Interoperability Protocol (CCIP) in an emerging multi-chain world as well as its core role in DeFi. Lastly we hold RNDR, a decentralised computational network which we expect to benefit from the growing crypto AI theme.

We are monitoring interesting protocols such as SEI, Monad, SUI and APT which differentiate themselves through parallelized execution environments and the use of the MOVE programming language in SUI and APT. New L2’s such as ZkSync, Eclipse and Mantle are also on our watchlist. These are first cycle coins so we are monitoring their adoption closely. We will look to build positions here and overweight our overall Alt coin allocation during the expansionary phase if adoption metrics reflect market interest.

We remain bearish on legacy ALT L1’s such as BNB, ADA, AVAX, DOT, LTC, BCH and XLM, fundamentally we view them as technical dead ends and expect to see them leave the Top 20 assets by market capitalization this cycle.

We now have an army of incentivised salesmen spreading the word and once the man on the street "gets it" - the genie is out the bottle. Financial services firms are exploring the technology for tokenization of real world assets, like mutual funds, stocks, real estate and bonds. This is the kind of production capital the industry needs to become a legitimate technology platform for the fourth industrial revolution. Blockchain technology is still firmly in its early stages of installation, we are entering the Frenzy stage as the industry expands to new real world use cases.

Source: Technological Revolutions and Financial Capital, Carlota Perez

Etherbridge holds a conservative posture as an investor in crypto assets, avoiding distraction and new shiny things. Narratives will come and go, but each year the technology gets better and the industry attracts young, passionate and talented human capital to continue the build out. Betting against crypto is a bet against human ingenuity, you don't want to be on the wrong side of that.

Our mission statement at Etherbridge is to ride out the S curve of adoption from 0% adoption to full market penetration, this is a long game that we expect to play out over the course of our lifetimes. There will be numerous hype cycles filled with blow off tops and crushing nuclear winters, that is simply the nature of investing in technological revolutions. This is as true for crypto as it was for the The industrial Revolution (1771 - 1829), The Age of steam and railways (1829 -1873), Age of steel, electricity and Heavy Engineering (1875- 1918), Age of Oil, Automobiles and Mass Production (1908 - 1974) and the most recent, the Age of Information and Telecommunications (1971- 2020’s).

Source: Technological Revolutions and Financial Capital. Carlota Perez

While it’s easier to look away, seeking to understand is the only path to a more enlightened and empowered world. Bitcoin, Ethereum and distributed ledger technology are complex systems that require due diligence to comprehend and operate in. Etherbridge lowers the barriers to understanding this fast-growing digital economy.

Keep up to date with the world of digital assets by subscribing to the Etherbridge newsletter.

This is not financial advice. All opinions expressed here are our own. We encourage investors to do their own research before making any investments. Collective Investment Schemes (CIS) are generally medium to long term investments. The value of participatory interests may go down as well as up. Past performance, forecasts or commentary is not necessarily a guide to future performance. As neither Lima Capital LLC nor its representatives did a full needs analysis in respect of a particular investor, the investor understands that there may be limitations on the appropriateness of any information in this document with regard to the investor’s unique objectives, financial situation and particular needs. The information and content of this document are intended to be for information purposes only and should not be construed as advice.